Turning Point Brands, Inc. (NYSE:TPB) noted double-digit growth of Stoker’s MST in a recent quarterly report, and the total amount of assets related to Stoker’s products increased. I believe that further investments in this business segment could bring further net sales growth. Additionally, given the expertise of TPB, I expect that successful expansion into new territories and new products will most likely lead to FCF growth. I know that changes in the legislation, lower demand for TPB’s products, and failed marketing represent risk factors. However, I believe that TPB appears undervalued.

Turning Point Brands

Distributing its products primarily in the tobacco accessories industry, Turning Point Brands is a company that manufactures, markets, and distributes adult products through its Zigzag and Stoker’s brands.

The tobacco market accessories industry, according to company reports, has experienced robust secular growth following the legalization of Cannabis in some areas of the United States and Canada and within the population segment to the extent that consumption growth has developed in the period of the last three years.

The alternative smoking accessories market is a dynamic market experiencing robust secular growth driven by cannabinoid legalization in the U.S. and Canada, and positively evolving consumer perception and acceptance in North America. Source: 10-k

Distribution is made to more than 800 wholesale points in the United States, and the company reports that its products are present in almost 200,000 retail stores in the country as well as 20,000 stores in Canada.

Turning Point Brands currently seeks to take advantage of the forecasts and trends within these markets through the diversification of its products in the form of the launch of new items and the reinvestment in the advertising of its brands through the use of positive capital flows from that it has.

Operations are currently divided into three segments organized by product brand. Thus, we find the Zigzag product segment, Stoker’s segment, and the most recent NewGen product segment. The first of these segments distributes mainly papers for assembling cigarettes, being, according to Management Science Associates, the preferred brand in the local market, and capturing 35% of the market.

The strength of the Zig-Zag® brand drives our leadership position in both the rolling papers and MYO cigar wrap markets. Zig-Zag® is the #1 premium and #1 overall rolling paper in the U.S. with approximately 35% total market share according to MSAi. Source: 10-k

Stoker’s segment distributes both wet pipe tobacco and chewing tobacco, comprising a large portion of the market for this product, reaching percentages close to 30% nationwide, positioning the company as the second largest distributor of this product. A detail within this segment that supports the growth it has had in recent years is the relationship with Philip Morris (PM), supplier of chewing tobacco for the company.

Finally, the NewGen product segment includes the distribution of different types of vaporizers, and has direct sales channels to its consumers. In addition to the marketing of these products, Turning Point Brands has made investments through this segment in some of the cannabis production companies such as Wild Hempettes, Docklight Brands, Inc., and Old Pal Holding Company LLC.

Solid Balance Sheet, With Some Debt

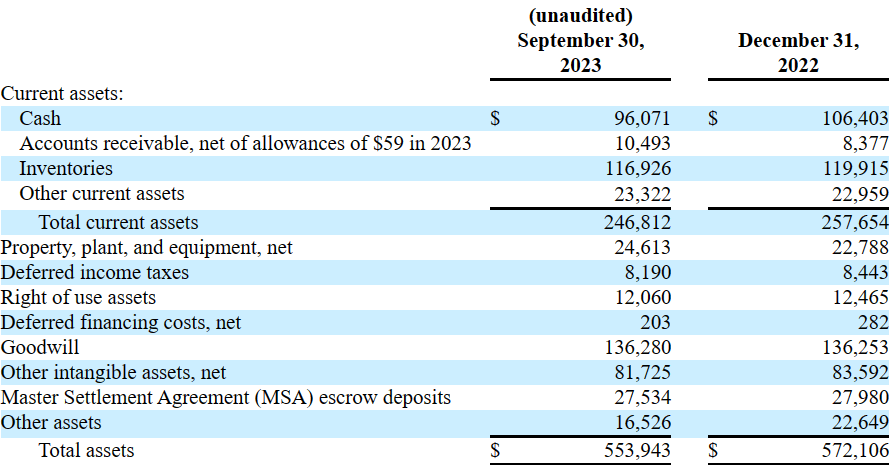

As of September 30, 2023, the company reported cash of about $96 million, accounts receivable of about $10 million, and inventories worth $116 million. Total current assets are equal to $246 million, and the current ratio is larger than 1x. I do not see a liquidity problem.

With property, plant, and equipment worth $24 million, goodwill would be $136 million, and total assets were equal to $553 million. The asset/liability ratio is more than 1x, so I believe that the balance sheet appears solid.

