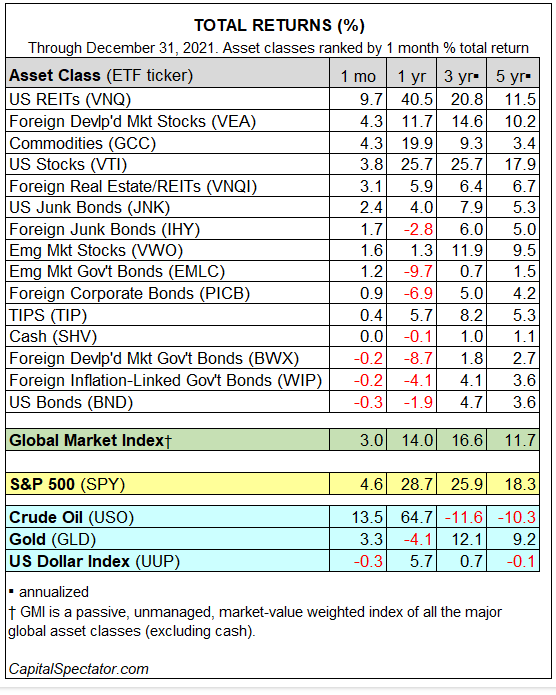

In 2021 the world was recovering from the Covid-19 pandemic, businesses were beginning to reopen as commerce slowly resumed, and the stock market went bonkers, with the SPDR® S&P 500 ETF Trust (SPY) returning 28% that year. This chart from the Capital Spectator shows the total return ranked by major asset classes for 2021.

Capital Spectator

As a result of increasing investor demand and a hunger for high yield income investments in a low interest rate environment, a dozen closed-end funds (“CEFs”) did IPOs in 2021. Those 12 funds included:

- PIMCO Dynamic Income Opportunities Fund (PDO).

- RiverNorth Flexible Municipal Income II (RFMZ).

- BlackRock Innovation and Growth Term Trust (BIGZ).

- Nuveen Core Plus Impact Fund (NPCT).

- Neuberger Berman Next Generation Connectivity Fund Inc (NBXG).

- Western Asset Diversified Income Fund (WDI).

- Thornburg Income Builder Opportunities Trust (TBLD).

- Pioneer Municipal High Income Opportunities Fund Inc. (MIO).

- BlackRock ESG Capital Allocation Term Trust (ECAT).

- MainStay CBRE Global Infrastructure Megatrends Term Fund (MEGI).

- Guggenheim Active Allocation Fund (GUG).

- Nuveen Variable Rate Preferred & Income Fund (NPFD).

As it turns out, 2021 was not a good year to launch a new publicly listed CEF based on the summary of results that I have compiled in the table below.

|

Ticker |

Fund Category |

Inception |

Discount* |

Yield* |

Total Return since inception |

|

PDO |

Taxable Global Fixed Income |

1/29/2021 |

0 |

12.90% |

-17.80% |

|

RFMZ |

Taxable Municipal Income |

2/24/2021 |

-13.76% |

8.38% |

-25.88% |

|

BIGZ |

US Equity |

3/26/2021 |

-14.67% |

8.20% |

-59% |

|

NPCT |

Taxable IG Fixed Income |

4/27/2021 |

-12.79% |

10.50% |

-38.90% |

|

NBXG |

US Equity |

5/25/2021 |

-17% |

11.90% |

-36.47% |

|

WDI |

Taxable Multi-Sector FI |

6/25/2021 |

-11.50% |

12.86% |

-18.30% |

|

TBLD |

Hybrid – Global Allocation |

7/30/2021 |

-13.26% |

8.45% |

-13.47% |

|

MIO |

Taxable Municipal Income |

8/6/2021 |

-14.45% |

5.15% |

-45% |

|

ECAT |

Hybrid – Global Allocation |

9/28/2021 |

-11.10% |

10% |

-11.95% |

|

MEGI |

Equity – Infrastructure |

10/27/2021 |

-16.50% |

12.70% |

-30.47% |

|

GUG |

Hybrid – Global Allocation |

11/26/2021 |

-11.80% |

10.27% |

-17.70% |

|

NPFD |

Fixed Income – Preferreds |

12/15/2021 |

-13.84% |

6.60% |

-28.80% |

|

Averages |

-12.56% |

9.83% |

-28.65% |

As you can see, none of the dozen funds offered a total return better than -11% since inception, with only 2 of the 12 funds returning better than -15%.

All twelve funds trade at wide discounts to NAV, with the average discount at -12.5%. Most of the dozen CEFs on the list offer high yield income, with annual yields as high as 12.9% in the case of PDO and the average for the group at almost 10%.

