The last four years have been quite eventful by any measure. From the pandemic to two ongoing wars now, investing would certainly seem challenging if you are looking at the macro. Part of long-term investing is to accept volatility as part of the game and continue to follow a systematic approach. But it’s undeniable that drawdowns can have a significant effect on long-term returns.

| Starting Net Worth | %Loss | Ending Net Worth | %Gain Needed to restore starting net worth |

| $100,000 | 1% | $99,000 | 1.01% |

| $100,000 | 5% | $95,000 | 5.26% |

| $100,000 | 10% | $90,000 | 11.11% |

| $100,000 | 15% | $85,000 | 17.65% |

| $100,000 | 20% | $80,500 | 24.22% |

| $100,000 | 25% | $75,000 | 33.33% |

| $100,000 | 30% | $70,250 | 42.35% |

| $100,000 | 40% | $60,000 | 66.67% |

| $100,000 | 50% | $50,000 | 100.00% |

| $100,000 | 60% | $40,000 | 150.00% |

| $100,000 | 70% | $30,000 | 233.33% |

| $100,000 | 80% | $20,000 | 400.00% |

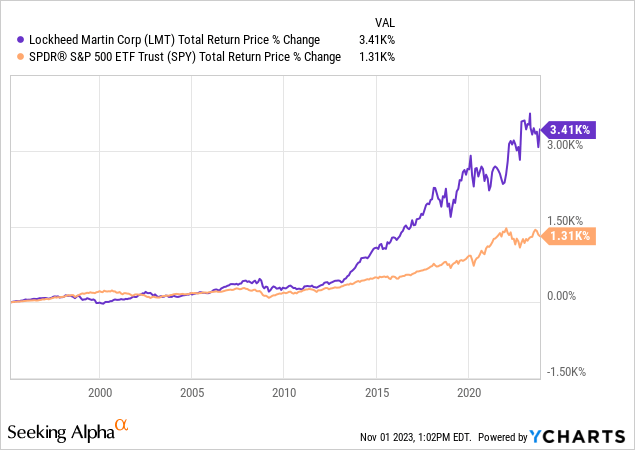

The Fed-induced measures have certainly made investors think less about drawdowns even though the evidence is right in front of us. But what can investors do to reduce these drawdowns? Specifically, what can cause these types of drawdowns? Wars, global pandemics, credit bubbles, and geological and climate events could be great examples (Certain events are even classified as “Black Swan” events which means they are unlikely and unknown). In many instances, the protection of investment portfolios is far out of reach for most retail investors. But war is one event where investors have options to mitigate drawdowns on a portfolio. We have a whole portfolio of defense stocks whose returns are not only uncorrelated to the S&P but also gain during times of war. In this thesis, we will focus on Lockheed Martin (NYSE:LMT), its performance during times of war, its long-term performance, and how it will continue to dominate as long as the U.S. continues its military spending and its role as a leader of the free world. All wars from recent history have not had a devastating effect on the stock market but there is one event specifically that has the potential to induce a massive drawdown and Lockheed Martin can serve as a good hedge if this event ever occurs.

The proof is in the pudding

In 1995, Lockheed Martin Corporation became the world’s largest defense contractor and was publicly listed through the merger of Lockheed Corporation and Martin Marietta Corporation. Although we have close to 30 years of price history, I first want to check how it performed during big drawdowns (considering only bear markets which is defined as a 20% fall) and if any of the stock’s outperformances during the market drawdowns coincided with geopolitical tensions.

