Rayonier Advanced Materials Inc. (NYSE:RYAM) recently reported new credit agreements that will, in my view, reshape the current balance sheet, and bring further interest from other debt and equity investors. RYAM also noted interest in selling Paperboard and High-Yield Pulp assets. In my opinion, there are obvious risks from supply chain problems, debt outstanding, or competitors, however RYAM remains very undervalued.

Rayonier Advanced Materials

Rayonier Advanced Materials focuses on the timber market within the United States, with assets under its ownership located in regions of high concentration of softwood lumber production, both nationally and within New Zealand.

The operations are conducted through different subsidiaries for each region, involving the United States and New Zealand, in which, by adding the properties that the company has, we find approximately 3 million hectares under its ownership. Occasionally and to a lesser extent, the company is also involved in the marketing of logs in the United States and New Zealand, where it is necessary for the company to sustain its operations.

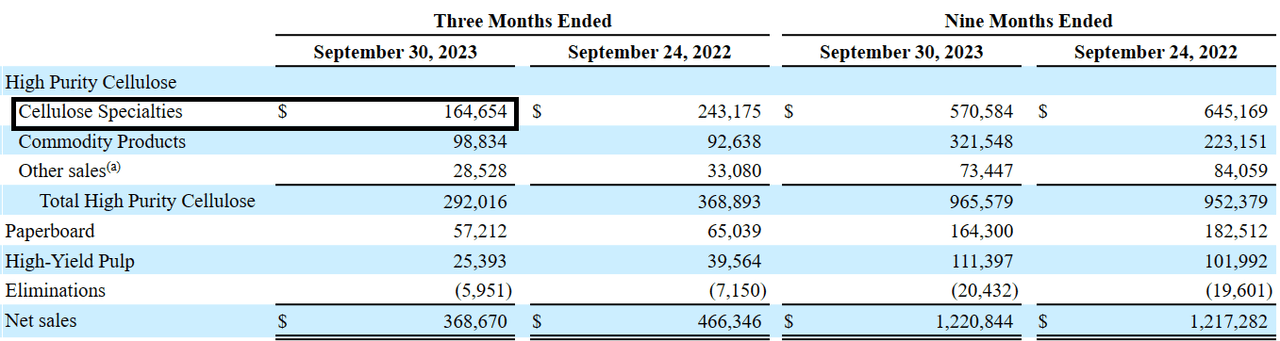

The operations are divided into three segments: High Purity Cellulose, Paperboard, and High-Yield Pulp that correspond to the type of activity and the territory where they are carried out. The largest business segment, offering cellulose, represented close to 79% of the total amount of sales in the three months ended September 30, 2023.

10-Q

A Quick Valuation Of The High-Purity Cellulose Business Segment Implies That Rayonier Advanced Materials Is Undervalued

