The BlackRock Corporate High Yield Fund, Inc (NYSE:HYT) is a closed-end fund aka CEF that specializes in providing its investors with a very high level of income. This is a task that the fund performs reasonably well, as its current 10.70% yield is among the highest available in the market. For the most part, the fund’s yield compares reasonably well to other junk bond funds:

|

Fund |

Current Yield |

|

BlackRock Corporate High Yield Fund |

10.70% |

|

Credit Suisse High Yield Bond Fund (DHY) |

9.69% |

|

BNY Mellon High Yield Strategies Fund (DHF) |

8.14% |

|

PGIM Global High Yield Fund (GHY) |

11.90% |

|

Credit Suisse Asset Management Income Fund (CIK) |

10.06% |

The only fund here that has a higher yield than the BlackRock Corporate High Yield Fund is the PGIM Global High Yield Fund, and that one is not a perfect comparison because it is more internationally focused. In short, we can clearly see that the BlackRock Corporate High Yield Fund offers a yield that should appeal to just about every income-seeking investor. The fund thus generally appears to be performing its task fairly well.

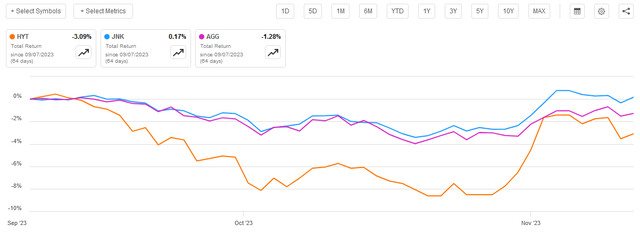

As regular readers may recall, we have discussed this fund a few times over the past couple of years. The most recent time was early September of this year. That was generally a weak market for most assets, as rising yields were pressuring asset prices down, which includes the price of bonds. High-yield bonds held up much better than investment-grade bonds in that environment though, as their shorter durations and high yields proved very attractive for investors looking to lock in a fairly large level of income from their investment portfolios. This market environment persisted until late October when the market started bidding up asset prices in expectation of a near-term rate cut. Unfortunately, this fund did not manage to perform very well over that interesting two-month period. As we can see here, the fund underperformed both the Bloomberg U.S. Aggregate Bond Index (AGG) and the Bloomberg High Yield Very Liquid Index (JNK) on a total return basis over the past two months:

Seeking Alpha

This is certainly very disappointing, although we can see that this fund has managed to stage a rally over the past two weeks. It does have a higher yield than either of these two indices though, so that may appeal to some investors.

Despite the generally strong performance that the fund has delivered over the past two weeks, it continues to trade at a reasonably attractive price. As such, let us revisit it and see if it could make sense to add to a portfolio today.

About The Fund

According to the fund’s website, the BlackRock Corporate High Yield Fund has the primary objective of providing its investors with a very high level of current income. This makes a great deal of sense considering the fund’s strategy. The website explains the fund’s basic strategy thusly:

BlackRock Corporate High Yield Fund, Inc.’s primary investment objective is to provide shareholders with current income. The Trust’s secondary objective is to provide shareholders with capital appreciation. The Trust seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its assets in domestic and foreign high yield securities, including high yield bonds (commonly referred to as ‘junk’ bonds), corporate loans, convertible debt securities and preferred securities which are below investment grade quality. The Trust may invest directly in such securities or synthetically through the use of derivatives.

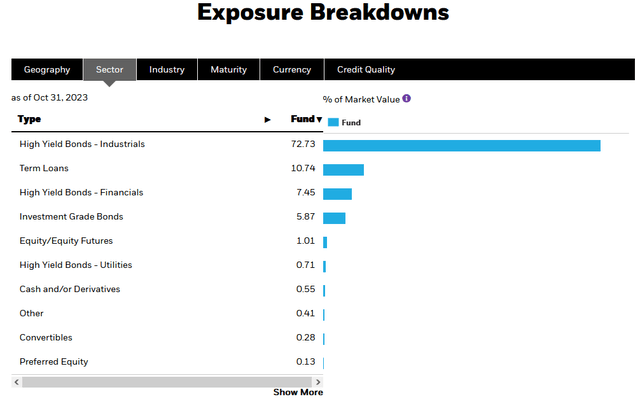

This description is basically that of a typical junk bond closed-end fund. This fund can include assets such as corporate loans though, which could give it a bit of an advantage over funds that cannot invest in these securities in certain circumstances. This is because corporate loans are typically floating-rate securities, so they hold their value much better than ordinary bonds during periods of rising rates. I discussed this in a previous article. However, as of the time of writing, only 10.74% of the fund’s assets are invested in corporate loans. The overwhelming majority of its assets (72.73%) are invested in junk bonds that are issued by non-financial companies:

BlackRock

The fund’s focus on high-yield bonds may concern some readers. After all, the market volatility over the past two years has caused many people to adopt a risk-off strategy and just preserve what they already have rather than take a chance on potentially losing more than they did in 2022 or in the market struggles of the latter half of 2023. Junk bonds are fairly well known for having a very high risk of suffering losses due to defaults. This is the reason that they are called “junk bonds.”

The risk of default losses has been rising over the past two years due mostly to rising interest rates. According to Moody’s Investors Service, the junk bond default risk will rise to 5.6% in January 2024 before slowly declining to 4.6% in August 2024. This is because many companies that have junk bond maturities over that period will not be able to afford the higher interest rates on the new debt that they have to issue to pay back the investors in the maturing debt. This problem is most prevalent with zombie companies, which have become rather common over the past fifteen years of very low interest rates. A zombie company is a company that generates sufficient revenue and operating income to pay the interest expenses on its debt, but it has to keep rolling over the debt because it cannot make any headway on the principal. These companies are almost certainly going to be unable to afford to finance their debt in today’s high-rate environment and will have no other choice but to default.

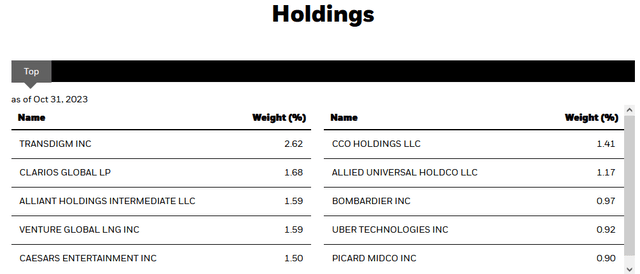

Obviously, this is something that will prove to be very concerning to risk-averse investors. After all, nobody likes to lose money, and losing money is particularly problematic for retirees who may have difficulty obtaining new principal. Fortunately, the BlackRock Corporate High Yield Fund has taken some steps to protect its portfolio, and by extension its shareholders, against the losses that accompany defaults. Perhaps the most important tactic that the fund is employing is to maintain a very diversified portfolio that does not have very much exposure to any individual company. Here are the largest positions in the fund as of the time of writing:

BlackRock

As we can clearly see, the largest holding in the fund only accounts for 2.62% of its total assets. Most of the companies that we see here account for a much smaller percentage of the portfolio. The percentages here are overall small enough that a single default should not really have a noticeable impact on the fund as a whole. After all, the current yield of the Bloomberg High Yield Very Liquid Index is 8.97% right now so we can assume that most of the bonds that are held by this fund are somewhere around that level. Thus, the interest payments that are received by the fund should be more than sufficient to offset any single loss caused by a defaulting company. Of course, the fund could still suffer if a black swan event causes a whole bunch of companies to default in rapid succession, but there is very little that can be done to protect against that occurrence.

Recent Performance

In the introduction to this article, we saw that the BlackRock Corporate High Yield Fund has underperformed the broader bond market indices on a total return basis since early September. This seems somewhat surprising considering that high-yield bonds have held up very well over the past two months. For example, Reuters stated last week that:

In recent days, as it started to appear that the Fed rate-hiking cycle might have peaked, investors have shown more willingness to dip their toes back into junk-rated bonds.

For my part, I pointed out in September that junk bonds were exhibiting a surprising amount of popularity as investors wanted to lock in high yields on their money before the Federal Reserve started to cut interest rates. Thus, it is somewhat surprising that the BlackRock Corporate High Yield Fund has delivered a negative total return since September considering that the junk bond index has been positive over the same period.