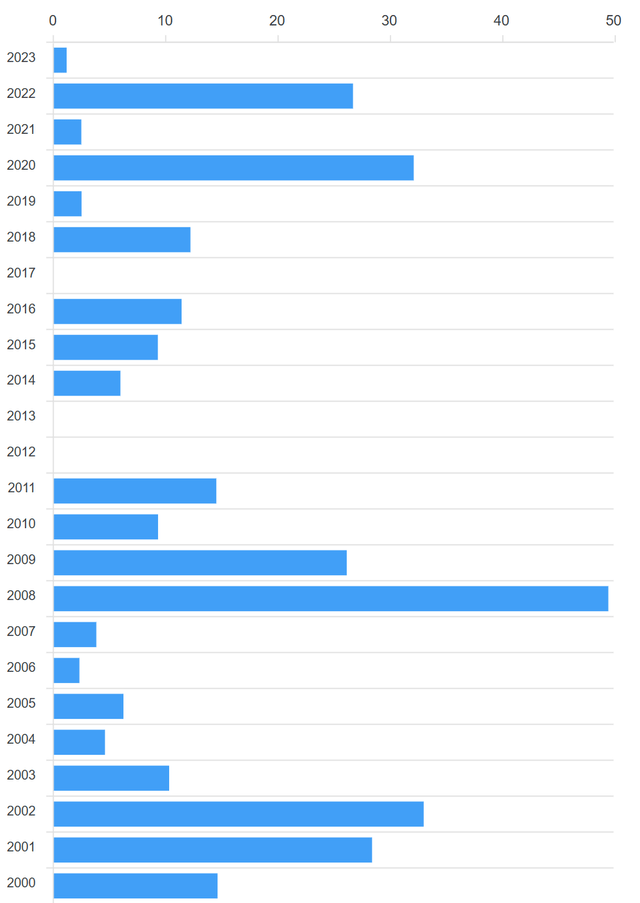

Intra-year Drawdown % By Year. Calculated using the closing price of the previous year to the lowest S&P 500 price observed during the current year. For years that did not have any drawdown a chart bar will not be observed (Slickcharts)

The market observed a greater than 20% drawdown during the years 2001, 2002, 2008, 2009, 2020, and 2022 in the last three decades.

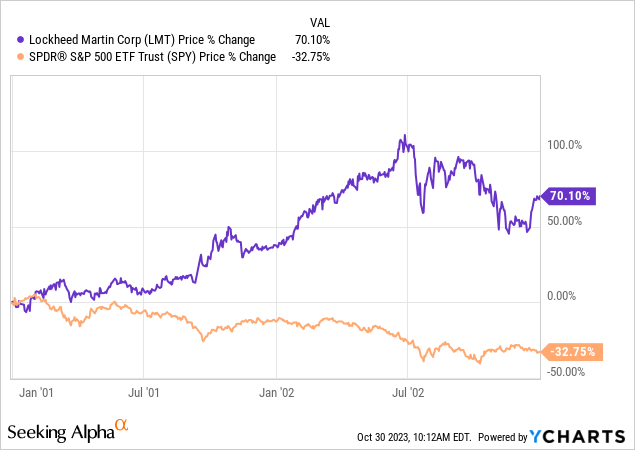

It could be argued that the decline in SPY in 2001 and 2002 was because of the market coming out of the dot-com boom era. But it has to be mentioned that 2001 was also the year when 9/11 occurred which did have a big effect on the stock markets. Subsequently, this was followed by the Afghan war. As seen from the chart Lockheed Martin significantly outperformed the SPY during its drawdown period.

2008 and 2009 years were the great financial recession. Both Lockheed Martin and SPY underwent similar drawdowns as there were no catalysts either to help the company outperform the S&P. In fact towards the end of 2009, the S&P recovered much faster than Lockheed, and the same pattern repeated in the pandemic-induced drawdown of 2020.

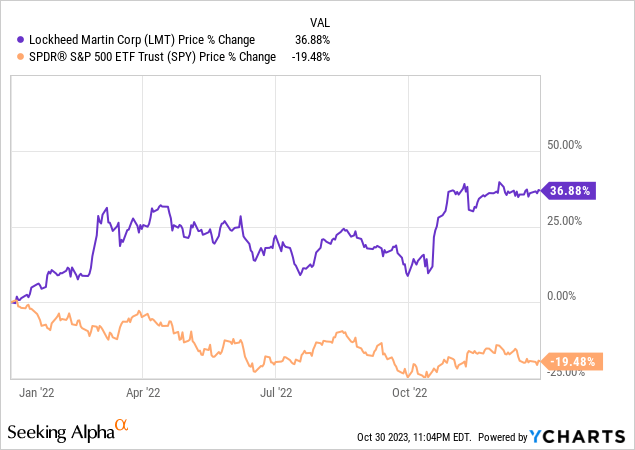

2022 paints a much different story. It can be argued that the drawdown in S&P during 2022 was due to the deflating of a fed-induced massive bubble that had its origins in the pandemic. But we know that this was also the year when Russia attacked Ukraine which set off a chain reaction in the markets. In fact, we saw a big divergence occur precisely during February when there was increasingly new evidence that we would escalate to a war and eventually saw Russia attack Ukraine.

