Research Note Summary

Today’s note covers Houston Texas-based food distributor Sysco (NYSE:SYY), who just had its earnings call a few weeks ago for its FY2024, Q1 earnings.

I am bullish on this company and gave it a buy rating.

Some positive tailwinds include above-average dividend yield and dividend growth, YoY earnings growth and equity growth, and a share price well below the moving average.

Some challenging headwinds include overvaluation on price to book value, extreme underperformance vs the S&P500 index, and only modest YoY revenue growth.

A key risk discussed was elevated debt levels and interest expense, as well as offsetting factors like declines in net debt ratios.

Methodology Used

My WholeScore Rating methodology looks at this stock holistically across multiple categories including key risks, and assigns a rating score. I exclusively cover stocks and foreign ADRs that are dividend-paying and trade on major US exchanges only (NYSE, Nasdaq).

Some of the data comes from the most recent FY24 Q1 results from October 30th., while the forward-looking sentiment relates to the upcoming FY24 Q2 earnings results expected on January 24th.

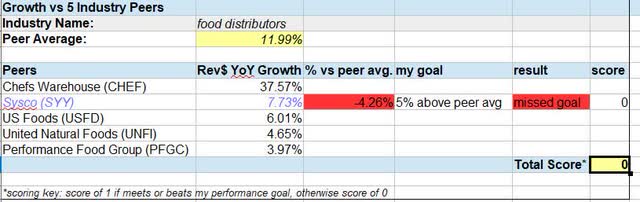

Growth vs Industry Peers

In this category, I picked 5 peers in the food distributors sector to compare each other’s YoY revenue growth.

In the report below, I selected a peer group of very large and comparable stocks, and it looks like this group achieved an average of 12% in revenue growth. My target stock, Sysco, achieved just under 8% growth so it missed my goal, losing a rating point here.

Sysco – growth vs peers (author report)

This industry supplies many of the restaurants, hospitals, hotels, fast food, and campus dining halls with various food supplies and materials. In fact, they are the big trucks you often see on the highway on the way somewhere and help make the behind-the-scenes logistics of food service possible, though I think are not so highly covered in financial media as are big tech stocks perhaps.

From its company profile, Sysco “distributes frozen food, such as meat, seafood, fully prepared entrées, fruits, vegetables, and desserts; canned and dry food products,” among other things.

Naturally, it is understood that such a massive logistics network of trucks, distribution centers, and supply-chain systems requires a lot of capital to run, and the balance sheet of a company like this may show lots of debt.

To backtrack to FY23, Sysco truly has proven itself as a “global” business and not just a US one, as the following graphic shows its diversification across regions, particularly its added reach via its international food group/IFG:

Sysco – global reach (company FY24Q1 presentation)

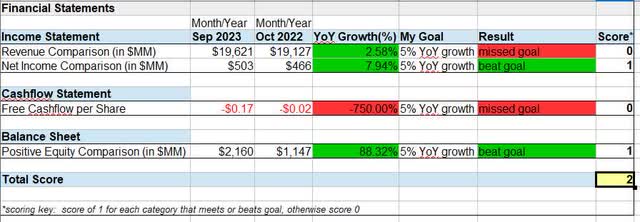

Financial Statements

What I am looking for is improvement trends on a year-over-year basis, so I typically compare the same quarter in different years.

From the income statement, a data story emerges about this firm in that we can see both the top-line and bottom-line grew modestly on a YoY basis. However, my goal of a 5% YoY growth was missed on revenue, but net income beat my goal.

Sysco – financial statements (author report)

In case you’re wondering, I use the 5% growth benchmark to simplify comparisons between years, as it is a relatively low and conservative number, so I am giving the firm quite a bit of rope.

When it comes to cashflow, which I also think is important to a serious company, their free cash flow per share remained negative and actually declined by 750%, which was a disappointment. However, keep in mind that items impacting cashflow could be one-time capital expenditures.

From the balance sheet, we see that the positive equity has improved by over 88% on a YoY basis, beating my target. I take this as an improvement to book value and as an analyst, I try to find companies with growth in positive equity.

The company in its earnings commentary pointed to some drivers of earnings growth:

This was fueled by volume growth, excellent margin management, and disciplined productivity improvement. Our actions to improve efficiency continued, with progress in supply chain productivity and implementation of structural cost-out actions.

Further, it is relevant to mention that the company’s CFO Kenny Cheung had a positive forward outlook for fiscal 2024 so far:

Our positive momentum in the first quarter gives us confidence in reiterating our FY24 guidance of mid single digit sales growth to approximately $80B and five to ten percent adjusted EPS growth to $4.20 to $4.40.

