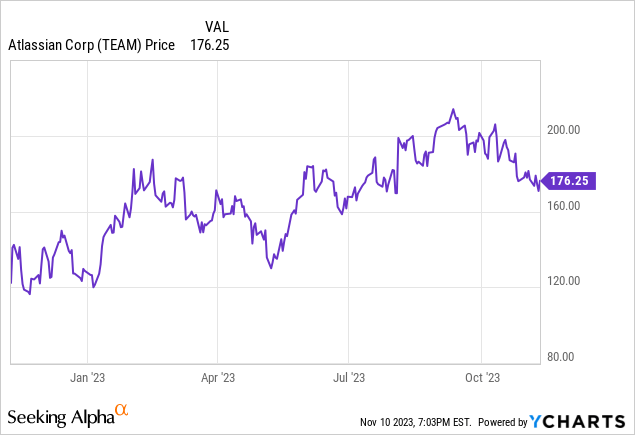

So far this earnings quarter, companies that have reported less-than-perfect earnings and outlook updates have been punished by substantial share price declines. Such is the case for Atlassian (NASDAQ:TEAM), the software developer behind the Jira collaboration platform and one of the leading large-cap companies in enterprise software.

Year to date, shares of Atlassian are still holding onto ~40% gains – but the stock is down nearly 20% from YTD peaks above $210. The company’s recent fiscal Q1 earnings print (corresponding to the third calendar quarter) did little to assuage investors of Atlassian’s performance, and the stock continued a downward march despite recent optimism returning to the growth sector.

Upgrading Atlassian to Neutral: a balanced bull and bear case

I last wrote on Atlassian in August, issuing a bearish rating on the stock when it was trading closer to $200. Now, with share prices having softened plus Q1 earnings under its belt, I am flipping my rating to neutral as Atlassian is approaching my buying threshold (though don’t rush in yet!)

At current share prices, I see a balanced bull and bear case for this company. On the bright side for Atlassian:

- Atlassian is a category leader. Jira and its suite of related products are among the most well-recognized collaboration and workflow tools for software developers, and the fact that the company can continue to grow at scale (>20% growth for a company with ~$1 billion in quarterly revenue is a rarity) is a testament to its strength.

- Rule of 40 operator, driven by a profitable operating model. Atlassian still remains in the “Rule of 40” club despite recent revenue deceleration. Its focus on word-of-mouth sales and free trials, as opposed to expensive direct sales forces, has helped the company build up a strong operating margin profile.

At the same time, however, there are risks to be mindful of:

- Revenue deceleration. Due both to tougher macro conditions plus the burden of Atlassian’s own scale, Atlassian’s growth rates are finally starting to moderate into the 20s (versus a ~40% growth rate during the peak of the pandemic era). Arguably, Atlassian’s core products also face stiffer competition as similar software products like Asana (ASAN) continue to grow from a much smaller base. Continued deceleration calls into question Atlassian’s premium valuation multiple.

- Margins are moderating. Similarly, as Atlassian continues to see a revenue mix shift into cloud (which carries a lower gross margin profile than its end-of-life server products), its low-80s gross margin is tapering off, which is hindering the company’s overall bottom-line expansion.

- Server end of life may cause higher than expected churn. When Atlassian stops supporting its server deployments in February 2024, it may alienate many longtime customers who refuse to migrate to either cloud or data center deployments, causing a revenue headwind.

Valuation checkup

But above all, an expensive valuation remains one of the core impediments to investing in Atlassian, in my view. At current share prices around $175, Atlassian trades at a $45.49 billion market cap. After we net off the $2.46 billion of cash and $1.00 billion of debt on Atlassian’s most recent balance sheet, the company’s resulting enterprise value is $44.03 billion.

Meanwhile, for the current fiscal year FY24 (the year for Atlassian ending in June 2024), Wall Street analysts are expecting the company to generate $4.15 billion in revenue, representing 17% y/y growth; and in FY25, consensus is calling for $5.01 billion in revenue (+21% y/y). This puts Atlassian’s valuation multiples at:

- 10.6x EV/FY24 revenue

- 8.8x EV/FY25 revenue

Needless to say, forking over a double-digit revenue multiple for a company whose growth is decelerating to the 20s is a tough proposition in this market – especially when interest rates are hovering around 5%. Atlassian’s strong operating margins and Rule of 40 achievements, however, must be given some consideration.

I am retaining my price target of $149 for the company, which represents 9x EV/FY24 revenue (and 7.5x EV/FY25 revenue). The bottom line here: it’s a good time to monitor Atlassian’s movements more closely and add this stock to your watch list, but be very cognizant of valuations before diving in.

Q1 download

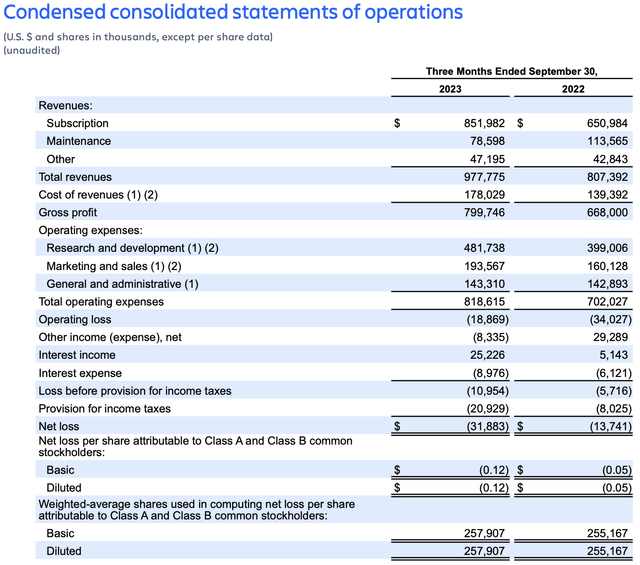

Let’s now go through Atlassian’s latest quarterly results in greater detail. The fiscal Q1 earnings summary is shown below:

