Investment thesis

Our current investment thesis is:

- Burberry has experienced a decade of soft growth and financial improvement, but the recent recruitment of Daniel Lee looks to be a game changer (Responsible for growing Bottega Veneta rapidly at Kering).

- His first collection was much anticipated given the mammoth brand he has taken over. The assessment was generally positive and was praised for his return to British Heritage. We believe he could enhance Burberry’s trajectory, supported by near-term demand growth in China.

- Margins continue to improve, as brand strength has allows the business to achieve impressive sales at premium prices.

- Relative to its peers and historical average, Burberry looks strong while being priced attractively.

Company description

Burberry (OTCPK:BURBY) is a British luxury fashion house founded in 1856. The company designs, manufactures, and sells clothing, accessories, and beauty products for men, women, and children. Burberry is renowned for its iconic trench coats, distinctive check pattern, and high-quality craftsmanship. With a strong presence in both retail and wholesale channels, Burberry operates globally and caters to a diverse customer base.

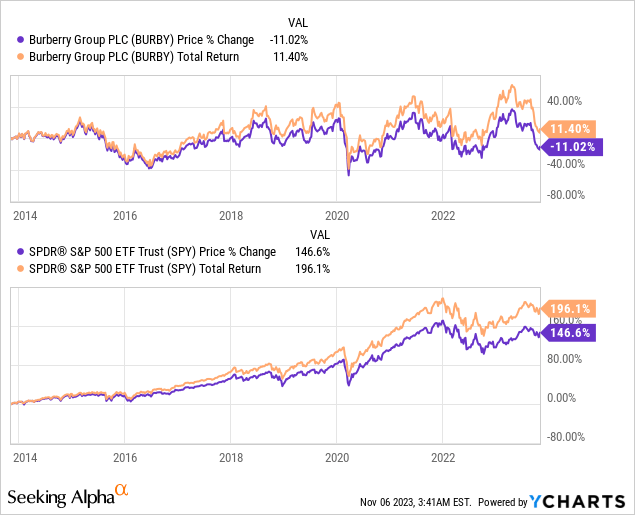

Share price

Burberry’s share price has performed poorly in the last decade, as soft growth has failed to propel the business forward. Despite this, Burberry has remained financially resilient, presenting an opportunity for improved performance.

Financial analysis

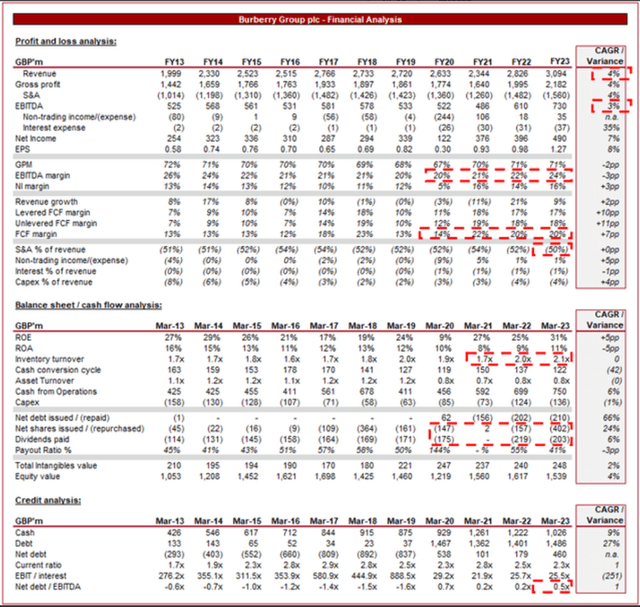

Burberry financial analysis (Capital IQ)

Presented above is Burberry’s financial performance for the last decade.

Revenue & Commercial Factors

Burberry has grown revenue at a CAGR of 4% across the last 10 years, only marginally above the inflation rate during this period. Growth has been relatively robust, when accounting for the FX impact, but has been underwhelming. Importantly, the company has recovered from the Covid-19 slump and is on an improved trajectory. The company is highly reliant on a single brand in a cyclical industry.

Business Model

Burberry offers a wide range of luxury fashion items, including apparel, accessories, footwear, and beauty products. The brand combines classic British aesthetics with innovative designs, appealing to fashion-conscious consumers. The company is famed for its Check and Trench Coats, initially developed for soldiers.

Burberry operates its own retail stores, e-commerce platform, and concessions, providing direct customer engagement and control over the brand experience. This is critical for a luxury brand, as consumers expect a premium in-store experience and a continuation of the brand’s aesthetic. Additionally, the company distributes its products through wholesale partnerships, both online and in stores.

Burberry is one of the oldest brands in the world, reflecting a successful combination of its timeless designs and the ability to continually innovate to meet changing tastes. Burberry’s rich heritage, iconic designs, and distinctive brand identity are comparable to the most elite brands, even if growth is not necessarily at a high level. This provides some protection to shareholders, as it allows Burberry to maintain strong pricing, as well as a smooth revenue curve. This is critical in the fashion industry as tastes can change quickly, meaning brands face periods of popularity and attractiveness over time.

