By Peter C. Earle

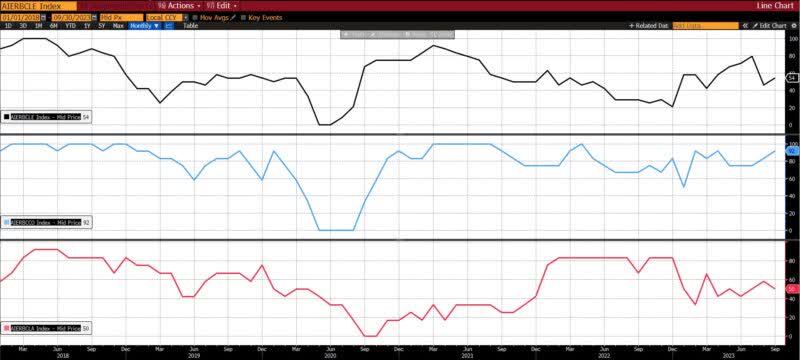

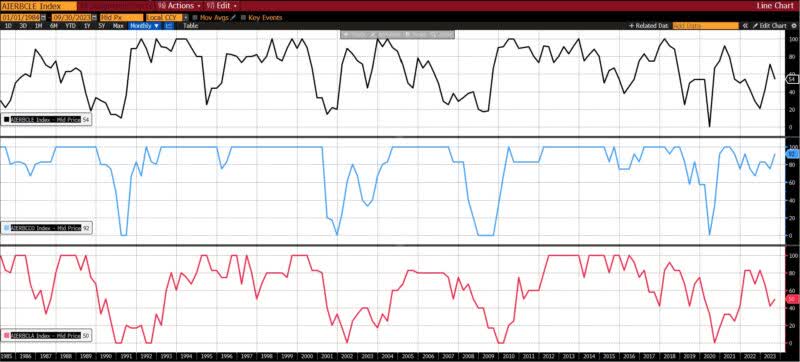

In September 2023, AIER’s Business Conditions Monthly indices continued on distinct trajectories. Our Leading Indicator rose from 46 to 54, remaining close to neutral, but with an expansion tilt. The Roughly Coincident Indicator continued its rise, reaching 92 after starting the year at 50. And our Lagging Indicator fell from a slightly expanding 58 in August to a neutral 50.

AIER Business Conditions Monthly (5 years)

AIER Business Conditions Monthly (1985 – present)

Leading Indicators (54)