The hybrid funds with global allocations, ECAT, TBLD, and GUG, have performed about the best in terms of total return (perhaps in part because they did IPOs later in the year), followed by the higher yielding taxable fixed income funds, PDO and WDI. The municipal fixed income funds and the equity funds have performed the worst of the bunch.

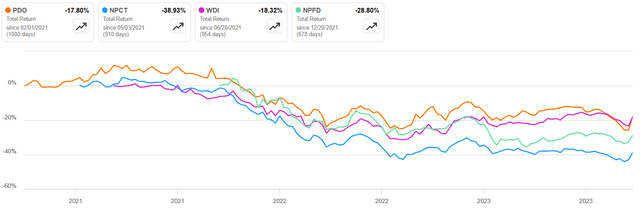

As you can see in the chart below comparing the 3 global allocation funds, each has tracked about the same over the past 18 months or so since their inception with a recent recovery and change in direction now becoming apparent at the end of 2023.

Seeking Alpha

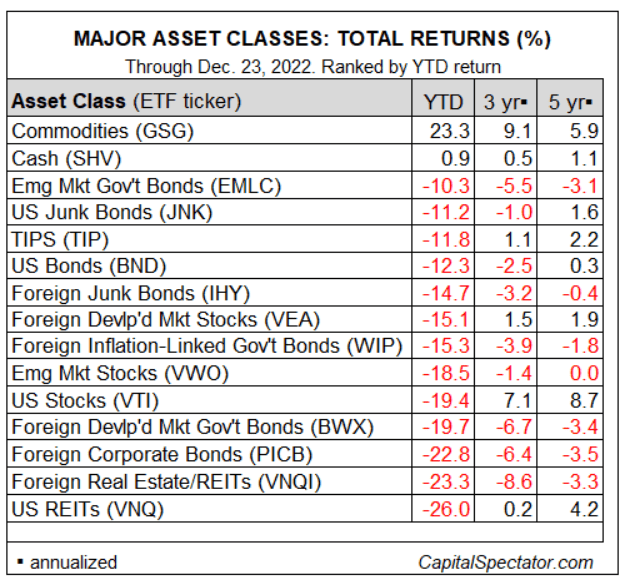

In 2022, the market pretty much went downhill for just about every asset class from stocks to bonds to municipals and real estate investment trusts, or REITs. Only cash and commodities returned positive performance in 2022, as illustrated in this updated chart from Capital Spectator as shown in Review of Major Asset Classes for 2022.

Capital Spectator

The resulting impact on the dirty dozen 2021 CEFs is that they spent most of 2023 trying to recover from lost ground in 2022. The fixed income funds, PDO, WDI, NPCT, and NPFD (to a lesser degree with mostly preferred stock and corporate bond holdings) have suffered from rising bond yields which has the effect of negative pricing on the fixed income holdings in those funds while driving up the distribution yield. Holders of those funds have received strong income distributions while suffering unrealized losses on their portfolio value. Again, in the case of these 4 funds there does appear to be some recovery now starting to occur as we reach the end of 2023.

Seeking Alpha

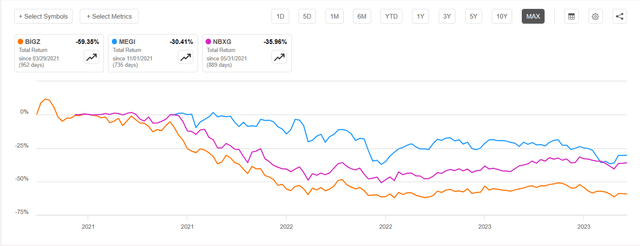

The equity funds including BIGZ, MEGI, and NBXG were all hit especially hard in 2022 and have not recovered as much in 2023. MEGI has struggled to recover from its downturn in utility holdings (which have been hit especially hard by rising interest rates over the past 18 months or so) despite increasing the dividend in August of this year.

Seeking Alpha

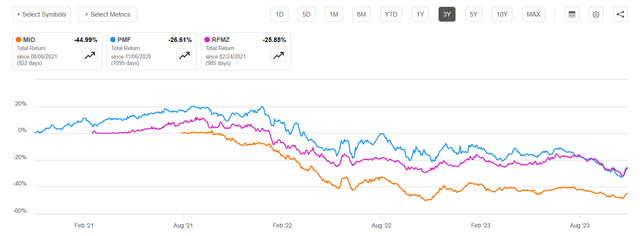

The Municipal Fixed Income funds, MIO and RFMZ have also struggled since inception with the Municipal Fixed Income asset class performing quite poorly lately, while paying a lower yield distribution than the other CEFs in the list. Using PIMCO Municipal Income Fund (PMF) as a benchmark for the municipal asset class, we can see that returns have been sub-par for that fund as well over the same period.