Given this factor, a clear weakness of Burberry relative to main its fashion peers is its reliance on one brand. LVMH (OTCPK:LVMHF), for example, owns a wide variety of brands, creating the benefit of diversification and allowing the business to always be at the forefront of fashion, regardless of brand.

Burberry’s extensive global presence, including its own stores, wholesale partnerships, and online platforms, allows it to reach a wide customer base and capture market opportunities. This is a key success factor as in the luxury segment, consumers care more about seeing a product in person, rather than just buying online.

Luxury Fashion Industry

Luxury fashion brands compete primarily on the following factors, brand reputation, product design, quality, pricing, and customer experience.

Burberry faces competition from other elite luxury fashion brands such as Gucci (OTCPK:PPRUF), Louis Vuitton, Prada (OTCPK:PRDSY), Dior, and Hermès (OTCPK:HESAY).

The growing popularity of streetwear and casual fashion has influenced consumer preferences and challenged traditional luxury brands, who historically focused on a cleaner, upmarket look. We believe Burberry transitioned well in response to this, led by Riccardo Tisci, its former head designer. The issue is that a rising tide lifts all and Burberry was unable to gain a noticeable amount of market share during this period.

Following the Riccardo Tisci period, Burberry poached the hyped young designer Daniel Lee, who led Bottega Veneta to substantial growth within Kering. Daniel Lee is already instilling his image of Burberry, having changed the logo and current designs, drawing inspiration from a different time in Burberry’s history. It is too early to judge Daniel Lee’s ability to drive growth, but we can see consider how fashion journalists are digesting his first collection.

Lee’s debut was one of the most anticipated for the Autumn/Winter 2023 season. People have high hopes for Daniel Lee, because he has been responsible for the impressive turnaround at Bottega Veneta. His strength in leather goods and handbags is something that people are most excited about because this is the category that Burberry has been lagging in for years.

It’s all strikingly contemporary, with motifs borrowed from Burberry’s Great British heritage.

Some objectively handsome pieces are obscured by the maximalist styling, presumably by intent.

I genuinely do like Daniel Lee’s Burberry debut. It’s a little messy, with more ideas than curation, but plenty fun. Evocative stylistic codes have bled over to Burberry from Lee’s work at Bottega Veneta

Lee’s first collection wound up a voyage through ideas and ideals of Burberry

The House has needed an “it” bag that the glitterati will clamber for, and Lee delivered several to choose from.

What stood out the most, above all else, was Lee’s ability to acknowledge what really sells for Burberry.

Among the whimsical wording of collection reviews was a general positivity of Daniel Lee’s first collection and importantly, the direction he’s taking the brand. High fashion is seeking British heritage and Daniel Lee is providing his spin on it. Interestingly, we noticed a recurring reference to quiet minimalism and contemporary designs, among the eccentric approach. The fashion industry is seeing hype in the “quiet fashion” trend, with fewer logos and prints, and a greater focus on tailoring and fit.

The direct-to-consumer channel represents a key area of development to drive financial improvement. with increasing pressure on brands to market their products, as opposed to “shelf-space” in retailers, we are seeing brands bring consumers in-house, a historical area of strength for Luxury. Currently, Burberry sells 81% of its products through its own retail footprint, a supreme level supporting its high margins. The target is to increase this further, gaining further control and margins.

China is the largest luxury market in the world, forcing brands to adapt to the market through marketing and design influence, in order to win sales. Burberry has performed well to capture this market, with 43% of its sales to APAC. With China recently seeing the back of Covid-19, we believe sales will pick up in the coming quarters.

Social media influencers and online platforms have become significant drivers of brand awareness, customer engagement, and purchasing decisions. Burberry’s strength as the premier British brand allows it to access a range of celebrities across British culture, including the likes of Shygirl, Skepta, Naomi Cambell, Stormzy, and Raheem Sterling, all of whom have a strong global following.

Economic & External Consideration

Burberry’s performance has been partially unfazed by the current economic weakness, with successive years of strong growth. This is a reflection of the financial strength of its core demographic, contributing to resilient demand. We expected this to occur when we analyzed LVMH last year, suggesting luxury resilience. Since then, LVMH’s share price is up 20% (over 40% at its peak).

Burberry’s most recent financial results have been incredibly impressive, with comparable store sales of +18%, driven by growth across all geographies, principally from China (+46%). Further, its product growth has been impressive, with Outerwear up +36% and Leather goods up +13%. Both implying momentum building in the brand in the lead up to Daniel Lee’s entry (Collection launching in store in Sep23).

This should allow Burberry to perform well relative to other industries until economic conditions improve, at which point we expect growth to really accelerate, at least in the short term.

Margins

Burberry’s margins are fantastic. The company currently has a GPM of 71%, EBITDA-M of 24%, and a NIM of 16%. Margins have improved in the last 5 or so years, reflecting improved pricing power, efficiency gains, and reduced operational spending.

Our view is that further margin improvement is possible, especially as the business transitions to more DTC sales, however, this will not be substantial YoY. The critical factor is that as a brand strength, reduced discounting is required, which materially drives margins.

