Dear readers/followers,

Over the course of 2023, I’ve been repeatedly adding to Intrum (OTCPK:ITJTY) (OTCPK:INJJF) as the company’s share price has gone below 90 SEK, 80 SEK, 70 SEK, and even at times, 60 SEK. I’ve been adding using a combination of common share buys, followed by cash-secured Puts which have gone through over the past 4-5 months. This has left me with a position the size of several percentages in my conservative private portfolio.

My investment logic might be hard to fathom to laymen and people who do not delve deep into the company’s results. After all, the company has absolutely crashed beyond what I believed it to be able to. But at the same time, there are reasons for this, and those reasons are logical. At least in part.

I also say that Intrum is certainly not an investment for someone with a weak stomach or low-risk tolerance here, as I expect the pain to persist for some time.

However, the company has done what it needs to do already in order to set the path for its 3-4-year recovery. By that I mean they’ve announced the elimination of the dividend, they’ve done asset sales and exited non-core markets, and the company recently reported 3Q23, which clarified my long-term upside even further.

Let me show you why I am not selling my stake, even if I could sell at least 40% of my position at a net profit including dividends.

Intrum – It went much farther than I expected

To begin with, I want to admit clearly that this company declined much, much farther than I expected it to. The risks it took 2-3 years ago turned out to be significantly worse for the company’s shorter-term safety than I estimated – slightly beyond even the worst-case projections that I did.

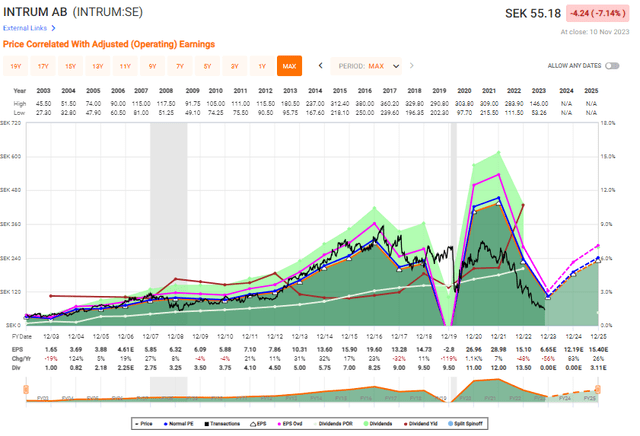

However, the current share price in no way reflects the company’s potential earnings and profit. The closest comparison I see here is something like Lincoln National (LNC) or Unum (UNM) when it was at a trough – and Intrum is currently trading at a 7x P/E for the downcycle, debt-impacted EPS.

My only question with regard to keeping my stake here is whether there is a fundamental risk to Intrum’s survival. My answer to this is no, there is not. Not that I see.

And I have been through these latest 3Q23 backward and forwards several times, estimating risk, updating my sensitivity tables, and seeing what “could” happen to Intrum here.

Simply put, Intrum is the largest collections and credit company (related operations) in Europe and most of the world. It, unfortunately, took on too much risk when the cost of capital was low and was unable to spin off this risk and assets at an attractive price. Also, some deals forced the company to make some unfortunate concessions and payments. This has left Intrum in a lurch, but the company is recovering – slowly.

Intrum’s plan is to reduce the leverage and de-risk what remains of the too-risky part of the platform.

It includes tactically selling parts of the back book and exiting selected markets, cost reductions, and your standard streamlining. A company trading at this level would be expected to have poor operating fundamentals.

That is not the case.

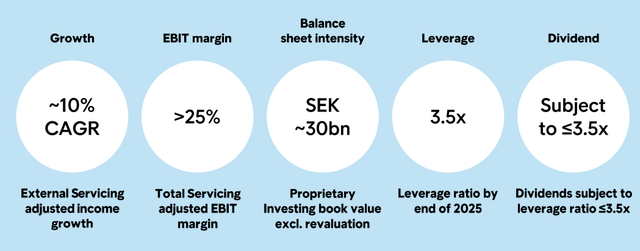

Intrum IR (Intrum IR)

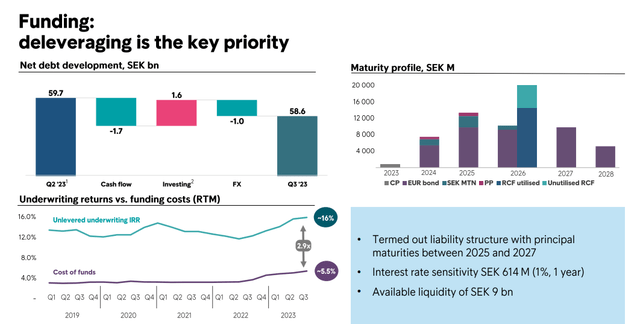

As you can see, Intrum even during the worst of its trough is inherently valuable and profitable. Its target is to take its impressive earnings, which are likely to come in at least 6-9 SEK/share, and move that straight to lowering leverage, which would reduce it to sub-3.5x in 2025E.