This rally had legs based on multiple tailwinds related to the war. Germany pledged to boost defense spending, offering an immediate €100B defense spending package for weapons such as F-35 fighter planes. Shortly after Canada also picked Lockheed as its preferred bidder for fighter jets. The war also caused the company to nearly double its production of Javelin anti-tank missiles as it was a key weapon in Ukraine’s defense against Russia. All of this suggests that the market is forward-looking and the run-up in the stock price is a correct assessment that the company would be a key beneficiary during war events.

Recent Correction

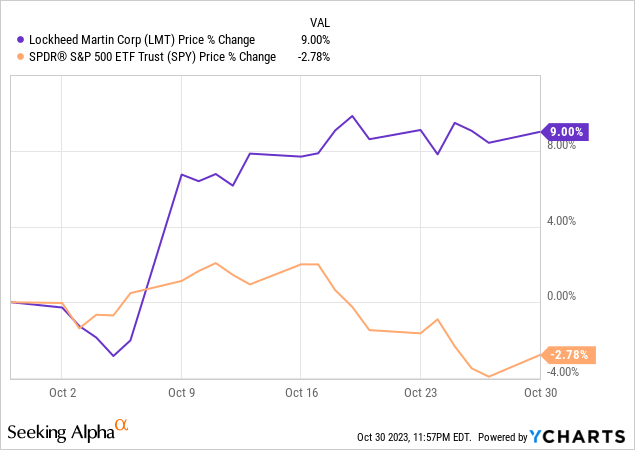

The S&P has fallen more than 10% in the last few months and there could be multiple reasons for this (Market movements gain clarity the more hindsight you have). But the performance of Lockheed again saw a clear divergence following the attack on Israel. It is still too early to say if the S&P will continue to underperform and enter a bear market territory and how much of this can be attributed to the ongoing war (especially since we are not sure to the degree to which it may escalate). However early indicators have once again proved that Lockheed stands to benefit from this situation.

These performances indicate that the company passed the litmus test for our hypothesis and it could act as a great hedge in a portfolio if ever a defining geo-political moment occurs.

The problem with China

So, where are we going with all this? I made a point earlier in the article that none of the geopolitical issues have been seen as devastating threats to the U.S. stock market (so far). A big reason could be that the military power of the U.S. is so far advanced that none of the conflicts can have ripple effects back home and the underperformance during the conflict times could be possibly explained away as being caused due to other macro factors. However, the outperformance of Lockheed’s stock could be attributed to its exposure to defense and the company being the largest federal defense contractor.

The one big exception where geopolitics could directly have a significant impact on the U.S. stock markets is if the U.S. enters into a conflict with China over its ambitions in Taiwan. China has made it clear that any moves that aim for Taiwanese independence will not be shown “mercy” and has increasingly been vocal about its desire for reunification with Taiwan. This has also gained significant momentum over the past two years. Recent developments highlight growing tension in the region, with China’s military activity around Taiwan escalating. In a single day, 32 aircraft and nine navy vessels were detected, and approximately 20 of these aircraft breached Taiwan’s air defense zone and Taiwan responded with its military measures. This also coincided with some notable political events, including a visit by Taiwan’s vice president to the United States. The U.S. further exacerbated the situation by approving a $500M arms sale to Taiwan, prompting strong opposition from China, which viewed it as interference. China called on the U.S. to honor its commitment against supporting Taiwanese independence.