Source: 10-Q

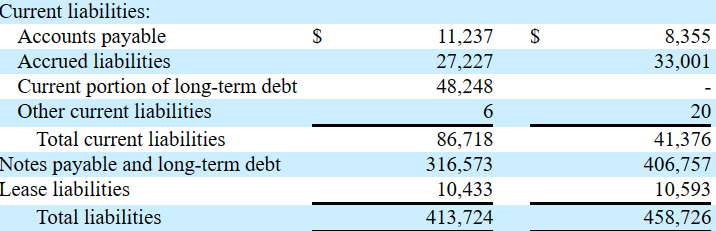

Accounts payable were equal to $10 million, with accrued liabilities worth $30 million, notes payable and long-term debt of $379 million, and total liabilities of about $430 million.

Source: 10-Q

I do believe that the total amount of leverage is not small. Certain investors would most likely not be interested in the company because of the notes payable. The financial leverage ratio stands at close to 2.9x, however management did lower the total amount of leverage in the last 5 years. In my view, further decreases in the total amount of debt would most likely lead to increases in the demand for the stock.

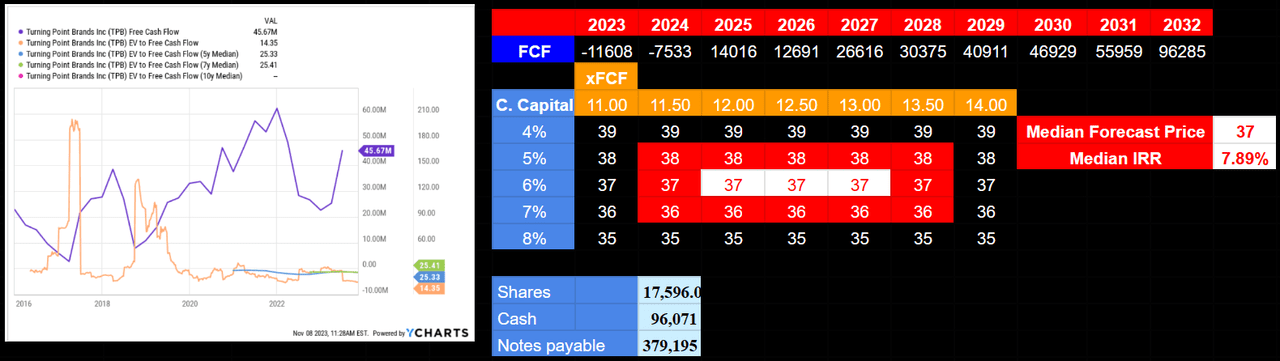

Source: YCharts

Cost Of Debt

For the assessment of the WACC, I had a look at some of the interest rates paid by Turning Point. The company reported a credit facility including Eurodollar rate plus an applicable margin of 3.50%. The Eurodollar or LIBOR is close to 5%-6%, so I believe that the interest rate would be close to 8%-9%.

Interest is payable on the 2021 Revolving Credit Facility at a fluctuating rate of interest determined by reference to the Eurodollar rate plus an applicable margin of 3.50%. The Company also has the option to borrow at a rate determined by reference to the base rate. Source: 10-k

The company also reported that Convertible Senior Notes bear interest at a rate of 2.50% per year, payable semiannually. In this regard, the following lines from the annual report provide further information.

In July 2019 the Company closed an offering of $172.5 million in aggregate principal amount of its 2.50% Convertible Senior Notes due July 15, 2024. The Convertible Senior Notes bear interest at a rate of 2.50% per year, payable semiannually in arrears on January 15 and July 15 of each year, beginning on January 15, 2020. Source: 10-k

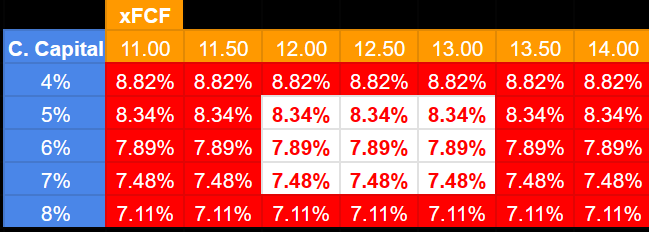

With these figures in mind, I think that assuming a cost of capital of around 4% and 8% would be reasonable. I tried to run a sensitivity analysis.

