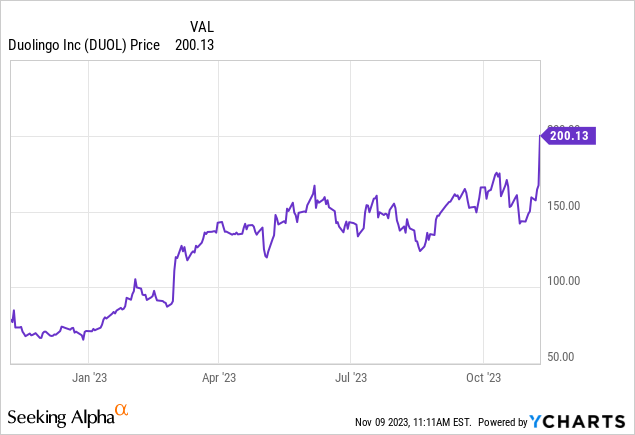

Especially with interest rate fears quelling, 2023 has turned out to be quite a boon year for tech stocks – and few more so than Duolingo (NASDAQ:DUOL), the popular language-learning app that has taken Rosetta Stone by storm. The app-based, gamified learning platform has seen its share price nearly triple so far this year, and the company’s recent Q3 earnings print did nothing to dent the recent momentum.

But with Duolingo stock now hovering around $200, investors have to be mindful: does valuation leave any room for upside here?

Bulls are excited about Duolingo’s multi-course future, but I’m worried about price

I last wrote a bearish opinion on Duolingo in August when the stock was trading closer to $140. And while I admit that my bearish call was premature, at current share prices, it becomes nearly impossible to champion a bull case in this company when you factor in the company’s valuation amid 5%+ risk free interest rates. I remain bearish on Duolingo (with the caveat that I am absolutely a fan of its product, as a Super Duolingo subscriber for the past several years – just not an adherent of its stock!)

Investors have largely rallied behind Duolingo after the company’s major product releases at its annual convention, Duocon. Among the most significant updates that the company announced was a new music learning course to add to Duolingo’s existing stable of language and math courses.

Duolingo Music (Duolingo blog)

Duolingo bulls took this addition to extrapolate into Duolingo’s future: one where the company expands to a wide variety of different subjects that can be monetized in more expensive subscription bundles. But while this extrapolation is tempting, we do have to consider the limitations of Duolingo’s music-teaching abilities for the present moment: while Duolingo can certainly teach rhythm and the ability to read music, Duolingo can’t exactly replace a hands-on music teacher who guides a student in playing a real musical instrument.

I can’t argue, of course, with the fact that Duolingo has seen plenty of strength in its bookings, which becomes all the more compelling when the company consolidates all of its learning courses into a single app. But to what extent is this strength already priced into Duolingo’s stock?

At current share prices near $200, Duolingo trades at a market cap of $8.21 billion. After we net off the $701.7 million of cash on Duolingo’s most recent balance sheet, meanwhile, the company’s resulting enterprise value is $7.51 billion.

Meanwhile, for next year FY24, Wall Street analysts have pegged Duolingo’s revenue at $659.4 million, representing 28% y/y growth. And if we assume a ~17% adjusted EBITDA margin on that revenue figure (roughly in line with this year’s guidance outlook margin), the company would generate ~$112 million of adjusted EBITDA on that revenue. This puts Duolingo’s valuation multiples at:

- 11.4x EV/FY24 revenue

- 67x EV/FY24 adjusted EBITDA

Needless to say, it’s incredibly difficult to justify these valuation levels in a high interest-rate environment. Though I’m impressed by both the expansion of Duolingo’s product portfolio plus the strength of its results in a difficult macro environment, I remain bearish on this name and think there will be plenty of downside when the market wakes up to realize how expensive Duolingo is trading.

