In July, I wrote a bullish article on Vita Coco (NASDAQ:COCO), but flipped to a “Hold” rating after the company lost a major private labor customer. With the company recently reporting earnings, let’s catch-up on the name.

Q3 Results

For Q3, COCO saw revenue rise 11% to $138.1 million, up from $124.0 million a year ago. That just missed analyst expectations for sales of $139.6 million.

Net income soared to $15.2 million, or 26 cents per share, compared to $7.3 million, or 13 cents per share, a year ago. That topped the consensus by 1 cent.

Adjusted EBITDA more than doubled from $11.8 million a year ago to $26.9 million.

Gross margins improved 1,440 basis points to 40.7%, up from 26.3% a year ago. On a sequential basis, gross margins rose 410 basis points.

Looking at segments, Americas Vita Coco Coconut Water saw revenue jump nearly 9% to $89.7 million. Volumes rose nearly 7%. Americas Private Label revenue, meanwhile, climbed 14% to $28.3 million, with volumes up 36%.

On the international side, Vita Coco Coconut Water sales jumped 7% to $11.4 million, despite volumes down -5%. Private label sales soared nearly 160% to $6.0 million. Volumes climbed 47%.

The company ended the quarter with $94.9 million in cash and de minimus debt.

The company noted that according to Circana that it had a 5% market share in the coconut water category. It noted the category grew 19% in the U.S., while its U.S. retail dollar sales were up 23%, showing that it is still taking market share.

This was a very solid quarter from COCO, with solid sales and volume growth across categories and markets. The market for coconut water continues to be strong, and COCO continues to take share within that market. International private sales have been particularly robust, boosted by new distribution with strategic retailers in Western Europe.

Meanwhile, gross margin recovery continues to be a highlight, as the company benefits from freight costs coming down. Ocean freight rates are now back to more normal pre-Covid levels and gross margins for 2024 should be similar to 2023 levels.

Outlook

Looking ahead, the company guided for full-year revenue to grow 13-15%. That’s up from an earlier outlook of 10-12% sales growth and original guidance of 9-11% growth. Vita Coco Coconut Water sales are projected to rise in the mid-teens. It also now expects to maintain most of the private label business from the customer it thought it lost, and to see expanded private label distribution from new and existing customers.

It is looking for gross margins to be between 35-37%, which is unchanged from its prior outlook. It originally forecast full-year gross margins of 32-34%.

Adjusted EBITDA is projected to come in at between $64-67 million. That’s up from earlier guidance of $56-60 million, and original guidance of $52-58 million.

Discussing the sudden change in outlook of its private label business on its Q3 earnings call, Co-founder and Executive Chairman Michael Kirban said:

“I’d like to provide an update on our private label business. As we indicated during our second quarter earnings call, we had expected to cease to supply a major customer on private label coconut water and private label coconut oil, with the transition potentially happening as early as the fourth quarter of 2023. We also indicated that this customer is important for our branded products, and we expressed our commitment to support a smooth transition. Since our last update, this customer has requested that we continue our partnership, and we now expect to continue supplying a significant portion of their private label coconut water needs, a decision that we believe is reflective of their valuing our supply chain for its outstanding reliability and quality. This is a significant change to our prior expectations for the private label business with this key customer, and we are excited to continue this partnership and explore ways to further expand it over time. As further evidence that our private label supply chain is one of the best in the world, all of our private label revenue growth in the third quarter versus the same period last year came from accounts outside of this major customer, including the benefits of new retailer relationships around the globe.”

The return of its big private label customer, which is presumably Costco (COST), is a huge win for the firm. The customer initially balked at price increases, but apparently couldn’t find a supplier with the scale of COCO to replace them with going forward.

It’s not often that a company wins a battle with the likes of a retail giant like COST, but COCO held firm and was willing to walk away from the business, which in the end allowed it to keep most of the business on its terms. This was an unexpected and impressive win.

Valuation

COCO trades around 22.6x the 2023 consensus EBITDA of $67.2 million and 20x the 2024 consensus of $76.0 million.

It trades at a forward PE of nearly 40x the 2023 consensus of 80 cents. Based on 2024 analyst estimates of 91 cents, it trades at 23.5x.

COCO is projected to growth its revenue between 14% this year, and then see it increase nearly 4% in 2024 before accelerating to 11.5% in 2025.

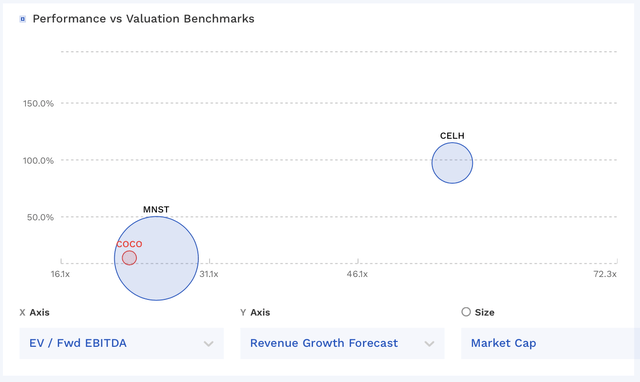

It’s difficult to find a good comparison for COCO. Monster Beverage (MNST) has a slightly higher revenue growth rate and trades at a slightly higher multiple, while Celsius (CELH) is currently much faster and trades at a big multiple.

COCO Valuation Vs Peers (FinBox)

Conclusion

The reason I lowered by rating on COCO earlier was due to the loss of its major private label customer. However, with that no longer being the case and the stock trading around the same price, I’m going to upgrade the stock back to “Buy.”

The fact that the company was able to have a major retailer come crawling back to it to supply the bulk of its private label coconut water offering on COCO’s terms is very bullish in my opinion. This just shows that COCO is the by far the most important player in this space and that the barriers to entry at scale even for private label are pretty high. Moving forward, COCO should continue to grow with the overall coconut water market, as well as with newer product innovations and increased distribution. Expectations for 2024 also don’t look that difficult given how the overall market has been growing, and I’d expect a similar beat and raise cadence next year for the company, similar to this year.

The biggest risks for the stock would be any overall slowdown in the market, perhaps due to a weaker consumer, as well as if ocean freight rates went up again.

Read the full article here