Atlassian Q1 results (Atlassian Q1 shareholder letter)

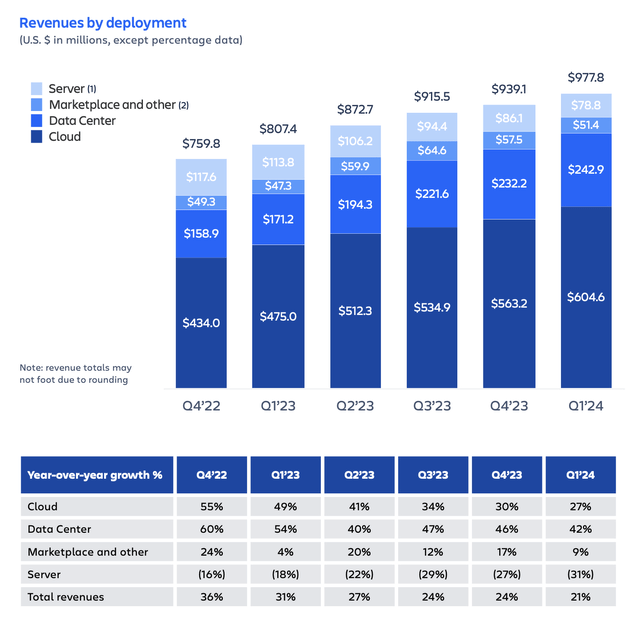

Atlassian’s revenue grew 21% y/y to $977.8 million, slightly ahead of Wall Street’s expectations of $965.4 million (+20% y/y). The chart below additionally shows that revenue growth has been in a sharp deceleration mode for several quarters, now falling 3 points sequentially versus 24% y/y growth in Q4 – the company’s lowest growth rate on record yet.

Atlassian revenue trends (Atlassian Q1 shareholder letter)

The key drivers here include server migrations into cloud, which is still growing 27% y/y and is now roughly two-thirds of overall revenue. The company notes that ten points of cloud growth are due to server migrations.

Recall again here that Atlassian will stop supporting server products in February. At this juncture, it’s highly possible that customers can use the service break to transition off Atlassian products for good and turn to a competitor (of which there are many: Asana (ASAN), Salesforce (CRM), Microsoft’s (MSFT) GitHub are just a few examples). Note that some level of churn is baked into Atlassian’s guidance for FY24, which calls for 25-30% cloud growth this year.

In the company’s Q1 shareholder letter, management wrote as follows:

While we are pleased with the solid results in Q1 and our healthy sales pipeline in Q2, our revenue guidance continues to account for two significant factors that may impact our results in FY24, consistent with what we highlighted last quarter.

First, the macroeconomic environment remains uncertain. Our guidance assumes that macroeconomic headwinds continue to negatively impact growth in paid seat expansion at existing customers and free-to-paid conversion rates, and that the trends we’ve seen in these areas throughout the last year persist in FY24.

Second, customer purchasing and migration decisions related to the end-of-support for our Server offering in February 2024 are expected to drive greater levels of variability in our Cloud and Data Center revenue growth rates depending on when and how Server customers ultimately choose to migrate: direct to Cloud, direct to Data Center, or to some combination of Cloud and Data Center. Our guidance continues to assume that Server customer migration rates to Cloud and Data Center are consistent with historical trends and that some proportion of our Server customers will not migrate in FY24.”

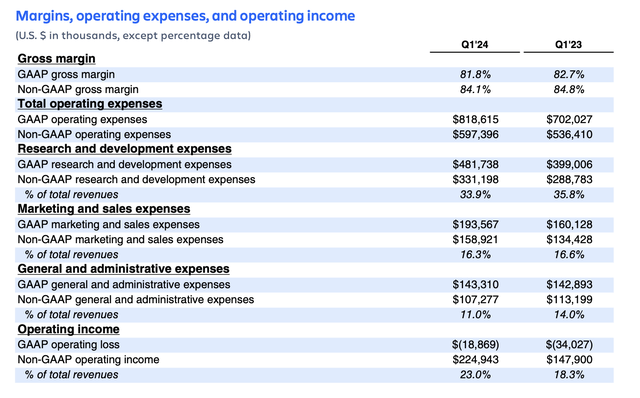

Rising margins, meanwhile, are the counterpoint to decelerating growth. The company has done a good job at reducing all elements of opex – in part driven by shrinking its real estate and introducing a “work from anywhere” policy.

Atlassian margins (Atlassian Q1 shareholder letter)

As shown in the chart above, pro forma operating margins hit 23.0% this quarter, up 470bps y/y – which on top of 21% y/y revenue growth still squarely positions Atlassian in the “Rule of 40” category.

Key takeaways

Atlassian is still an expensive stock, but recent pessimism may soon provide a good entry point in this venerable category leader that still manages to balance growth at scale with strong profitability. Keep a lookout on this name, but don’t rush to buy immediately.

Read the full article here