Enterprise Products Partners’ (NYSE:EPD) units have seen new unit price weakness lately which may be a good opportunity for dividend investors to engage and load up on a well-supported 8% dividend yield. The midstream company generates a ton of distributable cash flow from its growing portfolio of midstream energy assets and Enterprise Products Partners easily covered its distribution with distributable cash flow in Q3, implying distribution growth potential. The midstream firm is doubling down on its investments in the Permian, a fast-growing shale investment area for U.S. energy companies. Since units of Enterprise Products Partners are cheap again on the drop, and supply a well-supported yield, I believe the valuation, the yield and the risk profile are all favorable for dividend investors!

Previous rating

I recommended Enterprise Products Partners as a recession hedge (strong buy) six months ago due to the midstream firm’s safe dividend and diversified footprint of energy assets across the United States. Units of Enterprise Products Partners have started to languish in October, allowing investors to buy into a cheap midstream energy play. Enterprise Products Partners is also investing more heavily into its Permian asset base which could allow for faster distributable cash flow growth in the future.

Enterprise Products Partners is a key energy player in the U.S.

Enterprise Products Partners is a fully integrated midstream firm with considerable energy assets that include more than 50k miles in pipelines, 30 natural gas processing plants, more than 260 MMBbls of liquids storage as well as other assets. Like other midstream firms, Enterprise Products Partners gets paid for transporting raw materials to its customers… for which it gets a pre-determined fee… reducing market and cash flow risks.

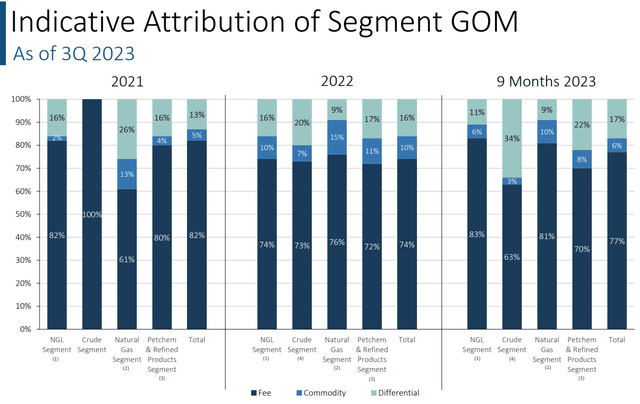

In the first nine months of the current year, FY 2023, Enterprise Products generated 77% of its gross operating margin from fee-based contracts. EPD’s core products include natural gas, natural gas liquids, crude and petrochemicals/refined products.

Source: EPD

Enterprise Product Partners presents dividend investors with stable DCF and strong coverage that allows for distribution growth

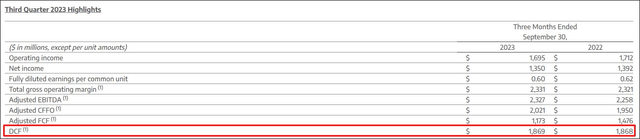

Enterprise Product Partners’ achieved stable distributable cash flow in the third-quarter, in the amount of $1.87B which was practically unchanged compared to the same quarter in the year-earlier period.

Based off of distributable cash flow, EPD had 1.7X distribution coverage in Q3’23 compared to 1.8X in the third-quarter of last year. The midstream firm’s distribution coverage is sufficient to pay investors a growing distribution, but also allows the company to retain cash for new investment projects. In the third-quarter, Enterprise Product Partners retained $773M of its distributable cash flow that could be used for new investments, capital expenditures or, potentially, debt repayments.

Source: EPD

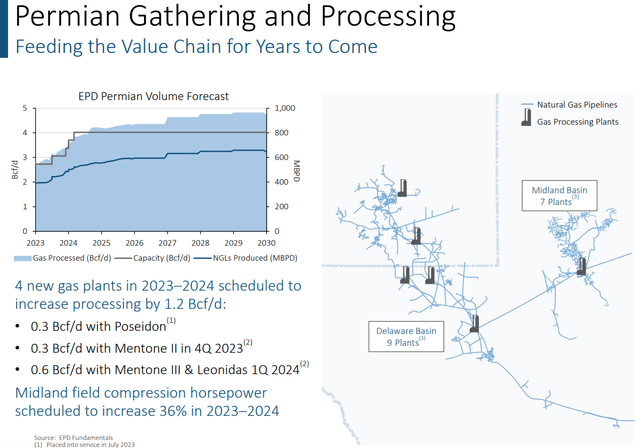

Strategic investments in the Permian basin

Enterprise Products Partners is pushing investments in the Permian, a shale investment play in the southwestern part of the United States that is known for its strong oil production growth. Enterprise Products Partners is aggressively investing in this key area and projects that crude oil production will increase “by over 700,000 BPD in 2023 and to grow by approximately 1.5 million BPD for the three-year period ending 2025” (Source). The Permian basin plays a huge role in Enterprise Products Partners’ growth strategy and the midstream firm plans to bring four new gas plants online in 2023 and 2024. The company also guided for $3.1B in Permian-related organic growth capital projects, a figure that could very well go up in coming years.

