A businessman puts money into his suit pocket.

The legendary supplemental insurer Aflac (NYSE:AFL) is a perfect example of two reasons why dividend growth investing is my predominant investing strategy. Without further ado, let’s elaborate on that statement.

When Aflac shared its third-quarter earnings on Nov. 1, it dropped a big, beautiful bombshell on shareholders: The company boosted its quarterly dividend per share by a whopping 19% to $0.50. Putting this into perspective, I was only expecting a 4.8% raise to $0.44!

So, for one, amazing businesses like Aflac can wildly exceed your expectations for dividend growth. Secondly, where else are you going to get a 19% raise?

From your day job? If you pour your heart and soul into it, maybe you’ll get that lucrative promotion. But even then, it’s pretty unlikely that you’ll get that big of a pay raise. The best part is that simply owning shares in great businesses requires very little effort. Beyond the initial phase of securing capital to invest in such a business and occasionally checking in on fundamentals, there’s no work to be done.

Since my previous article on Aflac in October, let’s reassess the company’s fundamentals and valuation to highlight why I am keeping my hold rating for now.

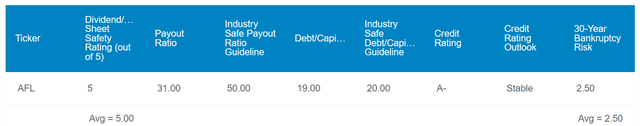

DK Zen Research Terminal

Aflac and its 2.5% dividend yield may not be able to shower you with huge starting passive income. But the Dividend Aristocrat makes up for this lower income with a very safe 31% EPS payout ratio. This is well under the 50% that rating agencies view as sustainable for insurers per Dividend Kings.

Aflac is also a financially sound business. The company’s 19% debt-to-capital ratio is just below the 20% that rating agencies consider to be solid. Perhaps it’s no surprise then that Aflac’s corporate credit rating is A- from S&P on a stable outlook. This signals that the risk of the company not being around in 2053 is merely 2.5%.

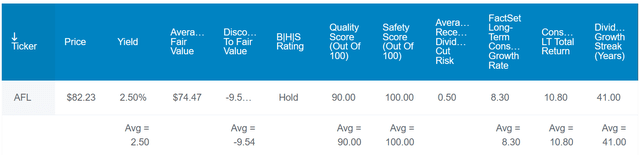

DK Zen Research Terminal

The only thing I don’t particularly like about Aflac right now is its valuation. An average of Dividend Kings’ fair values peg Aflac to be worth $74 a share, which is 9% less than the current $81 share price (as of November 10, 2023).

My fair value estimate using the dividend discount model is $73 a share, which is 12% above the current share price. I arrived at this fair value by using the annualized dividend per share of $2, a 10% discount rate, and a 7.25% annual dividend growth rate for the long haul.

Averaging these fair values together, I get a fair value of about $74 a share. Assuming Aflac meets the analyst growth consensus and returns to fair value, these are the total returns the company could deliver in the coming 10 years:

- 2.5% yield + 8.3% FactSet Research annual earnings growth consensus – 1% annual valuation multiple contraction = 9.8% annual total return potential or a 155% cumulative total return versus the 10% annual total return prospects of the S&P 500 (SP500) or a 160% cumulative total return

A Strong Third-Quarter Showing

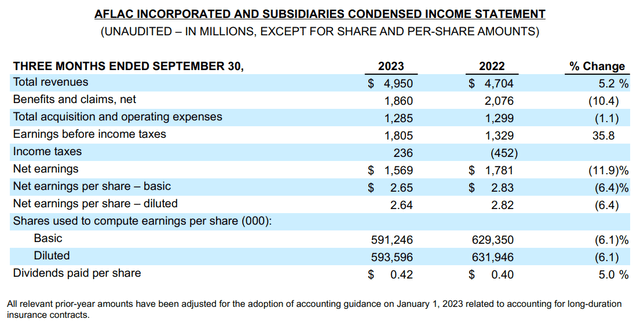

Aflac Q3 2023 Earnings Press Release

As stockalien in the Seeking Alpha community put it with a clockwork pun, Aflac is like quackwork. Seeing as Aflac’s revenue grew by 5.3% year-over-year to $5 billion during the third quarter, I couldn’t agree more with this assessment. For more color, this beat the analyst consensus by a staggering $500 million.