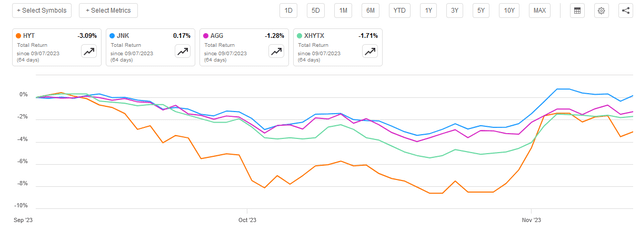

However, one of the interesting things about closed-end funds is that sometimes their performance in the market does not match the performance of their portfolios. This has been the case with this fund over the past two months. As we can see here, the BlackRock Corporate High Yield Fund’s portfolio has delivered a negative 1.71% return since the date that my prior article was published. This is a lot better than the negative 3.09% total return that was delivered by the shares in the market:

Seeking Alpha

There are a lot of possibilities for why the fund’s shares underperformed the portfolio, but it is certainly not atypical. In fact, as regular readers are likely aware, there have been a lot of closed-end funds whose shares have delivered very disappointing performances relative to their portfolios over the past few months. While this changed somewhat around the end of October, the market has generally been selling off anything that delivers most of its investment returns in the form of direct payments to its shareholders.

Closed-end funds such as the BlackRock Corporate High Yield Fund tend to have limited liquidity, so their selloffs can be larger than is really justified in such an environment. For example, this fund only has a few hundred thousand shares changing hands each day, so it does not require very much money to move the share price. During an environment in which a handful of retail investors (the primary holders of funds like this) panic, only a few people with holdings in excess of $100,000 need to sell in order to drive down the price. That is very different than a huge company’s stock price, which generally cannot be moved by a handful of small investors.

Fortunately, though, the fact that the fund’s share price performance has been much worse than is justified by the performance of the fund’s portfolio could create an opportunity for investors to get in at a fairly attractive price. We will discuss this later in this article.

Leverage

As is the case with most income-focused closed-end funds, the BlackRock Corporate High Yield Fund employs leverage as a method of boosting the effective yield of its portfolio. I explained how this works in my last article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase high-yield bonds and similar income-producing assets. As long as the purchased bonds have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case. However, it is worth noting that the rising interest rate environment has made this strategy less effective than it was a few years ago, when leverage was basically free.

The real downside to leverage comes from the fact that it boosts both gains and losses. As such, we want to ensure that the fund does not have too much leverage, because that would expose us to too much risk. I do not typically like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the BlackRock Corporate High Yield Fund has levered assets comprising 29.56% of its portfolio. This is a bit higher than the 28.33% leverage ratio that the fund had the last time that we discussed it, so it appears that the fund’s leverage is increasing. That is not really surprising though, as the fund’s net asset value is down over the past two months so simply keeping its leverage at the same level would result in the fund’s leverage going up. For the most part, this fund does not appear to be using an excessive amount of leverage even today at a higher level. It is certainly much less levered than many of the other fixed-income closed-end funds that we have discussed in this column. As such, there is probably nothing that we really need to worry about here. The trade-off between the risk and the reward appears to be acceptable as of the time of writing.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BlackRock Corporate High Yield Fund is to provide its investors with a very high level of current income. In order to achieve that objective, the fund invests in a portfolio that consists primarily of high-yield bonds and similar income-producing securities. As the name suggests, these bonds tend to have fairly high yields. After all, the Bloomberg High Yield Very Liquid Index currently has a yield-to-maturity of 8.97% and most of the bonds that are held by this fund should be in that same ballpark. This fund collects all of the coupon payments that it receives from these securities and then applies a layer of leverage to boost their yields beyond that of any of the underlying assets. This fund might also be able to exploit changes in bond prices to realize capital gains on occasion. Any realized gains from this function will add to the pool of money that the fund is accumulating, which then gets paid out to the shareholders on a regular basis, net of the fund’s own expenses. It might be expected that this would give this fund a very high yield.

That is certainly the case as the BlackRock Corporate High Yield Fund pays a monthly distribution of $0.0779 per share ($0.9348 per share annually), which gives it a 10.70% yield at the current share price. That is certainly a reasonable yield that is well beyond that of most bond indices, including ones that follow the high-yield debt market. It is certainly a higher yield than what is possessed by most common stock indices.