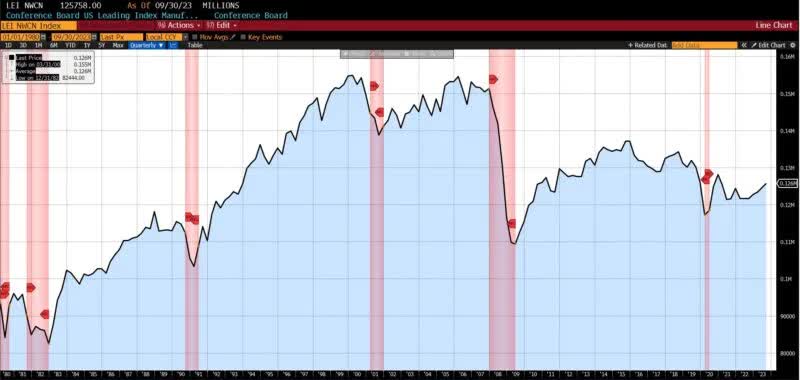

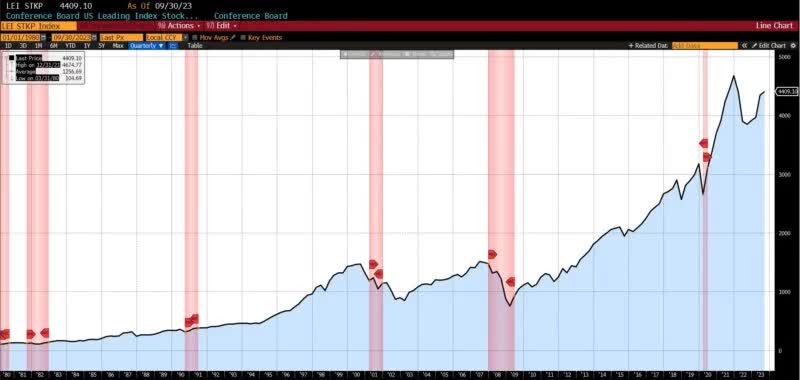

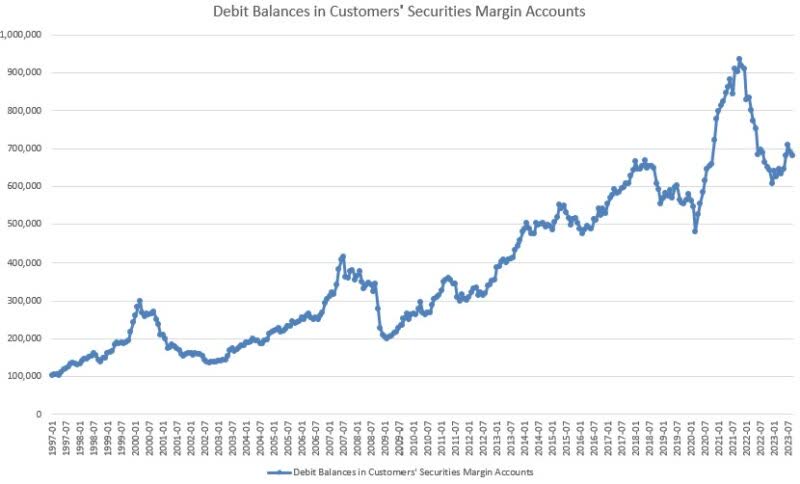

Five of the twelve leading indicators declined, one was unchanged, and six rose. Among the decliners were the University of Michigan’s Consumer Expectation Index (-8.0 percent), United States Heavy Truck Sales (-7.9 percent), the US Census Bureau’s Inventory to Sales Ratio (-1.4 percent), FINRA’s Debt Balances in Customers’ Securities Margin Accounts (-1.2 percent), and the Conference Board US Leading Index of 500 Stock Prices (-1.1 percent). The Conference Board US Manufacturers’ New Orders of Nondefense Capital Goods Excluding Aircraft was unchanged.

