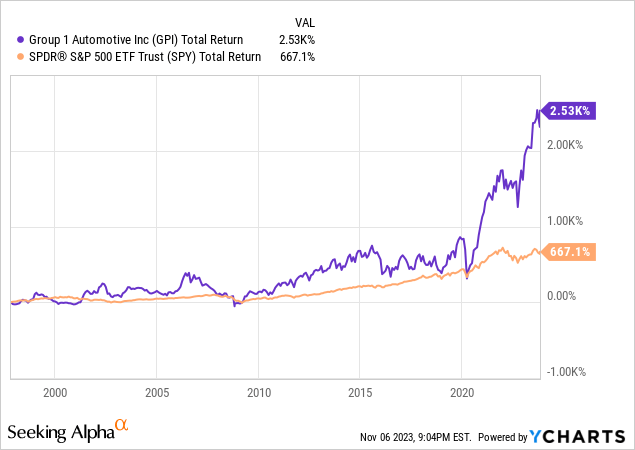

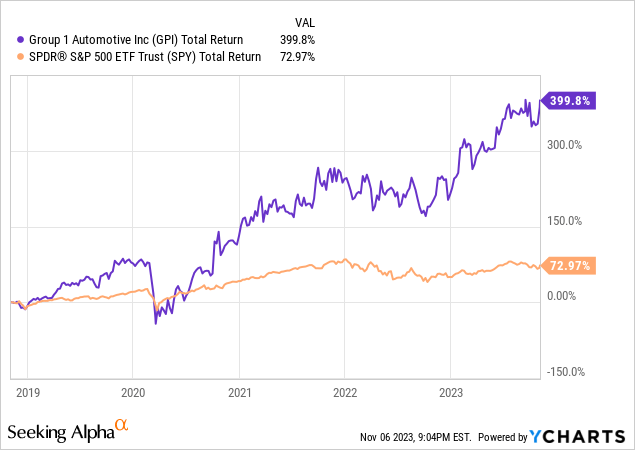

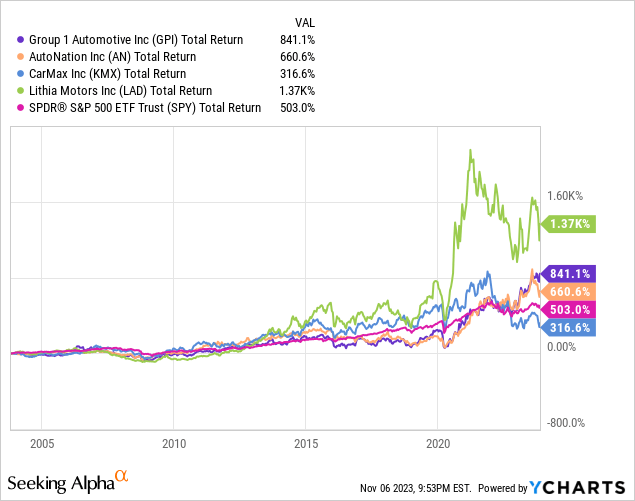

Shares of Group 1 Automotive, Inc. (NYSE:GPI) have proved an excellent investment historically. Since becoming a public company in 1997, GPI shares have delivered a total return of 2530% compared to a total return of 667% delivered by the S&P 500.

In addition to having a strong long-term historical performance record, GPI has also done well over more recent time periods. GPI has delivered a total return of 400% over the past 10 years compared to a total return of 73% delivered by the S&P 500.

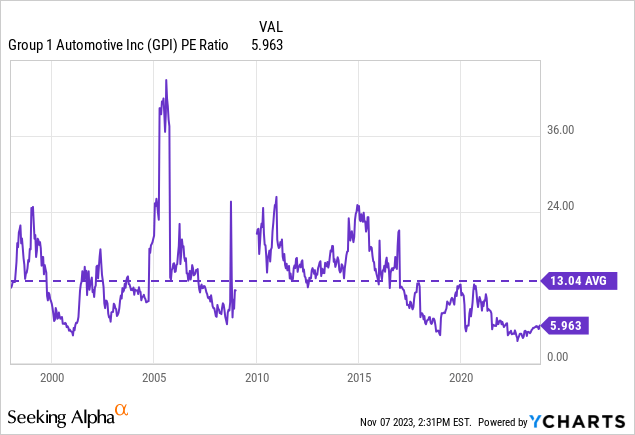

Despite this strong track record, GPI trades at a valuation of just 6x trailing earnings. I believe GPI is poised to continue outperforming the S&P 500.