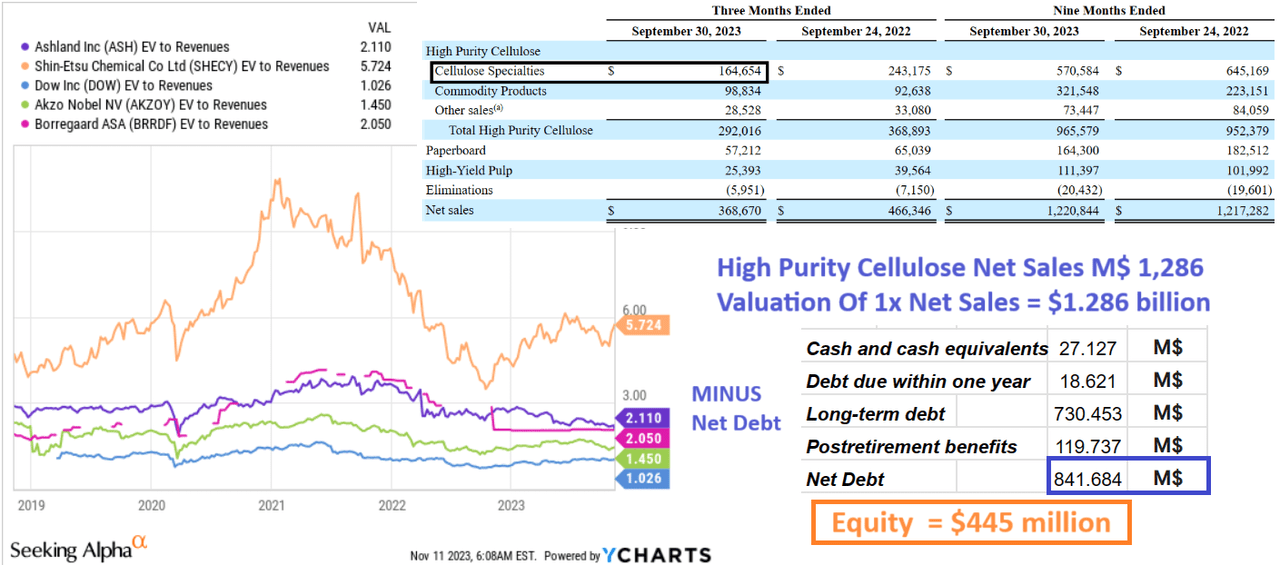

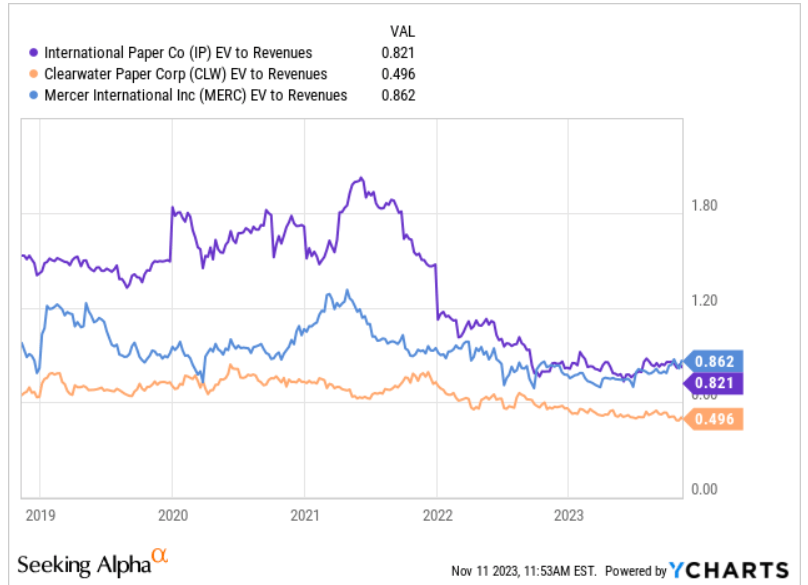

Before running a more complete DCF model, I had a look at the valuation of the largest business segment. In the three months ended September 30, 2023, Rayonier Advanced Materials reported $292 million from the sale of high-purity cellulose. In the nine months ended September 30, 2023, the company noted sales of $965 million from the same business segment. Other competitors in the cellulose market trade at close to 1x-5x. If we use a minimum valuation of 1x sales and assume annual net sales of $1.286 million, the implied valuation would be $1.28 billion.

YCharts, SA, and CW

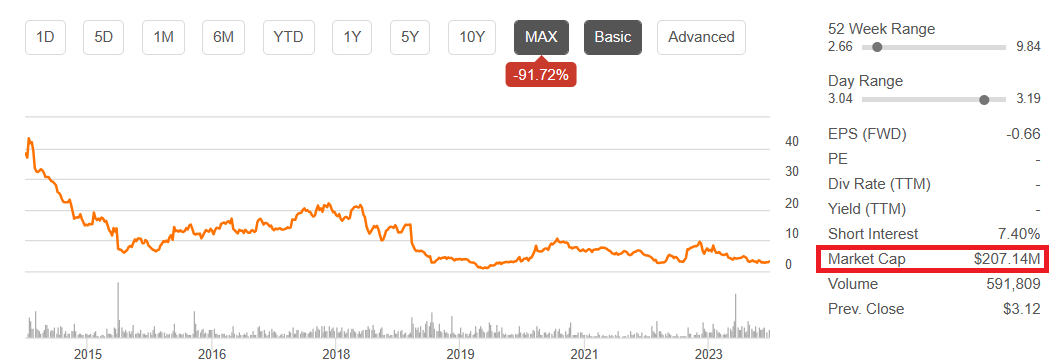

Even without taking into account the other business segments, if we subtract net debt of about $841 million, the implied equity valuation would be close to $444-$445 million. The company trades at about $207 million, so I believe that it is trading significantly undervalued.