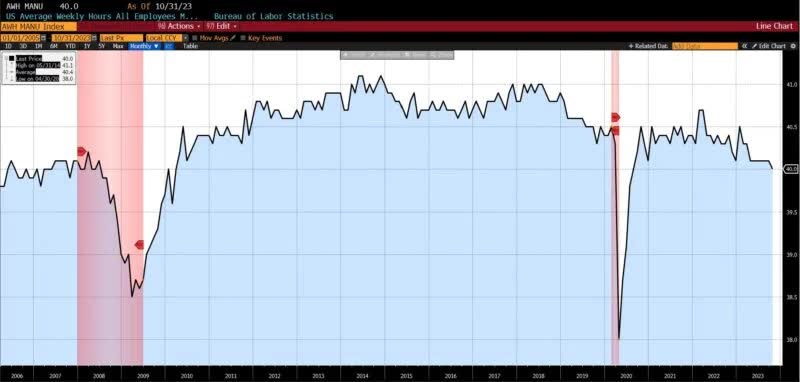

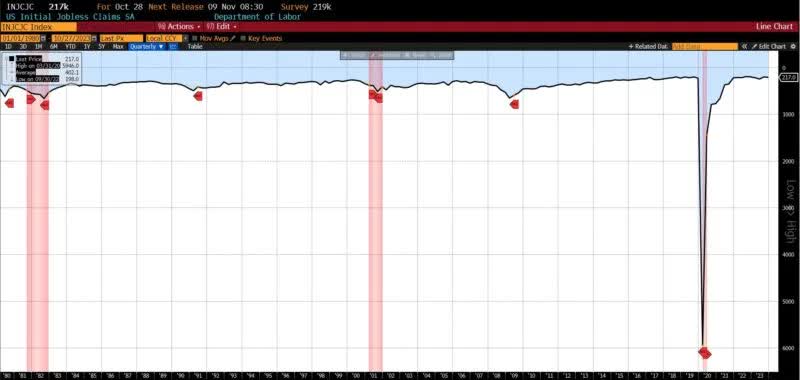

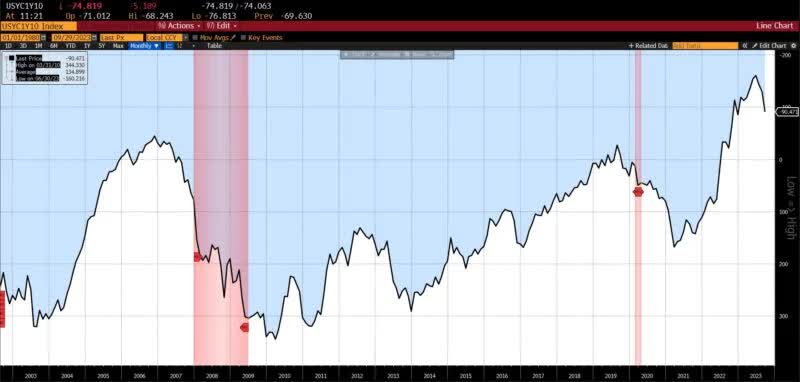

Rising were the 1-to-10 year US Treasury spread (30 percent), US New Privately Owned Housing Starts by Structure (5.8 percent), US Initial Jobless Claims (5 percent), Adjusted Retail and Food Service Sales (0.7 percent) US Average Weekly Hours All Employees, Manufacturing (0.25 percent), and the Conference Board US Leading Index of Manufacturer New Orders, Consumer Goods, and Materials (0.01 percent).

Roughly Coincident (92) and Lagging Indicators (50)

The Roughly Coincident Indicator rose to 92 in September from 83 in August, reclaiming a level it last reached in April of this year. After January 2023 (50), the indicator has been at a broadly expansive level of 75 and higher.

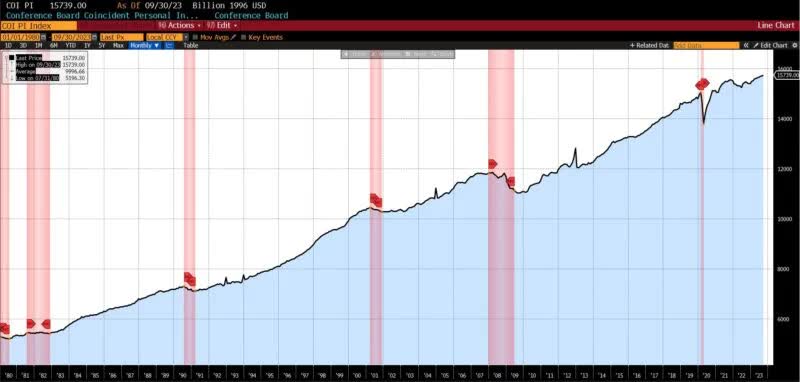

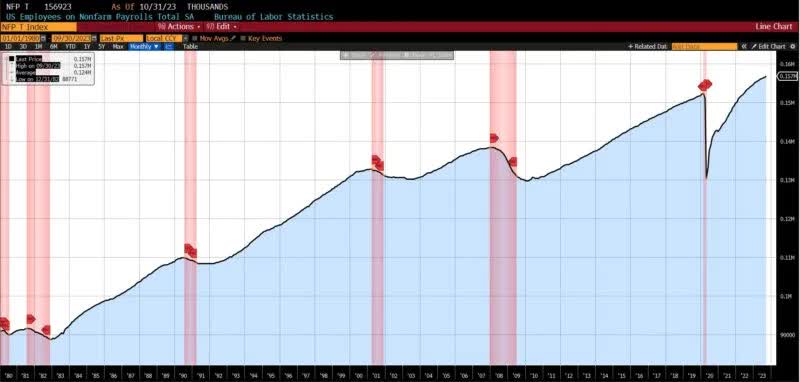

Five of its six constituents rose, with one unchanged. While the US Labor Force Participation Rate was unchanged, increases came in the Conference Board Coincident Manufacturing and Trade Sales (0.2 percent), US Employees on Nonfarm Payrolls (0.2 percent), Conference Board Coincident Personal Income Less Transfer Payments (0.2 percent), Conference Board Consumer Confidence Present Situation (0.3 percent), and US Industrial Production (0.3 percent).