Business Overview

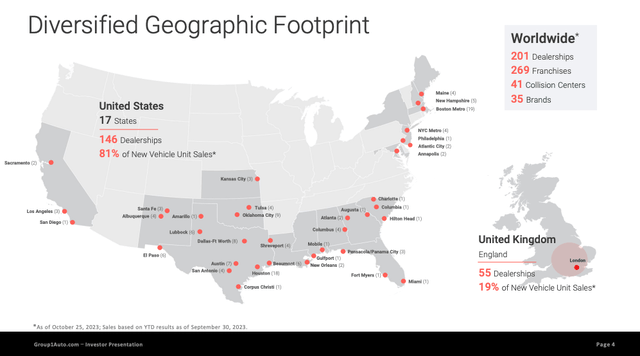

GPI is a leading international automobile retailer. The company sells new and used cars and trucks, arranges vehicle financing, sells service and insurance contracts, provides maintenance and repair services, and sells vehicle parts.

GPI has 201 dealerships worldwide including 146 in the U.S. and 55 in the U.K.

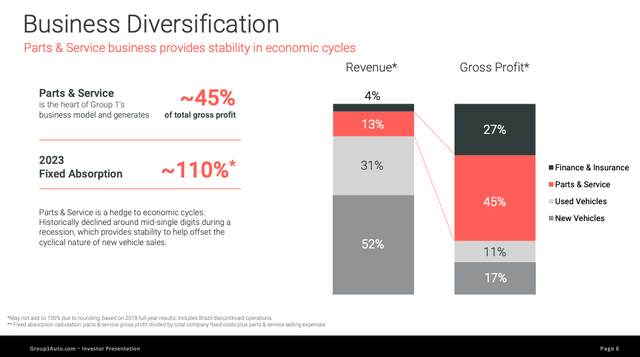

While new vehicle sales account for 52% of revenue, the profit drivers for the company are its parts and service and finance and insurance businesses which account for 45% and 27% of gross profit respectively.

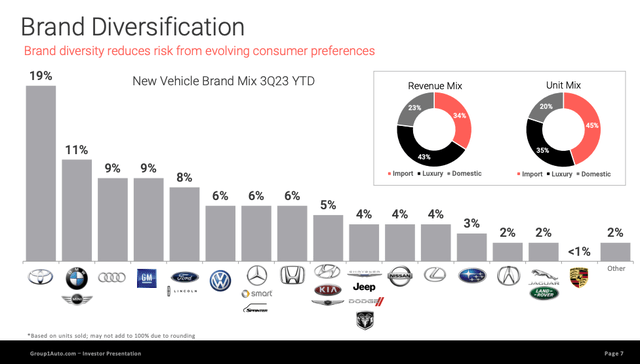

GPI is diversified across brands including Toyota, BMW, Audi, GM, Ford, and others. The company is tilted towards the luxury car business with luxury brands accounting for 43% of total revenue.

GPI Investor Presentation GPI Investor Presentation GPI Investor Presentation

Franchise Agreements Create Defensible Moat

While the car dealership and service business is somewhat competitive, entrenched players benefit from franchise agreements which offer certain protections from competition and which make it difficult for new players to enter the business.

In order to understand why car dealers enjoy a defensible moat, it is critical to understand how the business developed. By the mid 1920’s the automobile manufacturing industry had consolidated into just a few major producers while dealership franchise ownership was much more fragmented with small players. In response, laws were passed in states to protect the dealers from the automobile manufacturers. These laws include certain provisions which given dealerships territorial exclusivity for certain areas. Moreover, the laws also limit market entry for new players.

