Investment thesis

Superior Group of Companies (NASDAQ:SGC) operates through three unique business segments: Branded Products, Healthcare Apparel, and Contact Centers. The Company historically operated primarily as a uniform provider, as it was formerly known as Superior Uniform Group. SGC has a proven track record of value creation, and, while uniforms remain a critical component of the overall business model, management has expanded operations over the past few years. SGC offers a wide breadth of high-quality products which have empowered strategic relationships with customers who aim to create deep brand engagement, a trend experiencing increasing importance throughout the globe.

The Branded Products segment, typically about 65% of total sales, produces and sells customized merchandising solutions, promotional products, and branded uniform programs primarily through its signature marketing brands BAMKO® and HPI®. SGC aims to develop strategic partnerships with its customer base across numerous industries by offering them customized branding solutions and strategies that generate favorable brand impressions, bolster customer retention, and enhance employee engagement. The segment has an international presence with sales offices primarily located in the U.S., Brazil, and Canada, along with support offices in El Salvador, China, and India.

The Healthcare Apparel segment, typically about 20% of total sales, manufactures (through third parties or its own facilities) and sells a wide range of healthcare apparel, such as scrubs, lab coats, protective apparel, and patient gowns. This segment sells healthcare service apparel through two major brands (WonderWink and Fashion Seal Healthcare) to healthcare laundries, distributors, and retailers primarily in the United States. Notably, this segment has recently began expanding operations into Europe.

The Contact Center segment, typically about 15% of total sales, provides outsourced, nearshore business process outsourcing, contact, and call-center support services to primarily small and medium sized enterprises in North America. These services are provided through multiple The Office Gurus® (“TOG”) entities located primarily in Latin America.

Beginning with Q2:22, SGC realigned its reportable segments, combining the previous promotional products segment with the Company’s uniforms business to form the Branded Products segment. Additionally, the healthcare apparel business became its own segment. The newly reorganized operating structure is poised to unlock new growth opportunities, primarily through international expansion of the Healthcare Apparel segment as well as leveraging the capabilities of the old promotional products segment into the Branded Products segment. In this report, we will discuss the distinct tailwinds behind each operating segment and how SGC is favorably positioned to grow market share across three highly fragmented industries.

Branded Products: Unlocking cross-selling opportunities

The previous promotional products business comprised a sizable portion of total sales and was backed by many resources, including a sizable sales force of seventy-five individuals. The uniforms business only had roughly a five-to-ten-person sales force. With the combination of the promotional products segment and the uniforms business, the Branded Products segment ultimately stands to benefit from integration and cross selling opportunities by leveraging the larger sales force. End market customers include some of the largest employers in the U.S. and internationally, including Walmart, Coca-Cola, JetBlue, and Chevron, who present cross selling opportunities. We believe the benefits may already be materializing as segment revenue grew 29% quarter-over-quarter in Q2:22 after seeing 4% quarterly growth in Q1:22. Going forward, we assume mid to high single-digit top line growth for the Branded Products segment.

The Branded Products segment aims to gain market share by providing high quality, customizable products. The order cycle is relatively quick for the branded products (often less than one week), and the ability to customize quickly is a critical factor in developing strategic relationships with its customer base. SGC operates with scale advantages through multiple relationships with factories and a manufacturing presence in China, enabling quick customization of product orders.

Sales volumes in this segment are impacted by factors such as marketing programs of SGC’s customers and turnover of customers’ employees, which is often driven by the opening and closing of locations. As products are used by workers, business prospects are dependent upon levels of employment and overall economic conditions on a global level. While these sales present a degree of cyclicality, SGC sells to a diverse set of end market industries, which helps to stabilize revenue. For example, at the height of the COVID-19 pandemic, SGC saw a sharp drop in demand from restaurant and entertainment customers. This loss, however, was more than offset by demand from customers in the delivery service industry and certain retail industries, such as grocery and pharmacy.

