This article series aims at evaluating exchange-traded funds (ETFs) regarding the relative past performance of their strategies and metrics of their current portfolios. As holdings change over time, updated reviews are posted from time to time.

Strategy and portfolio

ALPS O’Shares U.S. Quality Dividend ETF (BATS:OUSA) started investing operations on 07/14/2015 and tracks the O’Shares U.S. Quality Dividend Index. It has 100 holdings, a trailing 12-month yield of 1.97% and an expense ratio of 0.48%. Distributions are paid monthly.

As described by O’Shares Investments, the underlying index selects “100 U.S. Large-Cap companies with the highest quality as measured by O’Shares’ rules- based methodology emphasizing profitability, dividend growth & coverage, debt, and volatility”.

The index starts from the 500 largest U.S. stocks by market capitalization. They are ranked based on 4 factors: quality, low volatility, dividend yield and dividend quality.

- Quality is calculated by combining profitability (Return on Assets) and leverage (Net-Debt-to-EBITDA).

- Volatility is measured by the 5-year standard deviation of weekly returns.

- Dividend Yield is based on the trailing 12-month regular cash dividend.

- Dividend quality is calculated by combining the 5-year dividend growth and the dividend coverage.

The index selects 100 constituents among the best-ranked stocks and weights them based on market capitalization modified by the 4 factors, with quality and low volatility receiving greater emphasis. The index is reconstituted annually and rebalanced quarterly. The index was modified in June 2020.

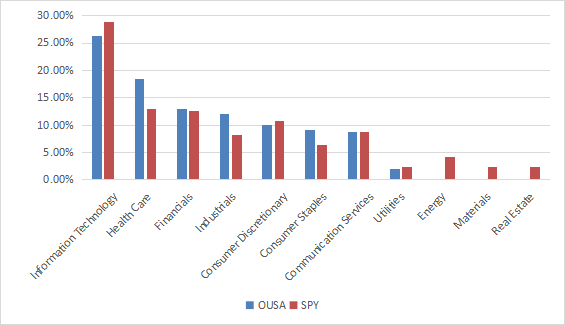

The fund invests almost exclusively in U.S. companies (96% of asset value), and in large and mega-caps (95%). Therefore, I will use the S&P 500 (SPY) as a benchmark. The sector breakdowns of OUSA and SPY are quite close, but OUSA ignores energy, materials and real estate. Compared to the benchmark, it moderately overweights healthcare, industrials and consumer staples. It slightly underweights technology, which stays the fund’s heaviest sector with 26.2% of assets.

Sector breakdown (chart: author; data: ALPS Advisors, SSGA)

The fund is also close to the benchmark regarding valuation metrics, as reported in the next table. Price-to-earnings and price-to-cash-flow ratios are slightly below S&P 500 values, while price-to-book and price-to-sales are higher.

|

OUSA |

SPY |

|

|

Price/Earnings TTM |

18.98 |

20.79 |

|

Price/Book |

4.62 |

3.69 |

|

Price/Sales |

2.72 |

2.38 |

|

Price/Cash Flow |

13.42 |

14.73 |

Source: Fidelity

The portfolio is quite concentrated: the top 10 holdings, listed in the next table, represent 39.7% of assets. However, risks related to individual stocks are moderate: the heaviest name is Microsoft with 5.65%.

|

Ticker |

Name |

Weight |

EPS growth %ttm |

P/E ttm |

P/E fwd |

Yield% |

|

MSFT |

Microsoft Corp. |

5.65% |

11.28 |

35.80 |

32.88 |

0.81 |

|

AAPL |

Apple, Inc. |

5.29% |

0.45 |

30.41 |

28.52 |

0.52 |

|

CMCSA |

Comcast Corp. |

4.47% |

213.84 |

11.63 |

10.80 |

2.77 |

|

VZ |

Verizon Communications, Inc. |

4.24% |

7.88 |

7.20 |

7.59 |

7.45 |

|

V |

Visa, Inc. |

3.97% |

19.60 |

29.95 |

24.79 |

0.85 |

|

JPM |

JPMorgan Chase & Co. |

3.69% |

41.43 |

8.74 |

8.78 |

2.87 |

|

MA |

Mastercard, Inc. |

3.21% |

14.67 |

34.35 |

32.42 |

0.58 |

|

AVGO |

Broadcom Inc. |

3.12% |

41.21 |

29.55 |

22.74 |

1.92 |

|

HD |

The Home Depot, Inc. |

3.04% |

-1.61 |

18.21 |

19.28 |

2.87 |

|

UNH |

UnitedHealth Group, Inc. |

3.04% |

12.84 |

23.49 |

21.69 |

1.39 |

Ratios from Portfolio123

Past performance

OUSA has underperformed SPY by about 2 percentage points in annualized return since inception in July 2015. As expected from its strategy, it shows a lower volatility, measured in the next table as standard deviation of monthly returns.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

