Investment Thesis

I wanted to take a look at Daqo New Energy (NYSE:DQ) which I recently bought because of the cyclicality in the polysilicon pricing, which led to many companies like DQ going out of business, while DQ stayed strong, although they got hurt quite considerably. I believe that the company with its strong balance sheet and continuing efficiency improvements will weather the downturn well and come out on top once prices turn back up as they have in the past. I initiate my coverage of DW with a buy rating.

Briefly on Financials

As of Q3 ’23, the company had $3.3B in cash and equivalents against zero debt. This is a fantastic position to be in during such a massive downturn in the prices of polysilicon. This provides flexibility in how the company wants to proceed during such low prices. Furthermore, the company can reward its shareholders by continuing share buybacks. The management mentioned in the latest quarter that they believe the company is very undervalued and is committed to fully using up the available capital that was approved for share buybacks, of which around $350m is left to utilize until the end of the year. By then, the management also said that they would eliminate the shares they bought, hence improving EPS for their shareholders. I like this strategy a lot more than paying a dividend because of taxes. With an FW PE ratio of 3.5, I do think that the company is quite cheap.

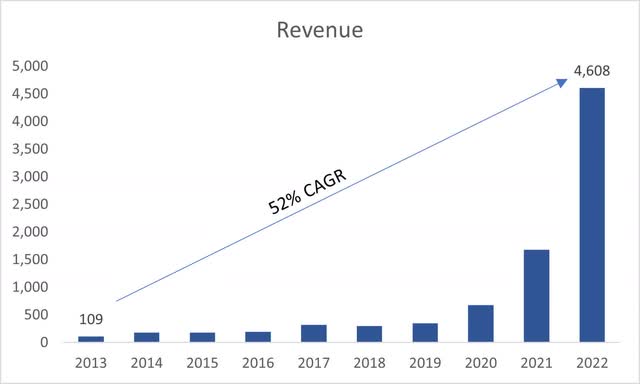

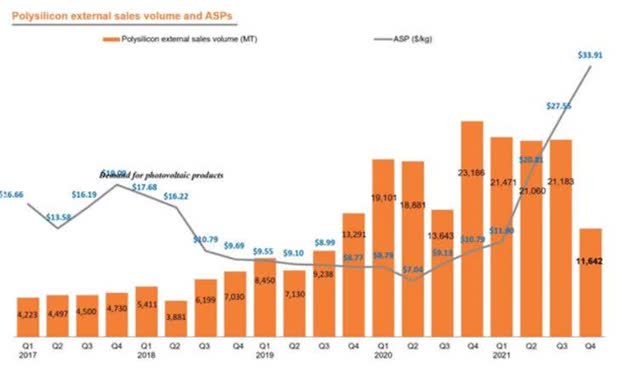

The company’s revenues grew at a tremendous rate over the last decade with FY21 showing a significant increase in sales, which can be attributed mostly to the average sale price going from around $7/kg in Q2 ’20 to around $34/kg by Q4 ’21. The low of $7/kg can be attributed to the pandemic panic. On top of the great price-performance was the company’s ability to increase capacity over time. In Q1 ’18 the company was doing around 5,000MT, and by Q3 ’21 it quadrupled.

Revenue over the last decade (Author) Polysilicon Production and ASP (DQ 10-K)

So, we can see that it is not the first time the ASP fluctuates so much, and it won’t be the last time.

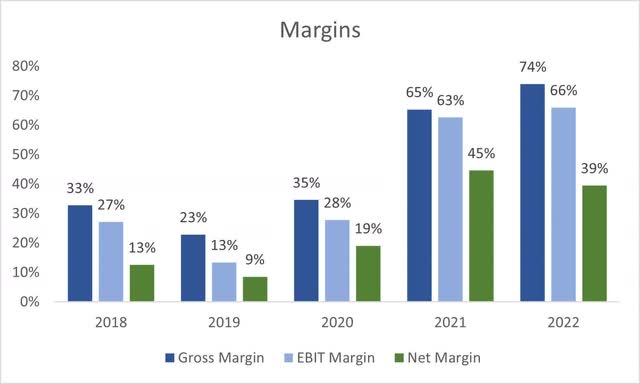

In terms of margins, we know that these have gotten hit tremendously in the last quarter because of low poly prices, however, if we look at how the company performed during the better cycles of pricing, we can see a company that is very efficient and profitable. Just last year Q3, the company’s gross margins were around 80%, so if we see prices climb back up eventually, I would expect a similar performance, or even better since the company managed to reduce production costs even in this environment.