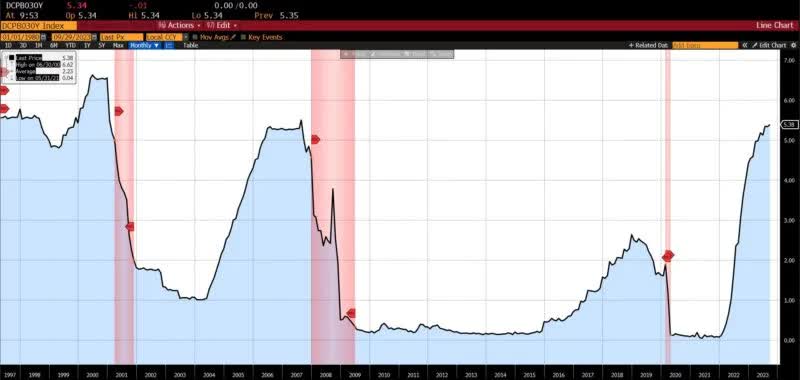

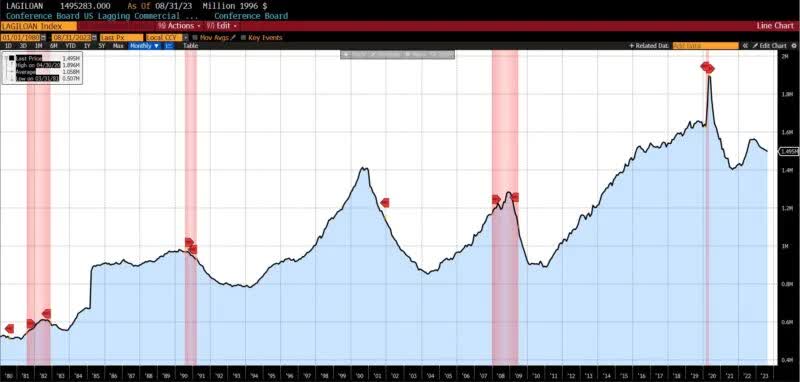

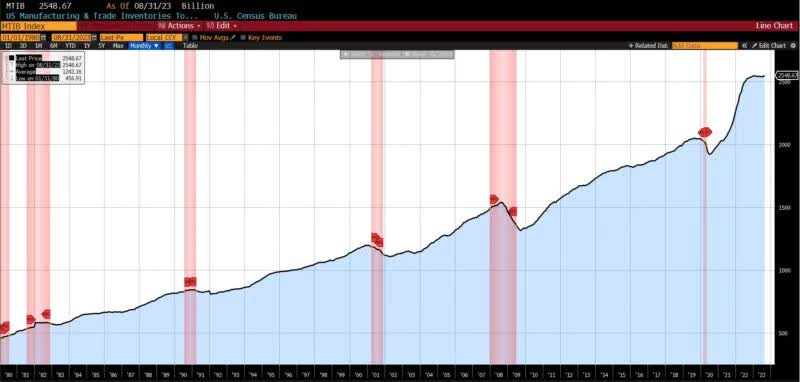

The six constituents of the Lagging Indicator were divided among three rising and three falling. The three decliners were the Conference Board US Lagging Average Duration of Unemployment (-5.4 percent), Core CPI year-over-year (-4.7 percent), and the Conference Board US Lagging Commercial and Industrial Loans (-0.4 percent). The Census Bureau US Private Construction Spending (Nonresidential) rose (0.3 percent), as did US Manufacturing and Trade Inventories (0.4 percent) and average 30-day yields (0.9 percent).

Discussion

The release of the first run of 3rd quarter GDP on October 26 provides a solid foundation for examining the current state of the US economy. The 4.9 percent annualized rate of expansion was the fastest in nearly two years, yet beneath the surface revealed an economy growing on the basis of disparate and unsustainable elements.

The three major contributors to the large 3rd quarter GDP print were consumption, private inventories, and government spending. Government spending contributed 0.8 percent to the 4.9 percent output, yet represents nonproductive redistribution generated by debt issuance, taxation, and/or monetary expansionism. Unsurprising in light of expanding US military aid commitments, 0.28 percent of the 0.8 percent of US government spending was national defense related.

