Siemens AG (OTCPK:SIEGY) is a German industrial legacy, founded in 1847 in a Berlin backyard and relocating to Munich after the Second World War, the company has since then manufactured about everything you could imagine from mobile phones to high-speed trains. In fact, well-known German semiconductor giant Infineon used to be Siemens’ semiconductor division before it was spun off in 2000. After a period of sluggish returns throughout the 2000s and 2010s, Siemens underwent a major restructuring, divesting 25% of its medical imaging division as Siemens Healthineers in 2018 as well as the majority of its energy business as Siemens Energy in 2020. Following his appointment in February of 2021, new CEO Roland Busch announced the firm’s new identity as an integrated technology company, marking a shift away from Siemens’ roots as a primarily capital goods manufacturer. Given the strong trajectory in the transformation of its business model which is well positioned to benefit further from key political and societal trends, I initiate Siemens at Buy with a price target of €156 per share, implying a c.22% upside to current trading levels.

Company Overview

Despite the mentioned slimdown of Siemens in the last years, the company still covers a wide area of industries across its four Industrial Business (“IB”) divisions.

Digital Industries (“DI”) – FY22 Sales of € 19.5bn

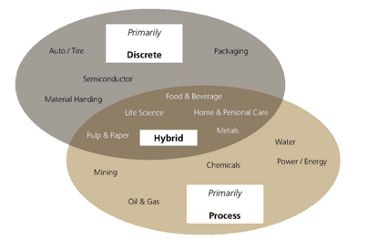

Key products are solutions in discrete and process automation along with motion control offerings. In addition, the segment also sells proprietary software solutions in the fields of Product Lifecycle Management (“PLM”) and Electronic Design Automation (“EDA”) which represent a growing percentage of sales and are fully integrated into the related Siemens hardware. This software segment is recently undergoing a transformation from an upfront payment to a service model. Key verticals served are the Automotive, Machinery and Chemical industries. Competitors include French Schneider Electric (OTCPK:SBGSF), Swedish-Swiss ABB (OTCPK:ABBNY) and US companies Rockwell Automation (ROK) and Emerson Electric (EMR).

Split of Discrete and Process Automation – Siemens serves both but focus slightly tilts towards discrete end markets (UBS Analysis)

Smart Infrastructure (“SI”) – FY22 Sales of €17.4bn

This segment operates across the entire electric chain of transmission from providing highest-voltage power grid operation and simulation over medium-voltage EV charging infrastructure to low-voltage household controls. It also offers integrated hard- and software solutions for building management such as energy, HVAC and fire controls. Siemens mainly competes with Schneider Electric, ABB and Johnson Controls (JCI) in this segment, however given the smaller barriers to entry compared to Siemens’ other divisions there are a multitude of smaller competitors, especially in building management.

Mobility (“MO”) – FY22 Sales of €9.7bn

Siemens Mobility primarily manufactures and sells rolling stock including the German ICE high-speed trains and rail infrastructure such as overhead train controls and signaling systems. Additionally, it offers services and software solutions over the entire lifecycle of its products. Similar to SI, a large part of the segments business is done in the public sector across National and Municipal levels. Competitors include French Alstom (OTCPK:AOMFF) (which at one point tried to merge with Siemens Mobility), Chinese state-owned CRRC (OTCPK:CRCCY) and Swiss Stadler Rail (OTCPK:SRAIF). Compared to peers, Siemens has a higher share of revenue coming from non-rolling stock with Siemens being the global leader in signaling systems which benefits margins.

Healthineers (“SHS”) – FY22 Sales of €21.7bn

Siemens Healthineers’ product range includes imaging technologies such as CET, MRT and X-Ray machines as well as clinical diagnostics equipment. Through the acquisition of Varian this division also offers radiation solutions for applications in Oncology. This segment has been partially spun-off in 2018 with Siemens retaining a 75% majority share and thus fully consolidating the segment in their accounts as per European IFRS guidelines. The two main competitors for Siemens in this segment are US-American GE HealthCare (GEHC) and Dutch Royal Philips (PHG).