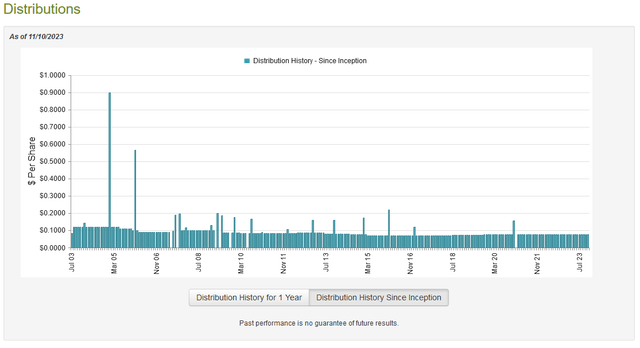

Unfortunately, this fund has not been particularly consistent with respect to its distributions over the years. As we can see here, the fund has been forced to change its distribution several times over its lifetime:

CEF Connect

The fact that the distribution has exhibited a great deal of volatility may be something of a turn-off for those investors who are seeking to earn a safe and certain level of income from the assets in their portfolios. However, this fund has been much more consistent than most other bond funds over the past two years. As we have seen in various previous articles, most closed-end funds that invest in traditional bonds have cut their distributions over the past two years as falling bond prices and rising yields have caused many of them to suffer losses across their portfolios. This fund has maintained its distribution over the same period, which is curious. We should have a closer look at the fund’s finances and attempt to determine why it has been able to perform a task that few of its peers have been able to accomplish.

Fortunately, we have a fairly recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. This report therefore covers a period that was characterized by a great deal of optimism throughout the capital markets. There were many investors who expected that the Federal Reserve would cut rates during the second half of this year, and they started bidding up asset prices accordingly. That belief proved to be false, but it may have still provided the fund with an opportunity to take advantage of the situation and sell some bonds into a market that was keeping their prices elevated. Unfortunately, this report will not show what happened after June 30, 2023, which is a shame because interest rates started rising fairly shortly after that date, so the fund undoubtedly took some losses.

During the six-month period, the BlackRock Corporate High Yield Fund received $43,555 in dividends and $67,139,088 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund earned a total investment income of $68,108,168 during the period. It paid its expenses out of this amount, which left it with $47,612,223 available for shareholders. That was, unfortunately, not nearly enough to cover the $66,697,943 that the fund paid out in distributions over the six-month period. At first glance, this seems likely to be quite concerning as the fund is clearly failing to cover its distributions out of net investment income. With a fixed-income fund, we generally want the net investment income to be higher than the distributions that were paid out.

With that said, there are some other methods through which the fund can obtain the money that it needs to cover the distributions. For example, it might be able to exploit changes in bond prices and make some opportunistic trades in order to obtain money that can be paid out to the shareholders as distributions. The fund generally had mixed results in this task during the period. It reported net realized losses of $69,338,743 during the period, but these were more than offset by $108,217,130 net unrealized gains. Overall, the fund’s net assets went up by $19,792,667 after accounting for all inflows and outflows during the period.

Thus, the fund technically did manage to cover its distributions during the period. This is a good sign, and it is better than a lot of other fixed-income funds managed to accomplish. However, the fund only managed to accomplish this because of unrealized gains. Its net investment income and net realized gains were nowhere near enough to cover the distributions that were paid out. The problem with relying on unrealized gains to maintain the net asset value is that unrealized gains can be erased very quickly once the market moves against the investor. As such, it is not a reliable way to cover your distribution. We will want to pay close attention to the fund’s finances as it reports in its full-year results to ensure that this distribution is sustainable, as the second half of this year may have erased some of these gains. It appears that this could have been the case, as the fund’s net asset value is down since July 1, 2023:

Seeking Alpha

However, the net asset value is not down by very much since this report’s ending date, so it is possible that the fund managed to lock in some of these gains or is otherwise having success at covering its distribution.

Overall, BlackRock Corporate High Yield Fund, Inc’s financial situation certainly appears to be better than most other bond funds and there does not appear to be an imminent risk of a distribution cut. Income-focused investors should be able to rest easy here.

Valuation

As of November 10, 2023 (the most recent date for which data is available as of the time of writing), the BlackRock Corporate High Yield Fund has a net asset value of $9.20 per share. However, the shares currently trade at $8.75 each. That gives the fund’s shares a 4.89% discount on net asset value at the current price. This is an acceptable price, although it is not as good as the 5.60% discount that the shares have had on average over the past month. Investors can certainly do worse than to buy today, though.

Conclusion

In conclusion, the BlackRock Corporate High Yield Fund is BlackRock’s take on a junk bond fund and it seems to be a good one. The fund has the diversity that we require to provide a degree of protection against the high risk of defaults by these securities and its performance is reasonably acceptable. The fund has somewhat underperformed the junk bond index over the past two months, but at least some of that appears to be caused by the fund’s shares declining by far more than the portfolio justifies. This is also one of the few fixed-income funds that appears to be covering its distribution. When we combine this with a reasonably acceptable price right now, it might be worth considering.

Read the full article here