Costco Wholesale Corporation (NASDAQ:COST) is one of the most beloved retail stores in America.

With an extremely popular membership that is nearing 120 million loyal customers, the warehouse-style retailer is only smaller (in market cap) than 3 other listed retail companies: Amazon.com, Inc. (AMZN), Walmart Inc. (WMT), and The Home Depot, Inc. (HD).

Despite the company’s size and premium valuation, management has proven that they can churn out consistent profit & growth, which, in our mind, makes the company a great long-term hold.

Today, we’re breaking down Costco’s prospects, and arguing why the company isn’t worth selling, even at its rich multiple.

Sound good? Let’s dive in.

Financial Results

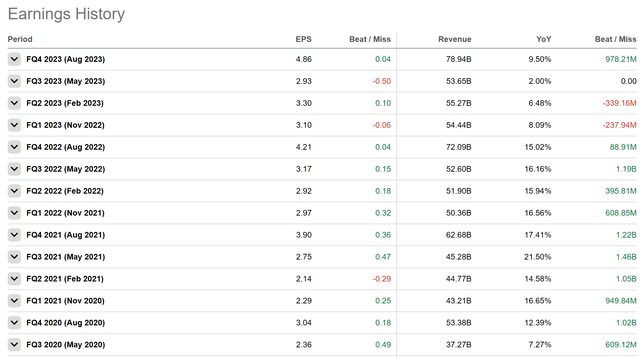

Costco recently reported earnings for Q4, and the results were solid. The company earned its highest-ever EPS of $4.86, which beat estimates by 4 cents. The company has a history of beating regularly, which you can see here below, although the track record hasn’t been perfect:

Seeking Alpha

The misses earlier in the year, some of which were on the EPS front and some of which were on the revenue front, are mostly due to inflation and consumer spending habits, which have been hurt as a result of the weaker overall economic period we’ve been experiencing.

That said, YoY revenue growth in Q4 was still in the high single digits, around 10%.

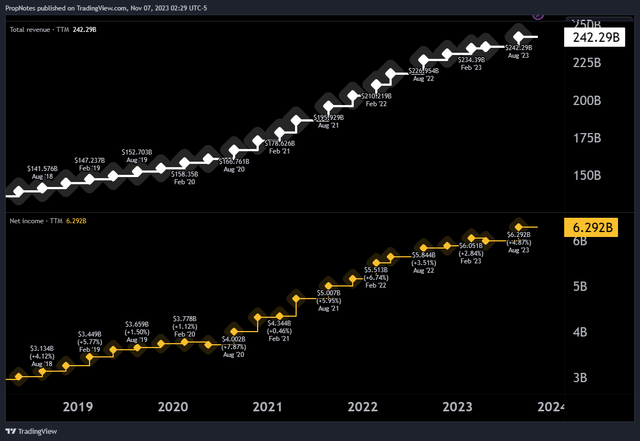

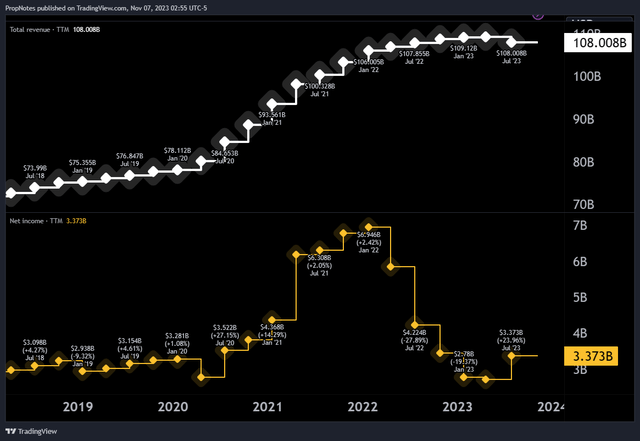

Zooming out a bit, we can see that these trends of growth in top and bottom line results have been consistent, increasing like clockwork over time:

TradingView

Since late 2018, COST has grown top line TTM sales from $141 billion to $240 billion, which is a CAGR of 11%, absolutely astonishing for a retail company at this scale.

Additionally, TTM net income has grown in that time from $3.1 billion to $6.3 billion over those five years, which represents an even more impressive 15% CAGR in profit.

These are the traits of a company that has a significant, durable moat, an incredible value proposition, and top-flight brand recognition.