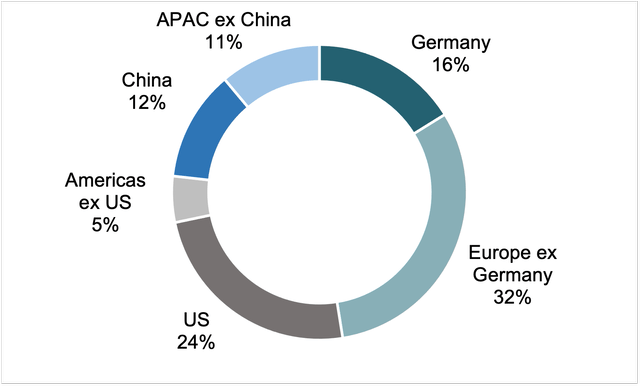

Alongside serving a diverse set of industries and end markets, Siemens also has a well-balanced geographical footprint with large shares of revenue coming from all major global regions. There is some focus on Europe with almost half of total revenue coming from Germany and other European countries, however the US accounts for the largest share of a single country with 24% as of FY22 ahead of Germany and China.

Revenue Geographic Split (Company Filings)

Profitability Analysis

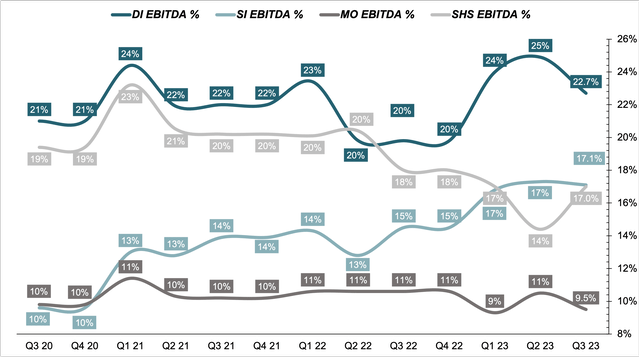

Given its highly differentiated business lines which partially operate in entirely different industries and areas in the value chain, one should take a look at the profitability for each segment alone. Over the last 3 years, strong margin expansion for SI and a slight increase in DI’s margins were to some part offset by recent weakness in Healthineers. Mobility has remained largely stable over the period. I think the most important positive things to note here are the strong margin development seen in SI and the overall high-margin profile of DI. Along with the high resilience in the Mobility division, this indicates the sort of pricing power that Siemens has towards its customers, allowing them to largely pass through input cost increases and protect margins. On the flipside, Healthineers’ margin contraction is something which Investors should monitor although margins have slightly trended up again after reaching a trough of 14% in Q2.

EBITDA Margin Development by Segment (Company Filings)

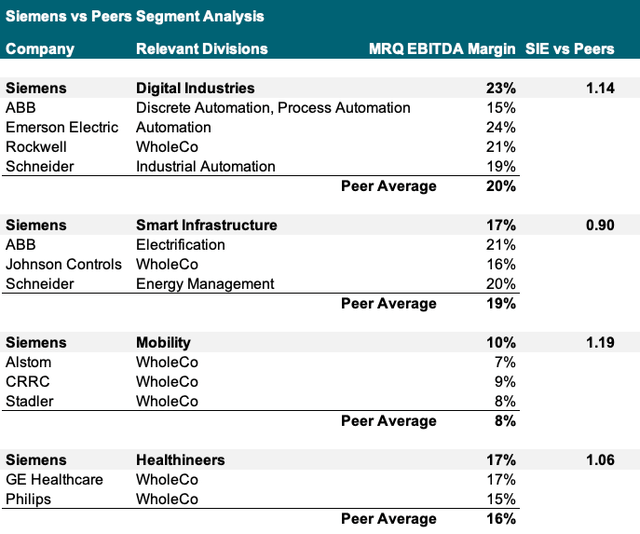

When comparing EBITDA margins to peers division by division, Siemens shows an impressive margin profile with 3 out of 4 segments outperforming its peer average. DI and MO stand out with a margin premium of 15% to 20% over competitors as of most recent quarter while SHS margins are slightly above newly spun-off GE Healthcare and Philips. Despite its impressive margin expansion over the previous periods, SI margins are still around 10% below peer average and around 15% below closest peer Schneider Electric Energy Management.