SA

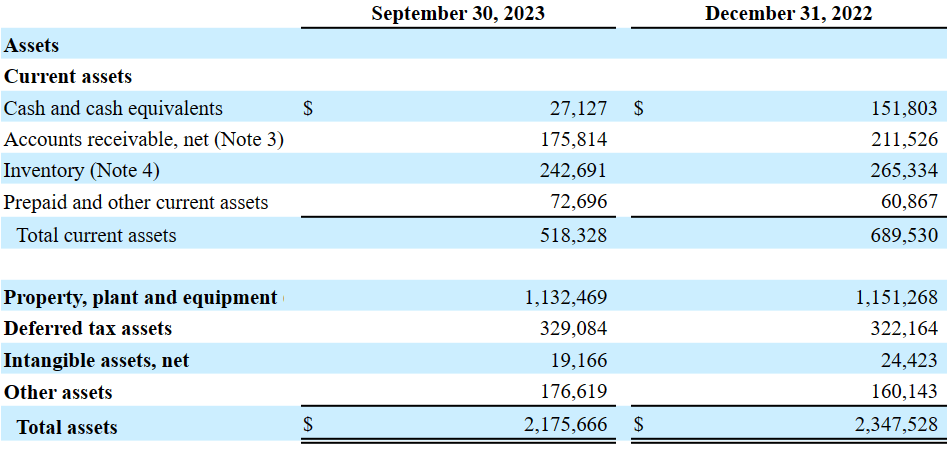

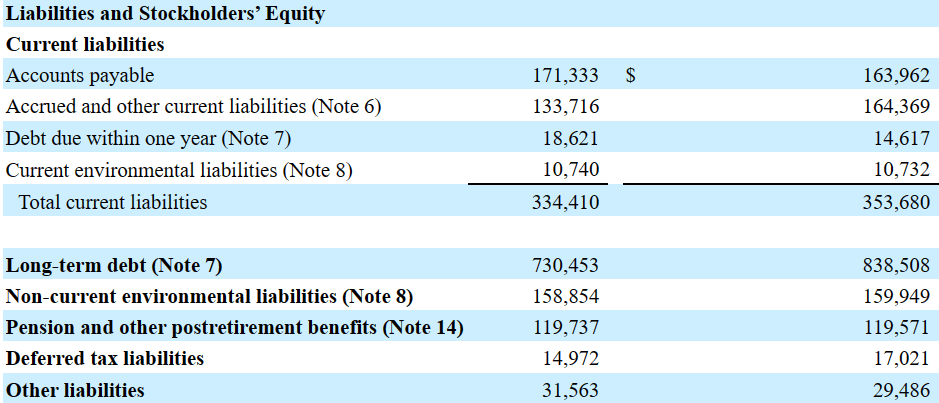

Balance Sheet

As of September 30, 2023, the company reported cash and cash equivalents worth $27 million, accounts receivable of close to $175 million, and inventory of $242 million. Total current assets are equal to $518 million, and the current ratio is larger than 1x. Hence, I believe that liquidity does not seem to be a problem for Rayonier Advanced Materials.

Property, plant, and equipment stands at close to $1.132 billion, and total assets are equal to $2.175 million. With an asset/liability ratio of more than 1x and such amount of property and equipment, I believe that the balance sheet stands in a good shape.

10-Q

The list of liabilities does not seem worrying. With accounts payable close to $171 million and accrued and other current liabilities of about $133 million, long-term debt was equal to $730 million. The total amount of debt appears to be significantly lower than the total amount of properties, so I believe that Rayonier Advanced Materials could receive more debt in the future.