Organic Growth, Inorganic Growth, New Products, Distribution Expansion, And Market Share Expansion Will Most Likely Bring Net Sales Growth

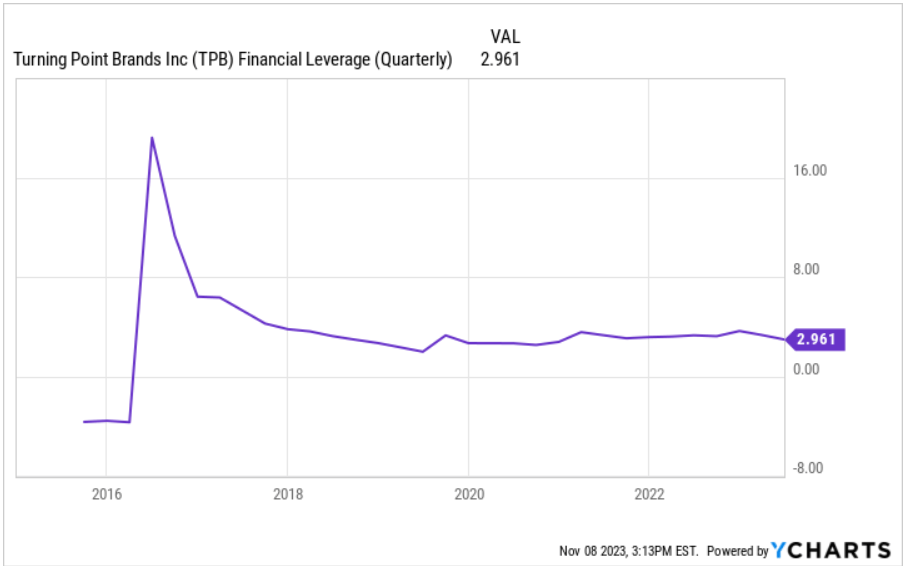

Given the expertise of Turning Point, I expect continued growth with sustainable margins, through organic and inorganic sales growth and by taking advantage of acquisitions that serve to diversify products as well as to expand the geographic footprint and distribution channels. In the past, we saw increases in operating margin, which does not mean that we will see them in the future. With that, it is good to point out what the company achieved.

Source: YCharts

For this, expanding the market share of its products nationally and internationally, accelerating growth through the international distribution network, and expanding into adjacent categories within the same market through partnerships and joint agreements may also be expected. An example of this is the recent distribution agreement the company has established with CLIPPER, the main marketer of reusable lighters in the United States and one of the main distributors globally.

Further Investments In Inventory Of Stoker’s Products And Distribution Expansion Of This Business Segment Could Accelerate Net Sales Growth

In the light of the results delivered in the last quarter about the double-digit growth of Stoker’s MST., I believe that continuous investments in this particular business segment could bring significant net sales growth.

For the nine months ended September 30, 2023, net sales in the Stoker’s Products segment increased to $106.6 million from $98.8 million for the nine months ended September 30, 2022, an increase of $7.8 million or 7.9%. For the nine months ended September 30, 2023, volume increased 1.0% and price/product mix increased 6.9%. The increase in net sales was driven primarily by double-digit growth of Stoker’s MST. Source: 10-Q

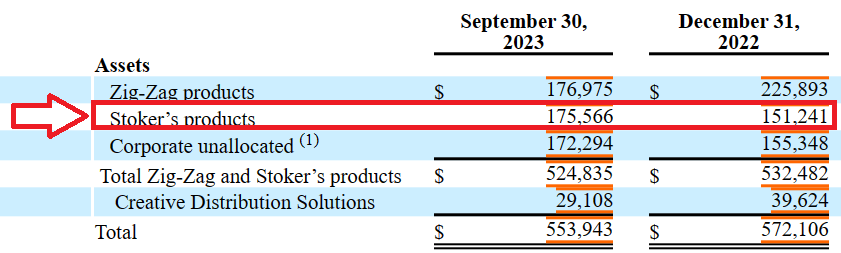

In this regard, it is worth noting that the company recently reported less assets related to Zig-Zag products and more products related to Stoker’s. It appears clear that Turning Point is investing in the business segment that offers larger net sales growth. I believe that management is working in the right direction.

Source: 10-Q

New Negotiations About The Debt May Receive Attention From Investors, And Enhance The Stock Price

I also saw with significant optimism the recent credit agreements reached in November with large institutional banks. In my view, if the company receives financing from banks, and more liquidity is shown in the balance sheet, we may see further increase in demand for the stock.

