A few months ago, I wrote a review of the iShares iBonds 2025 Term High Yield and Income ETF (IBHE), a fixed term bond fund from iShares that help investors build their own bond ladders. I liked the fixed term nature of the IBHE ETF and its roughly 2 year duration, but I did not feel that credit spreads were attractive at the time of the article.

As the calendar is about to flip to 2024, I believe investors should set their sights on the iShares iBonds 2026 Term High Yield and Income ETF (BATS:IBHF) instead of the IBHE, which maintains the roughly 2-year duration that I prefer.

Mechanically, the IBHF is very similar to the IBHE. The only major difference is the maturity of the bonds being held mature in 2026 instead of 2025. IBHF is currently being priced to deliver 6-7% forward returns, assuming the credit rating agencies are correct about elevated defaults. This does not look particularly attractive relative to credit risk-free treasuries. I would wait for a better entry point.

Fund Overview

The iShares iBonds 2026 Term High Yield and Income ETF is a fixed term bond fund from iShares that track the investment results of an index composed of high yield and other income generating corporate bonds that mature in 2026.

The iBond family of ETFs are designed to mature like a bond with a set maturity date, but trade like an ETF. iBonds combine the defined maturity and regular income features of a bond with the price transparency of an ETF, allowing investors to build a diversified bond ladder while managing interest rate risk that suit their individual risk appetites.

As I have covered the mechanics of the iBond products in my prior article, I will only briefly mention that the IBHF ETF will mature on or about December 15, 2026, at which time it will distribute its remaining assets to unitholders according to a plan of liquidation. IBHF tracks an index that consists of high yield bonds and BBB-rated bonds that mature between January 1, 2026 to December 15, 2026 ‘maturity window’.

The IBHF ETF has $152 million in assets and charges a 0.35% expense ratio.

Portfolio Holdings

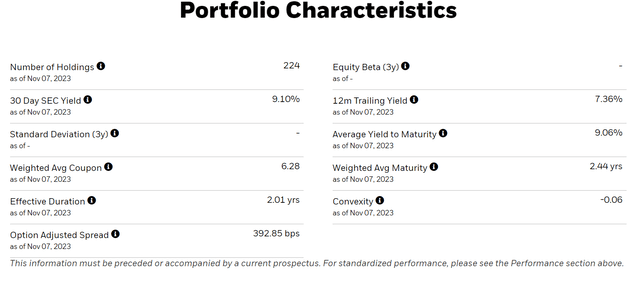

The IBHF ETF’s portfolio contains 224 bonds with an effective duration of 2.0 years and an average time to maturity of 2.4 years (Figure 1). The portfolio has an average yield to maturity of 9.1% and a 30-Day SEC Yield of 9.1%.

Figure 1 – IBHF overview (ishares.com)

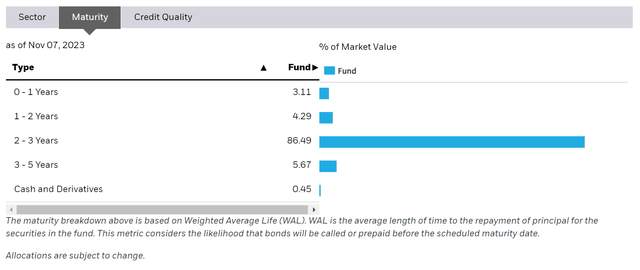

As designed, IBHF’s portfolio predominantly hold bonds that mature in 2 to 3 years (i.e. 2026), within the maturity window mentioned above (Figure 2).

Figure 2 – IBHF maturity allocation (ishares.com)

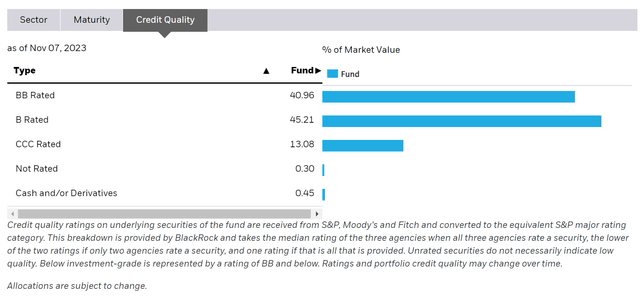

IBHF’s portfolio is mostly BB- (41.0%) and B-rated (45.2%), with a small allocation to CCC-rated (13.1%) bonds (Figure 3).