OUSA |

107.93% |

9.20% |

-33.12% |

0.56 |

14.17% |

|

SPY |

141.29% |

11.17% |

-33.72% |

0.62 |

16.06% |

Data calculated with Portfolio123

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares OUSA with a subset of the S&P 500: stocks with an above-average dividend yield, an above-average ROA, a good Altman Z-score, a good Piotroski F-score and a sustainable payout ratio. The subset is rebalanced annually to make it comparable to a passive index.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

OUSA |

107.93% |

9.20% |

-33.12% |

0.56 |

14.17% |

|

Dividend quality subset |

137.85% |

10.98% |

-38.04% |

0.61 |

16.82% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

OUSA lags the dividend quality subset by 1.8 percentage point in annualized return. Nonetheless, ETF performance is real and the subset is simulated. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

OUSA vs competitors

The next table compares characteristics of OUSA and 4 ETFs in the same dividend and quality style:

- Global X S&P 500 Quality Dividend ETF (QDIV)

- FlexShares Quality Dividend Index Fund (QDF)

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW)

- Vanguard Dividend Appreciation ETF (VIG)

|

OUSA |

QDIV |

QDF |

DGRW |

VIG |

|

|

Inception |

7/14/2015 |

7/13/2018 |

12/14/2012 |

5/22/2013 |

4/21/2006 |

|

Expense Ratio |

0.48% |

0.20% |

0.37% |

0.28% |

0.06% |

|

AUM |

$639.63M |

$46.44M |

$1.54B |

$10.28B |

$77.88B |

|

Average Daily Volume |

$1.42M |

$187.30K |

$2.24M |

$42.03M |

$196.41M |

|

Yield (TTM) |

1.94% |

3.47% |

2.25% |

1.85% |

1.99% |

|

3-Yr Dividend Growth (annualized) |

9.60% |

2.23% |

-5.12% |

6.04% |

12.33% |

OUSA is second to VIG regarding dividend growth in 3 years, which is a good point. On the downside, it has the highest expense ratio and the lowest liquidity in average daily dollar volume.

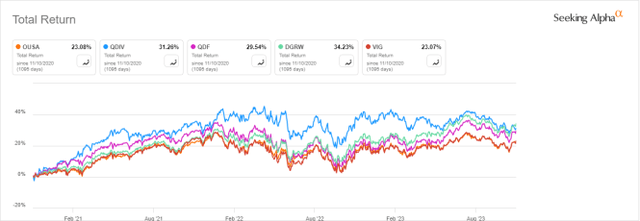

DGRW has been the best performer of this group in the last 3 years. OUSA has been lagging, along with VIG. This time interval is entirely after the modification of OUSA’s underlying index (which happened in June 2020), so it is relevant to assess the current strategy.

OUSA vs. Competitors, 3-year total return (Seeking Alpha)

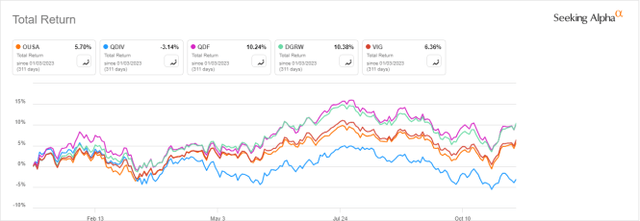

In 2023, OUSA is in the middle of the pack, once again very close to VIG.

OUSA vs. Competitors, total return in 2023 to date (Seeking Alpha)

Scanning the portfolio for quality

In my ETF reviews, risky stocks are companies with at least two red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate, where these metrics are unreliable. Here, only two stocks are risky: Amgen Inc. (AMGN) and Merck & Co., Inc. (MRK). Together, they weigh only 2.34% of asset value, which is a good point for the fund.

According to my calculation of aggregate metrics, reported in the next table, the portfolio quality is significantly superior to the benchmark. The return on assets is particularly good.

|

OUSA |

SPY |

|

|

Altman Z-score |

4.93 |

3.45 |

|

Piotroski F-score |

6.16 |

5.72 |

|

ROA % TTM |

12.42 |

7.19 |

Takeaway

O’Shares U.S. Quality Dividend ETF holds a portfolio of 100 dividend stocks selected and weighted based on profitability, dividend quality, low leverage and low volatility. It is close to the S&P 500 regarding the sector breakdown and valuation, but aggregate quality metrics are much better. OUSA has a nice dividend growth rate, but performance, liquidity and fees are quite unattractive relative to its close competitors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here