Pinnacle West Capital Corporation (NYSE:PNW) is the holding company for APS, or Arizona Public Service, the largest electric utility in Arizona. With a market cap of $8.05 billion, it is the 26th largest electric utility in the country and had the fifth highest utility shareholder return for 2022 at 12.9%, per the Edison Electric Institute. The company serves 1.3 million customers and currently has the largest nuclear plant in the US as part of its generating capacity. Standard & Poor’s rates the company as BBB+, or lower investment grade, and it is a component of the S&P 500.

PNW Share Price Last Five Years (Seeking Alpha Charting)

PNW shares are currently trading at $70.50, down 31.9% from their February 2020 peak of $103.50. At that time, the dividend yield was 3.0%, the Federal Funds Rate was 1.5% and the 30-year treasury yield was 2.25%. Utility dividends seemed like a potent alternative to most other yields available in the market three years ago. Today, however, the 30-year yield is 4.74% and utility dividends have some competition, so share prices are down. Pinnacle West’s current dividend is 5.0%, slightly higher than 30-year treasuries, but below the current 3-month interest rate of 5.24%. While utilities have been marked down by 15.0% by the market this year according to Morningstar, most yields are still slightly lower than treasuries, so if you are purchasing shares they need to have the possibility of appreciation upside.

PNW Current Share Valuation – Buy Below $70

The latest earnings per share guidance for 2023 is $4.10-$4.30 on a GAAP basis. Pinnacle has projected long-term growth of 5.0-7.0% for earnings per share, with retail customer growth of 1.5% to 2.5% per year. In 2022, earnings were $4.26 per share, down from $5.47 in 2021. That drop in earnings was due to a regulatory rate cut at the end of 2021 that lowered 2022 earnings by $0.98 per share. The allowable return on equity was reduced from 10.25% to 8.7%. PNW successfully sued the regulators, however, and recently the return on equity was raised to 8.9%, after a favorable ruling. Record heat in the third quarter created substantial electric demand that helped to offset the lower return. Also, the company currently has a $378 million rate increase request filed with the state, which would increase net income by $0.38 next year. The preliminary consensus for 2024 is now $4.50 per share. Earnings for the last five years, along with the projections for 2023 and 2024 are presented below.

Annual Earnings per Share (Annual Reports)

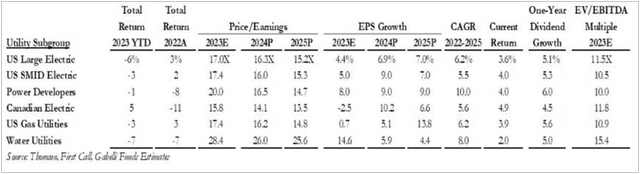

In order to value PNW shares, I am going to use P/E ratios and a discounted cash flow. According to Morningstar, the P/E ratio for the utility sector is 16.0, the lowest since 2009. This is down from a 2020 peak of 23-time earnings. There are several investor surveys that provide current P/E ratios for the various types of utilities from blended, to gas, to all-electric. According to Gabelli Funds Mid-Year 2023 Investor Update: “Over the past twenty-five years, (electric) utility forward multiples have ranged between 10x and 23x times earnings with a median of 17.1x.” The Gabelli survey is presented below.

P/E Ratios by Utility Sector (Gabelli Funds)

Using the 2024 projected EPS of $4.50 with the mid-size electric 2024 P/E ratio, the fair value of the company would be $4.50 x 16.0 = $72.00 per share. At 2023’s projected earnings of $4.30, and the Morningstar cited P/E ratio of 16.0, it would be $4.30 x 16.0 = $68.80.

I have also used a discounted cash flow to value Pinnacle’s shares. Here I estimate the fair value as $66.83 or $67.00 per share rounded. I used a growth rate of 6.0% per year, in line with the utility’s estimate of 5.0-7.0% per year, and the consensus earnings for $4.30 and $4.50 for 2023 and 2024 respectively. For the discount rate, I used 10.0%, in line with the average annual return of the S&P 500, which is about 9.8%. The reversion rate was 7.5%.