So, along the lines of the company’s own forecast, I am positive about their next round of results due in January, in terms of revenue and profitability. This is not to say that inflation did not have at least some impact on this business. For example, according to the fiscal Q1 results, “product cost inflation was 1.7% at the total enterprise level, as measured by the estimated change in Sysco’s product costs, primarily in the frozen and canned and dry categories.”

So, the fact that they were able to grow profitability in an era of inflation is another reason I would consider this stock in an investment portfolio.

Dividends

When it comes to dividends, this stock earned a spot in my “dividend quick picks” of the month and I’ll tell you why.

When comparing its quarterly dividend from October 2023 to that of October 2020, we see an 11% growth, easily beating my target.

In addition, the dividend yield is beating its sector average by almost 7%, with a nearly 3% yield.

Sysco – dividends (author report)

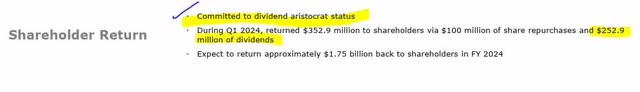

It is evident that this company is committed to returning capital back to shareholders, and has the capacity to do so.

From its own presentation, it mentions a commitment to being a “dividend aristocrat”:

Sysco – shareholder return (company quarterly presentation)

I think that while the overall market remains relatively bearish on this stock’s price, it will drive that elevated dividend yield for a while longer, so worth taking advantage of.

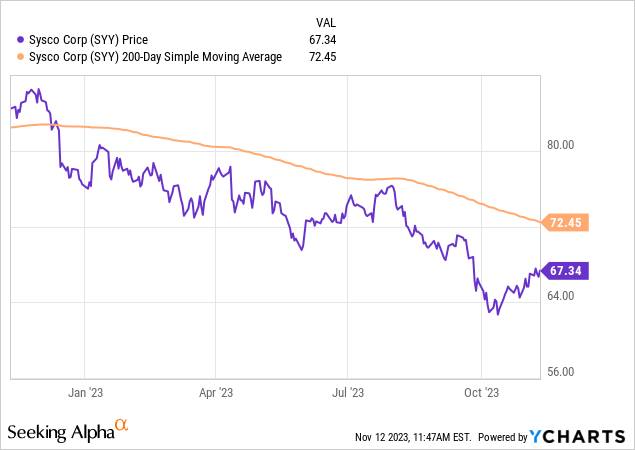

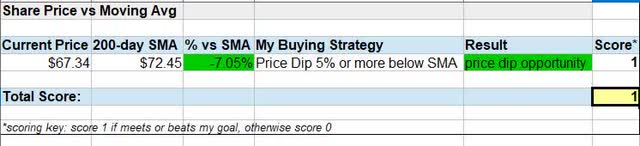

Share Price vs Moving Average

In my portfolio strategy, when it comes to share price I have simplified it down to looking for price dips 5% or more below the 200-day moving average.

In the chart below (as of the writing of this article) we are looking at a share price of $67.34, vs a 200-day SMA of $72.45. We also see a steady downward trend in the average, and a share price continuing to trade below it since around January. So, definitely signs of market bearishness on this stock, in my opinion.

This bearishness could present a buying opportunity, however. From my table below, I determined that since the price is trading 7% below the long-term moving average I would consider it a buy price.

Sysco – share price vs moving avg (author report)

The buy price alone would not make want to pick this stock, however, this along with the other factors discussed in this note presents a strong case for the value opportunity this stock presents.

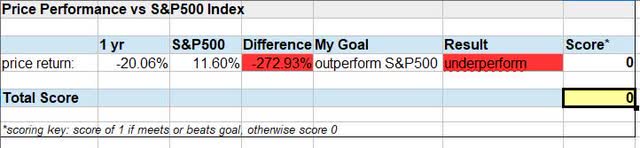

Performance vs S&P500 Index

As mentioned, the overall market seems to be unduly bearish on this stock, and it can be seen in its momentum vs the S&P500 index:

Sysco – performance vs S&P (author report)

Its 1-year price return of negative -20% is considerably outperforming the S&P500 index. However, it does not appear unique to Sysco but rather the bearishness is impacting multiple stocks in this sector.

For example, the top revenue leader in its peer group, Chefs Warehouse (CHEF), had a 1 year price return of negative -36%, while its other peer United Natural Foods (UNFI) had a negative -66% price return in that same year.

To spur a discussion in the comments section, I welcome your thoughts on why you think the market has been bearish on this sector and what factors contributed to it.

I think it could be a combination of factors: high inflation, high debt costs, and concerns over a potential recession impacting restaurants. At the same time, the financial media since spring has been hyping up “AI” (artificial intelligence) so it drove a lot of bulls into the big tech stocks again. That is my personal observation, of course.