10-Q

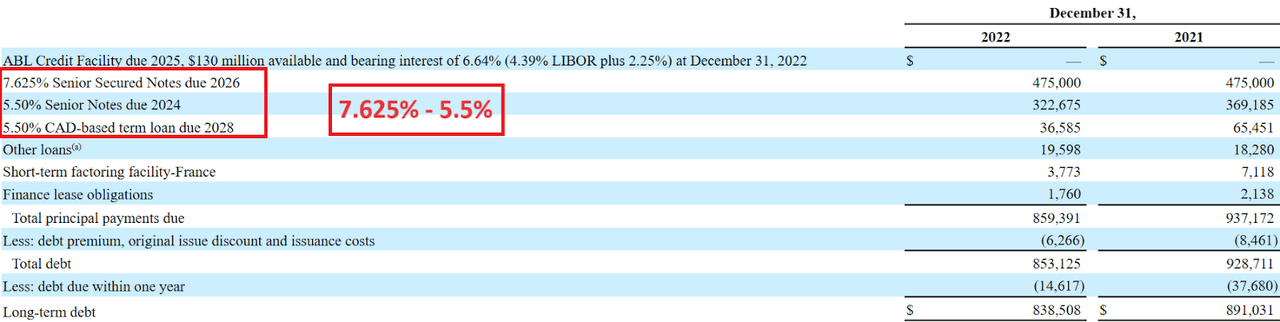

With that about the balance sheet, I think that having a close look at the debt agreements would make sense. The company reported senior notes and loans reporting debt of close to 7.625%-5.5%. With these figures in mind, I believe that the cost of capital would most likely stand at more than 7.625%-8.1%.

10-K

Recent Credit Agreements Reached In 2023 Will Most Likely Accelerate Investments From Other Debt Investors Or Equity Investors

In the last quarterly report, management noted new loan financing totaling $250 million and recent repurchases of notes. In my view, this information is quite beneficial for Rayonier Advanced Materials. It means that the company successfully refinanced its debt obligations. Debt investors successfully revised the business model and were interested in offering new financing conditions. Besides, the company also used some money to give back cash to certain note holders. Under my financial model, I assumed that further debt agreements will most likely bring demand for the equity and debt of Rayonier Advanced Materials.

In July 2023, we secured term loan financing of $250 million in aggregate principal amount, the proceeds of which were used, together with cash on hand, to redeem the $318 million principal balance of the 2024 Notes in August 2023. Source: 10-Q

In April 2023, we repurchased $10 million of our 2026 Notes through open-market transactions and retired the notes for cash of $9 million. Source: 10-Q

In March 2023, we repurchased $5 million of our 2024 Notes through open-market transactions and retired the notes for cash of $5 million. Source: 10-Q

The Sale Of Paperboard And High-Yield Pulp Assets Could Bring Close To $101 Million In Cash, Which May Enhance The Balance And The Stock Valuation

The company appears to be exploring the potential sale of the Paperboard and High-Yield Pulp assets located at the Temiscaming site:

In October 2023, we announced that we engaged a financial advisor to explore the potential sale of our Paperboard and High-Yield Pulp assets located at our Temiscaming site. This strategic move is aligned with our commitment to enhancing our operational and financial performance, optimizing our portfolio to align with our long-term growth strategy and providing flexibility to pay down debt and reduce leverage. Source: 10-Q

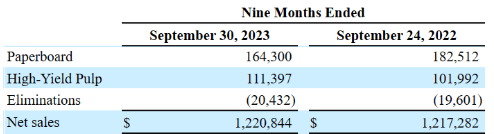

In the nine months ended September 30, 2023, Paperboard net sales stood at $164 million, and high-yield pulp net sales were close to $111 million.

10-Q

I assumed annual net sales from the Paperboard business segment close to $242 million and High-Yield Pulp new sales of $134 million. Competitors in the Paperboard industry trade at close to 0.8x net sales. So, I believe that the Paperboard business segment could be worth $193 million. I also assumed 0.8x net sales growth in the High-Yield Pulp market as many companies in the Paperboard business also offer High-Yield Pulp. Hence, the High-Yield Pulp business segment could be worth $107 million. In total, I believe that Rayonier Advanced Materials could obtain close to $300 million for the sale of these two business segments. In that case scenario, I believe that stock price would most likely trend higher.

YCharts

The New 2G Bioethanol Facility That Will Start Operating From 2024 Will Most Likely Bring Capacity Increases And Revenue Growth Potential

In my opinion, the new operations of the new 2G bioethanol facility that will commence in the first quarter of 2024 could bring capacity increases and revenue growth.

