Consumer Prices

The Consumer Price Index (CPI) rose +0.4% in April (4.95% Y/Y). Core services (ex-housing), an important sub-index for the Fed, came in a little hot at +0.4% M/M (vs. +0.3% in March). In our view, this alone isn’t likely to cause the Fed to raise the Fed Funds rate yet again when it meets in mid-June (13th & 14th) because disinflation (and deflation) signs are rapidly emerging.

The Bureau of Labor Statistics (BLS) uses data for used cars and rents that are several months old. So, if we just strip out used car prices and rents, which we know are now falling, and set them at 0%, the CPI would have deflated -0.1% in April. Better yet, if we substitute the Manheim Index for used cars and the Apartment List Index for rents, then this measure of the CPI would have deflated -0.4% in April!

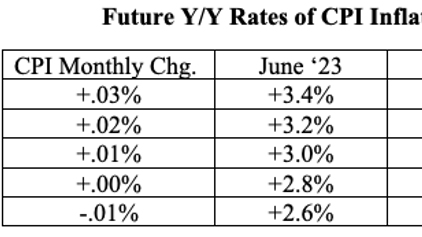

In addition, the CPI had a low comparative base in April 2022. Over the next two months, that base rises dramatically. So even if M/M inflation comes in hot, even at +0.5% M/M, June’s inflation rate would fall to 3.4%. And if CPI is flat (0%) in May and June, the Y/Y rate of inflation will fall into the mid +2’s. So, you can see why we are solidly in the deflation camp.

Producer Prices

The Producer Price Index (PPI), another leading indicator of the direction of inflation, rose +0.2% in April (a rather mild +2.3% Y/Y) with falls in food (-0.5%), construction costs (-0.3%) and a significant fall in transportation/warehousing (-1.7%). The latter represents the pulse of the economy as goods must move from their production place or their ports of entry to hundreds of thousands of places in the U.S. where consumers shop (or to delivery services if they shop online). The fact that transportation prices are falling simply means flagging demand.

Inflation’s Future

We did another thought experiment around what the Y/Y rate of inflation will look like in the future. The table at the top of this blog shows the Y/Y level of inflation for constant monthly changes in the CPI for selected future months. Note that the Y/Y rate of inflation falls from current levels under all scenarios. One key reason is that the base numbers for May and June 2022 were elevated as inflation had ignited back then. Since there are a few of us commentators that are in the deflation camp, our view is near the bottom of the table, especially since we see demand destruction in most cyclically sensitive sectors (example transportation/warehousing: PPI -1.7%).

In addition, we are observing falling prices in the commodity pits, weakening employment, and a consumer near the end of their spending capacity.

Commodities (from cycle peaks): Soybeans: -18%; Copper: -20%; Corn: -24%; Flour: -25%; Coffee: -28%; Iron Ore: -33%; Wheat: -35%; Milk: -36%; Hogs: -36%; Steel Rebar: -38%; Aluminum: -40%; Zinc: -40%; WTI Oil: -41%; Cotton: -46%; Coal: -60%; Pork Bellies: -64%; Baltic Dry Index: -72%; Lumber: -78%; Natural Gas: -81%; Eggs: -82%.

There are only three commodities still near their highs: Live cattle, sugar, and cocoa.

In April, airfares, hotels/motels, sports events, and delivery services all deflated. This past week, Airbnb missed on revenues and gave weak guidance (could the “catch-up” in travel and related demand be fading?). Microsoft

MSFT

An Update on Payrolls – So Much for the “Strong” Labor Market

As noted in prior blogs, markets and the media take the Seasonally Adjusted (SA) Payroll Data at face value. The chart shows a timeline, beginning in 1996, of consecutive Upside/Downside differences between the originally reported Payroll data and the Bloomberg consensus estimate. For example, if the consensus is +200K and the reported SA data is +250K, that counts as an “upside.” If that happens three months in a row, and then a “downside” occurs, the charted point would be “3”. Note that the highs were “5” in 1997 and 2020. That is, until the recent run of “13”!

David Rosenberg is a sceptic, like us. He recently published an analysis of the 2018 to 2023 April Nonfarm Payrolls (excluding the Covid lockdown period of 2020). The table shows both the SA and Not Seasonally Adjusted (NSA) data as initially published by BLS. As a reference, 2023’s 892K NSA number was the weakest number since 2012!

Due to the change in seasons, in April we expect, and generally get, significant job expansion. The NSA column bears this out. Employment generally increases around one million in that month. But what jumps out immediately is the big difference between 2023’s and 2022’s NSA data (892K vs 1,038K, a -146K difference) and essentially no difference in the SA number (253K vs. 254K). This makes no sense. The seasonal factors don’t (can’t) change that fast in an economy the size of the U.S. Look further in the table and you will see that in 2018, the NSA data was 977K (+85K higher than 2023’s 892K) while its SA number was 145K (-108K lower than the recent April Nonfarm Payroll release).

Rosenberg estimates that, if the seasonal factor was similar to those of the past four of the last five years (excluding 2020), the SA number should have been closer to +175K, right about where the Bloomberg consensus number resided. In addition, the Nonfarm Payroll data includes the Birth/Death model “add-in.” (That’s the number BLS adds to the data because they do not survey small businesses. While we agree that, over time, small business in the U.S. grows, we know that it doesn’t occur in a straight line – yet that is what BLS model assumes.) According to Rosenberg, the Birth/Death add-in was +378K. Without that uncounted add-in, the counted NSA number was 514K which would translate to just over 100K when seasonally adjusted, not 253K.