Figure 3 – IBHF credit quality allocation (ishares.com)

Distribution & Yield

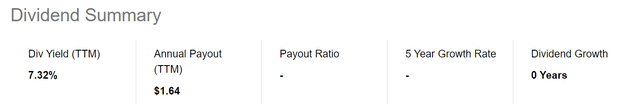

The IBHF ETF pays an attractive trailing distribution yield of 7.3% (Figure 4). This is well supported by the fund’s portfolio yield to maturity of 9.1%.

Figure 4 – IBHF pays a 7.3% distribution (Seeking Alpha)

Returns

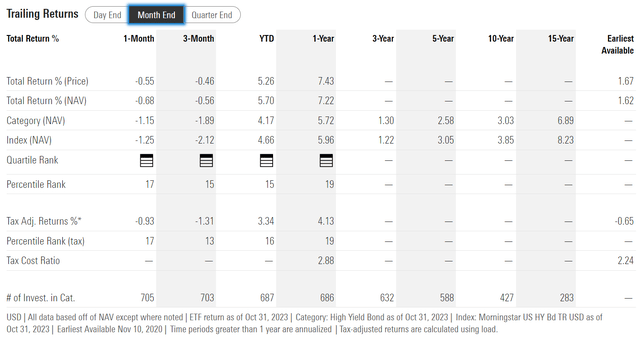

Historically, the IBHF ETF has earned a solid 1 year total return of 7.2% to October 31, 2023 (Figure 5). However, since inception returns have been much more modest at 1.6% per year, as 2022 was a bad year for IBHF, mostly due to duration losses as interest rates rose significantly.

Figure 5 – IBHF historical returns (morningstar.com)

Looking forward, if IBHF’s portfolio does not suffer any defaults, it will earn the portfolio’s 9.1% yield to maturity for the next 2.25 years or approximately 21% in total returns.

Credit Losses Are Inevitable

However, with a portfolio of non-investment grade credits, defaults are inevitable. The question is whether the portfolio’s yield will make up for the losses.

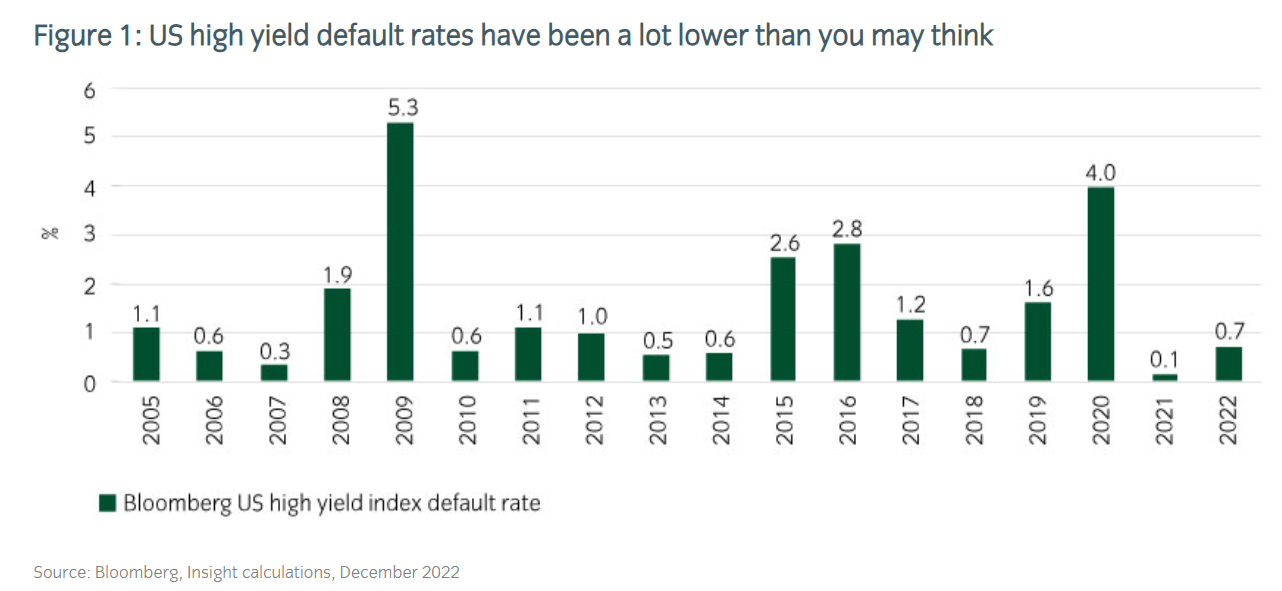

According to data from Insight Investment, U.S. high yield default rates in the past 15 years have averaged ~1.5%, with peak defaults of 5.3% and 4.0% occurring in 2009 and 2020 due to the Great Financial Crisis (“GFC”) and the Covid-pandemic respectively (Figure 6).