Segment EBITDA Margins vs Peers (Company Filings)

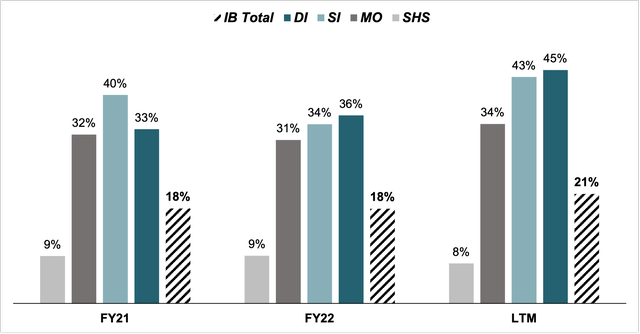

While margins provide a good entry point to assess a company’s profitability, those do not take into account the capital intensity of the business which is why it is helpful to look at the Return on Capital Employed which shows the relation between the capital that has been invested into the business and the annual operating profits it generates from it. Across all segments Siemens’ (pretax) ROCE sits at around 21% as of LTM, slightly up from 18% for fiscal years 2022 and 2021. In terms of segments, DI is leading with a current ROCE of 45% with a very strong trajectory since FY21. SI and MO have remained largely stable at around 40% and 33% respectively with both showing no clear trajectory. As for the Healthineers segment, which operates in an extremely capital intensive business, ROCE has slightly declined over the period to about 8% making it by far the least profitable segment among IB and thus dragging down the company’s overall ROCE by a significant amount.

ROCE by Segment (pre-tax using reported EBITA) (Company Filings)

To wrap this first part up, I see Digital Industries as the high-growth, high-profitability crown jewel in Siemens portfolio with Smart Infrastructure also showing a positive recent trajectory and Mobility providing some necessary stability to the business. Healthineers currently remains a question mark for me due to weak developments over the last quarters with margins and profitability falling. Given this assessment, a large part of my investment thesis for Siemens does focus on the Digital Industries and to an extent Smart Infrastructure segments which I see as detrimental for the company’s ongoing transformation into an integrated technology company.

Key Investment Thesis

Siemens is a direct and indirect Benefactor of several secular Tailwinds

Through its structure and exposure to a wide array of different end markets, Siemens can capture a variety of structural tailwinds to aid its topline in the coming years. In my view the two most important ones of those are further technological integration into the manufacturing process (Industry 4.0) as well as governmental and societal shifts towards energy transition. In Industry 4.0, Siemens DI offers a comprehensive suite of tools and technologies for its customers to improve their manufacturing process, leveraging tight hardware-software integration and capabilities in process monitoring, machine learning and AI to increase yields and eliminate inefficiencies.

In the field of energy transition, Siemens is mostly active through its SI (and to an extent MO) segment which I estimate to increase in importance as effective grid management becomes a more and more crucial topic given the higher focus on electrical energy as opposed to molecular energy that the energy transition will drive. It also offers solutions in Smart Architectures to increase energy efficiency and technological integration of buildings as well as charging infrastructure for EVs. Through MO, the company should also benefit from a shift in transportation mix from personal to public by capitalizing on demand growth for energy efficient and technologically integrated rolling stock and support systems. This can already be felt in recent quarters with strong order growth in the segment as customers, both private and public, replace aging fleets.

Lastly, and to a perhaps smaller extent, I also believe the global trend of aging populations and thus higher spending on healthcare to benefit Siemens through the Healthineers business. Especially spending for new innovative life science technologies in therapy areas such as cancer should see a lot of growth going forward with disease prevalence rising in all of Siemens’ core markets. Through its strong diagnostic portfolio and specifically the acquisition of cancer treatment specialist Varian in 2020, I see the segment as excellently positioned to capitalize on this trend.

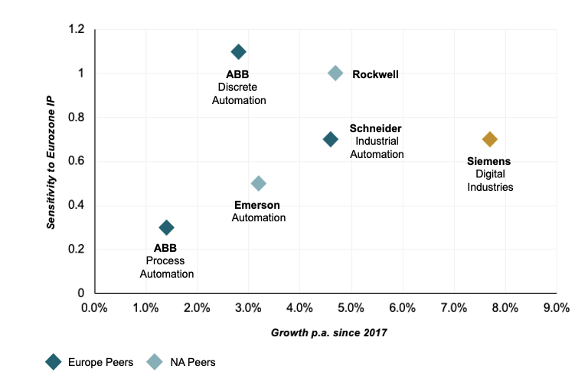

Best-in-Class Automation Business to further help Siemens navigate cyclical End Markets

Through its DI segment, Siemens is the largest player in industrial automation and one of the few that offer customers fully integrated hardware-software solutions with 45 million installed automation systems as of FY22. This is an important fact to consider as the automation market is more short-cycle compared to building infrastructure, rolling stock and medical devices which tend to have a longer product lifespan and less cyclicality. I estimate it is this market leadership that has allowed Siemens’ automation business to demonstrate a lower sensitivity to macroeconomic conditions compared to peers while having stronger structural growth. In the future with further rollout of its SaaS offering I expect a highly positive impact of earnings visibility for the segment.

