One of last week’s biggest losers was The Trade Desk (NASDAQ:TTD). The global technology platform for buyers of advertising saw its shares tumble more than 16.6% on Friday after the company reported its Q3 results. While the company announced both top and bottom line beats for the period, revenue guidance for the current quarter came in well below street expectations. With shares falling to a six-month low, one prominent investor bought on the drop.

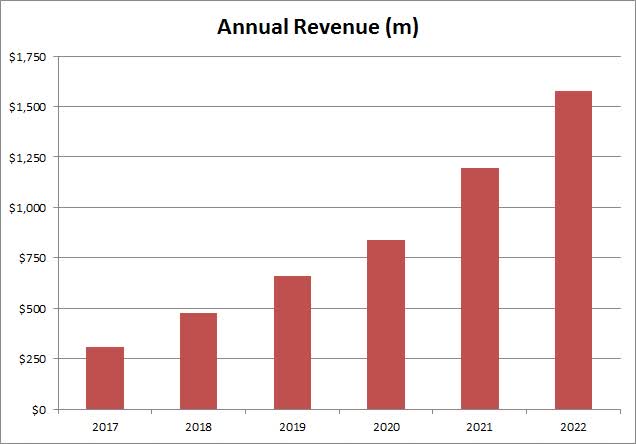

For those unfamiliar with the name, it operates a self-service cloud-based platform that allows buyers to plan, manage, optimize, and measure data-driven digital advertising campaigns across various ad formats and channels. The company has been around since 2009, but the business has really grown in recent years as seen below. Last year, almost $1.6 billion in revenue was reported, with the name being GAAP profitable in each of these six years.

Annual Revenues (Company SEC Filings)

Last week, the company announced revenue growth of nearly 25%, almost reaching half a billion dollars in the quarter. The top line figure beat street estimates by about $6 million, and there has only been one revenue miss in the past five years. On the bottom line, non-GAAP EPS of $0.33 beat by four cents, and there have been no misses of street expectations here over that same time period. Customer retention remained over 95% during the third quarter, as it has for the past nine consecutive years.

The main problem though was revenue guidance for the current period. Management said that Q4 revenues would be at least $580 million, but analysts were looking for about $611 million. Given the company’s history, it would not surprise me if estimates come down a bit, and then we get another revenue beat when Q4 results come in. For the year, the current expectation is a little under $2 billion, or about 22% growth, and the street believes that the top line number can double again to more than $4 billion by 2027.

The one area that can’t be debated is the company’s balance sheet, which is extremely healthy. The Trade Desk had a little over $1.52 billion in cash and investments at the end of Q3, and it is on pace to deliver around $600 million of free cash flow this year. The company is using a lot of cash to repurchase shares, buying back over $426 million worth of stock in the first nine months of 2023. Unfortunately, there’s a lot of stock-based compensation here, so the share count isn’t quite coming down right now.

The main criticism of this name over time has been valuation. Earnings growth rates right now are projected to be comparable to names like Alphabet (GOOG) (GOOGL) and Meta Platforms (META), with The Trade Desk reporting revenue growth rates about twice that of those two tech giants. However, if we look at 2024, The Trade Desk goes for more than 44 times expected earnings and over 13 times expected sales. That’s well above Alphabet’s 20 times and 5 times, respectively, with Meta at 19 times and 5 times.

Given that huge valuation difference along with the guidance disappointment, I wouldn’t be buying in right here. However, because I think growth names could become popular again in 2024 once the Fed changes course a bit, I would not be shorting this name either. Thus, I would rate the name as a hold currently, and I probably won’t change that stance until we see what the company projects for revenue growth in the beginning of 2024.

However, my focus today is on one prominent investor, and that is Cathie Wood. Her firm ARK Invest owned a small stake in The Trade Desk going into earnings, a little less than 165,000 shares as of last Thursday, in the ARK Next Generation ETF (ARKW). As we’ve seen with many names that collapse after earnings in the ARK universe, the firm stepped in right away, with the daily trades e-mail showing a purchase of another nearly 69,000 shares in ARKW on Friday, increasing its position quite a bit on a percentage basis. The more important thing, however, was what happened in the flagship ARK Innovation ETF (ARKK) as seen in the graphic below.

ARKK November 10th Trades (Ark Invest)

The Trade Desk was not in Cathie Wood’s top fund before Friday, so it is now one of 33 select names in this particular ETF. However, unlike Recursion Pharmaceuticals (RXRX) that also went in for the first time, The Trade Desk got an initial weight of more than 51 basis points. That puts the name with a higher weighting than four other stocks in the ETF already, with the potential for that ranking to jump rather quickly if there is more buying this week. Given that The Trade Desk has a market cap of more than $31 billion, comparable to an ARK favorite like Block (SQ), it is not likely to be like one of those 15 or so names that Cathie Wood’s firm owns more than 10% of, anytime soon.

In the end, shares of The Trade Desk tumbled after the company’s Q3 report last week. While the company did announce its usual set of headline beats, Q4 revenue guidance was quite a bit light. I currently would not own The Trade Desk due to its high valuation along with revenue estimates coming down, as it still is just too expensive for a company not growing as fast as previously hoped. Given that ARKK is down almost 9% in the past five years compared to a 126% gain for the Invesco QQQ Trust (QQQ) that tracks the NASDAQ 100 index, I’m even more skeptical to follow Cathie Wood and her team into the name. I will certainly be watching though in the coming weeks to see how much more money ARK Invest puts into this name, and I’ll look to re-evaluate the entire situation here at the company’s next earnings report.

Read the full article here