Originally published on April 28, 2023

By Alfred Kammer, Director, European Department, International Monetary Fund

Success will require tighter macroeconomic policies tailored to changing financial conditions, strong financial supervision and regulation, and bold supply-side reforms.

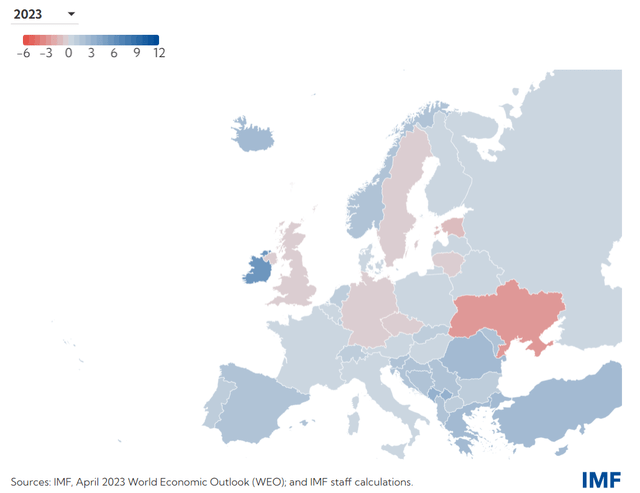

Following a strong exit from the pandemic, Europe was hit hard by the economic impact of Russia’s invasion of Ukraine. Growth slowed drastically, inflation shot up, and episodes of financial stress materialized. But as a result of decisive policy action, most economies narrowly avoided a recession this winter. Europe now faces the difficult task of sustaining the recovery, defeating inflation, and safeguarding financial stability.

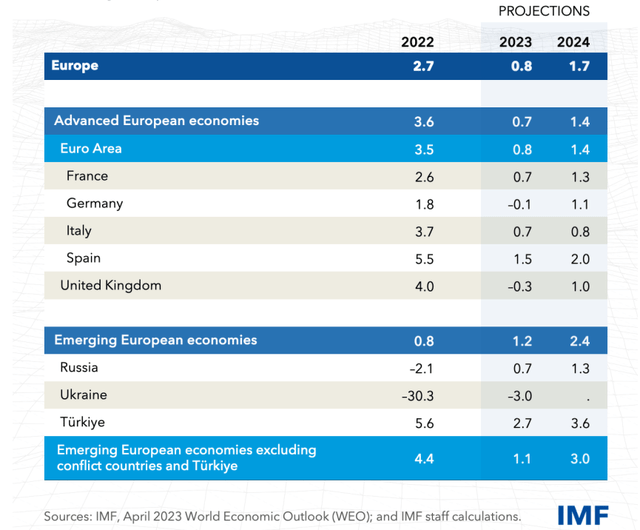

Growth in Europe’s advanced economies will slow to 0.7 percent this year from 3.6 percent last year, while emerging economies (excluding Türkiye, Belarus, Russia, and Ukraine) will also see a sharp decline to 1.1 percent from 4.4 percent. According to our latest Regional Economic Outlook, there will be a mild rebound in growth to 1.4 and 3 percent, respectively, in these two country income groups next year as real wages catch up and external demand picks up.

Europe’s inflation challenge

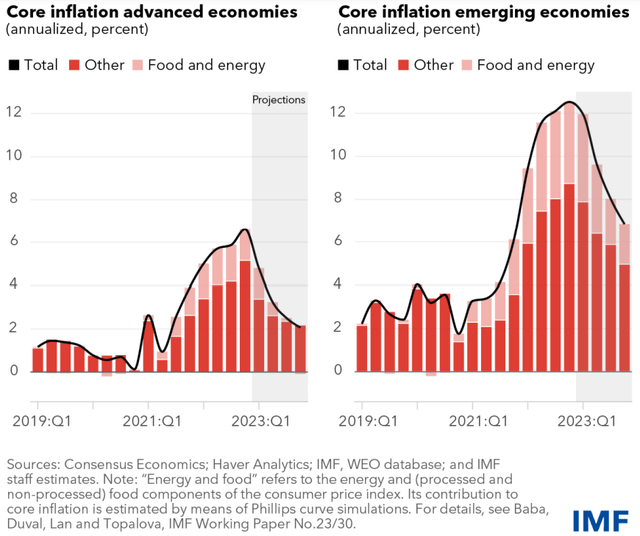

On their own, lower energy and food prices won’t be enough to bring core inflation back to central bank targets.

Headline inflation continues to decline, but underlying inflation (excluding energy and food) will remain persistent and uncomfortably above central bank targets even by the end of next year. Recent and projected declines in energy prices will feed into lower underlying inflation, but not enough to bring it down quickly.

This projection assumes that everything falls into place. The European Central Bank and other monetary authorities will succeed in steadily bringing down inflation. Any renewed bouts of financial stress will remain contained. There will be no further escalation of Russia’s war in Ukraine and associated sanctions, keeping energy prices in check. Broader geoeconomic fragmentation, another growth-reducing and inflation-increasing “stagflationary” risk, will also be kept at bay.

Yet things could get worse on all fronts – with growth, inflation, and financial stability risks all complicating policy choices.

Inflation risks

Take inflation, which could stay higher for longer. Energy prices could spike again. Wage growth could pick up more than projected as workers obtain greater compensation for recent purchasing power losses in tight labor markets. In turn, faster wage gains would make underlying inflation more persistent – a material risk across much of Emerging European economies, where nominal wage growth is in double digits.

