Thesis

Grosvenor Capital Management (NASDAQ:GCMG) offers an attractive dividend but don’t count on capital gains just yet. Despite being a newly listed public company, it has a half-century of history and a well-established business.

About

The company, which refers to itself as GCM Grosvenor, was founded in 1971 by Richard Elden. According to its website, the firm launched “its first portfolio of hedge funds, becoming a pioneer of the multi-manager investment approach.” Think of his original portfolio as a fund of hedge funds.

It became publicly traded through a merger with CF Finance Acquisition Corp., a SPAC sponsored by Cantor Fitzgerald on November 18, 2020.In its 10-K for 2022, it called itself a global alternative asset management solutions provider that invests across a wide range of alternative assets. They include absolute return strategies, private equity, infrastructure, real estate, credit, multi-asset class, and ESG & Impact. Altogether, it manages $76 billion in assets.

Competitive advantages

The firm claimed three competitive advantages in the annual filing. First, it called itself a leader in alternative credit, and said its one-firm approach to the asset class gives it an advantage.

Second, based on its long history in the market (52 years), it believes it has ‘one of the most comprehensive sets of data in the industry.’ It also argues it has an information advantage that ‘spans the breadth of private markets and absolute return investment strategies’.

Given these edges, I suggest the company has at least a modest moat. Established clients are unlikely to go elsewhere without serious reasons or incentives, and prospective clients could justify working with it.

Competition

According to MarketVector, the top five alternative asset managers, along with their AUMs, are:

- Apollo Global Management Inc. (APO): $512.8 billion

- Blackstone Inc. (BX): $880.9 billion

- KKR & Co Inc. (KKR): $519 billion

- Ares Management Corp. (ARES): $378 billion

- Brookfield Asset Management Ltd. (BAM): $585.16 billion.

These firms are much larger than GCM Grosvenor; however, $76 billion in AUM does give it significant heft and prominence as an industry player.

Dividends

At the close of trading on November 7, 2023, GCM Grosvenor offered a dividend yield of 5.21%. That’s well above the S&P 500 average yield of 1.62% in December.

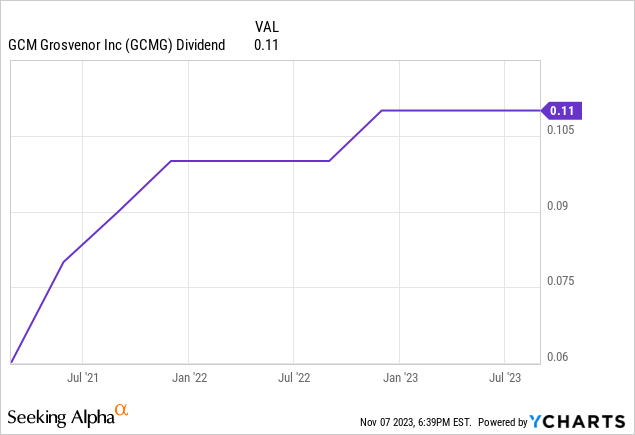

The firm began paying a dividend in the first quarter of 2021 ($0.06) and nearly doubled it by the end of the fourth quarter last year ($0.11).How does it determine its dividend? The company reported in its 10-K that it is based on fee-related earnings, less the cost of debt. Those earnings will have to push higher if there is to be more dividend growth.

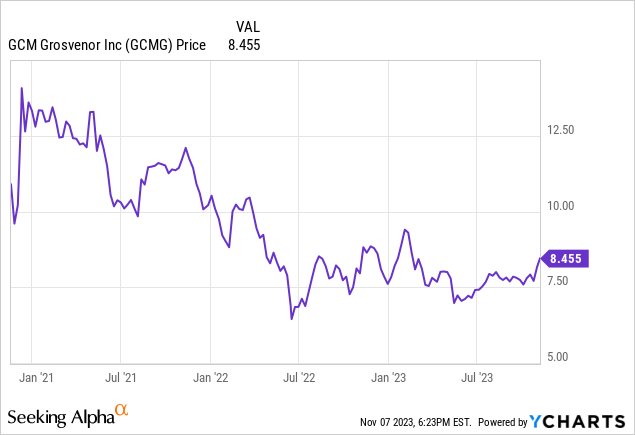

Indeed, the yield has been determined more by a falling share price than anything on the income statement. This chart shows the share price spiked up in late 2020 and then dropped precipitously before roughly plateauing:

The Seeking Alpha Quant system gives GCM Grosvenor a B- for dividend safety, a D+ for dividend growth, a B for yield, and a D- for consistency. I disagree with the rating for dividend growth, considering the firm nearly doubled it in less than two years.

Regarding the rating for dividend history, bear in mind that this company has only traded publicly for three years and thus has a short dividend history. In a related vein, the company repurchased $1.1 million worth of its own shares in Q2-2023 and upped its repurchase authorization from $90 million to $115 million. In 2022, it bought back more than 3 million shares.

Both the dividend and buyback initiatives indicate management and the board of directors are optimistic about the next few years.