Source: EPD

EPD’s valuation vs. other midstream firms

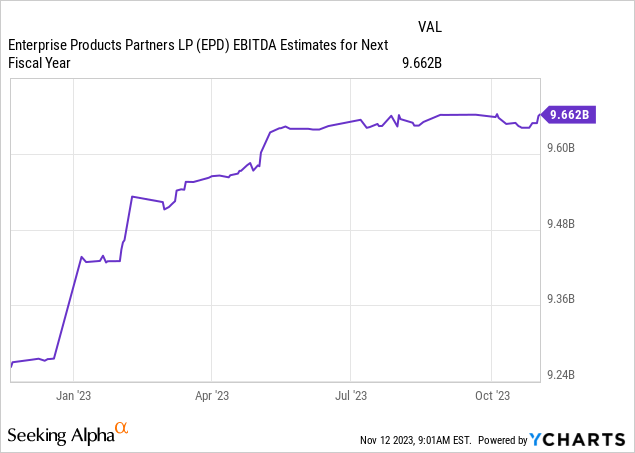

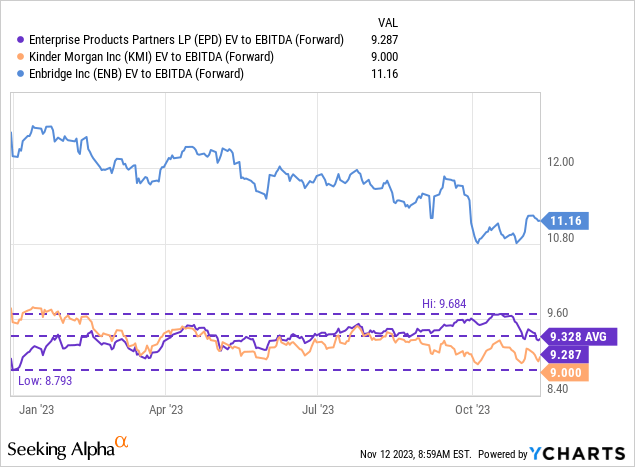

To value midstream companies like Enterprise Products Partners I use the enterprise-value-to-EBITDA ratio which takes into account that energy companies typically carry a lot of debt on their balance sheets and that they tend to have a large amount of depreciation expenses related to their multi-billion dollar capital projects.

Enterprise Products Partners is currently expected to generate FY 2024 EBITDA of $9.7B which implies a 4% year over year growth rate.

This means that units of Enterprise Products Partners are currently valued at an EV-to-EBITDA ratio of 9.3X which makes the midstream company the second-cheapest in the industry group. Kinder Morgan (KMI) and Enbridge (ENB) have enterprise-value-to-EBITDA ratios of 9.0X and 11.2X, so EPD comparatively looks like a good deal.

I especially like Enterprise Products Partners’ aggressive bet on the Permian as well as its low valuation. I like Kinder Morgan as well due to its focus on debt repayments and strong dividend coverage.

Risks with Enterprise Products Partners

Enterprise Products Partners operates in the fossil fuel industry and could therefore be subject to environmental regulations that are meant to further the development and utilization of green energy sources. Enterprise Products Partners is investing heavily in fossil fuel projects, including in shale basins such as the Permian, which makes the midstream company vulnerable to additional regulation. What would change my mind about Enterprise Products Partners is if the company were to see a drop-off in distributable cash flow and a decline in its DCF-based coverage ratio.

Final thoughts

Enterprise Products Partners is a well-run midstream firm with a diversified asset footprint and impressive distribution coverage of 1.7X in the third-quarter. The key value of Enterprise Products Partners is the firm’s stable distributable cash flow which should allow for continual distribution growth going forward. Investments in the Permian basin are promising and could yield incremental growth in Enterprise Products Partners’ distributable cash flow. Units are once again cheap on the drop, offering dividend investors a unique investment opportunity to buy a company with a 25-year distribution growth record for the long term!

Read the full article here