The growth in private inventories, which added 1.3 percent of the 4.9 percent total, are likely to have been cautionary in nature. Two explanations have been suggested to account for the large accumulation of stocks in the third quarter. One is growing concern regarding the continuing consumption potential of American consumers. Businesses that rely on maintaining high service levels or fulfilling contractual obligations thus seeking to ensure that they can meet customer demands amid a continued slowdown. Additionally, the inventory build-up may be a substitute for declining capital spending plans, which have fallen to the lowest level since June 2020. A second explanation is that the success of the United Auto Workers strike against Ford, General Motors, and Stellantis has prompted companies with collective bargaining exposure to hedge against the possibility of disruption, whether from their own workforce or that of vertically/horizontally integrated firms. Keeping a larger than average number of intermediate or finished goods on hand safeguards against unexpected and possibly intransigent labor disputes.

Consumption accounted for 2.7 percent of the 4.9 percent 3rd quarter GDP number. For some months now, the deterioration of consumer activity has been anticipated, yet slower to materialize than expected. September represents the fourth straight month in which real spending has grown faster than real income. This suggests that a substantial amount of recent spending, which has been a major contributor to US output, has been funded mainly out of borrowing and savings. In terms of borrowing, the Federal Reserve’s latest Senior Loan Officer Opinion Survey (SLOOS) indicates a continuing trend of tightening credit and higher credit standards. This comes atop declining demand for auto loans, consumer loans, and mortgage financing against a backdrop of rising interest rates. The prospects for ongoing borrowing are diminishing absent a reversal of the current monetary policy bias.

While wages and salaries rose by 0.4 percent in September 2023, disposable income fell for a third straight month, indicating that American consumers have been saving less to support future consumption. Personal spending growth is thus outstripping income gains. Also in September, the US saving rate fell to 3.4 percent, its lowest level since December 2022. These facts, on top of the resumption of student loan payments, stubborn inflation in certain goods and services, the ongoing contraction of credit, and higher interest rates, raise doubt as to the durability of robust spending.

Bolstering this interpretation, the University of Michigan’s preliminary consumer sentiment readings for October suggested an abrupt reversal of personal financial assessments among survey participants. The Conference Board’s consumer confidence index similarly declined from 104.3 in September to 102.6 in October. The slide in consumer confidence came on the basis of less optimistic views regarding current business conditions, a new post-pandemic low in job availability appraisals, and declining confidence regarding incomes over the next six months.

Recent employment data supports this conclusion. While September labor data was stronger than expected, October data showed job growth slowing by more than anticipated, with the U-3 unemployment rate rising to a nearly two-year high of 3.9 percent. The increase from 3.8 to 3.9 percent derives from a decline in the labor force by 201,000 and a decline in the number of individuals employed by 348,000, and consequently a rise in the number of unemployed by 146,000 (versus 5,000 in the previous month).

Eight of the last nine monthly US Bureau of Labor Statistics reports in 2023 have been revised downwards in subsequent releases. The 150,000 nonfarm payroll number in October not only came in lower than the 180,000 expected, but 50 percent lower than the revised 297,000 jobs reported in the September release. The October nonfarm payroll number was the second lowest since June 2023 (105,000) going back to December 2020 (-115,000).

The composition of the October report was poor as well. Of the 150,000 jobs reported, slightly more than one third (51,000) were government jobs financed not out of productive commerce but fiscal redistribution. Of the other 99,000 jobs, some 89,000 were in education, social assistance, and health services: jobs with a high proximity to public expenditure. The remaining 10,000 came from financial services, information services, and transportation. Manufacturing saw a decline of 35,000 jobs.

The October employment report also revealed a record number of multiple jobholders in the US economy. A record 8.5 million individuals currently have two or more jobs, with just under 400,000 joining those ranks in the last month. (This is a somewhat obscure data series which AIER has been following since August 2022; please see “Making Sense of the Recession.”) It is likely that the actual state of affairs with regard to multiple jobholders is vastly higher than even these numbers indicate, considering that many secondary or tertiary employment positions involve compensation outside of official payrolls.