Discounted Cash Flow (Author Calculated)

The numbers produced by these two methods indicate a fair value range of $66.83-$72.00, with a mid-point of $69.42. The P/E ratios are generally backward looking while the discounted cash flow is more forward-looking. Both have their merits, but I would think anything below $70.00 a share would be a strong entry point for Pinnacle. As outlined below, there are many features besides valuation that make this company attractive.

PNW’s Service Area is Fast-Growing

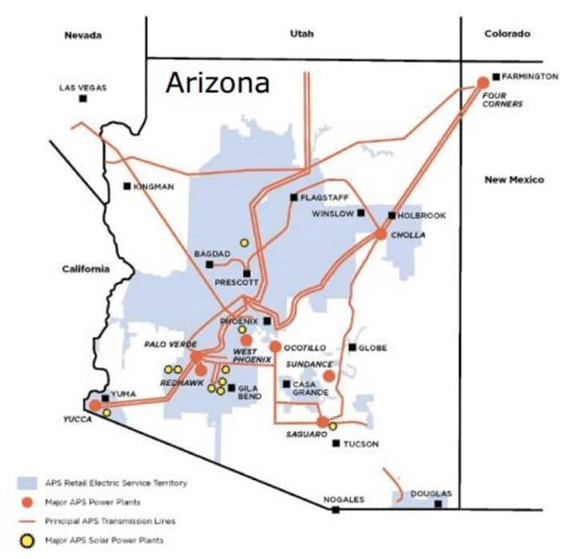

APS, PNW’s electric subsidiary, operates in 11 of Arizona’s 15 counties and the company has a generating capacity of 6,300 megawatts. About 51.0% of this is “clean” energy generation today. Its territory includes the major Arizona cities of Phoenix, Tucson, Flagstaff, Yuma and Prescott, as well as the growing Phoenix suburbs of Chandler and Mesa.

PNW Arizona Service Areas (2023 Investor Presentation)

Between 2010 and 2020, Phoenix was the fastest-growing US city, increasing in size by 11.2 percent. Phoenix is now the fifth largest US City. Flagstaff and Tucson also grew rapidly between 2010 and 2020, by 20.2% and 4.7% respectively. In 2023, two Phoenix suburbs, Queen Creek and Maricopa, were among the top 15 cities with the highest population growth rate in the country. APS’ retail customer base has traditionally grown at 1.5-2.5% per year, and given the population statistics, I think this can be expected to continue.

Current Regulatory Environment

APS currently has one of the more moderate consumer electric rates in the country, charging an average of $12.50 per Kilowatt hour in 2022, compared to $40.30 for Hawaiian Electric (HE), $28.36 for PG&E (PCG), or $26.43 for ConEdison (ED).

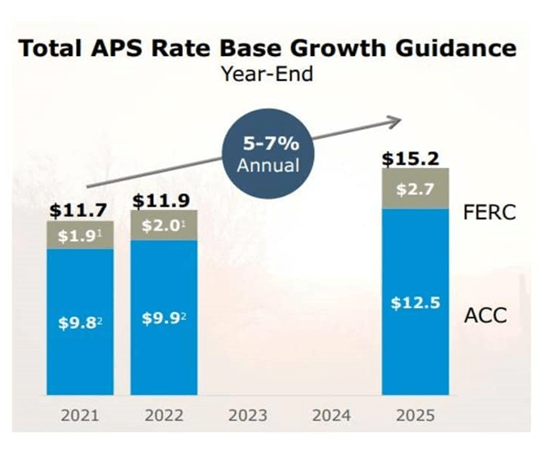

Retail electric rates are regulated by the Arizona Corporations Commission and are re-evaluated each June 1. Commissioners are elected by the public, and the public prefers lower rates over higher rates, creating a bit of an issue. This led to the company’s allowable return on equity being reduced from 10.0% to 8.7% for 2022. Regulators felt that the company’s cost of capital had dropped, and therefore the cut was justified. This occurred in a state that is generally viewed as pro-utility. PNW’s current weighted average cost of capital is 7.17%, see below. The FERC, or the US Federal Energy Regulatory Commission, regulates rates for the company’s wholesale power generation and transmission. About 12.0% of Pinnacle’s revenues are from wholesale power sold to other utilities. As illustrated below, the rate base for APS is expected to grow 5.0-7.0% per year.