DI vs Peers (Bloomberg Analysis)

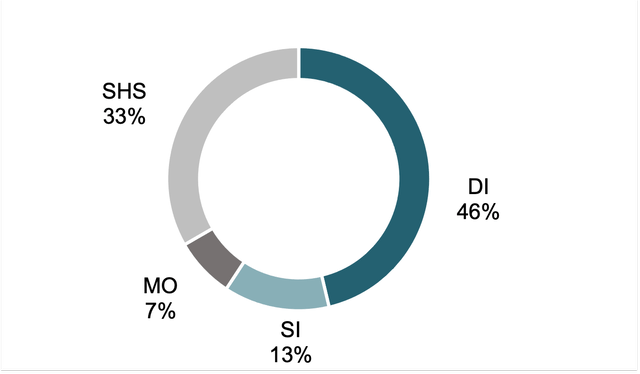

When breaking up Siemens total FY22 R&D spend by segment it also becomes apparent that DI has become the focus and anticipated key growth driver of the company with most research efforts concentrated on this segment.

FY22 R&D Spending Distribution (Company Filings)

Accelerating Transformation to a Technology Company with higher-Visibility, recurring revenues to drive a Mid-Term Rerating

Despite its status as a primarily capital goods manufacturer, Siemens has had a sizable software business for a long time. The majority of this is centered in the DI division and comprises of mostly-enterprise level Product-Lifecycle-Management (“PLM”) software such as Electronic Design Automation (EDA/CADS) solutions. Due to a, compared to peers, earlier adoption of an integrated hard- and software value proposition the company today ranks number 1 globally in automation software with IT-Research firm Gartner ranking it as the clear leader in the field.

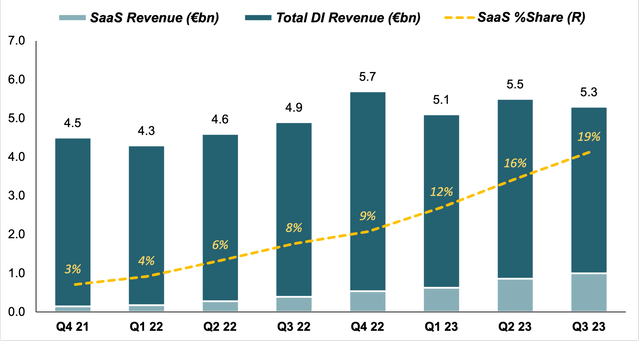

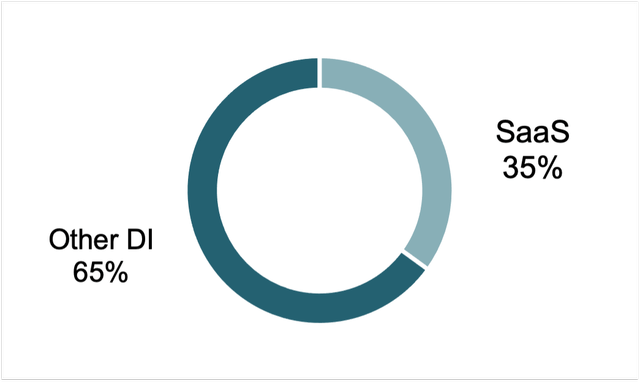

While most of this software had in the past been offered in an upfront- and one-time payment model, Siemens is currently transitioning to a subscription-based SaaS model, allowing for higher visibility in future earnings due to a predictable and continuously recurring revenue stream. In Q3 2023 Siemens recorded around €1bn in SaaS revenue, representing 19% of total DI segment up from €0.4bn and 9% a year prior. With software holding a 35% share of current DI backlog valued at €4.2bn, I estimate Siemens is able to sustain this strong growth in the coming Qs. Growing this higher-margin and less capital intensive business should be strong future driver to further expand margins and returns on capital.