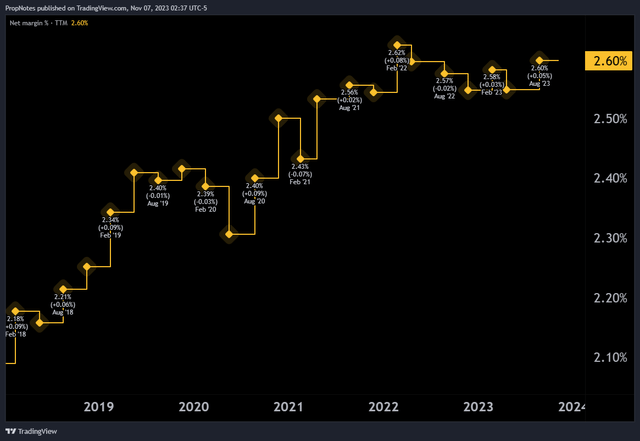

Additionally, this means that not only has the company been increasing the scope and scale of its business, but management has actually been increasing margins consistently as well, something which takes execution at an extremely high level:

TradingView

Since late 2018, net income margins have increased 40 basis points from 2.2% to 2.6%, which has fueled the strong aforementioned results. While this may sound low for those who are used to seeing much higher margins in the tech or consumer discretionary sector, low margins like this are common in the staples retail space.

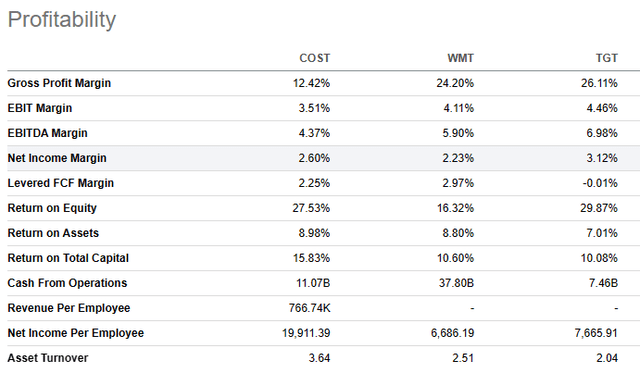

Here’s how these margins compare to peers like WMT and Target Corporation (TGT):

Seeking Alpha

Gross margins are lower as a result of the company’s volume-based business model, but after all expenses, COST has competitive margins with peers who operate in the space at scale.

Overall, we’re very happy with management’s track record of execution here.

Finally, the balance sheet is in pristine shape. With a current ratio above 1 and only $5 billion in long-term debt, the company’s leverage ratios are extremely low and present no existential risk to the business, in our view.

The Valuation

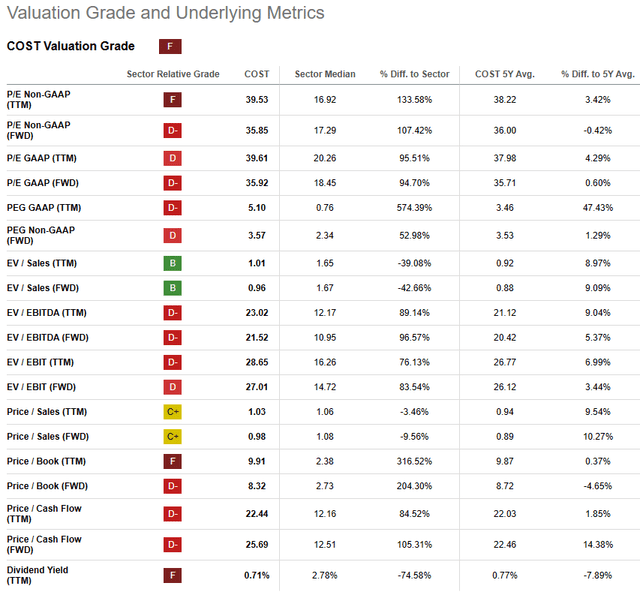

While execution and results have been top-tier, the company’s valuation is similarly ‘premium’, something which has been noted by many other analysts here on Seeking Alpha.

No matter how you slice it, the company looks expensive.

From a top-down view, the company has received a Seeking Alpha Quant Value Rating of ‘F’:

Seeking Alpha

We think this is a bit unfair, as COST shouldn’t be valued on its dividend yield or book value. Rather, for a growing, profitable company like Costco, we think measuring P/E and EV/EBITDA is a much better point of comparison.

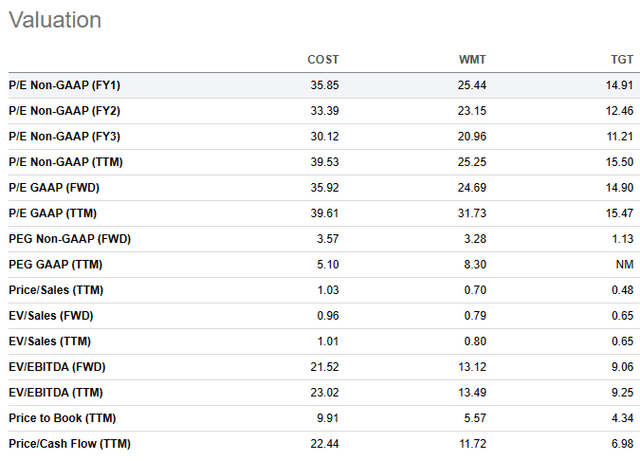

On these fronts, the company is more expensive than its peers, but not overly so:

Seeking Alpha

While the P/E remains nominally elevated vs. the average S&P 500 component, and above companies like WMT or TGT, COST’s results have been better. TGT, for its part, has seen very bumpy TTM profits over the last few years, which has dented the company’s historically premium valuation:

TradingView

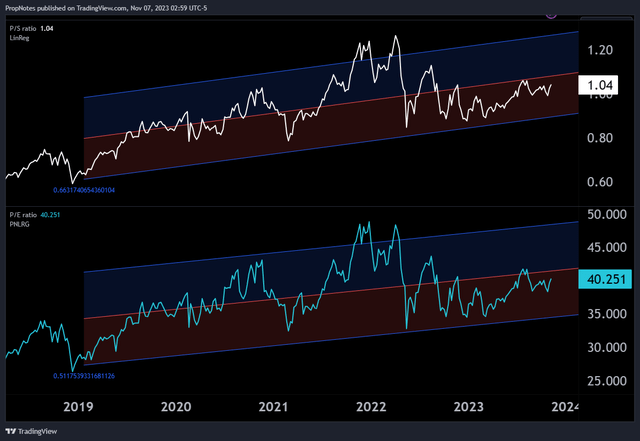

Prior to 2022, the company traded above 1x sales, which is where COST now sits, which gives some comparable context and makes the valuation seem a bit less over-the-top.

Additionally, COST itself isn’t trading at a relative premium to its own historical valuation. AKA, you’re not getting an unattractive multiple compared to where the company has previously traded:

TradingView

Here, you can see that COST’s average multiple has been slowly increasing over the last 5 years as results have exploded, and within that context, COST shares are actually trading below their long-term average on both top and bottom-line results.

Yes, a PE of 40 looks expensive, but the multiple is actually within the lower standard deviation band of the linear regression, which means that now could be an attractive time to buy, even with the nominal concerns.

Taken together, the incredible execution and results, and below-average multiple make us think that this is a reasonable time to build a position.

At the very least, if you’re already an investor, you shouldn’t be selling your shares on multiple concerns just yet.

Risks

That said, there are a number of risks in this thesis to consider.

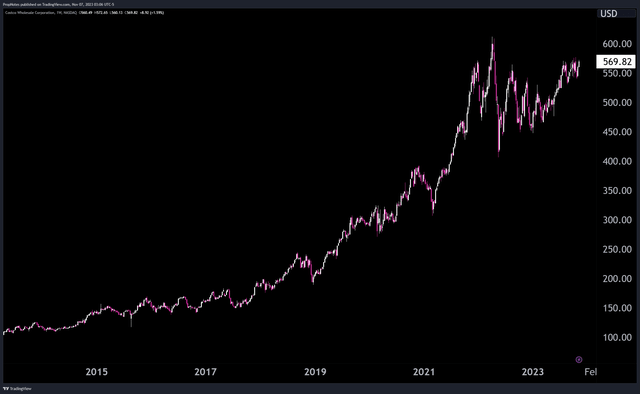

First, the company has what we can only describe as a ‘perfect’ chart:

TradingView

There are no big drawdowns over the last decade, and the company is trading near all-time highs.

While this does show the resiliency and consistency of the company’s fundamental results and business model, and it is typically a good idea to ‘add to your winners’, it also means that the company has a lot of room to the downside should the business stumble. The stock would likely lose its premium valuation, and the company could pull a “Target”:

TradingView

This doesn’t seem likely due to the differing nature of COST’s core inventory proposition (more staples), but it’s a concern nonetheless.

Thus, from a technical / sentiment perspective, there are some risks.

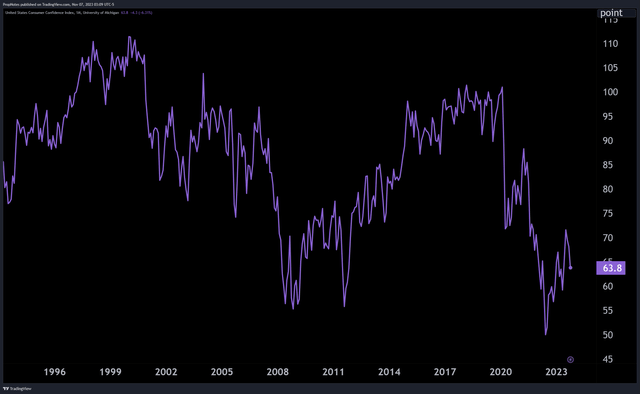

Additionally, COST could face further headwinds with the consumer. Sentiment still remains depressed, and as the yield curve begins to steepen again, that’s when we’ve historically seen recessions manifest in the economy:

TradingView

Thus, a poor macro environment could harm results and higher-for-longer interest rates could hurt the multiple.

Summary

While there are some risks, we think that the company has shown its ability to weather them. The company’s strong execution and historically ‘reasonable’ valuation make us confident about COST’s status as a great long-term investment, and we’re happy to rate this company a “Buy”, even with the heightened multiple.

If you’re already an investor, congratulations! Don’t let the valuation scare you into giving up on this great company that is poised to continue along its track record of success.

Cheers!

Read the full article here