Figure 6 – Historical U.S. high yield default rates (Insight Investments)

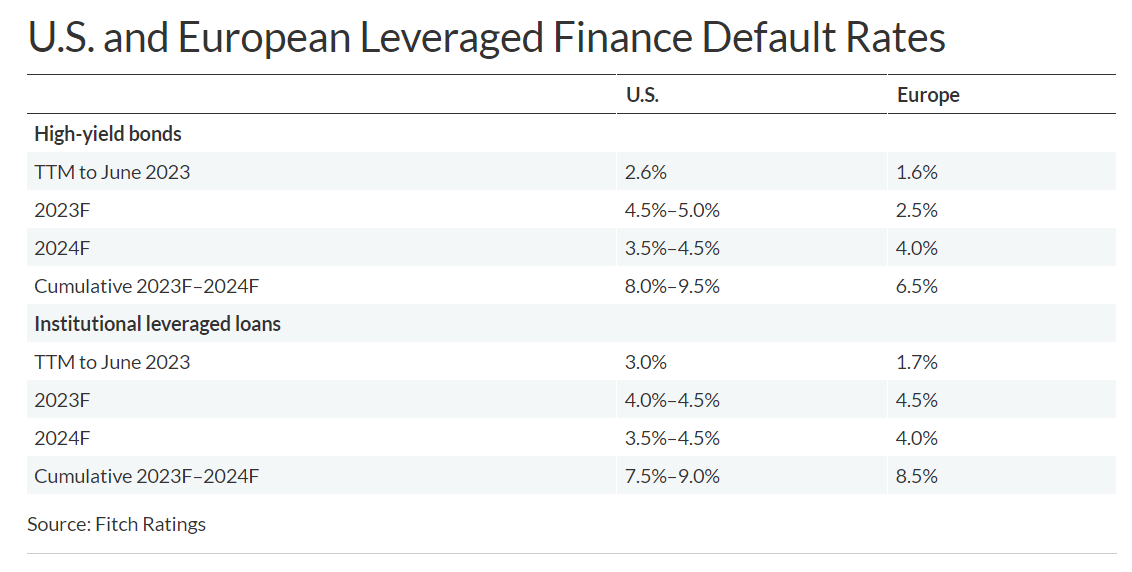

However, currently, credit rating agencies like Fitch are expecting high yield default rates to be elevated compared to history due to higher interest rates pressuring businesses, with default rates of 4.5-5.0% expected for 2023 and 3.5-4.5% expected for 2024 (Figure 7).

Figure 7 – Fitch expects elevated credit defaults (Fitch)

Assuming the credit agencies are correct and default rates are ~4.5% per year for the next 2 years, then IBHF investors may be looking at an annual 2.25 – 3.15% drag from defaults (assuming 30-50% recoveries upon default) for the next 2 years. Therefore, instead of the 9.1% yield to maturity, forward returns could be closer to 6-7%.

Compared to risk-free treasuries yielding ~5%, this forward return does not look particularly attractive.

Credit Spreads Currently Not Attractive

Another way to think about the attractiveness of the IBHF ETF is to consider current high yield credit spreads relative to history. High yield credit spreads are currently trading around 4.0%, which is below the 10-year average of 4.4% (Figure 8).

Figure 8 – High yield credit spreads are tighter than average (St. Louis Fed)

Simply put, elevated credit defaults expected by the rating agencies does not square with credit spreads.

Why Choose 2 Year Duration?