Q3 download

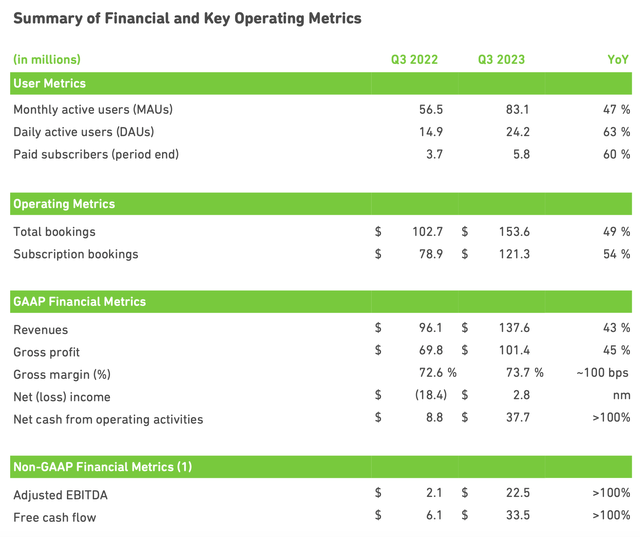

Let’s now go through Duolingo’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Duolingo Q3 highlights (Duolingo Q3 shareholder letter)

Duolingo’s revenue grew 43% y/y to $137.6 million, beating Wall Street’s expectations of $132.7 million (+38% y/y) by a five-point margin. Revenue growth kept the same pace as Q2’s 43% y/y growth pace – however, total bookings of $153.6 million outpaced revenue on both nominal terms as well as in y/y growth of 49%, which accelerated substantially over Q2’s 41% y/y bookings growth pace.

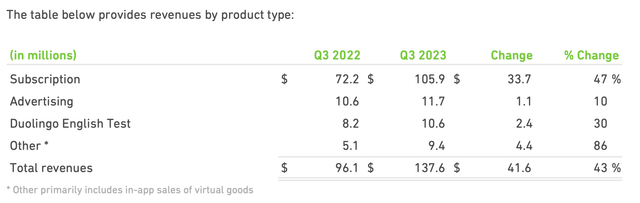

As can be seen in the table below, subscription revenue growth continues to be a major factor in Duolingo’s overall growth, up 47% y/y. The Duolingo English Test also saw 30% y/y, benefited in part by price increases.

Duolingo revenue disaggregation (Duolingo Q3 shareholder letter)

DAUs increased 63% y/y to 24.2 million, while MAUs grew 47% y/y to 83.1 million – the rapid growth pace of DAUs also demonstrates incredibly strong user engagement with the Duolingo app, which in turn drives high subscription retention and in-app purchases.

The company notes that selective marketing, especially with pop culture partners, has helped to drive new users to the app. Per CEO Luis Von Ahn’s remarks on the Q3 earnings call:

In Q3 of 2021, we had 2.2 million subscribers. In this past quarter, we had nearly 6 million. The way we have done this has been through our process of making small changes, running a test to see how users react and then doubling down where we see gains. We’ve also hit some exceptional home runs. For example, our marketing has been a source of extraordinary wins that were fantastic for the business even though they are hard to predict. Think of our partnership with HBO’s House of the Dragon and most recently our Barbie social campaign built around the inclusion of our trademark Bing in the Barbie movie. The campaign generated 140 million organic social impressions which is a record for us.”

Duolingo also achieved notable economies of scale alongside its +40% revenue growth, with pro forma expenses as a percentage of revenue falling 12 points y/y to 57% – note that in spite of high-profile marketing tactics and a big Duocon this year, sales and marketing as a percentage of revenue fell 2 points y/y, while the lion’s share of the quarter’s operating leverage came in a 7-point reduction of R&D costs as a percentage of revenue.

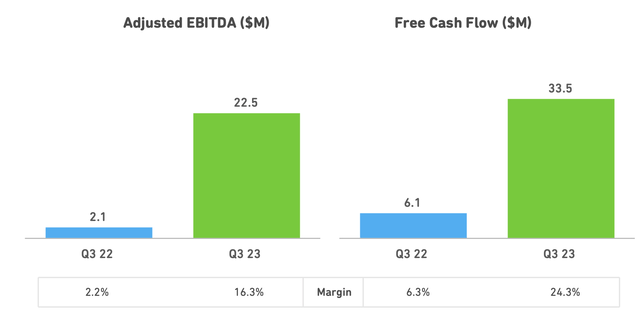

As a result, as shown in the chart below, adjusted EBITDA jumped to $22.5 million, representing a 16.3% adjusted EBITDA margin – fourteen points better than the year-ago quarter.

Duolingo adjusted EBITDA (Duolingo Q3 shareholder letter)

Key takeaways

While there’s virtually no doubt that Duolingo is experiencing strong product momentum and fantastic user results, I think all these strengths are already more than generously priced into Duolingo’s stock. Steer clear here and invest elsewhere.

Read the full article here