The potential consequences of China’s move toward realizing its reunification plan are significant, particularly for sectors heavily reliant on Taiwan. Notably, Taiwan is a major player in the semiconductor industry, responsible for producing over 60% of the world’s semiconductors, including over 90% of the most advanced ones. The semiconductor industry is often referred to as Taiwan’s “silicon shield,” and this dependence gives the world a compelling reason to defend the island. Companies like Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA) have direct exposure to China, and if the situation escalates, they may have to withdraw their business operations entirely similar to what occurred when Russia invaded Ukraine (Nearly 1000 Western companies had to pull their business operations and lost about $59B amid sanctions, rushed exits, and write-downs). The US and China are far more intertwined than the US and Russia and the impact on these major companies is significant enough to induce a “never seen before” drawdown of the S&P index.

Naturally what shape would a hedge against this event take? You guessed it! A strong defense contractor such as Lockheed Martin. The stock’s performance against “minor” events means it has passed the litmus tests and should a big enough event roll along, it can certainly play a big role in mitigating the losses on a portfolio.

I don’t like its location, and I’ve reevaluated that. I feel better about the capital that we’ve got deployed in Japan than Taiwan. I wish it weren’t so, but I think that’s the reality, and I’ve reevaluated that in the light of certain things that were going on

– Warren Buffett on selling his conglomerate’s shares of TSMC

Heads you win, Tails you don’t lose

Skeptics have argued that there are good reasons why China may never move on its Taiwan ambitions. The arguments are as follows –

- The political stakes of anything other than a swift, cost-effective, and victorious invasion are substantial.

- Prolonged gridlock in a conflict might erode China’s claim on its strength and might, thereby jeopardizing its objectives of national rejuvenation and a formidable military.

- In a worst-case scenario for China, the chance of being defeated by a well-prepared, entrenched, and resolute Taiwan, possibly with the intervention of U.S. forces is a nightmarish situation that could diminish Mr. Xi’s grip on authority and potentially challenge the rule of the Communist Party.

Russia’s debacle in Ukraine only strengthens the arguments of the skeptics. Does this mean that outside of this investment working as a hedge, there is no other bull case for Lockheed?

Nothing could be further from the truth.

As evidenced by the ongoing situation in Israel, there could always be events in the world that are favorable to the company’s prospects. So there are no requirements to time this investment perfectly (a task impossible unless with a crystal ball).

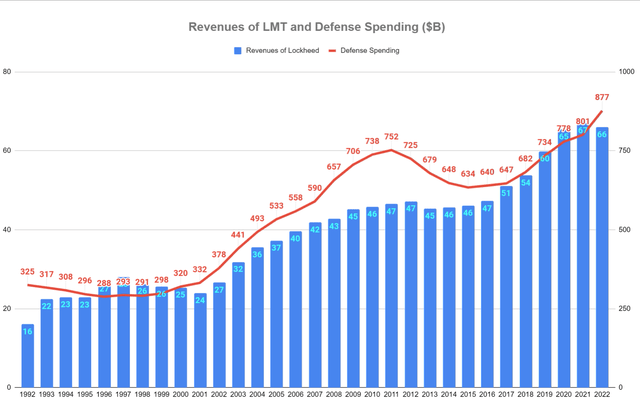

But in a general sense, the one thing you can certainly rely on is the United States’ strong commitment to defense spending. Just last year, the Senate approved an annual defense spending budget of $858B for the acquisition of weapons, ships, and aircraft. The legislation also allocates extra funds for the development of hypersonic weapons and the procurement of weapon systems, including Lockheed Martin’s F-35 fighter jets.

Lockheed being one of the prime benefactors of U.S. defense spending means the company has outperformed the S&P overall and may continue to do so even without a “big” event.

Financial Modelling Prep and Macrotrends

Company Financials

While we examined the company from the angle of its performance, how well it could work as a hedge, and also over the long term, I believe it’s crucial to measure it from the perspective of its financials as well. Charts and quantitative measures are good but not if there is a hole in its financials.

