The Company

The Boeing Company (NYSE:BA), established in 1916 and headquartered in Chicago, is a major aerospace company involved in the production of commercial jetliners, military aircraft, rotorcraft, electronic and defense systems, missiles, satellites, launch vehicles, and advanced information and communication systems.

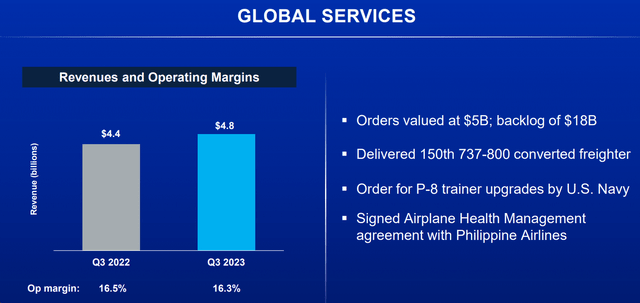

Boeing operates in 3 reportable segments, according to the latest 10-Q filing:

- Commercial Airplanes (“BCA”, 43.5% of 3Q FY2023 sales), which produces planes like the 737 MAX, 787 Dreamliner, and 777X; and

- Defense, Space, and Security (“BDS”, 30.3%), which manufactures products like the F-18 Hornet, AH-64 Apache helicopter, P-8 Poseidon aircraft, and KC-46 Tanker.

- Global Services business (“BGS”, 26.2%) is focused on creating value throughout the lifecycle of its products.

BA’s 10-Q

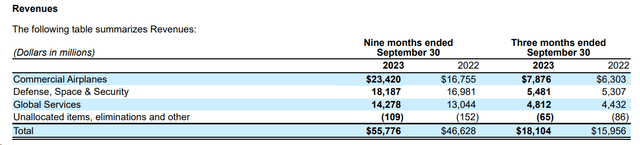

In Q3 2023, Boeing’s Commercial Airplanes segment saw a 25% YoY revenue increase, delivering 105 aircraft and booking ~400 net orders, including significant orders for the 737 MAX-10, 787s, and more. However, the EBIT margin remained negative for the 17th consecutive quarter (according to Argus Research, a proprietary source) due to ongoing production costs related to the 737 MAX and 787. The backlog grew to over 5,100 aircraft, valued at $392 billion. The 737 program is transitioning production to 38 planes per month. Due to supplier issues, the management revised this segment’s delivery expectations to 375-400 airplanes this year.

BA’s IR materials

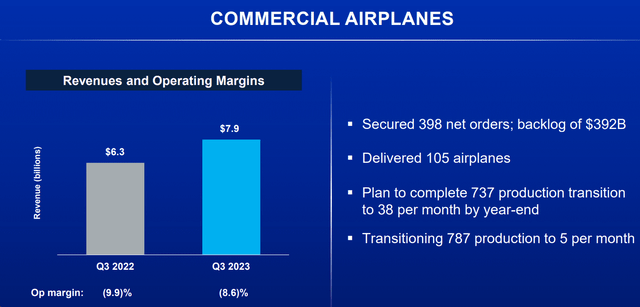

In the BDS segment, there was a 3% YoY revenue growth with a negative EBIT margin of 16.9%, primarily impacted by higher estimated costs on the VC-25B program and increased costs on a satellite program. The backlog remained stable at $58 billion. During the earnings call, Boeing outlined a recovery plan for BDS, emphasizing lean initiatives, cost productivity, and underwriting discipline to achieve high single-digit margins by 2025/2026.

BA’s IR materials

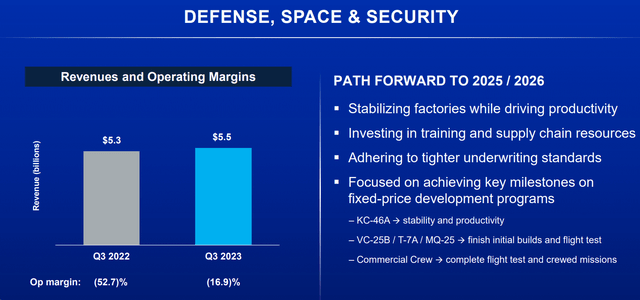

Q3 was a strong quarter for the BGS segment, which generated ~$5 billion in orders and maintained a solid backlog of $18 billion. The BGS segment reported 9% revenue growth in Q3, driven by higher commercial volume, with a 16.3% operating margin. Intermediate-term goals for this segment include mid-single-digit growth and mid-teens margins.