The 2G bioethanol facility at our Tartas, France plant is near completion and is anticipated to be operational in the first quarter of 2024. Source: 10-Q

Further Initiatives To Reduce The Carbon Footprint And More Complex Forestry Systems Could Bring FCF Margin Improvements

Rayonier Advanced Materials seeks to value its advantageous position in relation to the carbon footprint, taking advantage of general global trends on the reduction of emissions, providing solutions to businesses that are looking to reduce their footprint. With this, the introduction of more complex forestry systems, the optimization of wood production to generate liquidity margins, and expanding the areas and hectares of its projects and crops through inorganic growth and acquisitions are part of the strategy.

The company discussed some of its partnerships with large companies like 3M (MMM) to promote sustainability as well as to rely less on fossil fuels. Given the rise in sustainable investments expected for the upcoming years, I believe that Rayonier Advanced Materials could receive further attention from investors.

Company’s Website

Conservative Future Free Cash Flow Projections Imply Significant Undervaluation

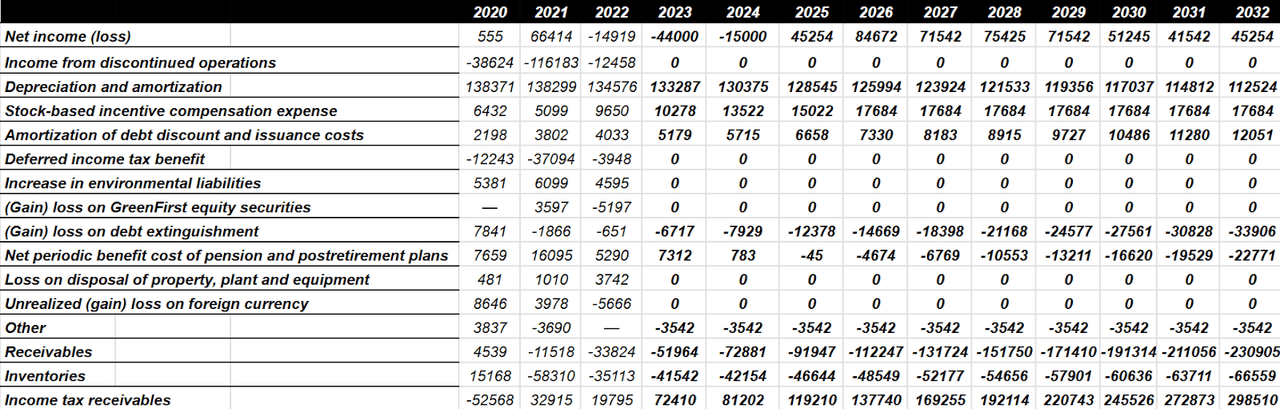

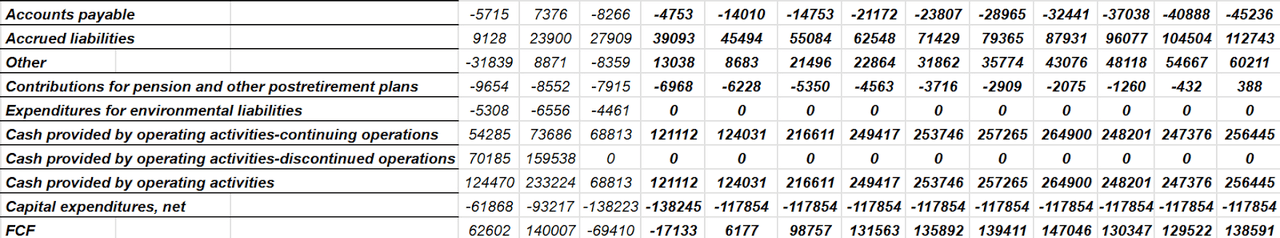

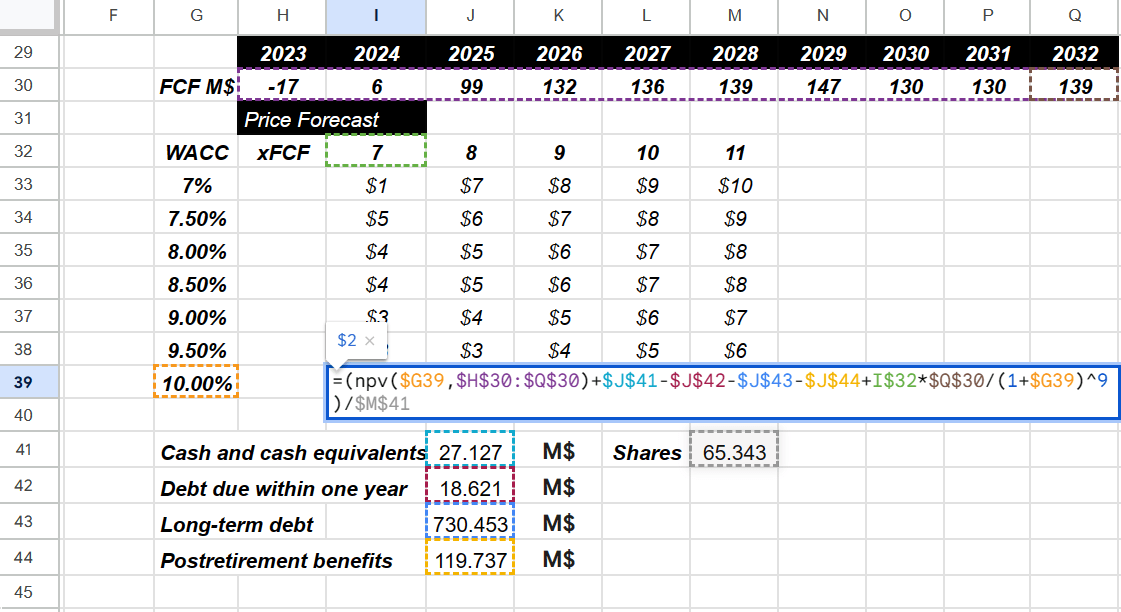

In my cash flow projections, I obtained 2032 net income of close to $45 million, 2032 depreciation and amortization of $112 million, stock-based incentive compensation expense worth $17 million, net periodic benefit cost of pension and postretirement plans of -$23 million, and changes in receivables of about -$231 million. Additionally, with inventories close to -$67 million, I also included income tax receivables of close to $298 million.

CW

I also assumed accounts payable of -$46 million and changes in accrued liabilities of about $112 million, which implied cash provided by operating activities – continuing operations of close to $256 million. Finally, with capital expenditures of about -$118 million, 2032 FCF would be $138 million.

CW

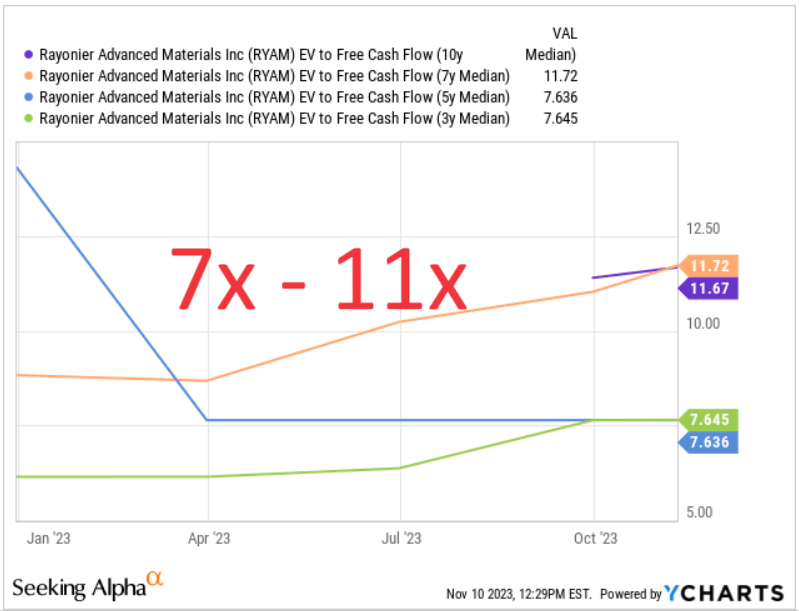

In the past, the company reported EV/FCF of about 7x-11x, so I believe that assuming an exit multiple of 7x-11x would be conservative.