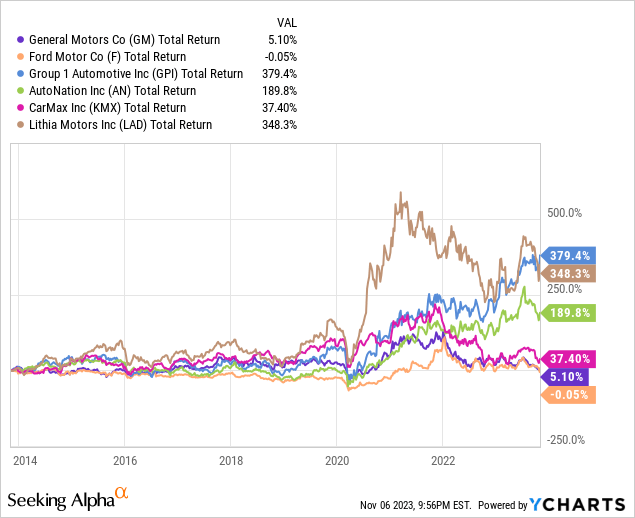

The result of this has been that the car dealership industry has been able to generate strong historical returns despite the struggles that manufactures such as Ford (F) and General Motors (GM) have experienced.

Warren Buffett has also signaled his belief that the automotive retail business is attractive when he acquired Van Tuyl in 2015 which was the No. 5 U.S. auto retailer at the time.

Bill Gates has been a long-time shareholder of AutoNation (AN) and continues to own 23.5% of the company. Eddie Lampert also owns ~12% of AN shares.

Strong Historical Financial Performance

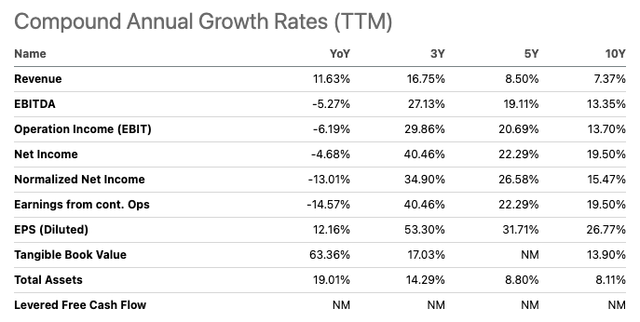

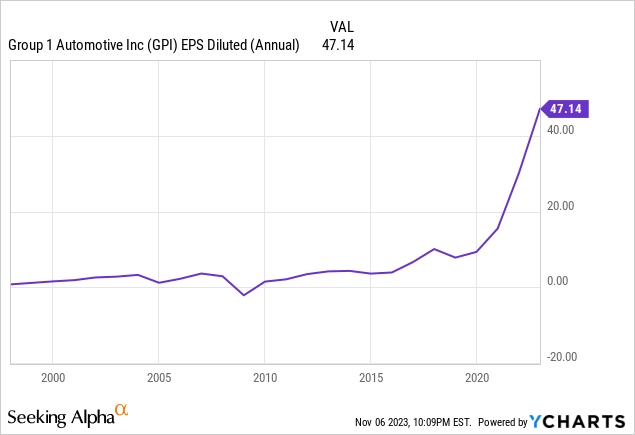

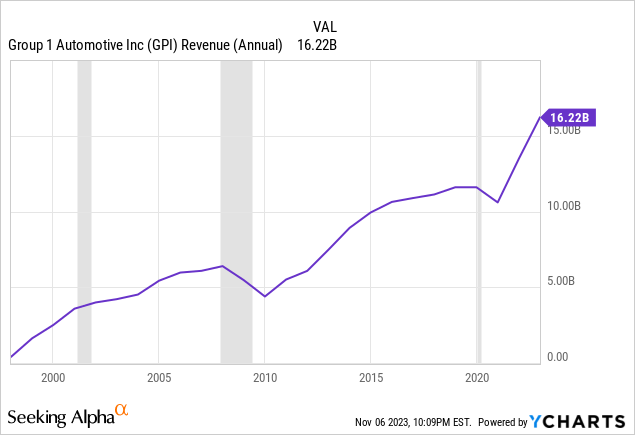

As show by the table and chart below, GPI has achieved very strong long-term and short-term growth rates in key metrics such as revenue, EBITDA, net income, and EPS.