DQ Margins (Author)

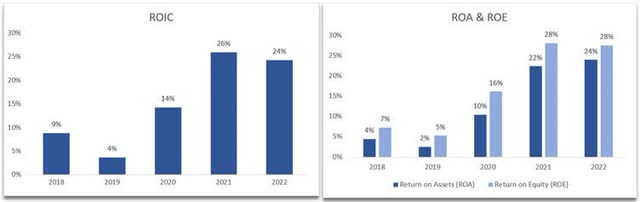

Continuing with historical efficiency and profitability, we can see where the company could end up being once again when the prices come back up sometime in the near future. We can see that the company was very efficient and profitable and had a good competitive advantage and a strong moat, which means that the company should be able to weather this downturn rather fine. This competitive edge is what makes the company resilient in such an environment, while the competition will struggle to stay in business due to cost inefficiencies.

Efficiency and Profitability (Author)

Overall, I see a company that had a really good time in the past and is very dependent on prices of poly to perform either good or bad. Seeing that the company is managing the downtrend quite well, I do not doubt that the company is going to come out on top once the prices stabilize, the demand picks up, and the poor competition leaves the market. The company’s strong balance sheet will keep it afloat for a while.

Comments on outlook

Over the last year, the price of polysilicon plummeted and is currently down around 77% since last December. So, it is unsurprising that the company’s profitability and revenues have plummeted also. Gross margins contracted to around 14% as of Q3, down from 80% a year ago when poly prices were in the $30s. The prices have been elevated for a while now, and many analysts have predicted the meltdown to happen sometime over the year, which it did. China is the largest player in the solar power supply chain and will continue to dominate the industry for many years. The reason is the government subsidies for green energy, especially solar. These subsidies fuel demand for solar energy and its producers, especially companies like DQ. The demand for polysilicon soared and the prices per kg followed suit. Seeing that it was very profitable to enter this industry, many companies in China did just that. Fast forward a year and the demand for solar power was not as robust as predicted, which led to oversupply. The oversupply brought down poly prices significantly over the last 10 or so months.

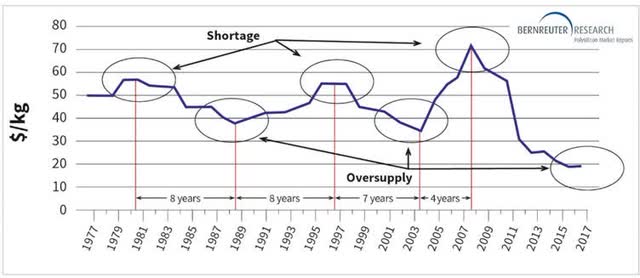

Polysilicon prices tend to fluctuate quite a bit and exhibit a cyclicality every 4-8 years as shown in the graph below.

Price cyclicality due to supply and demand (Bernreuter)

So, we are at the oversupply part of the graph right now and eventually will be out of the trough in the next half a year to a year. The reason I think we will see prices going back up is that the demand for solar energy is looking to continue to expand. The government isn’t going to stop the subsidies as it continues its efforts to go greener. As the CEO said in the latest transcript:

“And what’s happening here in China is — one is, it is Chairman Xi Jinping’s goal and his mandate that China deploy significant amounts of renewable energy. Also, the National Energy Administration is very proactive in terms of allowing and requiring actually local grids to accept as much renewable energy as possible. At the same time, China is building significant amount of capacity in energy storage. Expect that storage could reach a high of [15%] of the overall power generation for China over time. Even in the near term, China exploring technology, including not just battery storage but also in terms of hydrogen storage as well as hydro or water-based type of energy storage. So, this is all happening within China.”