On November 7, 2023, TPB Specialty Finance, LLC, a wholly-owned subsidiary of the Company, entered into a $75.0 million asset-backed revolving credit facility, with the several lenders thereunder, and Barclays Bank Plc, as administrative agent and as collateral agent (the “Collateral Agent”) and First-Citizens Bank & Trust Company as additional collateral agent (the “Additional Collateral Agent”). Source: 10-Q

The Stock Repurchase Program May Also Bring Further Demand For The Stock

I believe that the stock repurchase agreement would also interest most market participants, may enhance the demand for the stock, and push the stock price up. According to the most recent quarterly report, Turning Point Brands reported a stock repurchase program of close to $50 million.

The Board of Directors increased the approved share repurchase program by $24.6 million bringing total authority at that time to $50.0 million. This share repurchase program has no expiration date and is subject to the ongoing discretion of the Board of Directors. All repurchases to date under our stock repurchase programs have been made through open market transactions, but in the future, we may also purchase shares through privately negotiated transactions or 10b5-1 repurchase plans. Source: 10-Q

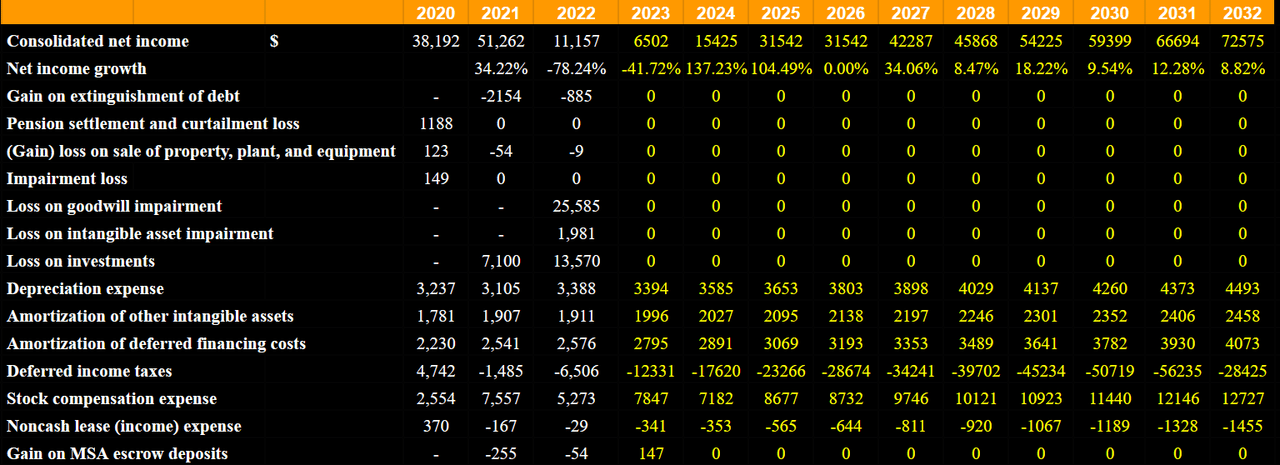

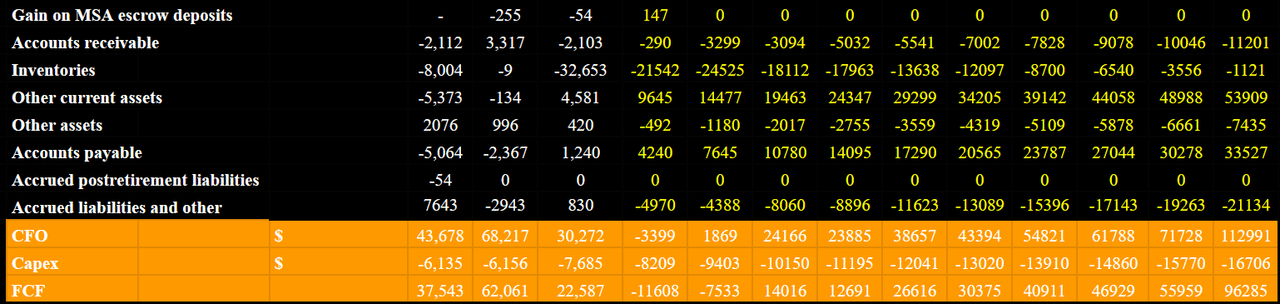

Given My Previous Assumptions, And Previous Cash Flow Statements, I Designed A DCF Model

My cash flow statement projections include consolidated net income of about $72 million, amortization of deferred financing costs of about $4 million, stock compensation expense worth $12 million, and changes in accounts receivable of -$12 million. Besides, I also assumed inventories close to -$2 million, with other current assets worth $53 million, changes in accounts payable worth $33 million, and 2032 CFO of $112 million. Finally, assuming capex of -$17 million, 2032 FCF would be $96 million.