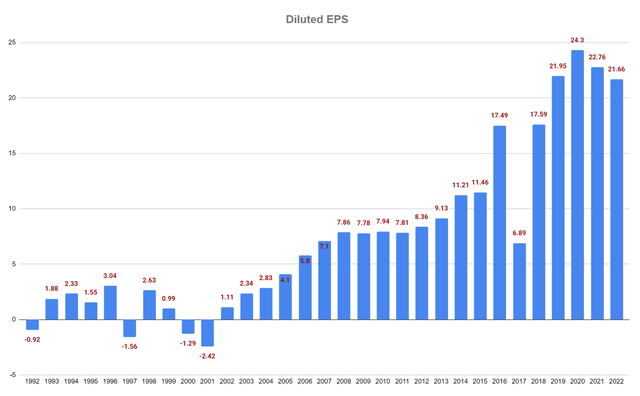

In terms of revenues as we saw from the chart above it seems to be well in sync with the U.S. defense spending and consistently increasing overall. With the exception 2017 taking a hit in terms of profitability in the last two decades, the overall bottom line trend has also held up.

Financial Modelling Prep

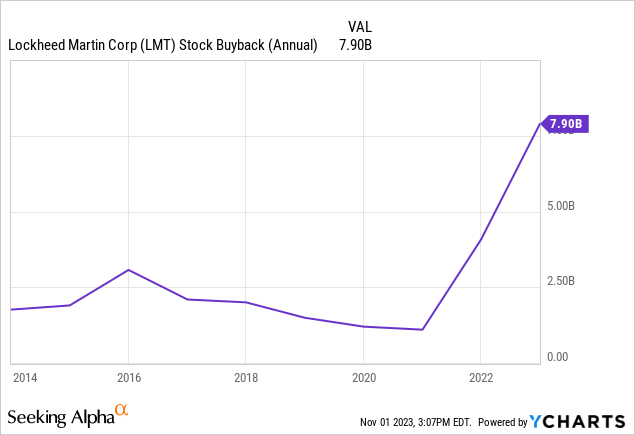

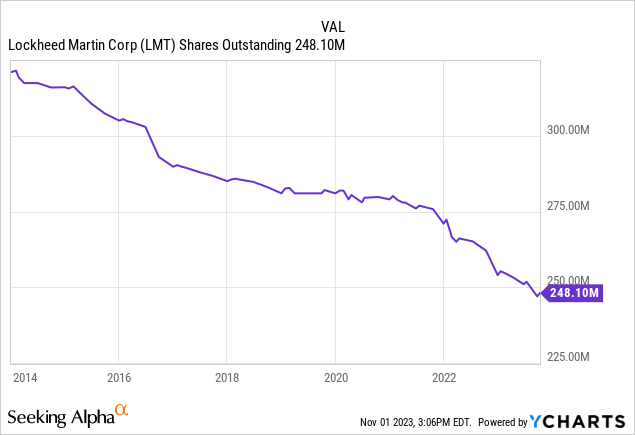

Outside of net income contributing to the growth in EPS, it is also aided by the fact that the company has been actively buying back stock thereby boosting the EPS. Holistically, there are many impressive things about how well the company has returned value to shareholders.

1. The net buyback yield stands at 6.3% and recently, management approved another $6B in additional share buyback which doubled the current authorization to $13B for future purchases.

2. Over the last 10 years, they have managed to reduce share count by almost 23%

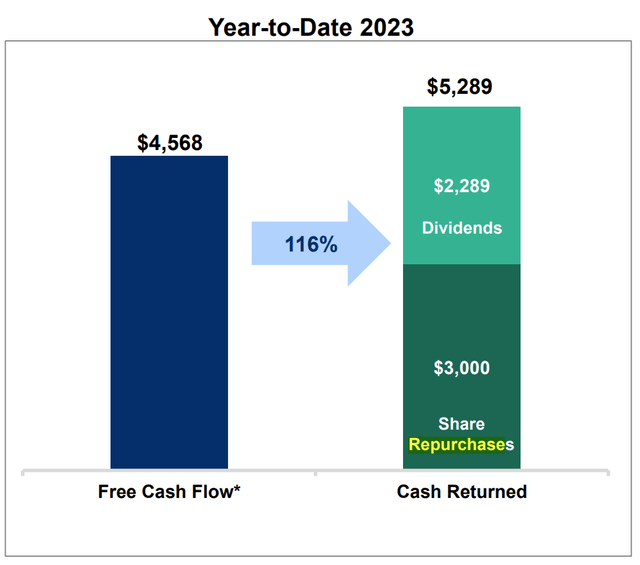

3. The dividend has been increased to $3.15, from $3 which marks 21 years of dividend increases for the company (Current Yield is at 2.64%). These dividend payments are also sustainable as indicated by the payout ratios from earnings and/or cashflows (<50%)