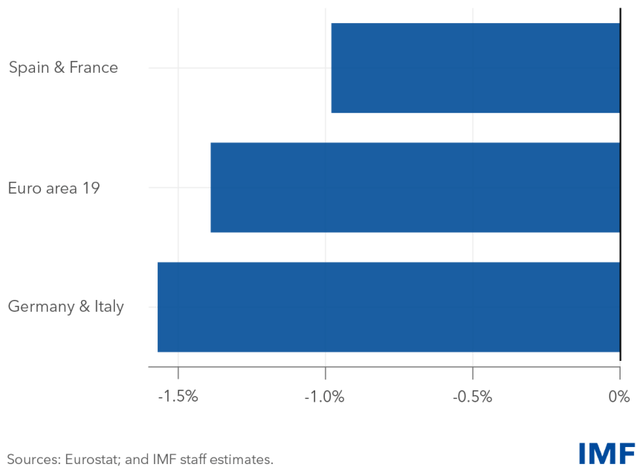

We also might still underestimate how much the two back-to-back COVID and energy crises have damaged Europe’s productive capacity and further heightened inflation risks. While companies have found ways to improve energy efficiency in the past year, persistently higher energy prices will reduce euro area output by more than 1 percent on average in the medium term, with larger losses in more energy-intensive economies such as Germany or Italy.

Likewise, shifting worker preferences away from long hours, and more workdays lost to sickness related to long COVID, may durably reduce labor supply and complicate the matching of workers with job vacancies. More broadly, economists’ real-time calculations tend to underestimate the permanent damage from crises – and thereby to overestimate the extent of economic slack – realizing their full extent only with a lag. Historically, in recovery periods, estimates of economic slack in European countries were revised downwards by a full percentage point one year after the fact and by even more later.

Energy Costs

Persistently higher energy prices will durably reduce euro area output.

Estimated reduction in future GDP due to projected rise in energy prices versus pre-pandemic levels

Tight monetary policy for longer

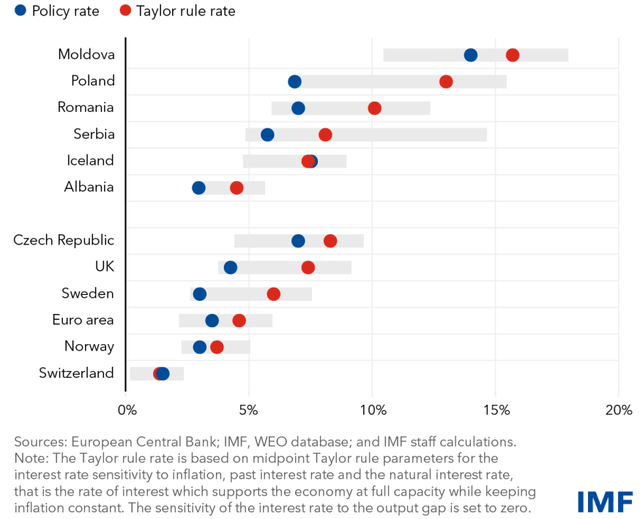

Faced with such uncertainty, central banks should maintain tight monetary policy until core inflation is unambiguously on a downward path back to central bank inflation targets. Further increases in policy rates are required in the euro area, while central banks in emerging European economies should stand ready to tighten further where real interest rates are low, labor markets are tight, and underlying inflation is sticky.

In fact, high uncertainty strengthens the case for tight monetary policy. If the inflation outlook is uncertain, there is more to lose from reacting too late rather than too early, because underestimating persistence would entrench high inflation and force central banks to tighten later for longer. This would likely require a sharp recession to bring inflation back to target.

Similarly, when the extent of economic slack is uncertain, monetary policymakers should place more weight on inflation and labor market dynamics, both of which now favor higher interest rates. Furthermore, even accounting for elevated uncertainty, policy rates in a number of countries are at the lower end of commonly used benchmarks suggesting that higher rates may be needed to rein in inflation.

Policy Rates

Monetary policy rates remain at the lower end of common benchmarks in a number of cases across Europe.

Latest policy rate and rate implied by Taylor rule under uncertainty

Should financial conditions tighten due to forces such as banking sector problems, central banks would not need as tight a monetary policy to achieve their objectives. However, it would be misguided to pause or reverse tightening prematurely on the legitimate concern that higher interest rates come with higher financial stability risks.

Work in concert

Central banks across Europe cannot succeed alone, however. To defeat sticky inflation while avoiding financial crisis and a recession, all macroeconomic, financial, and structural policies need to work in concert.

Maintaining financial stability will require close supervision and monitoring of both banks and nonbank financial intermediaries, contingency planning, and prompt corrective action. In the European Union, stability could be bolstered by extending the reach of bank resolution tools, clarifying the availability of the Single Resolution Fund’s resources, ratifying the European Stability Mechanism’s amended treaty, and agreeing on a pan-European deposit insurance.

Defeating inflation also calls for European governments to pursue more ambitious fiscal consolidation than embedded in their current plans. A good starting point would be to phase out most energy relief measures and target any remaining ones more narrowly to vulnerable households. Tighter fiscal policy would also help central banks meet their objectives at lower interest rates. This would reduce debt service costs and further bolster financial stability, by reducing euro area economies’ vulnerability to financial fragmentation risks, and emerging European economies’ vulnerability to spillovers from ECB monetary policy tightening and higher global interest rates more broadly.

Finally, supply-side reforms could help sustain economic growth amid restrictive macroeconomic policies. Those that could ease underlying inflation pressures come at a premium, such as reducing labor market tensions by raising female and older workers’ labor force participation and enhancing job matching. In the EU, progress implementing the Recovery and Resilience Plans and the Capital Markets Union could unlock investments needed to raise crisis-hit productive capacity, achieve the EU’s climate goals, and enhance energy security.

Economic forecasts

Real GDP growth, percent

Economic Forecasts: Europe

(real GDP growth; percent)

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here