October CPI is due to be released at 8:30 a.m. Eastern tomorrow, with core CPI figures expected to show an increase of 0.3% month-over-month and 4.1% year-over-year. Big-money investors closely watch these inflation figures for clues about how the economy is functioning and what the Federal Reserve will do next. Additionally, hair-triggered trading algorithms are standing by, ready to buy or sell billions of dollars’ worth of stocks based on how the report comes in. For obscure technical reasons, past CPI reports have driven surprisingly large moves in the S&P 500 (SPY). This is especially true for October CPI. October CPI is always a quirky case because the government figures its annual calculation of health insurance costs starting each year in October.

An Obscure Health Insurance Adjustment Is Set To Push Inflation Up

Obscure data adjustments in each October’s data tend to swing the CPI numbers enough to create “surprises” in inflation and have caused trading algorithms to go wild in the past. These adjustments artificially pushed inflation up in 2022 and down in 2023. It doesn’t change the reality on the ground, but these adjustments can and will bait trading algorithms to make huge trades based on noise.

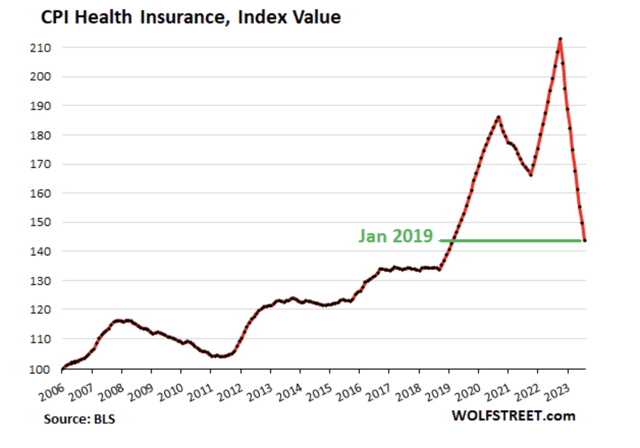

Based on the huge swing downward in the health insurance component of CPI and the Bayesian inference of everyone I know having their 2024 open-enrollment health insurance renewal go up sharply, we can guess that the next adjustment to health insurance will be up. You can see these bizarre swings here (graph below from Wolf Richter’s Wolf Street blog).

CPI Health Insurance (Wolf Street)

The overall effect of health insurance is small but real. Current estimates are that the health insurance adjustment reduced CPI by about 0.2% for the past year and that it will increase CPI by about 0.1% for the next year (i.e. a net swing of 0.3%). These numbers sound small, but algorithmic traders make huge bets based on CPI being above or below expectations. Higher CPI reports in the past have dropped the market by 2% or more in one trading session, and vice versa.

Is this a bit silly? Sure. The Fed itself prefers to use the PCE index for inflation to set policy because the data is less quirky. But CPI is commonly used as a benchmark in business contracts like leases, to set the payouts on various inflation-linked TIPS, and also to set tax brackets and social security payouts. A mere 0.3% net difference in CPI over the next year will redistribute billions of dollars of wealth back and forth when multiplied out by hundreds of millions of people participating in the entire US economy. And I don’t even know how they effectively can account for the ubiquitous “shrinkflation,” where restaurant portions and grocery store weights seem to continuously go down. Maybe we’ll all just own nothing and like it.

Even Without Health Insurance, Data Suggests Fed’s Inflation Fight Isn’t Over

In the past, I’ve used three basic techniques to handicap inflation reports.

- Countries that report before the US. France and Spain both reported inflation in line with estimates. The UK hasn’t reported inflation yet for the month. This indicator is neutral.

- Fed nowcasting. The Cleveland Fed’s inflation nowcasting model expects core inflation to come in at 0.34% for the month. The model was coming in high on inflation over the past year, but it didn’t have any adjustment for health insurance, causing it to overshoot. This highlights that core inflation might come in at 0.4% for the month– markets would react quite negatively to this. The Fed model differs from the economist surveys, and on average when this happens, the Fed model wins. This indicator suggests inflation will be hotter than expected.

- The Fed’s model is simple, so private vendors can fill in the gap to confirm what it says. Truflation is a really useful tracking tool for inflation in the US and UK, and the data shows that the rate of inflation is again in an uptrend since this summer’s Fed pause. Truflation shows that the Fed has yet to achieve its 2% annual inflation target at any point post pandemic and that inflation is now going in the wrong direction. They’re showing an inflation rate of around 3% annualized, up from a low of 2.1% this summer (note that Truflation’s figures and CPI aren’t directly comparable due to different methodologies). These numbers suggest that the Fed’s job on inflation is not simple, and it’s not clear that they’ve done enough tightening. If you’re paying attention, this is exactly what Fed speakers including Jerome Powell are saying. The market seems to have its earmuffs on. Truflation is another data point suggesting a hotter inflation figure.

Putting these together with the economist consensus inflation forecasts for October, I think core CPI is more likely than not to surprise to the upside. I think the number comes in at 0.4% due to these weird health insurance adjustments and what we know coming out of Truflation and the Cleveland Fed model. With CPI at 0.4%, there’s no telling how the market would react, but if the market starts to realize that inflation is a structural problem that won’t go away on its own, I’d expect stocks to fall back below last month’s correction lows sooner or later.

Bottom Line

I’m making some educated guesses here, but there are technical reasons for CPI to come in higher than expected tomorrow, and in that case, technical reasons that may cause stocks to sell off. The entire history of inflation suggests that the government doing the minimum doesn’t work and that the Fed is likely to be forced to hike further. Inflation tends to be a long-term problem. For these fundamental reasons, investors paying peak valuations for assets and speculating on a return to much lower interest rates are likely to find themselves in increasingly bad shape. In the short run, the algorithms could do anything tomorrow, but investors with patience and willingness to take risk when the odds favor them should prosper in the long run. The risk-reward remains exceedingly weak for the market, with inflation being one problem of many.

Read the full article here