Having initially been upbeat on the iShares MSCI Australia ETF (NYSEARCA:EWA) in January, I’ve since turned neutral on Australian stocks amid extended monetary tightening risks (see coverage of actively managed abrdn Australia Equity Fund Inc (IAF) here and here). In line with this view, the Reserve Bank of Australia (i.e., the country’s central bank or ‘RBA’) followed through with yet another 25bps hike at its November meeting. The hike wasn’t all that surprising, given the tight labor market and ever-present inflation risks (particularly rent and services) kept Q3 inflation numbers well above target. Nor was the RBA’s post-meeting commentary, which further reinforced the tightening bias.

For equities, an extended monetary tightening cycle poses more headwinds, weighing not only on domestic earnings but also on the valuation for rate-sensitive companies (e.g., Australian miners) already being hit by the China slowdown. Earnings are starting to roll over as well, with last month’s negative revisions moving consensus large-cap earnings growth forecasts to -6% for 2023 (low-single-digit percentage decline for 2024). Passively managed EWA, which tracks the flagship MSCI Australia Index, doesn’t screen all that cheaply either at ~15x P/E (2.1x P/B). Net, I would be sidelined here.

Fund Overview – A Reasonably Priced Australian Large-Cap Vehicle

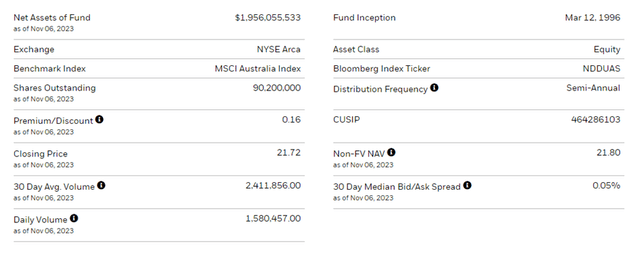

The iShares MSCI Australia ETF tracks (pre-expenses) the performance of the market cap-weighted MSCI Australia Index, a basket of Australian large-cap equities spanning ~85% of the country’s free float-adjusted market cap. The ETF has seen its asset base decline slightly to ~$2bn this year but maintains a 0.5% expense ratio, in line with other international iShares ETFs. While its closest comparable, the Franklin FTSE Australia ETF (FLAU), has a lower fee structure (~0.1% expense ratio), EWA comes with liquidity advantages and a longer track record.

iShares

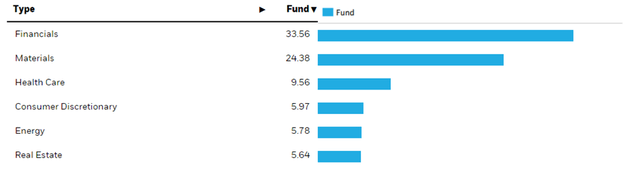

Throughout the year, the fund’s sector allocation has continued to shift further toward Financials (33.6%), historically its largest exposure. Materials (24.4%) and Healthcare (9.6%) also feature prominently in the EWA portfolio. Other sectors over the 5% threshold include Consumer Discretionary (6.0%), Energy (6.8%), Real Estate (5.6%), and Industrials (5.2%). As the top five sectors now contribute a larger 79.3% (slightly higher than FLAU, though the sector composition is similar), the fund’s fortunes are even more closely tied to the performance of these sectors.

iShares

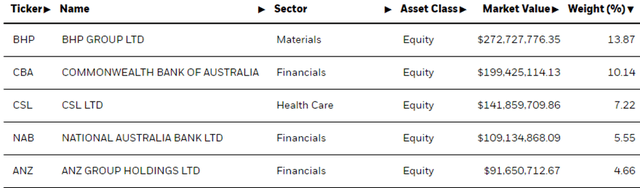

The fund’s single-stock allocation is led by mining and O&G conglomerate BHP Group Limited (BHP) at a slightly lower 13.9%, followed by Commonwealth Bank of Australia (OTCPK:CBAUF) (unchanged at 10.1%), biotech company CSL Limited (OTCQX:CSLLY) (slightly lower at 7.2%), and National Australia Bank Limited (OTCPK:NABZY) (unchanged at 5.6%). Of note, seven of the fund’s top ten holdings operate in the Financial and Materials sectors, in line with the sector focus. As a result of its less rigid weighting caps, EWA is relatively more concentrated than FLAU from a single-stock perspective as well.

iShares

Fund Performance – Undergoing Near-Term Turbulence

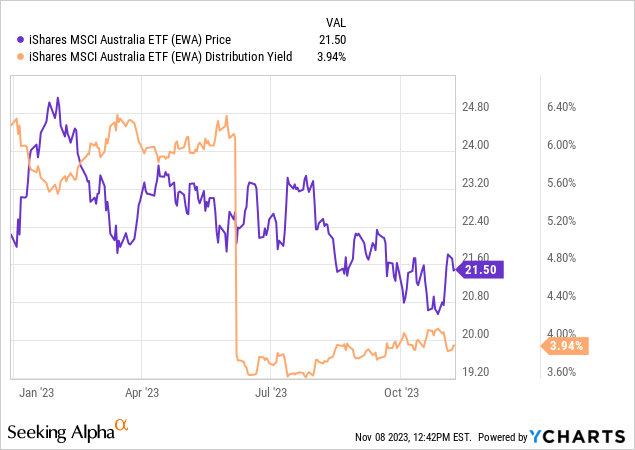

EWA has suffered a poor year by its standards – on a YTD basis, the ETF has declined by -0.8% following a -5.7% decline last year. Since its inception, however, the fund has compounded at an impressive +7% annualized since its inception in 1996. The caveat here is that a good portion of the returns are back-end weighted, with the five and ten-year total annualized return standing at a rather unimpressive +3.8% and +2.9%, respectively. By comparison, the capped FLAU has returned a slightly higher +4.8% annualized over the last five years, though its return of -2.5% this year is well below EWA.