Perhaps the most impressive metric is the 26.7% 10yr EPS CAGR.

This level of financial performance is even more impressive when considering the fact that the automobile retail industry is highly mature in nature.

Seeking Alpha

Strong Recent Financial Performance

On October 25, 2023, GPI reported Q3 2023 results. GPI reported record quarterly Non-GAAP EPS of $12.07 which beat estimates by $0.59. Revenue came in at an all-time high of $4.7 billion which beat estimates by $180 million and represents a 13% increase on a year-over-year basis.

In response to the strong results, GPI rose sharply and have moved higher by ~14% since the earnings release.

Opportunity For Further Industry Consolidation to Drive Growth

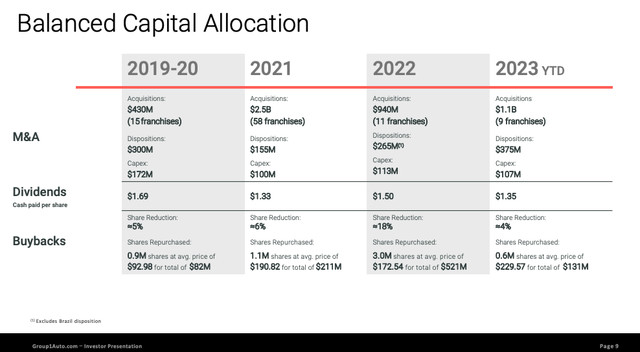

One of the biggest drivers of strong historical financial performance for GPI has been its consolidation strategy. As shown by the chart below, the company has been an active acquirer of smaller dealerships. Since 2019, GPI has spent ~$4.97 billion on new acquisitions. To put this total into context, GPI today has a market cap of just ~$3.7 billion and an enterprise value of ~$7.1 billion. Thus, recent acquisitions have proved a major part of GPI’s business strategy.

GPI has said that acquisitions remain a major part of its strategy. The company discussed the benefits of acquisitions in its most recent 10-K:

We evaluate all brands and geographies to expand our portfolio, seeking to acquire dealerships in growth-positioned or economically stable markets, or that are economically accretive to our existing markets. Acquisitions completed within our existing markets allow us to capitalize on economies of scale and provide for cost saving opportunities in key expense areas such as used vehicle sourcing, advertising, purchasing, data processing and personnel utilization. In addition to cost savings opportunities, scale enables us to make the EV, facility, compliance, real estate, and technology investments necessary to thrive in today’s retail automotive industry

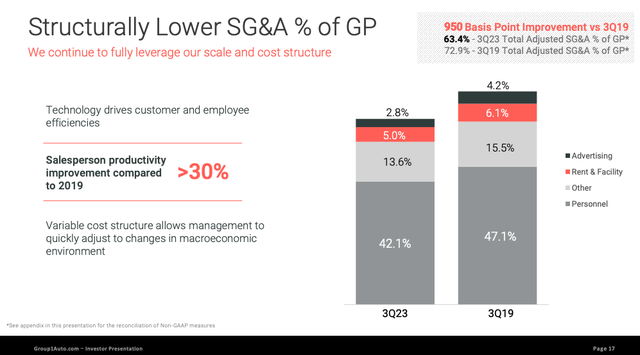

GPI has shown just how significant the efficiencies due to scale can be over the past few years. As shown by the chart below, GPI has reduced its SG&A % of gross profit from 72.9% in 3Q 2019 to 63.4% in 3Q 2023. This represents a 950 basis point improvement.

Despite significant consolidation in recent years, the industry remains ripe for further consolidation. As of 2022, it is estimated that the top 10 dealerships account for just 8.9% of total U.S. dealerships while the top 150 dealerships account for 23.3% of total U.S. dealerships.

Currently, GPI is estimated to account for just ~1.2% of total industry revenue. Thus, I believe GPI has an excellent opportunity to drive further grow via continued acquisitions.