Financials

The Q2-2023 income statement (GAAP) shows total operating revenue was $107.6 million, up 3% from the same period in 2022. At the same time, though, total operating expenses jumped from $84.5 million last year to $143.6 million this year. That caused net income to fall from $30.7 million in Q2-2022 to a net loss of $36.3 million this year.

The source of this reversal? Employee compensation and benefits surged from $61.4 million in Q2 last year to $114.9 million in the second quarter of this year. No explanation was provided in the quarterly report or during the earnings call. Higher staffing levels may suggest the company expects higher revenue levels ahead.

At the end of Q2-2023, GCM Grosvenor had total assets of $450.8 million and total liabilities of $551.7 million, including $389.2 million in long-term debt. Stockholders’ equity was $100.9 million.

From the cash flow statement, it had levered free cash flow of ($25.2) million at the end of the second quarter and unlevered free cash flow of ($21.9) million. Free cash flow per share was positive, at $0.59.

Valuation

GCM Grosvenor stands out among its peers with a Seeking Alpha Quant A grade for value. In contrast, its larger competitors appear to be seriously overpriced: Apollo: D, Blackstone: D+, KKR: F, and Ares: D-. while Brookfield does not have a Seeking Alpha Quant valuation grade.

The A grade suggests the company is cheaper than its peers in the sector and not just the biggest of them. The strength of the A grade comes from its A+ grade for EV/EBITDA (FWD) and EV/EBIT (FWD). It receives A grades for its Price/Sales (FWD) and Price/Cash Flow (TTM). The most negative grades come from P/E Non-GAAP (TTM) and Price/Book (FWD); both at D-.

Looking more closely, the EV in EV/EBITDA, or enterprise multiple, is based on a company’s market cap plus total debt and minus its cash and cash equivalents. The more familiar EBITDA is based on Earnings Before Interest, Taxes, Depreciation, and Amortization.

On the other hand, a valuation based on the P/E, or price divided by earnings, is less comprehensive; it only considers the share price and earnings. That distinction makes the overall A rating more significant in my mind, and gives me confidence the firm is undervalued, at least among its peers.

Risks

As a shareholder, you would have little influence on the direction of the company. As of February this year, a holding company owned by CEO Michael Sacks held Class C shares that controlled 75% of GCM Grosvenor’s voting shares (as reported in the 10-K). The remaining 25% of voting power rests with public shareholders. Note that Sacks’ shares have no economic interest, so 100% of returns go to the public shareholders.

Also, as a shareholder, you should not expect to profit from a takeover by another firm. The company’s charter and bylaws contain what’s usually called a poison pill; that makes it difficult for it to be bought by another company.

The company’s revenues may vary significantly since they depend on the amount of assets under management and the performance of its funds. It operates in an ‘intensely competitive’ environment. Barriers to entry are relatively low, and many larger and smaller companies operate in the space (more below). The five major firms listed above have size and scope on their side.

GCM Grosvenor invests its funds in other hedge funds and other opportunistic products. Hedge funds are distinct from other funds because they are subject to fewer operational rules and regulations, have less oversight, and can be riskier than traditional funds.

Opportunities

In its 10-K, the company reported that ‘substantially all’ of its current revenues come from management fees and incentive fees. It adds, though, that it intends to expand its business through additional products and services. That would include entering new lines of business and growing into new geographic markets. With the size of its current business, cross-selling could help launch these new products and services.

Apparently, there are opportunities for growth in the industry. In the annual filing, GCM Grosvenor cites a study by Prequin that expects alternative AUM to grow from $14 trillion in 2021 to more than $23 trillion in 2027 (Prequin is a data and intelligence service for the alternative assets industry). That growth estimate is based on several primary drivers, including:

- Growth in institutional wealth.

- Greater allocations to alternative investments.

- Alternatives are increasingly used in traditional portfolios.

- An increasing interest in ESG and Impact Investing.

- GCM Grosvenor claims it is “one of the few solutions providers globally with breadth and flexibility of execution across a broad spectrum of alternative investment strategies… and implementation strategies.”

But, the same Prequin study expected that the number of active investment firms will grow by 21%, from 28,000 in 2018 to 34,000 in 2023. That suggests there will be little low-hanging fruit and stiff competition.

As reported above, GCM Grosvenor has been in business 52 years and has built up “‘one of the most comprehensive sets of data in the industry.” That’s a strong competitive advantage in the race to act on these drivers.

In the short term, it expects to see material improvements. The firm advised, in its Q2-2023 earnings report, “Importantly, during the second quarter, the fundraising environment began to loosen up just a bit. Our second quarter fundraising of $1.5 billion was up about 50% from the first quarter.” In addition, it expected that second-half fundraising would top that in the first half of 2023.

Conclusion

GCM Grosvenor is a new player in the public markets despite being in the same business for more than half a century. Going public, in itself, suggests the company has growth ambitions, and I see no reason why it cannot achieve them.

In the meantime, it offers income investors a strong and sustainable dividend-if they buy now. If earnings and the share price grow, as I expect, in the next year, then capital gains also become a possibility. But don’t bet anything on that until there are positive signals.

We are looking at a mature, solid firm with a good outlook that has been a hidden gem so far.

Read the full article here