Thesis

Betsson, a major player in the online gambling industry, operates as a holding company with subsidiaries managing diverse online casinos and a sportsbook. With a strong presence in Europe, it boasts brands like Betsson, Betsafe, Nordicbet, and Casinoeuro.

The company has navigated challenges, such as adapting to the Dutch Gambling Authority’s policies and strategically shifting focus to Latin America. Led by CEO Pontus Lindwall, Betsson has maintained resilience, avoiding the cutthroat US market and concentrating on the promising Latin American region.

The company’s growth, geographic diversification, and commitment to compliance position it as a compelling long-term investment, despite regulatory and competitive risks.

Betsson’s consistent 10-year Compound Annual Growth Rate reflects a 9% annual growth, coupled with robust 7% owner earnings and the potential for a 20% increase in multiples, positioning it as an appealing long-term investment.

The Company

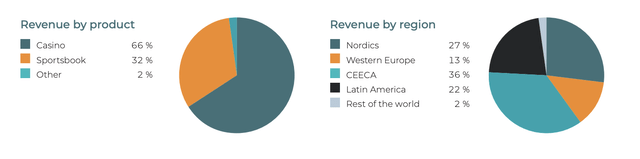

Betsson stands as a holding company specializing in investments and the management of businesses within the online gambling industry. Distinguished as one of the largest online gambling enterprises in Europe, its subsidiaries oversee a diverse portfolio. This includes the operation of online casinos, constituting approximately two-thirds of the group’s revenue, and a sportsbook, contributing to the remaining third. Customer outreach is achieved through a variety of brands such as Betsson, Betsafe, Nordicbet, and Casinoeuro. These brands deliver their services primarily through proprietary platforms, which efficiently handle payments, customer information, accounts, transactions, and the extensive range of games on offer.

Betsson Brands (Betsson Annual Report 2022)

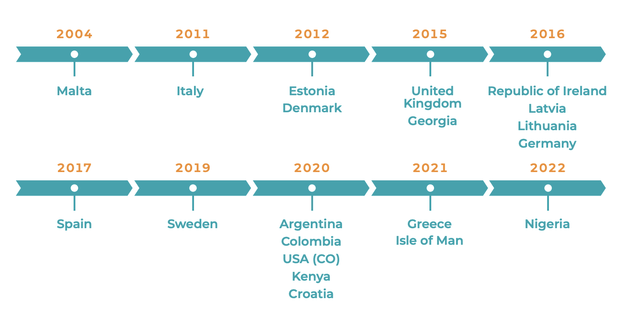

The Group possesses gaming licenses in 20 countries across Europe, Africa, North America, and South America.

Gaming License (Annual Report 2022)

In terms of geography, Betsson is publicly traded on Nasdaq Stockholm in Sweden. While their operational headquarters is based in Malta, their operational footprint spans various regions. Roughly 40% of their activities are in Western Europe and the Nordics, 35% in Central and Eastern Europe as well as Asia, and the remaining 25% in Latin America. Betsson emphasizes its commitment to maintaining a “global scope with a local focus.”

Revenue Split 2022 (Company’s Annual Report 2022)

Betsson offers a diverse array of gambling activities, providing entertainment to customers through a broad product portfolio. Typically, around two-thirds of its customers are male and fall within the younger age bracket of 18 to 45.

The Netherlands Incident

In response to the Dutch Gambling Authority’s new enforcement policy in 2019, Betsson’s operational subsidiaries discontinued the acceptance of Dutch customers on their international websites. This strategic move, aligning with regulatory goals and positioning for the Dutch licensing process, marked a notable shift despite the ongoing cooling-off period. Betsson reaffirmed its dedication to compliance with laws and ethical standards while expressing confidence in the Dutch market. Turning adversity into opportunity, the company redirected its focus to Latin America. What was once a marginal presence in the region swiftly became a significant success story—Latin America contributed almost a quarter of Betsson’s revenue and served as the primary driver of its growth.

Management

Pontus Lindwall, Betsson’s CEO since 2017, has been a pivotal figure within the company since 1991, holding various positions, including Chairman of the board for several years. In a brief episode in 2021, the board temporarily ousted Pontus as CEO, but the decision was promptly reversed. Speculation suggests that the disagreement centered on whether to venture into the fiercely competitive US market, aligning with many competitors, or to persist in prioritizing Latin America.