GPI Investor Relations GPI Investor Presentation

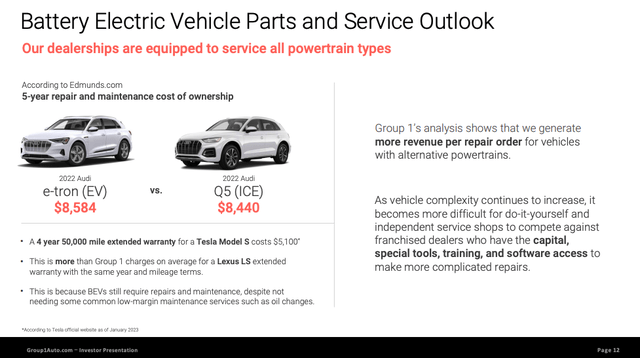

Transition to EV’s will lead to more demand for parts and service

The transition to EVs represents a potential positive catalyst for GPI overtime as EVs appear to have higher repair and maintenance costs compared to traditional vehicles. While GPI does not sell Tesla (TSLA) vehicles, GPI is certified to provide repair and service for Tesla’s at select locations.

In addition to driving higher service and parts revenue, EVs also appear to benefit dealerships as independent service shops lack the capital, training, and software access needed to make complex repairs.

GPI Investor Presentation

Shareholder Friendly Capital Allocation

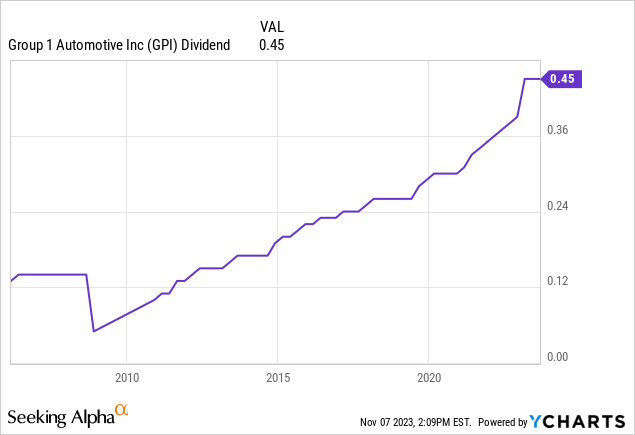

As shown by the chart below, GPI has been steadily increasing its dividend for the past 13 years. Currently, the stock yields ~0.66%.

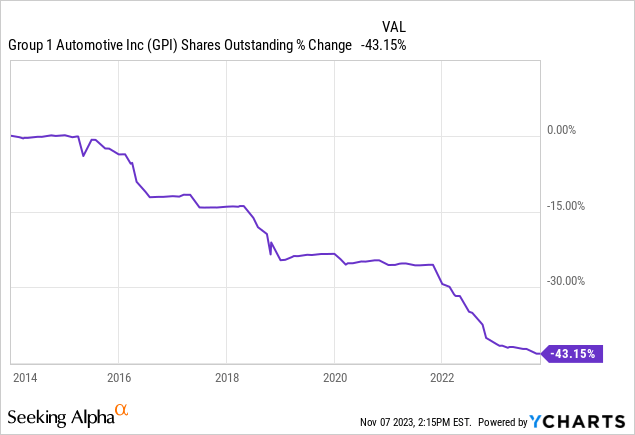

Additionally, GPI has been aggressively buying back stock. The total amount of shares outstanding has decreased by ~43% over the past 10 years.

GPI currently has $184.9 million remaining on its Board authorized share repurchase program.

Valuation

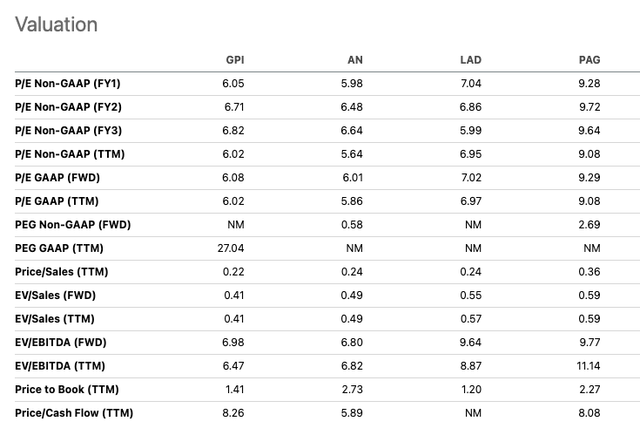

GPI trades at 6x FY 2023 earnings and 6.7x FY 2024 consensus earnings. Comparably, the S&P 500 trades at 18x 2024 consensus earnings. Thus, GPI is trading at a significantly lower valuation. Moreover, GPI has historically grown EPS at a 10 year CAGR of 26.7% while the S&P has grown earnings by ~8%.

