Thesis

The Gabelli Dividend & Income Trust (NYSE:GDV) is a flagship equity CEF from the Gabelli fund family. As per its literature:

Under normal market conditions, the Fund invests at least 80% of its assets in dividend paying or other income producing securities. In addition, under normal market conditions, at least 50% of the Fund’s assets will consist of dividend paying equity securities. In making stock selections, the Fund’s investment adviser looks for securities that have a superior yield and capital gains potential.

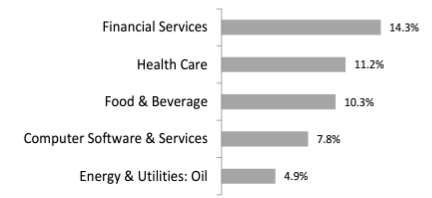

The fund falls in the ‘Large Cap – Blend’ Morningstar categorization, and due to its focus on dividend stocks, the vehicle has a very large Financials sectoral exposure, which currently sits at 14.3%.

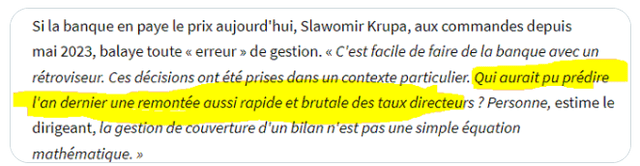

Financials, in particular regional banks, have been a sector to avoid this year, with a cascade of problems embedded in the capital structure. The violent rise in interest rates across the globe has put significant strain on banks’ ‘held to maturity’ securities, with the new Soc Gen CEO actually making the shocking statement of “Who could have predicted such a rapid rise in central bank rates?” in a recent internal memo:

Soc Gen CEO Quote (Memo)

At a first glance GDV might have too much concentration to a sector with embedded interest rate risk, but a closer inspection of the collateral gives us a different perspective.

Holdings and industry classification

When we look at the CEF’s sectoral allocation we get the following industry parsing:

Top Sectors (Fund Fact Sheet)

Financial Services is the top sector, followed by Health Care and Food & Beverage. However, when we have a look at the top names in the fund, we can notice a slight discrepancy to our expectations:

Top Names (Fund Fact Sheet)

Mastercard (MA) is a top holding in the fund with a 2.3% weighting, and is classified in the Financial Services sector. However, the company makes its money out of payment processing, and does not have any of the risks associated with a true lending institution and its associated asset/liability management. A retail investor might be surprised to find out that there is more than meets the eye to the sectoral classifications. Firstly, there are 11 main industry sectors as established by GICS:

The Global Industry Classification Standard (GICS) is a method for assigning companies to a specific economic sector and industry group that best defines its business operations. It is one of two rival systems that are used by investors, analysts, and economists to compare competing companies. A company’s industry classification is key to an investor whose aim is to create a diversified portfolio or to identify competitors of a company in the same industry. The top of the GICS hierarchy defines 11 economic sectors. These are further divided into 24 industry groups, then into 68 industries, and finally into 157 sub-industries.

While the likes of Mastercard and Visa fall in the Financials GICS classification, they have a specific industry, namely ‘Payment Processing’, which better reflects the way they generate net income.

Furthermore, systemically important banks such as JP Morgan have been a net beneficiary of the regional banks crisis, ending up purchasing for very little the likes of First Republic. In fact more than two thirds of the companies classified as ‘Financials’ here are either systemically important banks or companies which generate their net income outside the traditional banking lending mechanics. To that end the fund contains Berkshire Hathaway Inc. (BRK.B) which is also classified as ‘Financials’ from a GICS standpoint.

Premium/discount to NAV

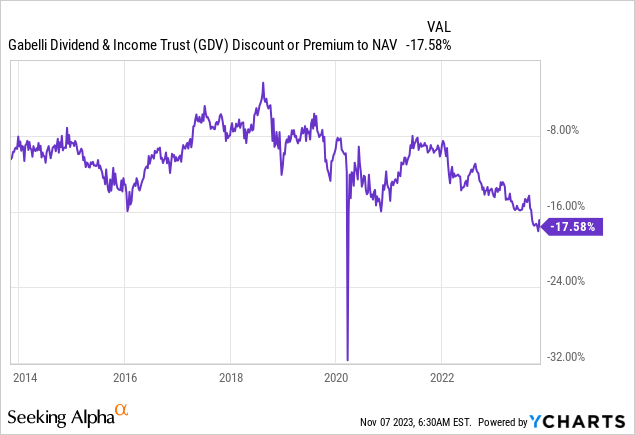

The fund is currently trading at a very large discount to its net asset value:

Looking back a decade we can observe the discount is towards the bottom of the range, with the CEF having traded at a -8% discount as recently as 2022.