The company continues to win commercial contracts – its win rate is increasing. It’s also managed to save 350M SEK on a run-rate basis, and recorded income growth of 9% in 3Q23, with record high ATV sales, the Fy23 target is already achieved.

Leverage decreased to 4.4x – so we’re around 1.1x left, with an RTM cash extraction of 4.8B SEK from investing. AUM is up 13%, and Intrum has a continued collection performance of 100%.

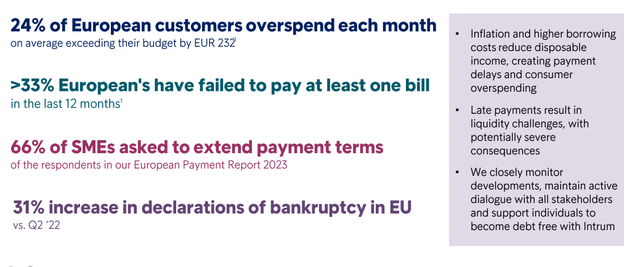

The continued European macro is still significantly beneficial to Intrum. As is, on one side, the higher interest rates.

Intrum IR (Intrum IR)

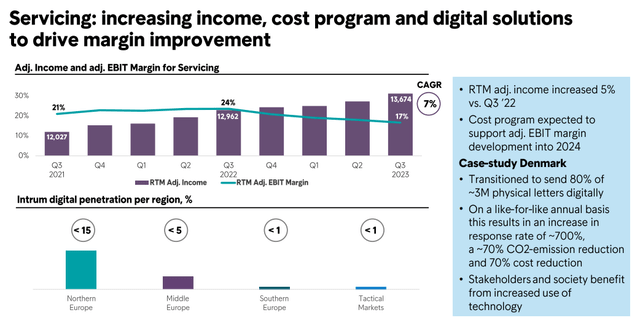

What I look at for Intrum is the company’s ACV pipeline, sales, and income performance. If I were to see any sign of fundamental problems here, I may change my thesis on the company. But both the investment and the servicing arm are improving materially, even if in servicing, this is currently coming at the cost of margin.

Intrum IR (Intrum IR)

The company is also showing incredible capacity to extract value from the company’s book. The savings program, which I want to see improving, is working well. 350M SEK is good on a run-rate basis, with further reduction in headcounts, renegotiation of the contract, and further reductions in spending coming at year-end.

Despite the decline in share price, the company is growing income for the third consecutive quarter. Both segments, Investing and servicing are contributing. FX, which is still heavy, is negatively impacting the company (with positive effects on Leverage). it’s important to point out here that the reduction in leverage is not (as of this time) a result of the company directing its significant earnings to this but as a result of Haya Real Estate and good FX. Once the company “bears down” here, we’re likely to go below 4x at a relatively rapid pace.

However, Intrum is still very much a profitable business, and most of its maturities are well below 2024.

Intrum IR (Intrum IR)

The company is currently meeting 3/5 targets for its 2026E targets – that’s 3 years early. What it needs to improve on is improving EBIT margins and lower leverage.

The picture I want to convey in the 3Q23 here, and going into the remainder of 2023 and 2024 eventually is that the company is showing plenty of business resilience and underlying strength. Growth and margin recovery in key segments are present. The company has no choice but to aggressively address its risk profile – this, unfortunately, includes cutting the company’s 2023E and 2024E dividends – but the company will be paying out the second half of this year’s dividend, and has done so at the time of writing this article.

My own YoC for my position here has been over 20% – which pays me well for the risk I am taking in holding onto my shares, rather than selling the majority of those at a loss.

Things can change – and things certainly did change. But the company’s “fortress” remains intact even with its current leverage. There are no breaches of covenants, no waivers, no headroom, and there are, at least theoretically, plenty of cash and debt sources that could still be used for dividends.

But I would agree with management that this is not the most effective use of capital and what’s best for the company at this time.

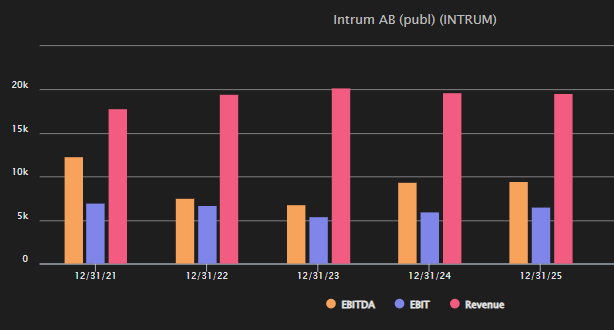

I want to show you EBITDA/EBIT estimates and revenue estimates for the company here – take a look.