What this low price does to competitors of DQ is eliminate them because the cost of production is much higher for the competitors than it is for DQ. Even in this turbulent time, the company managed to reduce its total production cost by around 6% q/q from $6.92/kg to $6.52/kg. The company seems to have a really good competitive advantage against new entrants in the industry as it can curb costs even in the trough seasons. Regarding the competitors, the CFO also had a say on this issue, which reflects what I said above:

“So, I think shutdown, including [indiscernible] shutdown and idling of some capacity, is a likely situation for non-competitive players within the industry.”

The company’s product seems to be of the highest quality and the most efficient, and I am commending the management on achieving this. I have no problem believing that the company will be able to survive the downturn in prices long enough until the cyclicality and the demand turn positive once again. The company’s high-quality n-type polysilicon is seeing a surge in demand and a price increase, which further helps to distinguish the company’s product as superior.

As I mentioned in the Financials section, the company’s balance sheet is very good with a lot of liquidity on hand and no debt that will certainly help weather this downturn for a long time, while the rest of the new competition that just entered the market or has costs that are too great handle during this time, will be out of business and will have to shut down.

Valuation

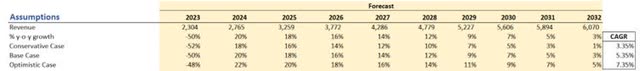

It is impossible to predict what the prices are going to be in the future. What I can do is come up with a conservative valuation analysis of how the company’s sales are going to perform in the next. I think my approach is very conservative given the current situation, which allows for more margin of safety. Below are my revenue assumptions for the base, conservative, and optimistic cases, and their respective CAGRs.

Revenue Assumptions (Author)

In this case, the company is going to go back to its FY22 sales number by FY28, which I believe is very conservative.

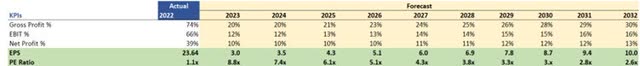

In terms of margins and EPS, I decided to be very conservative here and also compared what the company managed to do in FY22. This way it looks like the prices never recover and the company’s efficiency falls to very low efficiency. Below are those assumptions for FY22 performance for comparison.

Margins and EPS assumptions (Author)

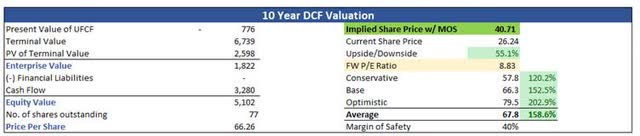

For the DCF model, I went with a 10% discount rate instead of the company’s WACC, which is around 7% because I wanted to add another margin of safety measure and to be more conservative. I also went with a 2.5% terminal growth rate.

On top of these assumptions, I decided to add another 40% margin of safety, which is probably an overkill but this way I get to have a good night’s sleep knowing that I didn’t buy a company that may have been overpriced. With that said, DQ’s intrinsic value is $40.71, implying that it is currently trading at a whopping 55% discount to its fair value and that is conservative.

Intrinsic Value (Author)

Risks

Since the company is Chinese, the risks of further price depreciation because of politics are a real threat. You have to be okay with owning a Chinese company and stomach anything that doesn’t concern the fundamentals of the company, which are very sound in my opinion.

Polysilicon prices may continue to go further down, which will wreak havoc on the company’s sales and profitability in the short run. It is hard to time the market so I think if you believe in the company and believe that prices will stabilize and increase in the future, I will take the short-term further deterioration in price as an opportunity to accumulate more shares for the eventual recovery.

Since the industry has so many players in the business, these players will want to take DQ’s slice of the pie, which will hurt its sales, however, seeing that many may not survive the low-price environment, DQ should be fine in the long run.

Closing Comments

I threw every conservative curve ball at the company that I could think of and still, the company came out on top, mostly because of the company’s massive pile of cash that it currently has. The poly prices will go through the ebb and flow as they had in the past, so I don’t doubt prices will start to pick back up and improve the company’s performance along with them. I have opened a small position recently and will accumulate over the next couple of months depending on what is going to happen to the climate of the industry.

The management knows that the company is heavily undervalued, and I think they will announce another share buyback program to take advantage of such a discount. Even with my very conservative estimates, there is still a lot of room for growth and if or when it reaches $40 once again, I will not be selling it as I believe the potential is greater than that.

Read the full article here