BA’s IR materials

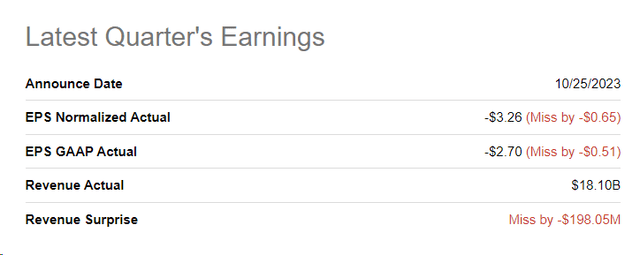

So on a consolidated basis, Boeing reported a 13% YoY increase in revenues, reaching $18.1 billion. However, the company experienced another operating loss, with a non-GAAP core operating loss of $3.26 per share (compared to a loss of $0.82 per share in Q2 and $6.18 per share in Q3 of the previous year). The consensus had anticipated a loss of $2.79 per share. As a result, Boeing missed Wall Street expectations on both the top and bottom lines:

Seeking Alpha, Boeing’s Earnings

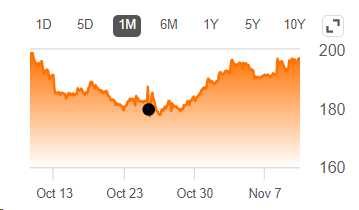

However, the reaction to the earnings miss was a contrary movement: BA shares have risen by >10% in less than a month since the Q3 figures were published.

Seeking Alpha

Why?

BA’s management emphasized a commitment to meeting financial goals for FY2023 and the FY2025/FY2026 timeframe. The company highlighted challenges faced in Q3 but expressed confidence in its recovery plan. Boeing still aims to stabilize and increase production rates for the 737 and 787 programs, eliminate 737 and 787 inventory by the end of 2024, and reach key milestones in various defense and space programs. The overall market demand for Boeing’s products and services seems to be strong, and the company aims for a meaningful improvement in operating performance in the coming quarters.

In 2018, before the 737-MAX groundings, Boeing delivered 806 commercial planes versus just 480 in 2022, and Airbus in 2019 delivered 863 commercial planes versus just 661 in 2022. Going off these numbers means we’re still ~32% below pre-COVID commercial airplane production, Atai Capital Management’s Investor letter [Q1 2023] mentioned back in April of this year.

We know that the ongoing supply chain challenges impacted production rates, hindering the planned output increase to meet post-pandemic demand. But despite these challenges, Boeing anticipates overcoming supply chain headwinds by 2024 and beyond, aiming to reach 38 aircraft per month for 737 production by the end of the year and is currently transitioning to 5 aircraft per month for 787 production. In comparison, pre-pandemic production rates were 52/month for 737s and 14/month for 787s, indicating room for future growth and margin expansion.

Assuming margins normalization, John Eade from Argus Research suggested in his November research report [proprietary source] that Boeing could reach an earnings power of $15-20 per share in 2025 or 2026:

Looking ahead, once the 737 MAX and 787 are fully back in production and Boeing is accelerating deliveries, we see earnings power of $15-$20 per share. It looks like that will be 2025-2026 at the earliest. Meanwhile, management is making progress on cash flow growth, which we think can lift valuation multiples.

Source: Argus Research, emphasis added by the author

Goldman Sach also sees significantly higher pricing for Boeing which is expected to boost margins in the future. Booming air travel and robust aircraft demand, fueled by growth and upgrades, have created a multi-year backlog for Boeing. So GS sees a lot of room for production to ramp back up towards pre-pandemic levels.

But like any stock under pressure, Boeing shares need a catalyst to take off. And here we may have 2 catalysts at once (in addition to the influence of the favorable backdrop described above).