Pontus’ foresight in choosing to prioritize Latin America now appears astute, especially in light of the cutthroat competition in the US that has adversely affected returns for other companies. A case in point is Betsson’s peer, Kindred, which has encountered challenges establishing itself in the US market. Pontus’ decision to steer clear of this competitive landscape seems both contrarian and courageous, safeguarding significant shareholder value. While Betsson is allocating modest funds for a US expansion today, the primary focus remains on the promising Latin American market.

As for Betsson’s leadership team, the CFO joined the company in 2019, and the Chairman assumed the role in 2018.

Financials

Betsson consistently generates substantial cash flow for its stakeholders, primarily distributed through dividends. Additionally, the company strategically accumulates cash reserves, deploying them for targeted acquisitions that contribute to further growth. A notable illustration of this strategy unfolded in June when Betsson acquired the Belgian company betFIRST for €120m, utilizing a significant portion of its available cash at that time.

In essence, Betsson has the potential to annually return nearly 7% of its current market capitalization to owners without adversely affecting its growth trajectory. This nuanced balance between delivering value to shareholders and strategically investing in acquisitions underscores Betsson’s dedication to optimizing its financial resources for sustained success.

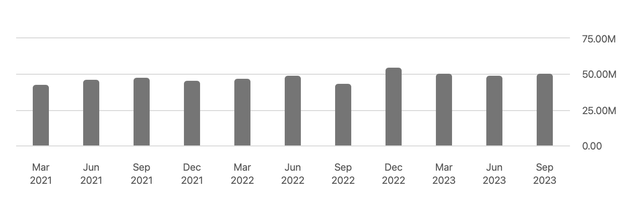

Costs of Sales

Betsson faces three notable expenses: costs of services provided, covering licensing fees and gambling taxes, marketing expenditures, and personnel costs. The company’s financial performance shows a consistent stability in margins since 2019.

Cost of Sales – Betsson (SeekingAlpha.com)

Growth

The company has a well-defined strategy for both organic growth and expansion through acquisitions, a commitment they actively uphold. Over the past decade, they have achieved an impressive 10% revenue Compound Annual Growth Rate.

According to Mordor Intelligence, online casinos are anticipated to experience approximately 11% annual growth from 2023 to 2028, with sports betting following a similar trajectory. However, in mature and regulated markets like Western Europe, growth is expected to be notably lower. Consequently, expansion in these regions is likely to heavily depend on strategic acquisitions.

The existing growth primarily originates from Latin America and CEECA (Central and Eastern Europe and Central Asia). Notably, a substantial portion of Betsson’s recent growth, now constituting a significant share of the company’s revenue and earnings, comes from Turkey. While they haven’t explicitly disclosed the market’s size, Betsson actively aims to mitigate their reliance on Turkish operations. They strategically utilize the proceeds from this market to acquire and foster growth in other regions.

Creating moats within the industry and safeguarding revenues and margins primarily revolves around brands, both local and international. The industry’s significant M&A activity is driven by the pursuit of acquiring new brands and licenses for expansions into new markets. Brands play a pivotal role in maintaining decent margins within the online gambling industry.

Regulatory and compliance factors serve as additional barriers to entry, collectively safeguarding the industry. In regulated markets, strict adherence to various countries’ regulations is imperative, as non-compliance can result in costly penalties.

Online operators often struggle to differentiate their products due to customer demands and the high cost of vertical integration. This challenge limits Betsson’s ability to significantly distinguish its offerings from competitors like 888.

Quarterly Report

In Q3 2023, Betsson achieved record revenue of EUR 237.6 million, marking the seventh consecutive quarter of sequential growth. Notable highlights include a 27% increase in casino revenue and a 42% growth in EBITDA. Active customers rose by 17% to 1,237,238. The CEO emphasizes strong financial performance, ongoing investments, and successful geographical expansion, including the acquisition of betFIRST in Belgium and entry into Serbia. Additional milestones involve securing a local sports betting license in France and launching the Betsson brand in Denmark. The quarter also saw Betsson’s first global advertising campaign, reinforcing its position as a leading global brand. The CEO expresses confidence in continued investments, leveraging geographical diversification and robust financials for long-term shareholder value.