SaaS Revenue Development (Company Filings) DI Backlog as of Current (Company Filings)

As of Q3 2023, Siemens has more than 9,200 SaaS enterprise-level customers (up 23% from last Q) of which 82% are comprised of SMEs as compared to 69% in last year’s Q3. This shows the high convenience that a SaaS solution offers for smaller customers which often do not have the financial firepower for large one-time purchases and is highly beneficial for Siemens as it puts less weight on each individual customer, therefore reducing cluster risk in revenues. A 76% rate of new subscriptions in YoY addition also supports lower barriers to entry for new customers due to lower immediate cost while record 94% contract renewal rate shows the high value proposition Siemens offers.

Record-high Order Backlog and below-target Leverage provide Margin of Safety against macroeconomic Downturn and Mid-Term Transition Risks

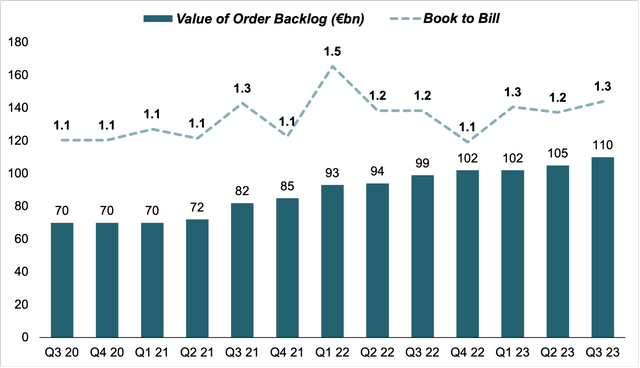

As of Q3 23, total order backlog for Siemens IB stands at a record high €110bn, up 11% YoY and 5% QoQ, which equates to a strong current book-to-bill ratio of 1.3, up from 1.2 for the last quarter. This healthy backlog indicates the strength that Siemens gains from its multi-segment structure as a cyclically-driven decline in DI orders has been more than offset by a stellar quarter for the Mobility division with several key contract wins worldwide, reaching a record segment backlog of €44.5bn. It also gives the company a comfortable cushion against the already occurring downturn specifically in the more short-cycle end markets for DI and SI with Siemens expecting to realize around €35bn of that backlog in FY24.

Siemens Backlog Development (Company Filings)

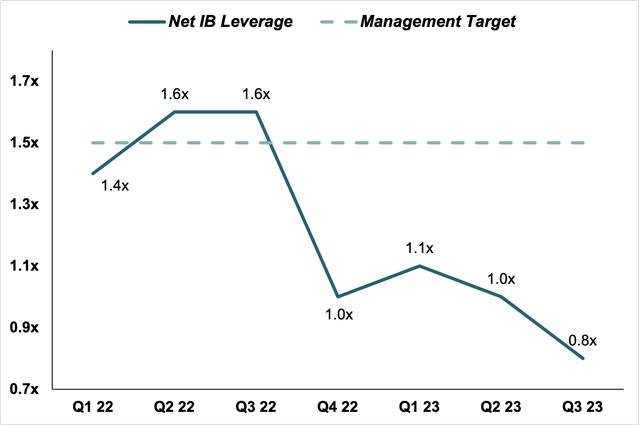

Next to a record high order backlog, Siemens also has successfully delevered over the last quarters from the Varian acquisition to now stand at a net IB leverage of 0.8x EBITDA with €12bn in Industrial Business Net Debt excluding any debt issued by Siemens Financial Services or Portfolio Companies. Given the company’s target IB leverage of 1.5x, Siemens therefore has about €11bn additional debt capacity which could be used to pursue value-accretive M&A or buy back shares to benefit shareholders.

Siemens IB Leverage Development (Company Filings)

Key Risks

Continuation of greater-than-expected Customer Destocking and Order Decline, especially in Short-Cycle Automation Business and China Market

