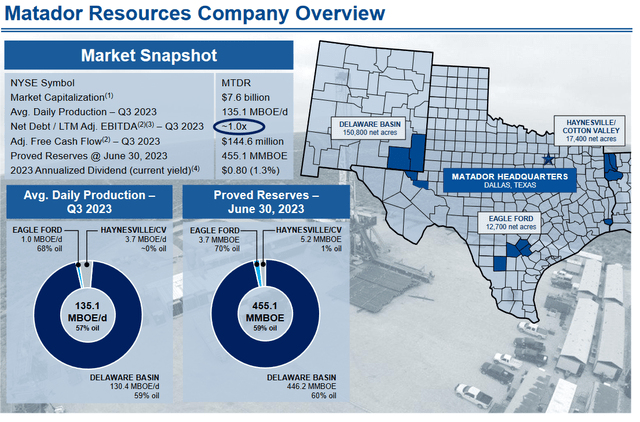

Matador Resources Company (NYSE:MTDR) is an independent American exploration and production company that primarily operates in the Permian Basin, Eagle Ford Shale, and Haynesville Shale plays of Texas and Louisiana:

Matador Resources

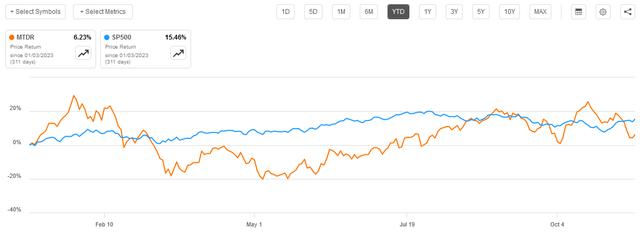

The company also owns a midstream company in New Mexico that has been enjoying a great deal of success recently. However, this is still an independent exploration and production company, and as such its stock price performance tends to be at least somewhat correlated with energy prices. That is not necessarily the best thing right now because natural gas prices remain suppressed relative to last year’s levels, although crude oil prices (CL1:COM) have generally done okay. The company’s stock price is up 6.23% year-to-date, which is unfortunately much less than the 15.46% return of the S&P 500 Index (SP500) over the same period:

Seeking Alpha

We do see that the stock has shown strength over the past six months or so though, which could be a positive sign. The company may also have room to run going forward, as its valuation is at a very reasonable level right now and the fundamentals for crude oil point to rising prices going forward.

About Matador Resources Company

As stated in the introduction, Matador Resources Company is an independent exploration and production company that operates in the Permian Basin, Eagle Ford Shale, and Haynesville Shale in the southern part of the United States. As the map above shows, though, the company’s presence in the Permian Basin is substantially larger than its presence in either of the other two regions:

| Basin | Net Acreage |

| Permian Basin | 150,800 |

| Eagle Ford Shale | 12,700 |

| Haynesville Shale | 17,400 |

It is not particularly surprising that Matador Resources’ largest presence is in the Permian Basin. After all, this is the region that has been the core focus for most American energy companies over the past decade. This is due to a combination of its relatively low costs and its incredibly high reserves. As of 2019, the U.S. Energy Information Administration estimates that the Permian Basin has 12.1 billion barrels of crude oil and 49.9 trillion cubic feet of natural gas remaining, despite the fact that it has been producing since the 1920s. That easily makes this one of the largest oil-rich provinces known to exist worldwide. It is also one of the most resource-rich areas of the United States, although its natural gas reserves are dwarfed by the massive Marcellus Shale of Appalachia.

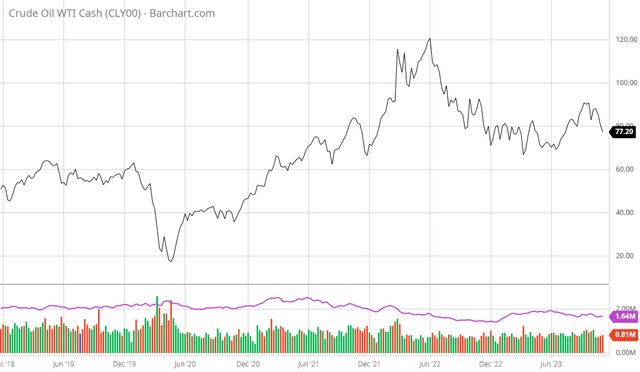

The generally low cost of producing crude oil in the Permian Basin have served Matador Resources well over the years. Over the past five years, the spot market price of West Texas Intermediate crude oil has ranged from $17.18 per barrel to $120.67 per barrel:

Barchart.com

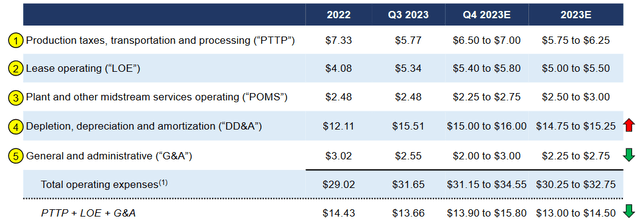

This is important because crude oil prices dictate the price that Matador Resources receives for the products that it sells. In the third quarter of 2023, 57% of Matador Resources’ production was crude oil so that product is more important to the company’s top and bottom lines than natural gas or other hydrocarbons. It currently costs Matador Resources an average of $31.65 per barrel of crude oil to produce based on its third-quarter figures:

Matador Resources Company

Thus, we can see that the company should be able to profitably operate in all but the worst-case scenario. After all, crude oil prices were only below $31.65 per barrel for a very short period of time in 2020. The incredibly low energy prices that we saw during that time were driven by a series of government-enforced “stay at home” orders that prevented people from traveling or engaging in other activities that would consume large amounts of crude oil. This naturally caused an oil glut in the United States, which was cleared up once the economy reopened.

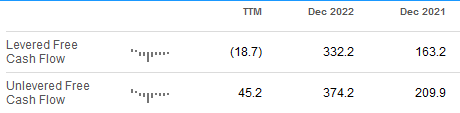

The fact that Matador Resources is able to produce crude oil for such a cheap price is very beneficial because it should mean that the company is able to generate a positive margin and cash flow through just about any oil price environment. We can in fact see this by looking at the company’s free cash flow. As we can see here, Matador Resources has managed to generate a positive unlevered free cash flow in both 2021 and 2022, as well as in the trailing twelve-month period:

Seeking Alpha

This is a huge improvement from prior to the pandemic. As I pointed out in a few previous articles, one of the biggest problems that shale companies had prior to 2020 was that they were unable to generate positive free cash flow from their operations. As such, these companies were issuing copious amounts of debt to finance themselves. This may have been one reason, out of several, that the energy sector significantly underperformed the S&P 500 Index over the 2010 to 2020 period.

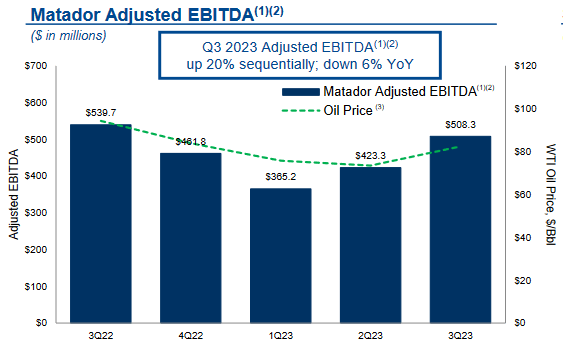

Matador’s low cost of production has also been beneficial for the company’s adjusted EBITDA (a proxy for pre-tax cash flow) over the past few quarters:

Matador Resources

As expected, the company’s performance still fluctuates with energy prices, but the improvements that we see in the past few quarters are impressive. This is particularly true for the second quarter of 2023, in which the company experienced the lowest average energy prices of the past year but still managed to beat its first-quarter numbers.

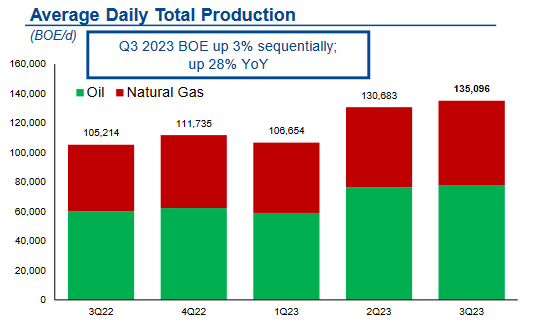

The growth that we see in the company’s adjusted EBITDA over the course of this year was driven by rising production. Matador Resources experienced a significant increase in the second quarter and was able to boost it further in the third quarter:

Matador Resources

The company itself credits this production growth for its strong performance. In the third-quarter 2023 earnings press release, the company stated the following:

The third quarter of 2023 was the best quarter of total production in Matador’s history, as we averaged more than 135,000 barrels of oil and natural gas equivalent (‘BOE’) per day. This record total production for the third quarter of 2023 was 3% better sequentially than our former total production record of 130,683 BOE per day in the second quarter of 2023. Notably, we also achieved record oil production during the third quarter of 2023 of 77,529 barrels per day, which was 2% better sequentially than our previous oil production record of 76,345 barrels per day in the second quarter of 2023. Matador also achieved record natural gas production during the third quarter of 2023 of 345.4 million cubic feet per day, which was 6% better sequentially than our prior natural gas production record of 326.0 million cubic feet per day in the second quarter of 2023. We achieved these record production results despite the challenges of bringing on the largest batch of wells in Matador’s history as well as challenges associated with maintenance, weather and potential midstream takeaway constraints.