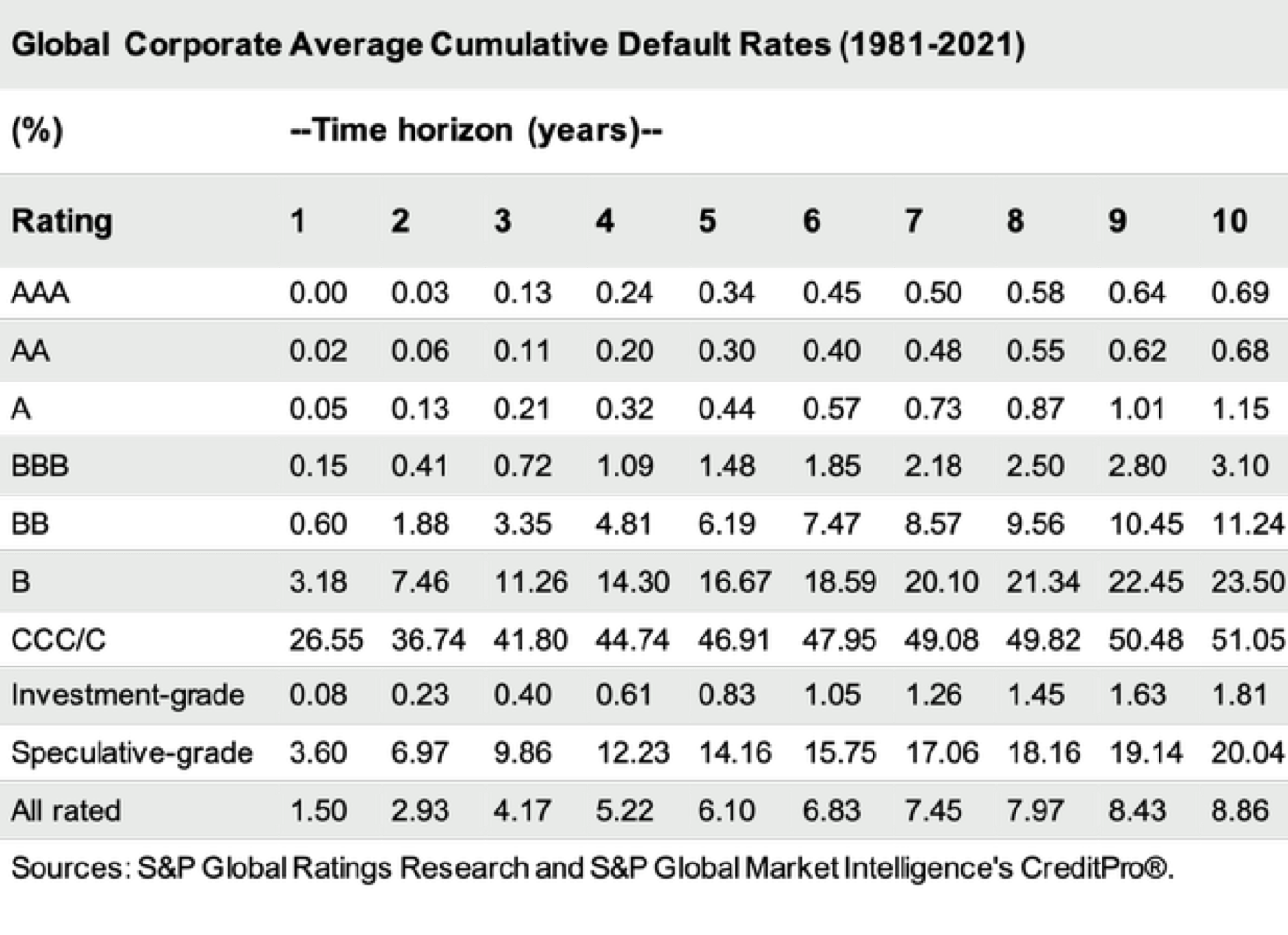

One question I get asked is what is so special about a 2 year time-horizon? To answer this question, we need to consider cumulative default probabilities of high yield credits. According to historical data from S&P Global, investment grade credits have very good cumulative default rates, even up to 5 and 10 years.

However, when it comes to high yield credits, cumulative defaults start to pile up beyond a few years, with BB-rated credits having 2-year cumulative default rate of 1.9% while B-rated credits have a 7.5% 2-year cumulative default rate (Figure 9). CCC-rated credits are even worse, with a 2-year cumulative default rate of 36.7%.

Figure 9 – Cumulative default rates by starting rating (S&P Global)

So my choice of a 2-3 year time-horizon is to avoid holding high yield credits for too long, as over 10% of B-rated, and over 40% of CCC-rated credits historical default after 3 years.

Conclusion

Similar to my conclusion for the IBHE ETF a few months ago, the forward return of owning high yield credits for the next 2 to 3 years using the IBHF ETF is not particularly attractive at the moment compared to credit risk-free treasury bonds.

I continue to recommend investors be patient and wait for a better entry when high yield credit spreads widen, increasing the margin of safety of owning credit instruments like the IBHF ETF.

Read the full article here