APS Base Rate (2023 Investor Presentation)

Again, there is a $378.0 million rate increase currently pending. This was filed in October of 2022 and revised and re-filed again in August of 2023. This is expected to become policy in early 2024 and will increase electric residential rates by 11.2%.

Weighted Average Cost of Capital (2022 Annual Report)

Capital Expenditures – Renewable Targets

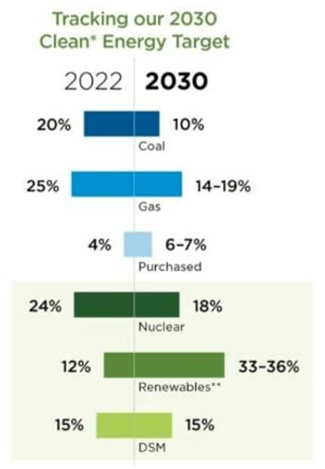

In 2022, Congress passed the Inflation Reduction Act that created new incentives for utilities to move away from coal generation, with a target of reducing greenhouse emissions by 40.0% from 2005 levels in 2030 and net-zero emissions by 2050. This legislation provides $369 billion in incentives to achieve these goals. It provides $2.0 billion in loans for updating transmission facilities and 10-year-long tax credits based on kilowatt hours of electricity generated by solar, wind, hydro, or geothermal. There are another $9.7 billion in loans available to expand renewable energy into rural areas. Below are PNW’s goals for rebalancing its current generation portfolio by 2030.

Plan to Shift to Renewables (2022 Annual Report)

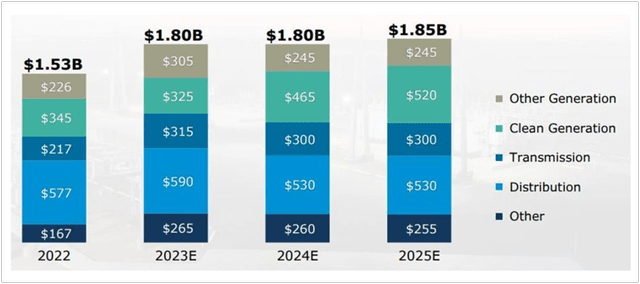

APS, Pinnacle’s electrical company has set 2030 goals of a power generation mix of 65.0% clean energy, and 45.0% renewable energy, and ending the use of coal generation by 2031. It has a $5.45 billion capital expenditure plan to start this process over the next three years. For the 2030 generation goals, the company will continue to rely on its three-unit Palo Verde nuclear plant and expand into renewable sectors. Nuclear power is currently defined as clean energy and there are a total of 54 such plants in the US, with Palo Verde being the largest. Currently, the company has six natural gas-fired generating plants, two oil plants, and three coal-fired plants. One of the three coal plants ceased operation in 2019 but is still being held as a depreciating asset. Pinnacle also has two major solar projects, Arizona Sun and Red Rock Solar, that operate multiple solar fields. Together these generate 224 megawatts of electricity. Pinnacle’s capital expenditure budget is presented below, with the number for clean generation ranging from $325 million to $520 million per year.