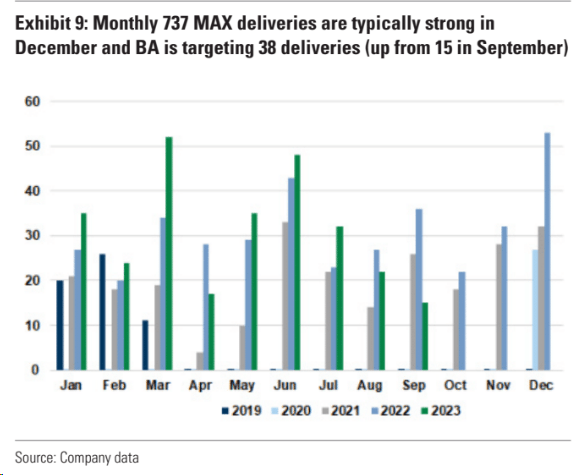

First, Boeing seasonally makes most of its deliveries in the last quarter, so Q4 numbers are likely to be strong as Boeing itself is targeting 38 deliveries (up from 15 in September):

Goldman Sachs

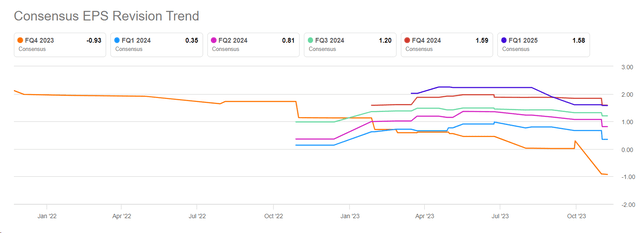

At the same time, we have strong downward earnings revisions for the fourth quarter, which should give Boeing more opportunity to exceed expectations, in my view.

Seeking Alpha, BA, Earnings Revisions

The second catalyst refers to China. A few hours ago (at the time of writing) Bloomberg published an article stating that China is reportedly considering resuming purchases of Boeing’s 737 MAX aircraft and that talks are taking place ahead of the meeting between US President Biden and Chinese President Xi at the APEC summit. The terms of the potential deal are still being negotiated and could be announced in the form of a memorandum of understanding. Boeing has struggled to sell its 737 MAX jets to China since 2018 due to global grounding following crashes and strained relations between the US and China. If the deal goes through, it could include the delivery of around 85 737 MAX jets already in storage and help Boeing reach its target of 375-400 aircraft this year. This would bring less uncertainty to the market, which could generate strong buying pressure for BA.

But what about Boeing’s valuation?

The Valuation

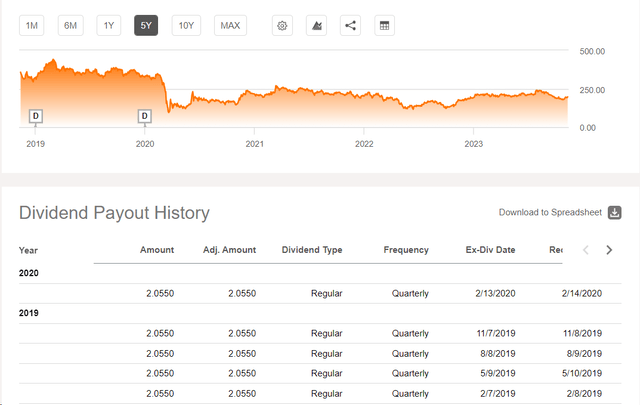

As you might know, in response to the economic impact of the COVID-19 pandemic, Boeing suspended its $2.055 per share quarterly dividend in March 2020, aiming to conserve cash. This decision dealt a significant blow to income-seeking investors, leading to a notable drop in the stock price. Despite stating intentions to reinstate the dividend when financially feasible, Boeing has not provided a specific timeline for this reinstatement, leaving investors uncertain about the future of dividend payouts. The stock price has yet to fully recover from the initial decline following the dividend suspension.

Seeking Alpha, BA’s dividends

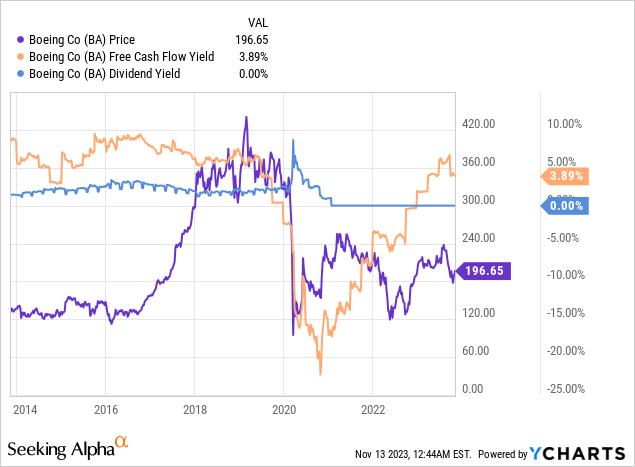

However, as I understand from the latest data, the company has already generated almost the same FCF yield as before the pandemic.