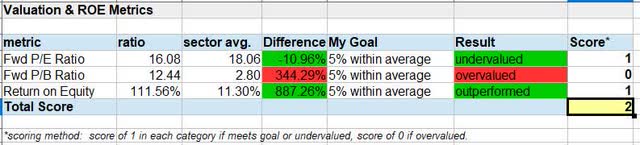

Valuation and ROE

The valuation of this stock shows a mixed bag. For one thing, the forward price to earnings of 16.08 is a good amount below the sector average, so I consider it reasonably undervalued.

However, the forward price-to-book ratio of 12.44 is ridiculously higher than the sector average, to the tune of 344% higher!

Sysco – valuation and ROE (author report)

The return on equity of 112% also greatly outperformed the sector average, earning a rating point from me, however, it also begs the question of what is driving these extreme metrics.

In terms of the high ROE, I would say the driver is perhaps the recent positive earnings growth combined with the relatively low book value, a victim of high debt. For instance, total liabilities on the balance sheet are 91% of total assets. Total long-term debt of $10.7B greatly overshadows total cash of just $569MM. This situation I believe is also driving the P/B ratio to show a high premium between price and book value.

The P/E looks more reasonable, considering that the share price has been bearish yet the earnings have grown. This could drop even further in the next quarter if earnings continue to grow while the share price does not.

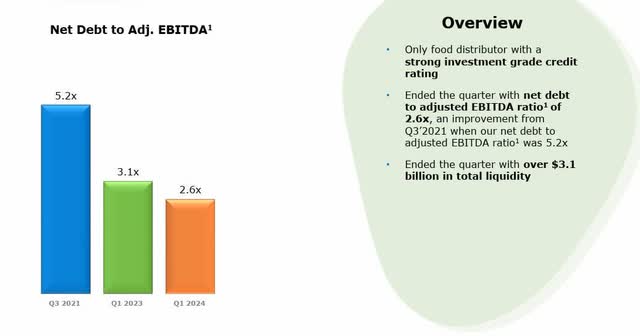

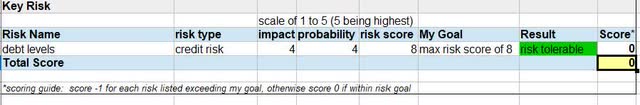

Key Risk

Now that we are on the topic of book value and what could impact it, one key risk to mention with this company is the $10.7B in debt, however it has only gone up about 4.2% on a YoY basis:

Sysco – rise in debt (Seeking Alpha)

This seems to correlate with an 8% YoY rise in interest expenses, which makes sense given the current rate environment we are in. This is a risk as it can impact the income statement with additional costs, while the balance sheet can be impacted by rising debt. So, this is why I try to tailor research notes within the context of accounting statements and their relevance.

Sysco – rise in interest expense (Seeking Alpha)

However, there is one more element to point out, which is shown in the following graphic from the quarterly presentation. As the graphic shows, the company’s net debt to adjusted EBITDA earnings has actually declined, which I think is a positive sign, along with a strong liquidity position of $3.1B and an investment-grade credit rating:

Sysco – net debt ratio (company fiscal q1 results presentation)

Based on the evidence, I determined in my risk table that the business impact as well as the risk probability is moderate, so the debt situation is within risk tolerance. This is due to the rising debt and interest levels being offset by the strong liquidity, credit rating, and declining ratio of net debt to EBITDA.

Sysco – key risk (author report)

WholeScore Rating

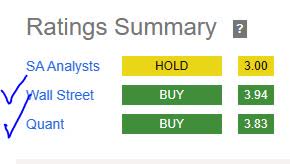

In today’s note, this stock scored a WholeScore of 7, earning a buy rating from me today, one of my first ones for November.

Sysco – WholeScore (author report)

In comparing my rating with that of the consensus ratings, I agree with the bullish sentiment of Wall Street and the quant system, but think that the SA analysts’ consensus may be overly cautious on this stock.

Sysco – rating consensus (Seeking Alpha)

My Forward-Looking Sentiment

This is one of those companies that help power the behind-the-scenes magic that helps get food on your plate, but as a relatively under-covered equity, it also seems to present a value-buying opportunity as I have shown through evidence.

It is also a “dividend quick pick” of the week, offering an attractive yield and steady payout for the dividend investor.

As for recession fears impacting restaurant spending, I will leave you with the following quote from a late October article in Fast Company:

The economy saw solid growth in almost all the key components of GDP. Consumer spending was up 4% year-over-year, thanks to low unemployment, falling inflation, and the fact that consumers still have more than a trillion dollars in extra savings built up during the pandemic.

Read the full article here