Yesterday, after market hours, Euronext released its 9M results (OTCPK:EUXTF). Since our strong buy rating upgrade, the company’s total return is up by 16.15%, outperforming the S&P 500 change. However, as shown below, stock price performance has been very volatile in the last year. This should not be the case for a company with a beta lower than 1x (not correlated to the market) and a deleveraging story in the process. Our overweight target was also supported by expected synergies, an attractive valuation compared to the closest peers (Deutsche Börse and London Stock Exchange Group plc), a new share buyback program post-H1 results, and supportive regulatory frameworks.

Mare Past Analysis

Q3 results and our upside are still in place.

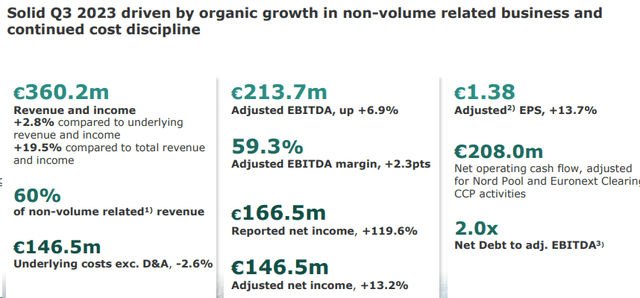

Euronext closes the third quarter with a positive earnings trajectory. Top-line sales reached €360.2 million and were up by 21% compared to one year ago. The company also reported an adj. EBITDA of €213.7 million, signing a plus +6.9% with a margin of 59.3%. Cross-checking analyst estimates, Q3 adjusted EBITDA was forecasted at €207.2 million with a margin of 57.2%. Sales were supportive, but the key emphasis is Euronext growth in the non-volume-related business. In numbers, non-volume turnover now accounts for 60% of the total sales and covers 148% of the company’s recurring expenses. This marks one of our investment pillars.

Going down to the P&L analysis, the company confirmed a continued focus on cost discipline thanks to our higher synergies expected. In addition, on a full-year basis, costs are expected to be lower than anticipated. Here at the Lab, in our forward-thinking estimates, this is not new; however, we positively report this evolution, and we believe the sell-side and buy-side will price in this new status. Currently, the group demonstrated a double benefit from revenue diversification and better cumulative synergies. By the end of 2024, the €115 million cost savings envisaged in the plan were (once again) confirmed.

Looking at the net profit evolution, Euronext delivered a plus +119.6% to €166.5 million; however, on an adjusted basis, net income was up by net profit by 13.2% to €146.5 million. This difference is explained thanks to a €41.6 million capital gain due to LCH SA’s disposal. Looking at the EPS achievement, a crucial input in our valuation methodology, the adjusted EPS reached €1.38.

Post Q2 results, as mentioned, the company announced a new share repurchase for €200 million. In early November, the company completed 59.21% of the buyback program. In numbers, Euronext bought back 1,784,064 shares at an average price per share of €66.37. Despite this outflow and thanks to the EBITDA evolution, the company’s net debt EBITDA declined to 2.0x. Once again, our buy rating thesis supported by a deleveraging story is still in place.

Euronext Q3 Financials in a Snap

Source: Euronext Q3 results presentation

Why are we still supportive?

With the CEO’s words, Euronext “strengthened its position as the leading venue for equity listing and trading in Europe. We welcomed 72% of the new equity listings in Europe this quarter.”

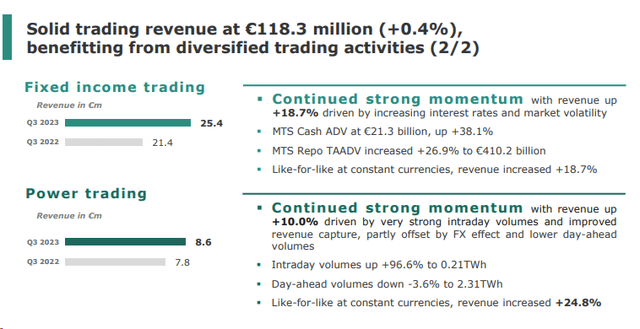

Aside from the equity listing, the company reaffirmed its leading position within the fixed income. In the quarter, €261.2 billion in financial obligation was raised in the exchange, representing a +51.2% vs. last year. VIX is a strategic option in the equity; however, having a grip on bond issuance is also a priority for the Group. In addition, there is a positive momentum of ESG bond offerings with a total value of €1.2 trillion in sustainable bonds listed on Euronext from over 450 issuers.

The company announced that the EU “has nominated MTS as a recognized interdealer platform for the implementation of electronic market making on European Union issued debt instruments to support this evolution.” This was successfully launched in early November, and according to the CEO, he confirmed in the Q&A that transaction volumes have proven to be very dynamic. This is positive and welcome news that shows support from the regulators (as we were expecting).

MTS trading

In detail, for the next visible period, we forecast sales of €1.54 billion with an adjusted EBITDA of €920 million, confirming a margin of 59.7% (higher than Wall Street consensus). There is also a deleveraging plan (we are not assuming any strategic acquisition) for almost €350 million per year. In number, we are forecasting a DPS hike of 14.5% thanks to an FCF of €615 million.

Conclusion and valuation

The company appears most attractive compared to its closest European peers, as it trades at a 40% P/E discount. Our comps analysis does not look at US peers such as ICE, CBOE, and Nasdaq. Here at the Lab, we anticipated that a 20% discount is more than justified. Applying a 15x P/E (compared to a current 13x) on a €5.66 EPS, we arrived at a target price of €85 per share. This is based on the non-volume revenue increase and the Borsa Italiana acquisition. Given the solid results, we should increase our estimates; however, we are already above Wall Street estimates and prefer to remain cautious. The downside risks in our target price are lower trading volumes and volatility, operational risk on platform migration, and lower-than-expected synergies.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here