These results were mostly due to a significant uptick in net investment gains, which more than doubled to $514 million in the third quarter. This was largely due to a foreign currency gain from the weakening Japanese Yen (pages 20 and 26 of 129 of Aflac 10-Q filing).

The other factor that helped Aflac a 3.9% growth rate in Aflac U.S. adjusted revenue to $1.7 billion for the third quarter. Steady underlying demand for its products and growth initiatives of group life and disability and network dental and vision contributed to this growth per Chairman and CEO Dan Amos’ opening remarks during Aflac’s Q3 2023 earnings call.

Aflac Japan’s adjusted revenue fell 4.9% over the year-ago period to $2.7 billion during the third quarter. This isn’t what it seems, though. The segment’s currency-neutral sales grew by 12.4%, which was led by double-digit growth in cancer insurance sales. This revenue decline was only because of the Yen’s unfavorable foreign exchange rate versus the U.S. Dollar.

Aflac’s currency-neutral adjusted diluted EPS soared 31.9% year-over-year to $1.90 for the third quarter. Besides a higher revenue base, the company’s surging profits were fueled by margin expansion. Aflac US recorded a pretax adjusted profit margin of 28.8% (it was 21.6% in the year-ago period) and Aflac Japan posted a 32.8% pretax adjusted profit margin (versus 29.3% in the year-ago quarter). A 6.1% reduction in the company’s outstanding share count due to share repurchases also played a part in the much higher currency-neutral adjusted diluted EPS.

As you’d expect for a well-run insurer, Aflac’s capital structure is quite conservative as well. The company had $111.3 billion in investments and cash as of Sept. 30 versus just $86 billion of estimated policy liabilities (details in previous paragraphs according to Aflac Q3 2023 earnings press release).

The Dividend Can Keep Moving Higher

Accounting for Aflac’s upcoming quarterly dividend per share, its dividend has grown by 85% in just the last five years. While I wouldn’t expect that much growth over the next five years, I still believe respectable dividend growth lies ahead.

Through the first nine months of 2023, Aflac generated $2.4 billion in free cash flow (per page 10 of 129 of Aflac 10-Q filing). Against the $730 million in dividends paid during this time, that is just a 31% free cash flow payout ratio. This leaves plenty of room for the dividend to continue growing.

Risks To Consider

Aflac is a remarkable company with a track record that’s tough to beat. However, it still has risks that investors must tolerate.

As I discussed in my previous article, two of the most notable risks are the concentration of revenue and assets in Japan, and Aflac’s dependence on face-to-face interaction to conduct its operations.

Additionally, the company faces underwriting risk as an insurer. If morbidity and mortality significantly differ from Aflac’s expectations, the company’s financial results could be hurt.

Summary: The Right Entry Point Could Be Very Profitable

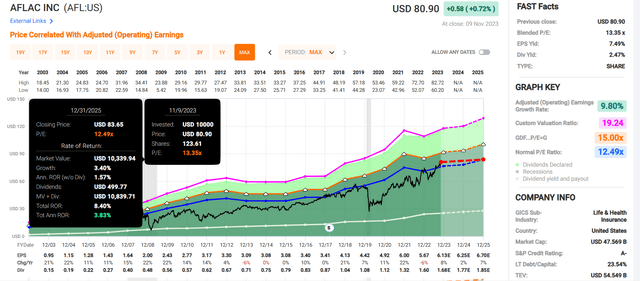

FAST Graphs, FactSet

Aflac’s reputation of four consecutive decades and counting of dividend growth puts it in the conversation of being an elite business. But I live by the philosophy of Warren Buffett to buy wonderful businesses around or below fair value.

Unfortunately, Aflac looks priced a bit beyond its fair value. According to FAST Graphs, the stock’s 13.4 blended P/E ratio is greater than its normal P/E ratio of 12.5. Taking this into consideration, Aflac may only deliver 4% annual total returns through 2025 if it reverts to fair value. At the right valuation, Aflac could beat the market. But as it stands with the current valuation, it will have a tough time doing so. That’s why I rate it a hold.

Read the full article here