Balance sheet & Cash Flows

Burberry is conservatively financed, with a ND/EBITDA ratio of 0.5x. This gives the business flexibility to change strategy if required. We have always felt an M&A strategy could transform Burberry, acquiring smaller fashion houses as part of a wider (British only?) Fashion Group.

Inventory turnover has gradually improved for several years, implying better inventory control over demand, allowing for an improved CCC.

Given this, alongside the improved profitability, Burberry’s FCF-M has consistently reached 20% in the last 6 years. We believe the company should normalize at a >18% level, which is highly lucrative.

Outlook

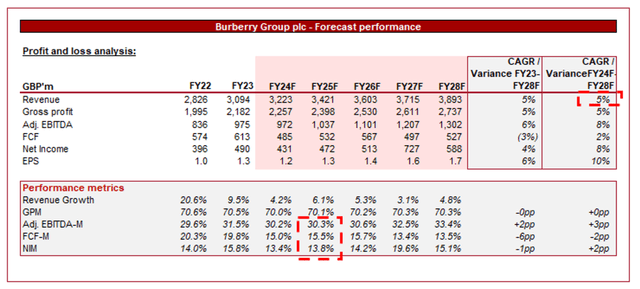

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting healthy growth in the coming years, although nothing groundbreaking. Given the track record of soft growth, this appears reasonable in our view. We believe FY23-FY25 could exceed this if Daniel Lee’s approach does materialize in the vein of his time at Bottega.

Margins are also expected to improve, as Burberry’s pricing strategy and approach continues to yield benefit. This allows for a strong EBITDA trajectory.

Industry analysis

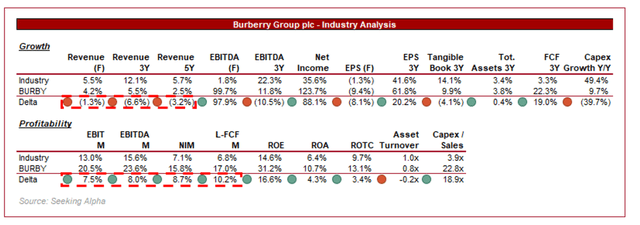

Fashion industry (Seeking Alpha)

Presented above is a comparison of Burberry’s growth and profitability to the average of its industry, as defined by Seeking Alpha (33 companies).

Burberry performs well relative to the industry average in our view. The company is significantly higher on a profitability basis, even if low-performers are removed. This is a reflection of the company’s brand strength allowing for aggressive pricing, offsetting any scale disadvantage.

Growth has lagged behind the market, as it is heavily reliant on its single brand, which faces significant competition from other luxury houses. We expect the business to improve in the coming years, although it will be difficult to reach parity.

Based on the weaker growth but offsetting margins, we believe Burberry should be trading within vicinity of the peer group average valuation multiples.

Valuation

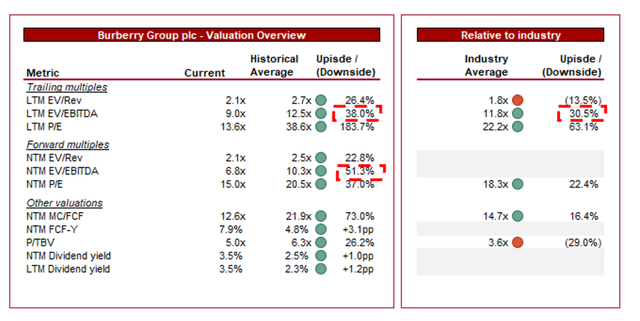

Valuation (Capital IQ)

Burberry is currently trading at 9x LTM EBITDA and 7x NTM EBITDA. This is a discount to its historical average.

A discount to its historical average is unjustifiable in our view. Burberry has experienced an improvement in margins and pricing power in recent years, as well as scope for an improved growth trajectory. We consider the former alone to be a sufficient enough factor. Investors are likely concerned that growth from China will materially slow.

Further, Burberry is trading at a large discount to the industry. Even if the largest 4 multiples are excluded, Burberry remains at a discount. Once again, we believe this implies upside, as Burberry’s strong relative performance suggests parity or a small discount is fair.

At a FCF yield of 7.9%, we believe Burberry represents fantastic value for shareholders. The brand has a long heritage and a track record of incremental improvements.

Key risks with our thesis

The key risks to our current thesis are

- FX. Burberry generates its revenues and incurs its costs across a range of currencies, which has the potential to materially impact the presented results. With a substantial decline in the USD in the last year relative to the Sterling, we could see a degree of underperformance.

- Brand. Given the single brand, cyclical trend changes must be responded to perfectly, otherwise Burberry faces falling out of fashion.

- China. A slowdown in growth from China, given the heavy weighting toward APAC, could materially derail the improvements made in recent years.

Final thoughts

Burberry is a fantastic business in our view. It has a truly global brand that has endured over a century, becoming a leading brand in the luxury market. Its growth has been underwhelming, however, the business has financially progressed consistently, and is entering a new era. Under Daniel Lee, we are confident the company can progress further, supported by its margin improvement, as the brand returns to its British Heritage.

With Burberry trading at a discount to its historical average and peers and a NTM FCF yield of ~8%, we see good upside at the current price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here