Healthcare Apparel: On the path to international growth

The Healthcare Apparel segment represents the most defensive segment and appears to be the strategic priority at SGC. The institutional line incorporates stable, recurring revenue characteristics into the Company’s business model. Within the institutional line, SGC sells a wide range of healthcare apparel to distributors and laundries that service hospitals, which tend to experience a relatively high degree of usage and turnover in apparel like scrubs, protective apparel, and patient gowns. The retail line is comprised of high-grade, fashionable healthcare apparel. Together, the institutional and retail lines market products through virtually every distribution channel and the Company believes that they are the only industry participant serving all sales channels of Healthcare Apparel.

In Q2:22 and in coordination with their realignment, SGC announced the hiring of Catherine Beldotti Donlan to head the Healthcare Apparel segment. Beldotti Donlan joins SGC as an international business executive with nearly 25 years of experience in the apparel industry and a track record of success in building and growing sales, marketing, and product development teams in the past for iconic brands such as Nike. We believe that the strategic hiring of someone with a history of growing apparel lines will be vital to successfully expanding the Healthcare Apparel footprint to international markets.

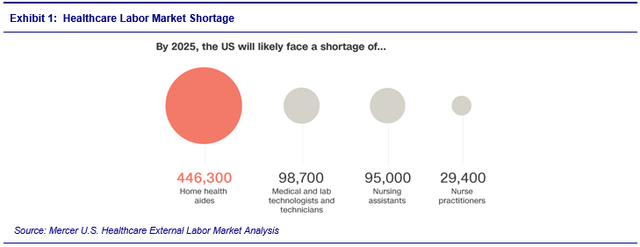

The international expansion ambitions come at a time of shifting healthcare labor market dynamics. While difficult to quantify, the World Health Organization estimates that the healthcare workforce will fall short by approximately 15-18 million people by 2030. Exhibit 1 highlights similar shortages in the U.S. by 2025, as estimated by Mercer Analytics. Considering the imperative return to equilibrium in the healthcare labor market, SGC is well positioned to take advantage of the growing demand for high quality healthcare apparel. We expect the Company’s signature marketing brands, Fashion Seal Healthcare® and WonderWink®, to gain market share in a tight healthcare labor market where workers demand higher quality products.

Mercer US Healthcare External Labor Market Analysis

Contact Center: Continuing to capitalize on an underserved market

The Office Gurus® (TOG) has developed into an award-winning outsourcer offering voice, email, text, chat, and social media support. TOG emphasizes a customer-service oriented environment designed to retain customers and expand, evident by an impressive top line 5-year CAGR of almost 32%. The nearshore call-center market has experienced a long period of growth as businesses look to reduce operating costs while maintaining high-quality customer support, a trend that is likely to continue.

The SGC advantage

SGC’s unique portfolio of product offerings leads to more diversified revenue streams, providing benefits throughout economic cycles. The Branded Products segment and the Call Center segment are both more cyclical in nature while the Healthcare Apparel segment (particularly the institutional line), which will likely make up a larger portion of total sales in the coming years, has more stable demand from end market customers. The Healthcare Apparel segment, with leading retail partners like Amazon and Target, has a large presence in the U.S., and we are confident in management’s ability to expand internationally. This growth should translate to greater revenue visibility in the future.

Brand recognition is a key advantage across SGC’s products and services, primarily in the Healthcare and Call Center segments. Certain brands are instrumental to the Company’s ability to market its products and services while growing market share. Specifically, Fashion Seal Healthcare and WonderWink brands, both of which are included in the Healthcare Apparel segment, are high quality brands with high customer satisfaction. These two brands, which together comprised about 20% of FY:21 revenue, have strong recurring revenue characteristics from brand loyalty. The Company has a long operating history of successfully identifying fashion trends and conforming to consumer preferences when it comes to the Branded Products and Healthcare Apparel segments. The image of key brands in SGC’s portfolio have been critical to success, and we are confident in the Company’s ability to continue to correctly judge evolving fashion trends and consumer preferences.