The nearby chart shows the original Payroll numbers (black line) and what happens in the revisions. Note that in 2022, for 10 of the 12 months (except January and April) the revisions were all to the upside (blue line). That has changed so far in 2023, with the January through March revisions all to the downside. We expect significant downside revisions to the April number in May’s update, and perhaps again in June’s.

We have opined that the large layoff announcements in Q1 would show up in Q2 data. And sure enough, the week of May 6th saw initial claims spike by +22K (SA). Note that this spike is an unusually large one. WARN Act announcements were up +26K in March (latest data) and the three-month moving average is up +175% from a year earlier. The chart below shows the percentage changes from a year earlier in WARN Act notices. Except for the COVID lockdown period, note the similarity in the current data to the Recessions of ’01 and ’08.

Other Recession Markers

· In March, Real Consumer Spending (adjusted for inflation) fell -0.3%. In February, that number was down -0.5% and has been down now in four of the last five months. January was responsible for all of Q1s consumer growth (likely weather related). The hand-off to Q2 was quite weak.

· The National Federation of Independent Businesses (NFIB) has a monthly Business Confidence Survey. In April, that index was 89.0, down from March’s 90.1, and below Wall Street’s overly optimistic consensus estimate of 89.7. What is of interest here is that this index was much higher entering the last four Recessions: March ’08: 90.1; September ’01: 96.2; July ’90: 97.9, and in the 1982-82 Recession chapter, the lowest level was 94.4.

· In March, there was a surge in credit card debt (+$17.6 billion), the fourth largest surge since 1968. Interest rates on credit cards are in excess of 25%. The average balance per household has risen to $3,500 in March from $3,000 a year earlier. Six percent of accounts are now 30 days late which equals the pandemic high. These kinds of increases usually occur when the consumer doesn’t have enough cash and is trying to maintain a standard of living. The increase far exceeds anything attributable to inflation. In our view, this is an ominous sign. It portends rising credit card delinquencies, something else the beleaguered banks will have to deal with.

· Everyone is aware of the recent bank failures. There is ongoing volatility in the equity values in that sector, especially among the Regional Banks. The chart above shows the percentage of banks tightening credit in Q4, Q1 and Q2. Note that, except for mortgages, banks were tightening credit prior to the recent banking fiascos and that they have clearly tightened credit standards much more since. This impacts economic activity in a relatively short period of time, like a quarter or two. We are seeing the reason for such tightening in the delinquency stats. Auto loan default rates, for example, were 2.0% in Q4. They rose to 17.3% in Q1 and are now at 27.5% (Q2). That leads us to believe that the rise in credit card debt is due to consumer stress.

· The Fed recently released its Q2 SLOOS (Senior Loan Officer Opinion Survey) and its Semi-Annual Financial Stability Report. The major takeaways from these reports are as follows:

- Commercial Real Estate (CRE) has become a major risk; Regional and small banks have significant exposure to this segment;

- Rate increases raise the risk that CRE borrowers will not be able to refi (a significant portion of these loans come due every year);

- There are concerns over elevated CRE loan/value ratios;

- Because of the turmoil in the banking sector, the pullback in lending will only exacerbate the oncoming Recession.

· Neither the financial media nor Wall Street commentators have raised much stink about the possibility of a default by the Treasury if the debt ceiling isn’t raised. At this writing, each party appears intransigent. According to Treasury Secretary Yellen, early June appears to be the deadline. There are tricks that can be tried, like minting a $trillion coin, or invoking the 14th Amendment to the Constitution which says the U.S. shall not default on it obligations. We don’t know what’s going to happen here. Like everyone else, we hope a compromise is reached before any events of default. What we do know is that the closer we get to the deadline, the more volatile the financial markets will become. Could be an opportunity for the brave.

Final Thoughts

We are still of the opinion that we have not seen the end to bank liquidity issues and we won’t see that end until the Fed lowers interest rates. Such an event still appears to still be several months off. Share prices of the Regional Banks continue to be volatile. With interest rates near zero for most of the years between 2008 and 2022, most banks have significant unrecognized losses in their loan and investment portfolios if these were marked to market. This is what 15 years of extreme monetary policies have wrought.

The inflation appears to now be dissipating. (It really was “transitory” after all!) As indicated above, we believe that over the fairly near-term, the annual rate of inflation will rapidly approach the Fed’s 2% backward looking year over year inflation goal.

We again refer our readers to the chart of the annual rate of change in M2 (cash + demand deposits + time deposits at banks). For the first time in the history of the series, its annual growth rate is negative. According to Milton Friedman and the Monetary School of Economics, this means deflation is in our future. Then consider that the Fed has raised rates at the fastest pace in modern history. As discussed above, this has caused the banking system to significantly tighten credit with the inevitable outcome being Recession.

Unfortunately, this particular Fed doesn’t yet see this outcome because they are fixated on lagging indicators (i.e., the backward-looking annual rate of inflation). For the economy, there is a simple solution that every economist is aware of, but that simply gets no traction because of the idea that human intervention can somehow fix the economy. That solution consists of two parts:

- Set interest rates at “neutral.” Economists agree (and so does the Fed) that this rate is around 2.5%. Then don’t touch it!

- Grow the money supply (M2) at the economy’s potential growth rate, somewhere near 2%.

Then simply step away! In a couple of years, inflation won’t be an issue and the economy will be growing at its potential. The words from some distantly remembered commercial keep ringing in our ears: “Set it and forget it!”

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here