It should be fairly obvious why rising production would have a positive impact on the company’s adjusted EBITDA. After all, if Matador’s production is higher then it naturally has more products that it can sell in order to generate revenue. The more revenue that it has, the more money that is available to cover fixed expenses and ultimately make its way down to cash flow and profits. In the second quarter, the increased production was sufficient to offset the fact that West Texas Intermediate crude oil prices were lower than in the first quarter of the year. In the third quarter, Matador Resources benefited from even higher quarter-over-quarter production and slightly higher crude oil prices.

Matador Resources is one of the few American energy companies that is actively growing its production. According to The Wall Street Journal,

Some oil executives said most of the shale industry plans to stand pat even as global oil prices increase further. Most shale companies have vowed to hand over their winnings from high energy prices to investors via share buybacks and dividends. They also face pressure from inflation and high-interest rates.

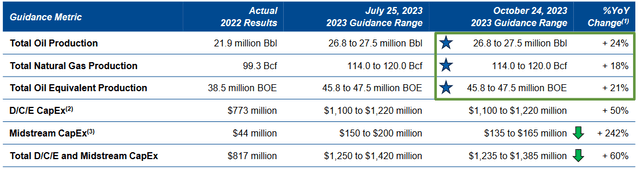

I discussed this in various previous articles on companies such as Diamondback Energy (FANG). The basic focus of many of these companies right now is to simply sit back and maintain their production while paying out most to all of their free cash flow to the shareholders in the form of dividends and share buybacks. Matador Resources appears to be an exception to this, as the company has been rather aggressive about growing its production over the course of this year. The company’s guidance certainly confirms this:

Matador Resources Company

As we can see, the company’s guidance is pointing towards a 24% year-over-year increase in crude oil production and an 18% increase in natural gas production. The company reaffirmed this guidance during the most recent earnings presentation so we can probably assume that it should be fairly accurate, especially since there is not much time left in this year.

Matador Resources has not publicly provided any 2024 guidance, although it implied in the earnings conference call that it would be aiming to increase production over the course of next year. The company specifically stated that it would be adding an eighth drilling rig to its current operating fleet. That suggests that Matador Resources wants to drill more wells in 2024 than it drilled in 2023, which should result in higher year-over-year production. This is certainly not a guarantee, however.

Thus, assuming that energy prices remain stable or increase from today’s levels, the company’s 2024 earnings and cash flows should come in a bit stronger than its 2023 earnings figures. Investors should obviously be able to appreciate that.

Crude Oil Price Fundamentals

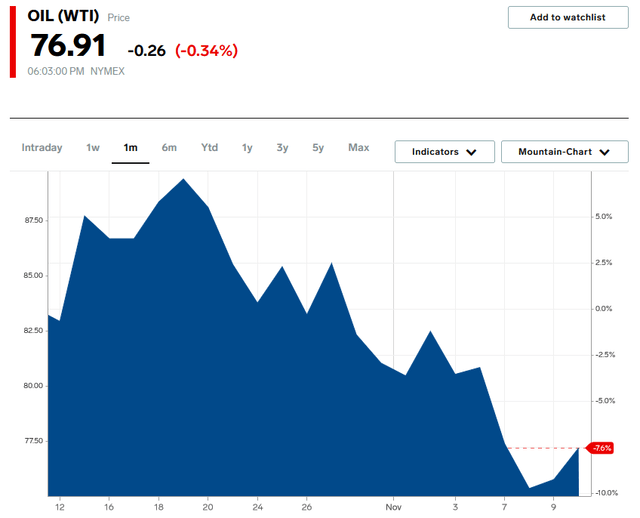

The long-term fundamentals point to rising crude oil prices going forward, although recent market action has not reflected that. In fact, West Texas Intermediate crude oil prices have declined by 7.6% over the past month:

Business Insider

I explained some of the reasons behind this in a recent post at Energy Profits in Dividends, but suffice it to say that not all of this price decline has been driven by fundamentals. In particular, hedge funds have been dumping an enormous amount of paper crude oil, which pushes the price down regardless of the actual supply and demand dynamics in the economy.