Competition

The gambling industry stands as a fiercely competitive and fragmented market with major players such as 888, Flutter Entertainment, Bet365, Entain, William Hill, Penn International, DraftKings, and more, alongside numerous small and local alternatives. Despite Betsson being a significant player, its market share remains in the low single digits, reflective of the vast scale of the industry.

Valuation

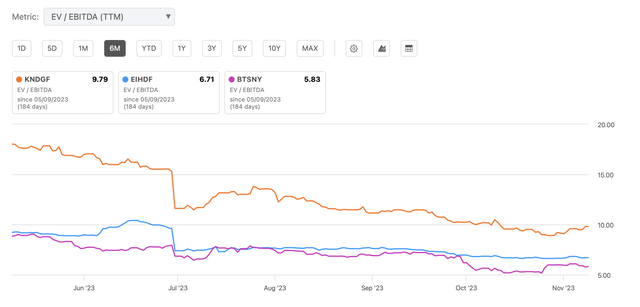

Betsson is presently valued at an EV/EBIT ratio of 5.83. Our assessment primarily focuses on the EV/EBIT, underscoring our attention to the influence of the company’s net debt level. With a current operating margin of 18%, Betsson’s current valuation is at its lowest point compared to historical EV/EBIT levels observed over the past decade.

Betsson Peers Comparison (SeekingAlpha.com)

It is worth highlighting that Betsson’s operating margin experienced a downward trend over the last decade; however, it has stabilized since 2019, and we do not foresee any further decline in the near-term future.

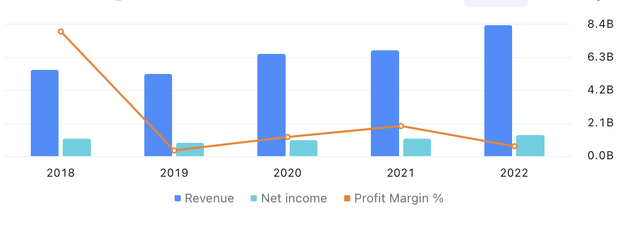

Profit Margin of Betsson (Tradingview.com)

Betsson is currently valued below its peer companies. This may be justifiable, considering Betsson’s higher proportion of casino revenue compared to most peers, a category often perceived as “riskier” than sportsbooks. Additionally, Betsson derives a substantial portion of its income from regions such as Turkey.

Nevertheless, we hold the view that the company merits a slightly higher valuation than EV/EBIT 5.83, considering its operational excellence and lengthy track record. Despite this, we acknowledge that the company may not trade at a higher level, partly due to the influence of the ESG movement, restricting institutions and funds from investing in this industry. While companies typically adhere to their historical trading range, we exercise caution in anticipating significant movements. However, a reasonable expectation could be a 20% increase in multiple expansion.

Risks

Online gambling presents a dual challenge in legal aspects, with some countries aiming to minimize or eliminate gambling due to addiction concerns, while others seek to regulate and control it, capitalizing on the associated tax benefits. In regulated markets, Betsson faces risks related to compliance with regulations, potentially resulting in fines, temporary setbacks, or license loss. The risk of increased tax rates is also present, though Betsson’s geographic diversification mitigates the impact. In unregulated countries, the transition to regulation can disrupt revenues, but larger companies like Betsson gain organizational advantages post-regulation. While gambling is perceived by some as potentially destructive, Betsson’s diversified operations and market resilience offset regulatory risks. Supplier risks are minimal due to competition among providers, and customer risks are mitigated by geographic diversity, although Turkey represents a significant part of revenue and profit, which the company aims to dilute through additional growth. Despite theoretical concerns about gambling’s attractiveness, its historical resilience suggests long-term stability, and the industry remains recession-resistant.

Conclusion

Betsson, as a non-cyclical and expanding enterprise, presents an opportunity for acquisition at a reduced price attributed to ESG concerns and exposure to the Turkish market. While regulatory and competitive risks are notable, the company’s consistent 9% annual growth, coupled with a robust 7% in owner earnings, and the potential for a 20% increase in multiples, positions it favorably as a prospective long-term investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here