One common misconception about investing is that the companies that you buy into must achieve continual growth in order to be attractive. Any sort of decline in revenue or profits makes an investment unwise. Personally, I never ascribed to this view. While I do prefer companies that achieve consistent growth from year to year, with no end to that growth in sight, companies that are trading at very low multiples and that have robust balance sheets can still make for appealing opportunities even when revenue and profits are on the decline. This doesn’t mean that they won’t experience volatility. It’s possible they will see more volatility than most companies. But if purchased at a low enough price, they should achieve nice upside potential in the long run.

A solid furniture play

While the introducing paragraph of this article does not reference any particular company, it could reference a number of them. One particular enterprise that does come to mind is Haverty Furniture Companies (NYSE:HVT) (NYSE:HVT.A), a specialty retailer that focuses on residential furniture and accessories. Back in the middle of July of this year, I wrote a bullish article about the firm, remarking how it was great to see marginal outperformance of shares relative to the broader market even as its top and bottom lines were weakening year over year. Even then, I acknowledged that the furniture industry was seeing some weakness. But this didn’t stop me from rating the company a ‘buy’ because of how cheap shares were and how strong the company’s balance sheet was.

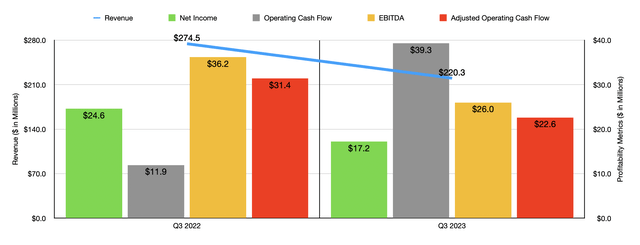

Author – SEC EDGAR Data

Since then, things have not gone exactly as planned. While the S&P 500 is down 3.2%, shares of Haverty Furniture have seen downside of 9%. This sizable disparity can really be chalked up to the lackluster fundamental performance offered up by management. Consider revenue. During the third quarter of the company’s 2023 fiscal year, sales came in at $220.3 million. That’s 19.7% lower than the $274.5 million reported one year earlier. According to management, issues such as inflation, volatility in the stock market, and rising interest rates, all have had a negative impact on discretionary spending that has resulted in lower revenue for the furniture space. Management stated that written business for the third quarter was down 11.5% year over year while written comparable store sales were down 12.6%.

In such a low margin industry, it shouldn’t be surprising that a decline in revenue would result in a rather meaningful drop in profits. And that is exactly what we saw. During the third quarter of this year, revenue came in at $17.2 million. That’s down from the $24.6 million reported one year earlier. It is true that operating cash flow more than tripled from $11.9 million to $39.3 million. But if we adjust for changes in working capital, we get a decline from $31.4 million to $22.6 million. And finally, EBITDA for the furniture chain fell from $36.2 million to $26 million.

When looking at the data for the first nine months as a whole, we see an identical path when it comes to revenue, profits, and cash flows. What is really interesting is that the average ticket size of an order for the company actually increased during this window of time. For the first nine months of this year, the average ticket was $3,284. That’s up slightly from the $3,213 reported for the same time last year. But the sales per square foot for the business plunged 14.8% from $236 to $201. So what we see here is that, while consumers are spending more at its stores on a per capita basis, fewer are going to those very stores and that has been the driver behind the drop in sales.

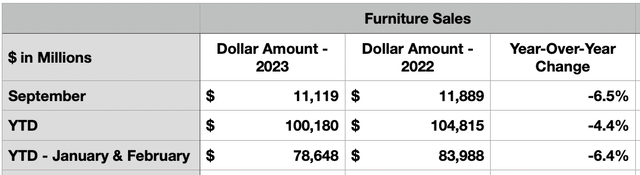

Author – Federal Reserve Bank

As I mentioned earlier, management attributed the weaknesses that the company is experiencing to broader economic conditions. I am always a little skeptical when I hear this because I have seen too many instances in which company specific issues are the cause of pain and not economic conditions. But in this case, management seems to be right. In September of this year, for instance, the furniture market generated revenue of $11.12 billion. That was down 6.5% from the $11.89 billion reported one year earlier. For the first nine months of this year, sales of $100.18 billion came in 4.4% lower than what was seen during the same time of 2022. But if we exclude January and February from this list, we get a more significant decline of 6.4%.

Naturally, investors should expect this trend to continue for as long as the economic environment is less than ideal. But the good news is that if any company can survive this, that company would be Haverty Furniture. As of the end of the most recent quarter, the business had nothing in the way of debt. And it boasted cash and cash equivalents of $141.4 million. This should result in a great deal of stability even if times get really difficult.

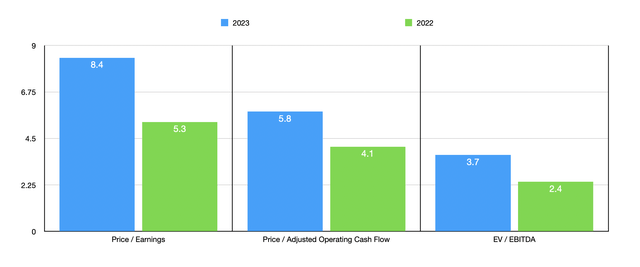

Author – SEC EDGAR Data

In terms of what the future holds, if we annualize results seen so far for this year, we would get net income of $56.3 million, adjusted operating cash flow of $82.2 million, and EBITDA totaling $87.6 million. Using these results, I was able to create the chart above, which shows how shares are priced relative to the data from the 2022 fiscal year. Even though the stock looks more expensive on a forward basis, placing it in the single digits is still quite attractive, especially when we are talking about the cash flow figures. As part of my analysis, I also compared the firm to five similar companies as shown in the table below.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Haverty Furniture | 8.4 | 5.8 | 3.7 |

| The Aaron’s Company (AAN) | 24.8 | 1.2 | 0.6 |

| Hooker Furnishings (HOFT) | 25.3 | 2.6 | 240.1 |

| Sleep Number (SNBR) | 31.3 | 14.0 | 6.9 |

| Kirkland’s (KIRK) | N/A | 2.4 | N/A |

| Arhaus (ARHS) | 8.6 | 8.2 | 3.9 |

On a price to earnings basis, it ended up being the cheapest of the group. Using the EV to EBITDA approach, only one of the five companies was cheaper than it. But it’s important to note that one of the five did not even have a positive reading for me to compare the firm to. And finally, using the price to operating cash flow approach, I found that three of the five companies ended up being cheaper than our target. To be fair, some of these metrics are very volatile. But that’s to be expected in an industry with such low margins, high levels of competitiveness, and weakening results.

Takeaway

Operationally speaking, Haverty Furniture might not be doing the best at the moment. Revenue, profits, and cash flows have all dropped because of industry weakness. But shares are trading at very low multiples on an absolute basis and are trading a bit lower than many similar firms. Add on top of this the surplus of cash the business has on its books, and I would argue that it makes for a solid ‘buy’ even with the problems it’s dealing with.

Read the full article here