YCharts

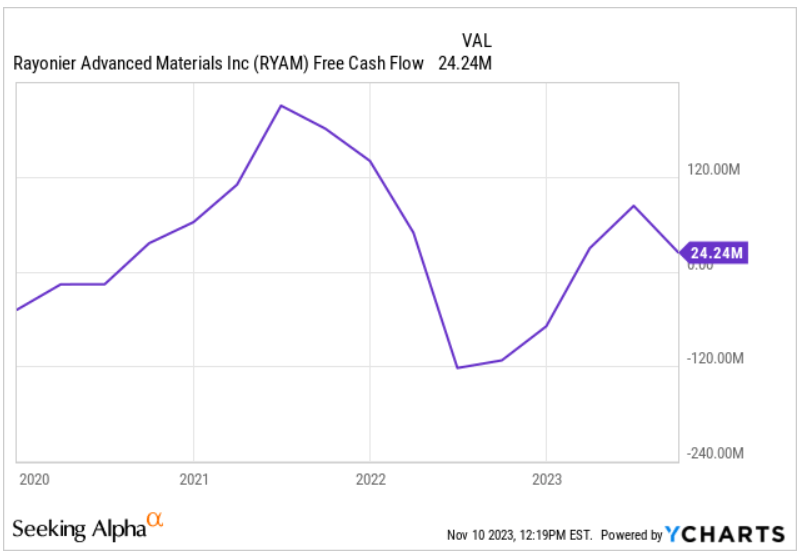

My FCF projections stand at about -$17 million and $139 million, close to the figures reported in the past. I really did not think out of the box.

YCharts

Hence, with a WACC ranging from 7% to 10% and an EV/FCF of close to 7x-11x, the implied forecast price would be between $1 and $10 per share, but with a median forecast price of $6-$7 per share.

CW

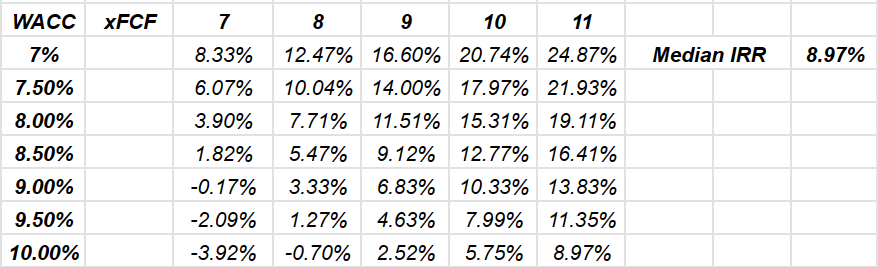

The internal rate of return would range from -3% to 24%, but the median internal rate of return would be 8%-9%. In any case, I believe that the company remains undervalued.

CW

Competitors And Risks

Weyerhaeuser Company, PotlatchDeltic, Manulife Investment Management Timberland and Agriculture Inc., Resource Management Service, and Forest Investment Associates are the main competitors in the wood market within the United States, with slight differences in their positioning in the territorial markets in which Rayonier participates.

In New Zealand, the five main market participants account for almost 40% of the market, which include Manulife Investment Management Timberland and Agriculture Inc., Kaingaroa Timberlands, Ernslaw One, OneFortyOne Plantations, and New Forests.

Along with the risks inherent to high competition, there are risks related to the current situation of economic uncertainty, the increase in inflation rates, the effect of inflation on the price of materials as well as land, costs, and supply and distribution activities that are not carried out by the company.

Conclusion

Rayonier Advanced Materials recently noted a new credit agreement, which will most likely accelerate other investments from equity investors. Additionally, management announced that it may sell Paperboard and High-Yield Pulp assets, which could bring significant cash in hand to the balance sheet, and enhance the stock valuation. I also see that the recent efforts to reduce carbon emissions and partnerships with large corporations like 3M are quite beneficial. I do obviously see some risks from the total amount of debt, competition, and failure to sell certain divisions, however, Rayonier appears significantly undervalued.

Read the full article here