In addition to trading at a very attractive forward P/E ratio, I believe the consensus estimates for EPS growth are too conservative. Currently, consensus estimates call for GPI to grow earnings at low single digits over the next few years and EPS is expected to modestly decline.

I view these estimates as much too conservative given GPI’s strong historical performance and growth opportunities.

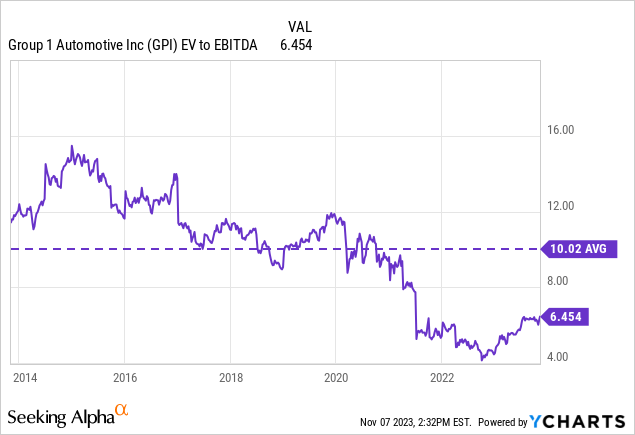

On a relative to peers basis, GPI is trading toward the lower end of its peer range based on key metrics such as forward P/E and forward EV/ EBITDA multiples.

GPI is currently trading at significant discount to its average historical valuation on both a P/E ratio basis and EV / EBITDA basis. Thus, I view GPI as highly attractive at its current valuation relative to historic norms.

Seeking Alpha Seeking Alpha

Risks to Consider

I believe the primary short-term risk to my bullish view is that macroeconomic economic conditions worsen and the U.S. heads for a serious recession. GPI is in a highly cyclical business as demand for new cars tends to fall during times of economic weakness. Additionally, consumers may be more hesitant to spend money on services and parts unless repairs are absolutely critical. While an economic downturn would be a short-term negative for GPI in that earnings are likely to fall, I believe it would represent a long-term opportunity. Smaller dealerships may be weakened by an economic downturn which would provide GPI attractive consolidation opportunities.

Another risk to GPI is that Toyota struggles vs peers. Toyota is GPI’s largest brand and accounts for ~19% of new vehicles sold each quarter. Thus, if Toyota were to lose share to other automakers GPI could stand to lose to some degree. However, I believe this risk is mitigated by the fact that GPI is well diversified and would benefit from gains in other brands such as GM, Ford, or Honda.

Conclusion

GPI has delivered very strong returns for investors historically. While GPI competes in a fairly competitive industry, it does enjoy some competitive advantages due to state regulations which limit competition in certain geographic areas.

GPI is one of the largest auto retailers in the world and is able to use its scale to drive efficiency relative to smaller players. Over the past few years, GPI has acquired a number of smaller dealerships and has been successful in driving efficiency gains. Despite significant consolidation in recent years, the auto dealership industry remains highly fragmented. Thus, GPI will have additional consolidation opportunities in the years ahead which have potential to drive substantial growth.

GPI trades at a significant discount to the S&P 500 despite the company’s strong historical financial performance and growth rates. I believe the market is over-focused on the cyclical nature of GPI’s business (and potential for near-term earnings headwinds in the event of a recession) and fails to consider the significant growth potential due to further industry consolidation. In addition to trading at an attractive level vs the S&P 500, GPI is also attractive relative to its own historical valuation range.

For these reasons, I am initiating GPI with a strong buy rating. I would consider changing my view if the stock increases substantially from here.

Read the full article here