Intrum Forecasts (TIKR.com)

Again, you don’t really see much issue here. We even have a dividend estimate for 2025E, coming to 7 SEK/share. That would imply an 11% 2025E yield, even today. Though I am obviously not saying you should invest here due to this.

As I’ve said, I’ve been through the company’s results backward and forward several times. This is a big position for me – and much of it was a mistake, at the valuation. I am not sugarcoating this, or making excuses.

However, realize that many of these things affect comparability, and they’re coming down.

As you can see, there is about SEK 18 million of items affecting comparability. That is to a part or a good part related to what we are doing on the cost program and also other activities in terms of making our operations more effective and efficient. So we will see that coming down. And obviously, our goal is to particularly impact the indirect costs with the activities we are taking and then over time, also making the direct costs more effective, e.g through more digitalization. So I would obviously expect, on a relative basis, so relative to the volume of income that we have, both of those to come down into 2024, which drives the margin improvement where we’ve laid out the trajectory to the end of 2026 with our target of more than 25% adjusted EBIT margin.

(Source: Michael Ladurner, Intrum 3Q23)

And many of the new ACV signings will take time to flow through.

ACB, generally speaking, once we sign it, it’s a run rate revenue that takes between 6 and 12 months to get up to speed. So we should be seeing these ACV signings in ’24, get up to run rates of the levels that we’re talking about and correspondingly, the higher level of margins. So that’s what it takes time. Now remember, we’ve had a record ACV year. We started signing back in the first quarter, although the third quarter was the best. You will see these coming in, in the coming 2 to 4 quarters.

(Source: Andres Rubio, Intrum 3Q23)

Let’s look at the company’s valuation.

Intrum – I still guide for a 200-250 SEK long-term target

My target is now likely at 2025-2026, not before. But the overall price targets for Intrum as of the latest quarter, have improved. The company also expects its 4Q23 to be the strongest quarter this year (Source: Andres Rubio 3Q23 earnings call).

Also, the company has set itself up to not need to access the market for its maturities for the next few years, seeing pressure here.

We’re going to selectively be in the market if we can. And obviously, the market recently has softened a little bit or opened up a little bit more to certain issues. We will see what happens when we get closer, and we will dynamically manage that. But ultimately, we intend to not depend on market participation and market access over the next 2 years. But Michael, I’m sure you have more specifics as it relates to how the RCF interplays with our bond maturities and the like.

(Source: Andres Rubio, Intrum 3Q23)

Essentially, every SEK that’s being generated is going to be directed at bringing down the liability side of the company’s balance sheet for the next two years.

If you’re fine with that, then this is a great investment. I have to be fine with that, because most of my position is in the red, and I don’t see any fundamental danger – and I don’t sell my investments at a “loss”.

I also expect that my Intrum position, once it matures like a great wine, will appreciate no less than 200%.

This is not the first time Intrum has traded like this going into a recession or financial difficulty – but Intrum has always recovered – and I expect that it will do so this time as well.

Intrum (F.A.S.T graphs)

My position in Intrum won’t make me rich, if this materializes -based on my portfolio I’m already considered “rich” – but it will certainly make me “richer”. Even in this position, which is one of my exposed I’ve been to risk in some time, I’m not all that exposed at all. I could take this loss entirely, and I’d be back on track within 10-12 months. This showcases my rate of diversification.

Intrum also remains one of the shorted stocks in all of the Swedish stock market. The current short-interest ratio is still 2.0 and is quite telling here, and the company’s volatile 3-5% intra-day ups and downs bespeaks quite a bit about the company’s current trends.

S&P global targets here have been up since my last article. 4 analysts give the company a range of 77 SEK on the low side and 99 SEK on the high side, with 2 at a “BUY” and 2 at a “HOLD”.

The upside based on conservative recovery to a 10x P/E here is 188% RoR until 2025E – excluding any sort of dividend, or 64% per year. I estimate the company higher, believing a 13-15x long-term P/E to be likely, implying a 240 SEK share price.

This would entail an annualized RoR of 100% or 342% in 3 years.

This is a higher-risk play, but I do not believe it to be as high risk as most investors seem to consider it.

I will keep updating here, and should something change or I consider myself forced to sell, I will make this clear here.

Here is my thesis for the company after 3Q23.

Thesis

- Intrum is a market-leading debt collection and credit company. In Europe and LATAM, it’s one of the more significant ones. The company is currently trading down due to a mix of headwinds, primarily from assets it got as part of an M&A.

- I view these issues as temporary, even if that “temporary” could turn into 1-2 years prior to normalization, given the pressures on the company to de-lever, and do so quickly.

- I rate Intrum a “BUY” here, at any time the native share price is below 140 SEK. My long-term expectation is for the company to go above 200-240 SEK again.

- This thesis is updated as of November 2024E.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Despite the cancellation of the dividend, I am unfazed. This company remains a “BUY”.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here