Another statistic which has been reported previously is the increase in WARN Act (Worker Adjustment and Retraining Notification Act of 1988) filings. AIER first mentioned this in early May 2023 (see “The Path to Full Stagflation”) as not only beginning a gradual ascent, but historically leading federal unemployment statistics. This seems to be the case.

The recent U-3 unemployment of 3.9 percent is close to triggering the so-called Sahm Rule. Named for former Federal Reserve economist Claudia Sahm, the rule stipulates that when the three-month average of the US unemployment rate rises by at least 0.50 percentage points above its lowest point from the previous 12 months, it indicates the start of an economic recession. With a low three-month moving average this year of approximately 3.4 percent, the October rate of 3.9 percent brings the increase to 0.43 percent. The rule has successfully identified all 11 US recessions since 1950, with a false positive rate of approximately 1 percent. A similar rule employs the U-1 unemployment rate (which focuses on individuals who have been unemployed for 15 weeks or more as a percentage of the total civilian labor force). Although the U-1 rate historically lags the U-3 rate, when it surpasses its 12-month low by greater than 0.2 percent, it has identified recessions with a false positive rate of 0.6 percent, albeit with a five-month delay. The current U-1 rate of 1.4 percent meets that criterion, 0.3 higher than the average rate of 1.1 percent in February, March, and April 2023.

A weakening labor market marked by consumers spending beyond their income capacities, with dwindling savings and increasingly diminishing borrowing options, is unlikely to sustain the rate of consumption which has dominated heretofore. And considering the prominent role which consumption has played in buoying economic data for some time, suggests an unfavorable trajectory for economic growth ahead.

With declining demand, firms are likely to struggle to pass along cost pressures, which in turn does not augur well for US production. The recent Institute of Supply Management (ISM) manufacturing gauge fell 2.3 points from September to October, landing at 46.7 (below 50 indicates contraction) in the largest decline in over one year. This indicator may, however, rebound in the wake of UAW strike resolutions. The ISM services indicator, meanwhile, fell from 53.6 in September to 51.8 in October, indicating ongoing expansion, albeit at a slowing pace.

There are signs in equity markets of a broader slowdown as well. Berkshire Hathaway’s cash position at the end of September 2023 reached a record $157.2 billion, of which some $97.3 billion was in cash and T-bills. A quarterly increase of 36 percent in cash and cash-equivalent instruments amid an increase of 3 percent in equity investments suggests a paucity of opportunities, at least in the context of higher yielding government securities. Since the reporting season began, S&P 500 4th quarter earnings per share estimates have declined by nearly half, from 7.6 to 4.6 percent. Bloomberg reports that 8 of eleven sectors have been subject to negative growth revisions.

“Mega-bankruptcies,” which describes filings by firms with greater than $1 billion in assets, reached 16 in the first half of 2023. From 2005 through 2022, that number averaged 11. Bankruptcies filed by both public and private companies holding assets exceeding $100 million rose in the first half of 2023, reaching a total of 72 filings, which has already exceeded the 53 bankruptcy filings recorded in 2022.

Among bellwethers, Caterpillar Inc.’s third quarter order backlog showed its first annual decline since mid-2020. Although the COVID pandemic skews results somewhat, of ten other instances in the past decade where Caterpillar has reported falling backlogs, seven saw GDP decline by roughly one percent in the following quarter. The global shipping firm Maersk has announced plans to reduce its global headcount by at least 10,000 employees percent amid a 92 percent drop in profits stemming from a decline in shipping rates. FreightWaves reports that some 35,000 trucking businesses (the majority of them owner-operated) have shuttered as of the end of September 2023 fiscal year.

In March 2023, we cited the “clear… deteriorat[ion]” of US economic fundamentals “with risks compounding to the downside.” Our baseline estimate at that time was for an economic recession within the next twelve to eighteen months. Our choice to extend a substantially longer-term forecast for an economic downturn than most other economic analysts was anchored in historical data, empirical evidence, and professional experience. While we refrain from providing a specific magnitude for our recession forecast and acknowledge the possibility of inaccuracies or outright error, we maintain our contention that the US will enter an economic recession by September 2024.

Leading Indicators

Roughly Coincident Indicators

Lagging Indicators

Capital Market Performance

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here