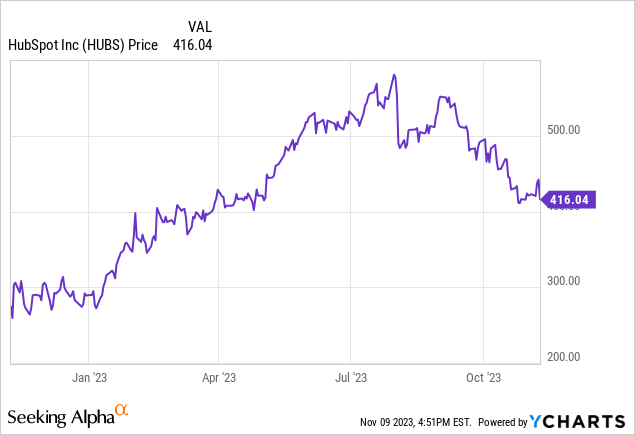

Amid sharp interest rate volatility this earnings season, stocks have seen wide swings in beats and misses this quarter. HubSpot (NYSE:HUBS) is one such example: the SMB-oriented sales software company initially spiked after reporting strong Q3 results that featured a beat and raise to the FY24 outlook, alongside slight revenue acceleration. That initial pop, however, faded as investors considered valuation.

Year to date, HubSpot is still sitting on generous 40%+ gains: though in spite of this, the stock is down more than 25% from mid-summer highs above $550.

I last wrote on HubSpot in September when the stock was trading closer to $500 per share. Since then, the stock has lost more than $2 billion in market value alongside a strong earnings report. In light of this, I’m upgrading my viewpoint on HubSpot from bearish to neutral.

From a fundamental perspective, I have long been a champion of HubSpot. The company has built a strong following in the SMB space, effectively competing against the industry giant in CRM – Salesforce. Here, in my view, are the top bullish elements to consider in this name:

- HubSpot relies on “pull” rather than “push” marketing, which is the essence of both its product and its margins. By de-emphasizing the maintenance of a large direct sales force (which is the de facto standard of most enterprise software companies), HubSpot has been able to achieve substantial margins.

- Rule of 40. More to the point above, HubSpot has long maintained a “Rule of 40” operating approach – wherein the sum of its revenue growth and pro forma operating margins exceeds 40%, a rarity among enterprise software names.

Price, meanwhile, remains the biggest impediment to being fully bullish on HubSpot. At current share prices just above $415, HubSpot trades at a market cap of $20.80 billion. After we net off the $1.75 billion of cash and $455.7 million of convertible debt off HubSpot’s most recent balance sheet, the company’s resulting enterprise value is $19.51 billion.

Meanwhile, for next fiscal year FY24, Wall Street analysts are expecting HubSpot to generate $2.56 billion in revenue, representing 21% y/y growth (data from Yahoo Finance). This puts HubSpot’s valuation at 7.6x EV/FY24 revenue.

Now, this is much more modest than HubSpot’s previous multiples which have consistently hovered around the double-digit mark. I think the company will be able to sustain a 7-8x revenue multiple at least over the next couple of years (given the company’s Rule of 40 dynamic as well as its ability to continue growing at scale), so in terms of a comfortable valuation premium to buy the stock at, I’d wait for HubSpot to drop to a ~6.5x EV/FY24 revenue multiple or a $360 price threshold (~14% downside from current levels) before buying.

The bottom line here: it’s time to add HubSpot to your list of stocks to monitor daily, but it’s not quite time to jump in just yet.

Q3 download

Let’s now go through HubSpot’s latest Q3 results in greater detail. The Q3 earnings summary is shown below:

HubSpot Q3 results (HubSpot Q3 earnings release)