Seeking Alpha

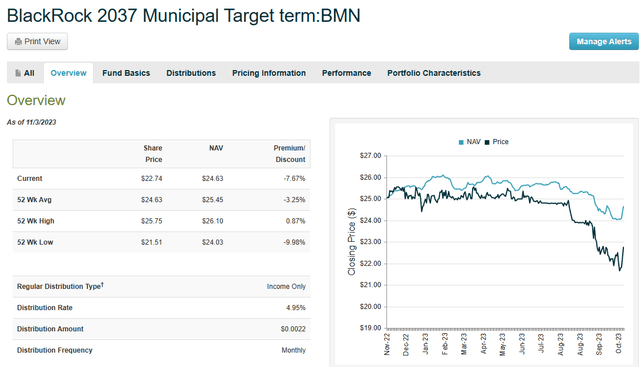

One of the four newly listed CEFs in 2022 was another municipal fund, and this time it was Blackrock’s turn to attempt to start a new municipal fixed income fund at an inopportune time. The BlackRock 2037 Municipal Target Term Trust (BMN) had an inception date of 10/28/2022 and trades at a discount to NAV of -7.67% while yielding 4.95%. As you can see from the overview chart on CEFConnect, the fund has not performed well since its inception, although it also appears to be turning the corner now in early November, a year after inception.

CEFConnect

As income investors, it is important to know when to buy and when to sell or trim positions that are not working out. While most of the poor performance has been due to a widening of discounts in the dirty dozen funds that did IPOs in 2021, the timing was bad and could not have been predicted at the time they were conceived. Nobody knew in early (or even late) 2021 that Russia would invade Ukraine or that inflation would soar causing interest rates to skyrocket.

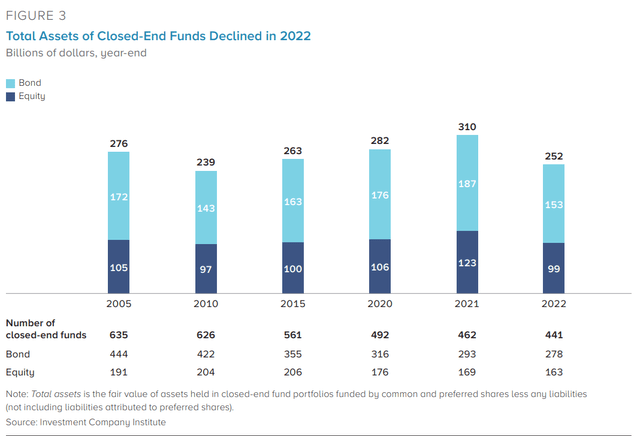

Investment Company Institute

Investor demand for CEFs has plummeted since the end of 2021 with many CEFs dissolving or merging in 2022 and 2023. As of Q3 2023 there were a total of 434 listed CEFs with a market cap of $202 billion. Total fund assets at the end of 2022 were $252 billion. Total CEF assets at the end of 2022 decreased 19% from the previous year.

Figure 3 (above) from an ICI Research Perspective dated May 2023 clearly illustrates the shrinking CEF market over the past 15 to 20 years.

Another “honorable mention” is a CEF from PIMCO that had a January 2022 inception date. The PIMCO Access Income Fund (PAXS) is another taxable fixed income fund that currently trades at a discount of just -1.3% and yields 12.8% after increasing the dividend in October 2022. The total return since inception is -13.23% as shown using the Charting tool in Seeking Alpha. With a slightly better total return than its sibling fund, PDO, PAXS has better NII coverage as well and is poised to outperform going forward as I suggest in my recent article covering the fund, PAXS: The Best PIMCO Taxable Bond CEF To Buy Now.

Seeking Alpha

Summarizing my Thoughts

For several years now, I have been investing in CEFs to take advantage of the high yield income that they offer and reinvesting those distributions each month to buy more shares to compound and grow my future income stream. As the market has been in a mostly bearish pattern since the end of 2021, this has allowed me to increase my share count at a lower cost per share while increasing the yield on my investment. The downside is that unrealized losses have been piling up, which is a concern if it continues.

It appears that the market has started to turn back toward a more bullish pattern just in the past week, as the Federal Reserve paused rate hikes (for now at least) and bond yields started to come down. Whether that bullish pattern continues into 2024 is anyone’s guess, but for now I continue to hold the CEFs that I do own and will continue to collect and reinvest the monthly distributions into more high yield holdings and keep growing my future “river of cash.”

Of the 14 CEFs that I mentioned in this article, I currently own shares of 4 of them: PDO, PAXS, MEGI, and WDI. Thanks for reading and please leave comments below if you have anything to add or share.

Read the full article here