Capital Expenditure Plan (2023 Investor Presentation)

Pinnacle’s 5.0% Dividend Looks Sustainable

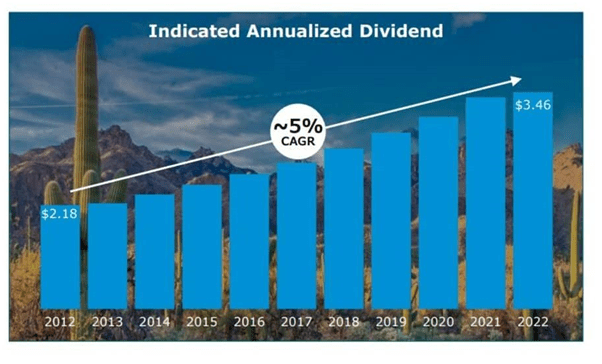

Pinnacle West has paid a quarterly dividend since 1993 so for the last 30 years. The company increased the dividend every year until the great financial crisis when it remained fixed at $0.525 per quarter for five years from 2007-2011. Since that time it has increased the dividend each of the last 12 years, from $0.545 to $0.88 per quarter, a compound annual growth rate of about 4.1%. Before the regulatory rate cut at the end of 2021, the typical dividend increase was about 5.0% per year. In 2022 and 2023 it was less than 2.0% per year. I do believe the company will resume a higher rate of growth when the rate increase filed in 2023 is approved for 2024.

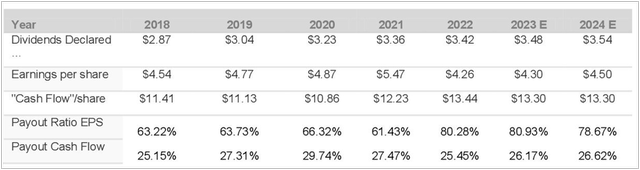

Below I have calculated Pinnacle’s payout ratios based on earnings per share and cash flow. The ratio jumps from 61.43% in 2021 to 80.28% in 2022 when the rate structure was revised downward. In terms of cash flow, however, the dividend is consistently in the 25.0-29.0% range, easily sustainable.

By way of comparison with its peers, the dividend for ConEdison is 3.63%; for Southern Company (SO) it is 4.1%; for American Electric Power (AEP) it is 4.53%; for WEC Energy (WEC) it is 3.88%; and for Eversource (ES) it is 5.02%. So PNW is paying a yield at or above many similar utilities.

Dividend Growth History (Investor Presentation) Payout Ratio Over Time (Author Calculated)

Long-Term Debt

The Arizona Corporation Commission (ACC) requires APS to have a “common equity ratio of at least 40.0%. APS cannot pay common dividends if the dividends would reduce the ratio below the 40.0% threshold. Here the common equity ratio is defined as total shareholder equity divided by the quantity of total shareholder equity plus long-term debt, including the current portion. This number is currently about 50.3%, per the recent Investor Presentation. As of year-end 2022, long-term debt less current maturities was $7.74 billion, and in 2021 it was $6.91 billion. Long-term debt was $6.31 billion in 2020 and $4.83 billion in 2019.

Risks to Outlook

In a state filled with abundant sunshine, the biggest risk to revenues would be customers switching in large numbers to residential solar installations. However, Arizona’s solar incentive is currently only 25.0% of the cost of residential solar or $1,000, whichever is less. Federal tax credits are better at 30.0% of the total cost, recently extended through the Inflation Reduction Act of 2022. This credit decreases to 22.0% in 2034 and then to 0.0% afterward. Still solar installations require a significant initial outlay by the customer. The other risk, which was made obvious in 2022, is a rate commission filled with elected, not appointed, positions where members have some incentive to placate a public that does not want higher electric rates. And the direction of the commission may change over time.

Conclusion

Pinnacle West is the premier utility in the fast-growing state of Arizona, with the City of Phoenix at the heart of its service area. Its customer base is likely to continue to expand and with several months of weather over 100 degrees every year, it ensures PNW has strong electric demand for the foreseeable future. Shares have finally been discounted by the market, along with the rest of the utility sector, to a defensible entry point and the dividend is now at a very competitive (with money markets) 5.0%. I believe that dividend growth will pick up after the next rate increase is granted in early 2024. And at the current payout ratios, the dividend is easily sustainable. For the moment PNW is a hold, but I think anything under $70.00 is a buy. Shares hit a low of $61.00 as recently as March 2022, so getting in below $70.00 is certainly a reality.

Read the full article here