I did not include items like gain on extinguishment of debt, pension settlement and curtailment loss, gain on sale of property, plant, and equipment, or impairment loss or goodwill impairment because they do not seem part of the regular business.

Source: DCF Model Source: DCF Model

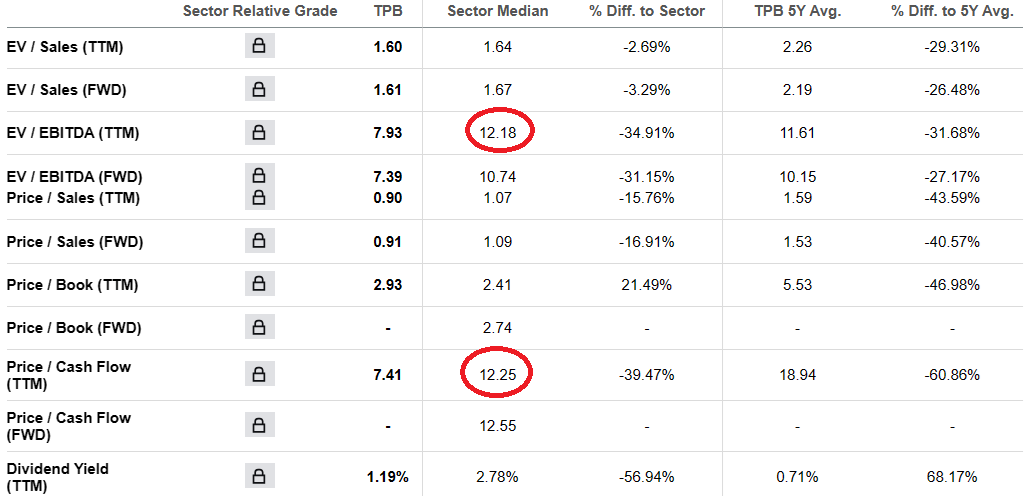

I studied a bit the valuation multiples in the sector. The median EV/EBITDA stands at close to 12x, and the price/cash flow is about 12x. With these figures, I believe that assuming an exit valuation multiple between 11x and 14x is conservative.

Source: SA

With cost of capital of 4%-8% and an EV/ 2032 FCF of 11x-14x, the implied stock price would be about $35-$39 per share. The median forecast price would be close to %36-%37 per share, and the IRR would range between 7% and 8%.

Source: My DCF Source: My DCF

Competition, And Risks

The competition for each segment is high, and is given by large companies with a historical presence in the tobacco market. In any case, due to the decrease in the consumption of traditional cigarettes, these companies are also diversifying their products towards secular markets within the same industry.

Republic Tobacco, L.P., HBI International, Good Times USA, LLC, and New Image Global, Inc are the main competitors for ZigZag. Swedish Match, the American Snuff Company, LLC, Swisher International Group, Inc., and U.S. Smokeless Tobacco Company are competitors for the Stoker’s product segment.

Along with competitive risks, it must be considered that any decrease in product consumption would generate a decrease in sales that would translate into lower margins for reinvestment in its brands and new products. Although the forecasts are good for the secular tobacco industry, these trends may not come to pass for a variety of reasons.

On the other hand, the legislation on this type of market is high, and any radical change in this sense could mean complications when it comes to the distribution and marketing of its products both nationally and internationally.

My Takeaway

I believe that the double-digit growth of Stoker’s MST and the increase in the total amount of assets related to Stoker’s products are quite promising. In my view, further investments in this particular business segment may accelerate both the net sales and FCF growth. Also, considering the expertise of the company in the industry, further expansion into new geographies and economies of scale may bring operating margin growth and stock price increases. I did find certain risks related to changes in the legislation, lower consumption, or failed introduction of products. However, with that, the company does look cheap.

Read the full article here