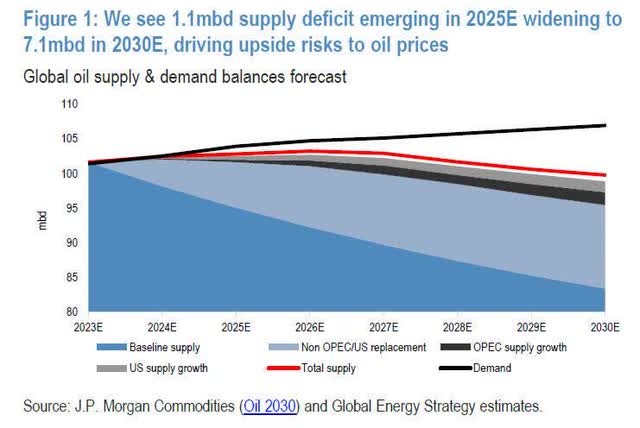

The long-term fundamentals are pointing to crude oil prices being much higher than most of us are used to going forward. This is mostly because the demand for crude oil is not going away, nor is it declining. In fact, it is increasing but energy companies have not invested in the production capacity to satisfy this rising demand. As a result, JP Morgan currently projects that globally there will be a 1.1 million barrel shortage of crude oil by 2025 that then expands to 7.1 million barrels by the end of the decade:

Zero Hedge/Data from JP Morgan Commodities

There is no conceivable way that such an imbalance in supply and demand will result in anything but rising energy prices as buyers around the world compete to purchase a product that is increasingly hard to obtain.

Obviously, a sustained rise in energy prices going forward, as JP Morgan is suggesting will be the case, will be beneficial for Matador Resources. After all, that will result in the company receiving ever greater amounts of money from each unit of product that it sells and thus padding its margins beyond where they already are.

Financial Considerations

As I pointed out in a previous article on Matador Resources:

It is always important that we investigate the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the proceeds to repay the existing debt. That can naturally cause a company’s interest expenses to go up following the rollover in certain market conditions. When we consider that interest rates are at the highest level that we have seen since early 2001, that is a very real risk today. In addition to interest rate risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flow to decline could push it into insolvency if it has too much debt. As we have already seen, Matador Resources has significant exposure to commodity prices so this is a risk that we should be cognizant of.

One ratio that we can use to evaluate a company’s ability to carry its debt is the leverage ratio, which is defined as net debt-to-adjusted EBITDA. This ratio theoretically tells us how many years it would take a company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of September 30, 2023, Matador Resources had a leverage ratio of 1.0x based on its trailing twelve-month adjusted EBITDA and its net debt as of September 30, 2023.

That leverage ratio is an enormous increase over the 0.10x ratio that the company had at the start of the year. One obvious reason for this is that crude oil and natural gas prices have been much lower this year than last year, which has weighed on the company’s adjusted EBITDA. The other reason is that Matador Resources took on a lot of debt to finance the acquisition of Advance Energy earlier this year. The company stated at the time that it intends to pay down this debt over the next two years. It does have a good start, as the extra production from the Advance Energy assets is the reason why the company’s production jumped sufficiently to keep its cash flow as high as it has over the past two quarters. Matador Resources remains below the 1.0x ratio that we normally deem acceptable in this sector, but I will admit that it will be nice to see the company pay down this debt over the next two years as it plans.

Valuation

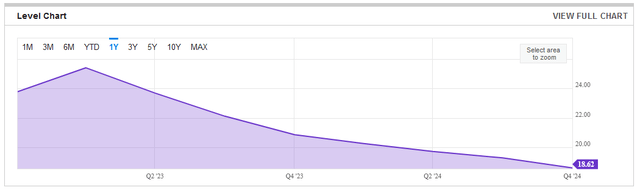

According to Zacks Investment Research, Matador Resources currently trades with a forward price-to-earnings ratio of 8.13. That is, to put it mildly, incredibly cheap today. The forward price-to-earnings ratio of the S&P 500 Index is 18.62 as of today:

YCharts

Matador Resources thus looks incredibly cheap relative to the market as a whole. However, as I have pointed out numerous times in the past, the entire traditional energy sector has been looking remarkably cheap relative to anything else in the market. As such, it would be a good idea to compare Matador Resources’ valuation to that of its peers in an attempt to determine how cheap it truly is.

Here is a comparison chart:

| Company | Forward P/E Ratio |

| Matador Resources Company | 8.13 |

| Diamondback Energy | 8.79 |

| Devon Energy (DVN) | 7.66 |

| Coterra Energy (CTRA) | 11.76 |

| EOG Resources (EOG) | 10.23 |

| APA Corporation (APA) | 7.51 |

As we can see, Matador Resources Company appears to have a reasonable valuation relative to its peers, but it is certainly not the cheapest company in the sector. It is certainly not overpriced though, so right now could be an acceptable time to get into the company.

Conclusion

In conclusion, Matador Resources Company is a very solid independent exploration and production company that has been consistently proving itself over the past few years. The company is slightly more dependent on crude oil than natural gas, but that is not necessarily a bad thing as the fundamentals for both commodities are very strong right now. Matador Resources Company appears to still have some forward growth potential and trades at a very reasonable valuation so it could certainly be worth considering for purchase.

Read the full article here