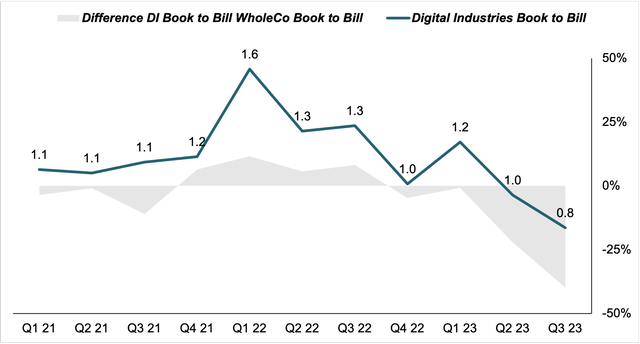

Q3 YoY% orders in DI fell by 35% to a quarterly book-to-bill ratio of 0.8, compared to 1.3 for the entirety of Siemens IB with order flow in all major regions down double digits. As the company’s most cyclical business, DI had profited strongly from post-lockdown demand surges with a record book-to-bill of 1.6x in early 2022. With a weakening economic outlook and supply chain issues gradually easing, the automation cycle entered a destocking driven downcycle with segment book-to-bill slipping below WholeCo book-to-bill in Q4 of 2022. At 0.8x the difference between DI and WholeCo book-to-bill ratios currently stands at a record high 40%. While this is not an immediate reason for overconcern given the natural cyclicality of the business, the next quarters will be crucial to establish a clear vision of the segment’s near-term trajectory.

Digital Industries Book to Bill Development (Company Filings)

China Risk due to possibility of further economic Downturn and Trade Restrictions

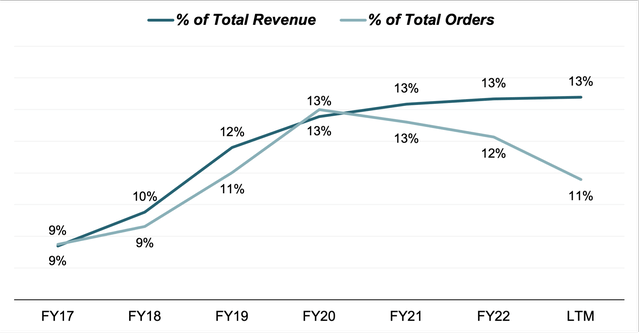

Another point investors should monitor are developments in Siemens’ China business which, after a period of expansion from 9% to around 13% of total IB revenue, has largely stagnated since FY20 driven by long-lasting Covid lockdowns and a weaker than expected economic recovery. While revenue share has remained constant around 13%, China’s share of total group orders has dropped sharply from 13% in FY20 to just around 11% as of LTM. Next to weak economic development, further tensions between the Chinese government and the West have flamed up in recent times, hitting trade relations between the blocs. Despite Siemens not being an exporter of technology that is crucial on a National Security level such as ASML, I estimate that a further cooling of relations and potential new trade barriers from either side could greatly hurt Siemens business in China, especially in factory automation, and thus represent a sizable headwind to revenue growth if those risks materialize.

Siemens China Revenue and Orders Development (Company Filings)

Need for more Writedowns in Siemens Energy Stake

Siemens’ remaining stake in its former subsidiary Siemens Energy (“SE”) had long plagued investors of the company with several major earnings impacts in FY22 and FY23 following a series of issues at the company including write-downs for its Russian business. Largely stagnant revenues and negative profits have led its share price to fall almost 50% below its IPO level in 2020 with the most recent hit in June when the company revealed technical problems related to its wind turbine business. Following this, in August SE reported a net loss of €2.9bn for the quarter and forecasted a total loss of €4.5bn for FY23. Despite Siemens CEO Busch having announced that he does not expect any further major slimdown in the corporate structure, I think management has noticed the issues related to its stake and the risk this poses to attracting investors as the company recently transferred 6.8% of their remaining 31.9% stake in SE to the Siemens pension fund, leaving it with 25.1%. I think further trimming of this stake could help reassure investors of Siemens announced new trajectory as a technology focused company and help alleviate the overhang that the uncertainty around SE has on Siemens stock.

Valuation

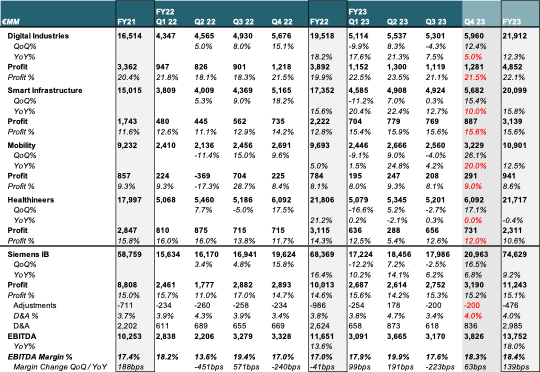

For the Digital Industries segment, I estimate a Q4 YoY% growth of 5%, below the 7.5% read for Q3 as I estimate FX headwinds from a stronger dollar and further delivery pushbacks to offset seasonal effects against strong Q4 22 comps. This would bring total FY24 YoY% growth at 12.3% vs guidance of 13%-15%. For margins, I expect a stronger Q4 and full year margin at 22.1% on the lower end of guidance (22-23%) given management’s comments around significant performance improvements in software-related margins compared to Q3.