From a structural standpoint this is an ideal time to purchase the CEF, with a very significant discount to NAV, and the potential for a 10% gain from the discount narrowing once the fund’s performance normalizes. We expect that normalization to occur now, with the Fed on track to have ended their rates increases.

Performance

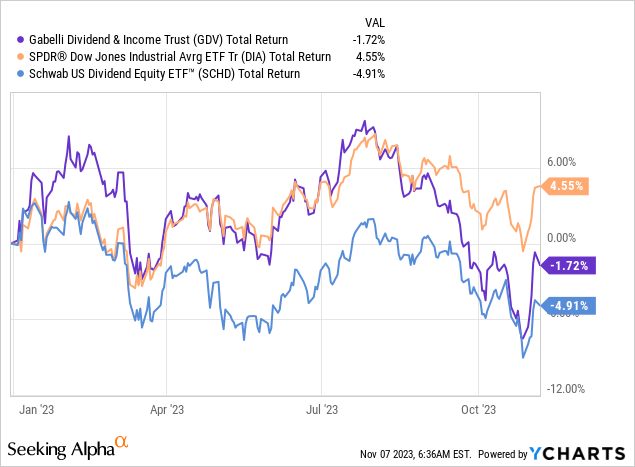

The fund is up this year, beating the dividend focused Schwab US Dividend Equity ETF (SCHD):

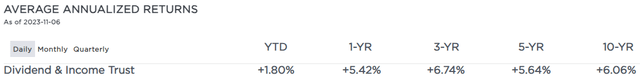

Long term the CEF has delivered, with robust total returns:

Annual Returns (Fund Fact Sheet)

Even after a tough 2022 and 2023, the CEF has a robust 10-year average annualized return of 6%.

Analytics

- AUM: $1.8 billion.

- Sharpe Ratio: 0.36 (3Y).

- Std. Deviation: 19.7 (3Y).

- Yield: 6.8%.

- Premium/Discount to NAV: -17.5%.

- Z-Stat: -1.96.

- Leverage Ratio: 14%.

- Effective Duration: n/a

- Composition: Dividend Equities

Leverage composition

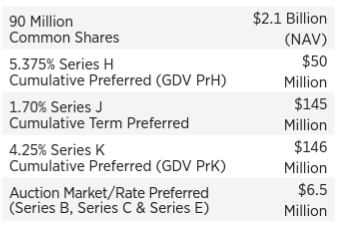

Many CEFs have been hurt in 2023 by their leverage compositions. CEFs broadly speaking, lever up either via bank funding facilities or preferred shares. Bank facilities are floating rate, meaning they see an increase in the cost of funds as rates move up. Conversely preferred equity is a term funding instrument by locking in the cost of funds upon issuance. The CEF’s leverage comes mainly from preferred equity:

Leverage (Fund Fact Sheet)

The fund has three series of regular preferred shares outstanding, plus a series of auction rate preferred. Auction Rate preferred securities are though floating rate via their structure, however they represent only a small piece of the CEF’s capitalization:

Auction rate securities (ARS) are debt or preferred equity securities that have interest rates that are periodically re-set through auctions, typically every 7, 14, 28, or 35 days. ARS are generally structured as bonds with long-term maturities (20 to 30 years) or preferred shares (issued by closed-end funds).

Conclusion

GDV is an equities closed end fund. The vehicle focuses on dividend producing stocks, and has financials as its largest sectoral exposure. Despite its headline financials risk, the CEF actually contains many payments processors and large conglomerates such as Berkshire, which are categorized as ‘Financials’ as per GICS.

The CEF is trading at a historic wide -17% discount to net asset value, which offers a potential 10% upside if it narrows to its average range. Dividend equities have been pummeled this year on the back of higher rates, but are set to benefit from the current Fed neutral stance. With attractive seasonality factors currently in play, we believe GDV offers a compelling value proposition at the current price point.

Read the full article here