Q3:23 financial results

Quarterly revenue down 1.9% YoY to $136.1 million. Revenues of $136.1 million declined YoY by 1.9% in Q3:23 from $138.7 million in Q3:22. The biggest decline came in the Company’s largest segment, branded products, where revenues were down 3.8% YoY. While it is always disappointing to see a YoY revenue decline, this result is a vast improvement over the 22% decline experienced in Q2:23. Given the premier customer list of this segment, we believe revenue will continue to improve moving forward. Revenues in the healthcare apparel segment were down 1.3% YoY, but up 5.6% sequentially. The Company continues to work to right size inventory levels and continues to grow it direct-to-consumer website, featuring their Wink brand of products.

Contact Center Sales grew 3.2% YoY. The contact center segment continues to be a good news story in Q3:23, with revenues up 3.2% YoY and 6% sequentially. The Company has replaced some of the seats that had been lost in the prior quarter and continues to gain new customers. The pipeline for new customers in this segment remains very strong, and management continues to project strong growth and profitability for this segment going forward.

EPS of $0.19 per share in Q3:23 down versus adjusted EPS of $0.27 per share in Q3:22 but ahead of forecast. Net income was $3.1 million or $0.19 per fully diluted share in Q3:23, exceeding our forecast of $0.09 per share. Gross margins of 39% were better than the 37% gross margins realized in Q3:22, but SG&A expenses bumped up $3.4 million YoY as the result of a shift in sales mix. In sum, however, operating profit of $5.7 million materially beat our $4.4 million projection, enabling the better-than-expected EPS result.

Investment risks

- Inflation in raw material inputs has led to higher cost of sales, a trend likely to continue. Additionally, SGC sources goods and raw materials primarily from China which may be impacted by tariffs or other regulations.

- Executive officers and directors, together with certain family members, own a large portion of outstanding common shares, equating to about 31% of the Company, a high concentration of ownership.

- The Company’s debt in their capital structure carries a variable interest rate, which has recently increased significantly and will likely continue to weigh on net income.

Guidance and valuation

Management reduced previously provided full year guidance for revenue of $550 to $560 million to a new range of revenue of $538 to $545 million. EPS guidance was narrowed from a range of $0.45 to $0.55 to a new range of $0.46 to $0.53. We have adjusted our FY:23 estimates to align with the new guidance and continue to take a cautious view. Our new FY:23 revenue and EPS estimates are $539.5 million and $0.50, versus $550.1 million and $0.45 previously.

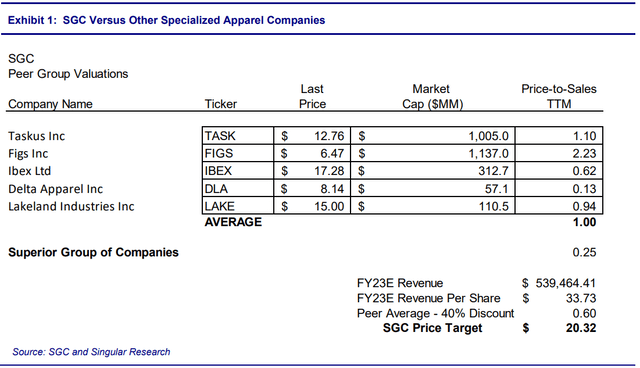

SGC trades at just 0.25x our expected FY:23 revenue estimate of $539.5 million. As shown in the Exhibit below, this ratio is much lower than the average for their competitors. We value SGC using a blended valuation methodology where we blend 50% of SGC’s price target using relative P/S ratios and the other 50% to SGC’s DCF model.

SGC and Singular Research

In our relative valuation, we assume SGC’s P/S ratio expands to 60% of the average competitors’ P/S ratio of 1.00 times FY:23 revenue. The peer group includes TaskUs (TASK), FIGS (FIGS), IBEX (IBEX), Delta Apparel (DLA), and Lakeland Industries (LAKE). This valuation leads to a price target of $20.32.

In our DCF model, we estimate the firm would earn a return on capital of 10%, reinvesting 20% of this return into their business, and growing EBIT by 2% each year going forward. We believe these assumptions are conservative, especially with SGC’s solid earnings history. These assumptions lead to a DCF price target of $11.74.

We then equally blend the relative valuation price target, $20.32, and the DCF valuation price target, $11.74, to come to a final rounded target price of $16.00 per share.

Read the full article here