In Smart Infrastructure I expect a strong year end performance in both YoY% growth and margins as the longer-cycle electrification markets have continued to perform well into H2 and order flow has not declined as sharply as in DI. For Q4 I expect a slightly weaker print than in previous Qs due to strong 2022 comps at 10% YoY which brings FY23 YoY% to 15.8%, reflecting the upper end of 14-16% management guidance. With Q4 margins in line with Q3 I expect a fully year profit margin of 15.6%, slightly above 14.5-15.5% guidance.

Given stellar order flow in Mobility with several multibillion Euro contract wins announced in recent Qs, I project this segment to grow above management guidance (FY24 YoY% growth of 10-12%) with full year growth of 12.5% fueled by 20% YoY growth in Q4. Margins should come in line with guidance at c.8.6% for the full year and 9% for Q4, slightly above Q3.

For Healthineers, I expect stagnant Q4 and FY23 growth rates in line with management comments to expect 1% to -1% growth. Margins should stabilize in Q3 and come in at around 10.6% for the full year, down significantly from 14.3% in FY22.

Including adjustments for amortization and full year depreciation at c.4% of total IB revenue, I estimate FYae EBITDA of €13,752MM at a 18.4% margin, up c.140bps YoY. Compared to FY22 I project 18% EBITDA YoY growth, mainly attributable to continued strong performance in DI and SI and an exceptional MO Q4 print while Healthineers lagged. Both metrics reflect a very strong H1 slightly offset by a weaker H2 as demand continues to normalize.

Siemens Financial Model Q3 (Company Filings and Author’s Projections)

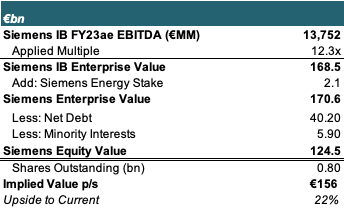

Using FY23ae EBITDA and Siemens’ share data and net debt as of November 3, I calculate a current forward year EV multiple of 10.8x, c.16% below 5Y average of 12.6x. Compared to its closest peers Schneider Electric and ABB at 13.0x and 11.5x respective FY23 EV/EBITDA multiples, Siemens shares trade at a discount of c.14%. I feel both discounts are unwarranted given Siemens’ strong trajectory in driving SaaS revenues and record backlog as well as its leading position in discrete and process automation markets. I value Siemens at a mid-cycle multiple of 12.3x which is in line with peer average and balancing both Siemens’ leadership vs peers in terms of margins and growth as well as a slight headwind from its conglomerate structure.

However, I do see the possibility for further multiple expansion if Siemens continues to successfully streamline its operations and grow the share of high margin, recurring digital business.

Applying a 12.3x multiple to FY23ae EBITDA I obtain a base Industrial Business EV of €168.5bn. Adding its 25.1% stake in Siemens Energy (EV of €7.3bn as of November 3), I calculate an Enterprise Value of c.€170bn for Siemens. Adjusting for net debt (including debt attributable to Siemens Financial Services) and minority interests in Healthineers and Portfolio Companies, I obtain an Equity Value of €124bn, or €156 per share, giving c.22% upside to current share price.

Siemens Multiple Valuation as of November 3 (Company Filings and Author’s Projections)

Wrap-Up & Outlook

I view Siemens as a high-quality company which strong long-term prospects are currently being undervalued by the market given recent cyclical downturns in several of its end markets and overhang surrounding issues at Siemens Energy. Going forward I estimate the growing share of recurring SaaS revenues and continued outperformance in automation to drive an eventual rerating of shares as investors begin to appreciate the company’s transition into a fully integrated hardware and software company.

Despite my positive view of the long-term trajectory Siemens has set up for itself, I acknowledge current headwinds, mainly related to a slowdown in its China business and weakness in DI. I think the next few quarters will be crucial to understand the extent of the destocking in those end markets with the Q4 earnings call scheduled for November 16. Recent earnings by peers ABB and Schneider have shown the risk of an even more severe cyclical downturn especially in discrete. Electrification has held up relatively well so far and thus should also be closely monitored, especially for any signs of a possible rollover.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here