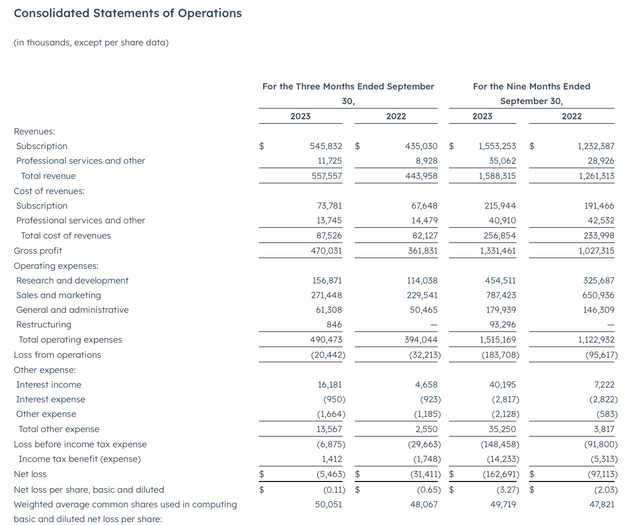

HubSpot’s revenue grew 26% y/y to $557.6 million, beating Wall Street’s expectations of $534.4 million (+20% y/y) by a large six-point margin. Revenue growth also accelerated slightly from 25% y/y growth in Q2 – which is an accomplishment to tout for A) a company of HubSpot’s scale and B) in this difficult macro environment where seat-based products like HubSpot are under special pressure. Especially in light of the fact that many companies (in particular SMBs that are facing more pressure than others) are cutting sales and marketing heads to save on cost, HubSpot’s strength is notable.

The company added over 9k net-new customers in the quarter to end Q3 with 194k total customers, an all-time record for the company. The company notes that its free trial program has been successful at converting prospects in the lower end of the market to paid users, while on the larger side of the spectrum the company has been successful at cross-selling multiple products into the install base and increasing overall wallet share.

Per CEO Yamini Rangan’s remarks on the Q3 earnings call regarding the sales environment:

Let’s shift gears and talk about what we’re seeing in the macro environment. Overall, we continue to operate in a choppy and challenging environment. Sales cycles remain lumpy, budgets are still under scrutiny and buying urgency remains low. It is clear based on my conversations with customers that they still need approvals from multiple decision makers and are continuing to optimize spend. Despite these headwinds, HubSpot’s connected value proposition continues to resonate with customers looking to optimize spend and boost productivity. As we look ahead, we will continue to navigate this macro environment by following our playbook to drive product innovation and consistent strong execution.”

The company’s CFO went on to mention that while net upgrades and seat expansion have become more difficult in this climate, the company expects to maintain net revenue retention rates above 100% – indicating that upsells will continue to outpace churn. Another note for growth: the company also spent a relatively minor $150 million this quarter to acquire a B2B marketing intelligence software company called ClearBit. This is more of a tuck-in technology acquisition, however, and unlikely to contribute meaningfully to financial results in the near term.

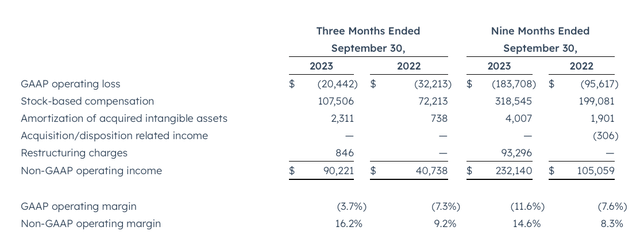

From a profitability perspective, HubSpot continued its upward march in margin – expanding pro forma operating margins by 700bps y/y to 16.2%, as shown in the chart below, while nominal pro forma operating income dollars more than doubled to $90.2 million.

HubSpot operating margins (HubSpot Q3 earnings release)

Management is targeting an 18-20% margin by FY26, while its long-term operating model calls for a 20-25% margin.

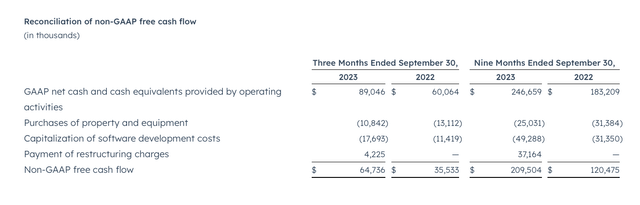

As shown in the chart below, HubSpot has also achieved generous FCF growth this year, with YTD FCF of $209.5 million representing a 13.1% margin (similar to YTD pro forma operating margins) and growing 74% y/y.

HubSpot FCF (HubSpot Q3 earnings release)

Key takeaways

With HubSpot’s sudden swing downward after a strong earnings quarter, it’s a good time to put the stock back onto your watch list. In the long haul, the company’s sales-light growth model and its high margin profile distinguish it among software peers but be mindful of valuations before you dive in.

Read the full article here