Moreover, Boeing confirmed its previous FCF guidance of $3-5 billion for FY2023 according to data from the latest IR presentation. Therefore, I assume that the resumption of dividend payments will not be long in coming – this should play into the hands of the company’s current multiples and give them some kind of premium.

Goldman Sachs gives the stock a target price of $258, deriving it exactly from FCF: they foresee a FCF yield of 4% for FY2024.

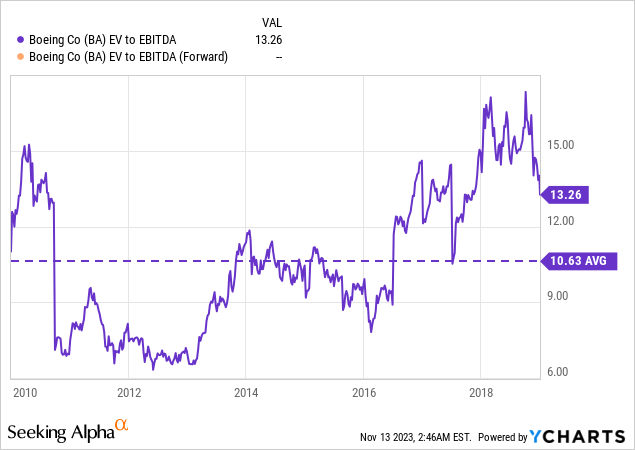

I believe that we should include cycle normalization in the calculation. Over the last decade (excluding 2020), Boeing stock has traded at an average EV/EBITDA of 10.63x, according to YCharts data:

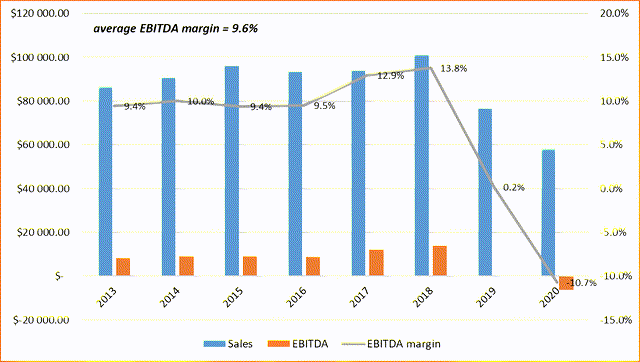

Let’s take the normal period 2013-2018. At that time, the EBITDA margin fluctuated slightly and, according to data from Seeking Alpha, averaged 10.8% for the period under review:

Author’s work, Seeking Alpha data, BA

Let’s assume that the company returns to its pre-pandemic EBITDA margin of 13.8% in FY2025 and achieves consensus sales of $101.01 billion. I find these assumptions quite conservative, as they are based on very “weak market hopes” (i.e. after 19 downward revisions in a row with no upward revisions).

Then, all other things being equal, BA’s EBITDA should rise to $13.94 billion, and assuming an EV/EBITDA of 13x (2018’s norm), the enterprise value of the company should be ~$116 billion. With a net debt of $38.9 billion, the implied market capitalization should be $142.31 billion – that’s ~19.6% higher than what we have today.

The Bottom Line

You should keep in mind, that investing in Boeing stock carries risks as the company has faced financial losses for 3 consecutive years, with unclear prospects for returning to profitability. Intense competition from aerospace rivals, regulatory uncertainties, vulnerability to supply chain disruptions, and geopolitical events pose additional challenges. Boeing’s ability to pay dividends and invest in new ventures may be impacted.

But despite the existing risks, I expect a gradual normalization of FCF and Boeing’s return to a new upswing in its operating activities. When this happens, the company will most likely resume paying dividends quickly, which will attract income-seeking investors again and only reinforce the potential recovery rally I’m talking about. Boeing needs a realization of 1 or 2 catalysts to really take off, and I expect the company to get them in the next few months.

Thanks for reading!

Read the full article here