iShares

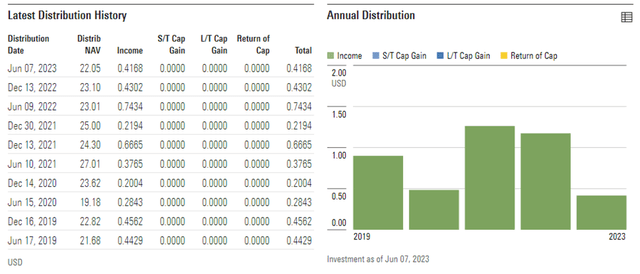

Income has long been a key reason to own Australian equities, as EWA’s consistently strong (semi-annual) distributions have shown. Currently, the trailing twelve-month yield stands at 3.9%, helped by the $1.17/share payout last year. With the H1 2023 payout already falling short of 2021/2022 levels, though, expect some income downside at the upcoming H2 payout.

iShares

One More Rate Hike

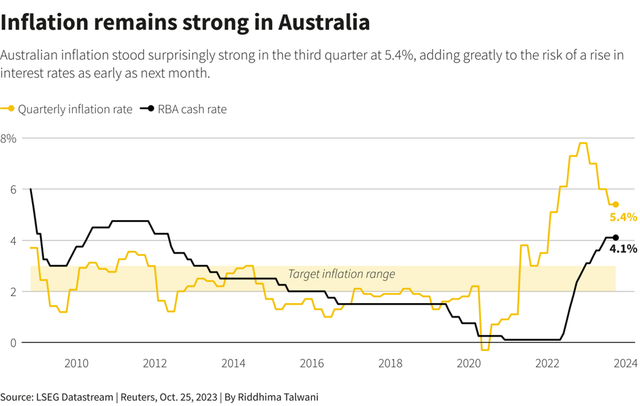

The RBA’s decision to raise the Australian cash rate by 25bps to 4.35% at this week’s Board meeting wasn’t all that surprising. Recall that Q3 consumer price inflation (+5%) had been running well above the central bank’s forecasts. One reason for the RBA’s inflation-fighting struggles has been its decision to stay behind the curve (vs. peer central banks) in addressing inflation; hence, getting back to target will understandably take longer. How much longer is the key question – thus far, labor market tightness, surging rent prices, and ‘sticky’ services inflation indicate inflationary pressures haven’t quite responded to higher rates.

Meanwhile, the Board’s broader emphasis on “domestic demand” in its post-meeting statement indicates concern that inflation is broadening out. No surprise then that the tightening bias remains intact (“risk of inflation remaining higher for longer” and “more persistent than expected a few months ago”), with inflation forecasts incrementally raised by ~20bps to 3% through end-2025 and unemployment forecasts cut by ~25bps to 4.25%. In effect, this month’s inflation/unemployment updates suggest that the RBA sees a runway for more rate hikes going forward.

Reuters

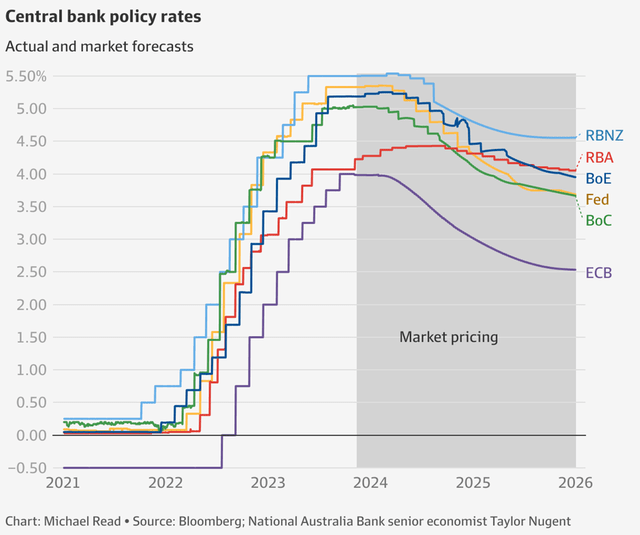

For now, though, the RBA’s most likely course of action is to maintain, rather than hike, policy rates pending visibility into ‘mortgage cliff’ vulnerabilities (i.e., when a large percentage of fixed-rate mortgages expire). Note that the standard variable mortgage rate is going up nearly twofold from 2022 lows, so we could still see some trouble ahead as policy rate hikes finally flow through to repayments. Also pushing the RBA’s bias toward near-term inaction are ongoing uncertainties related to a yet-to-be-appointed Deputy Governor and institutional reform (per RBA review earlier this year). Externally, there’s also the risk of renewed supply-side pressures from geopolitics, particularly in crude. In contrast, the market is pricing in an easing cycle kicking off in late 2024, which seems a tad premature at this point.

Australian Financial Review

Extended Monetary Tightening Looms Large in Australia

The RBA has generally followed in the Fed’s footsteps thus far, so the recent cash rate hike marked a notable divergence. At the heart of the issue is Australia’s ‘sticky’ core inflation problem, which might require an extended period of monetary tightening to solve – at the expense of the domestic economy. It also adds to ongoing pressures on commodity-dependent Australia from the China slowdown, further weighing on near-term earnings. The only real beneficiary from a ‘tighter for longer’ scenario is the banking sector, another key component of EWA. Yet, any rate-driven positives from rising net interest margins could well be offset by asset quality deterioration and slowing loan growth as rate hikes start to bite. At ~15x earnings (vs. consensus estimates for more earnings declines next year), EWA investors have little margin for error here and would be better off sidelined, in my view.

Read the full article here