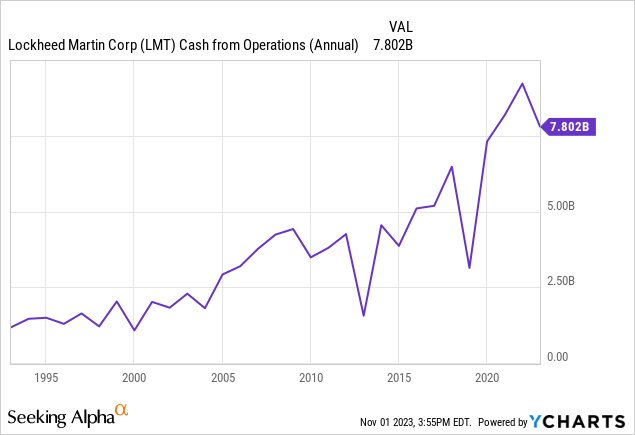

4. The company is also a cashflow machine and has continuously grown this over the last several years. For LTM alone, Cash from Operations came in at $7.5B

Cash returned to Shareholders YTD (Q3 Investor Presentation)

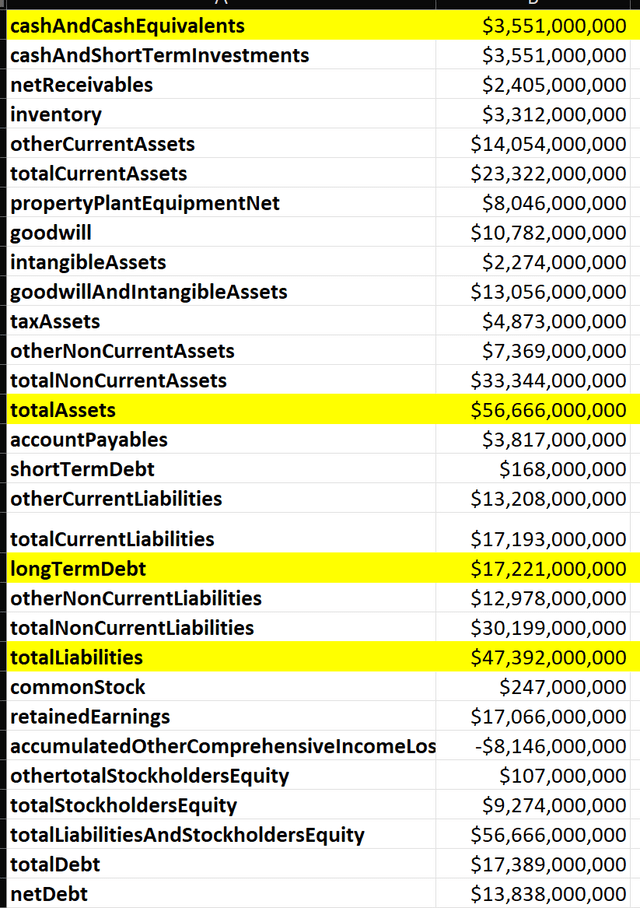

Debt is not a concern

The company’s debt compared to its equity (1.8) is in line with what is seen in the industrial sector and the defense and aerospace industry. Its debt is well covered by OCF (Total Debt: 17.3B) and interest payments on its debt are also well covered by EBIT. Overall there seems to be no concern with respect to its balance sheet.

Balance Sheet latest quarter (FMP)

Attractively valued in the industry

The main thesis here is that defense stocks such as Lockheed should be part of a portfolio based on the nature of the world we live in and its potential to act as a hedge in light of a certain event. This makes it a hard case to draw a line in terms of valuation. What we need to be certain of is that this is not already trading in the extremes and thus has the potential to relatively underperform other defensive names in light of extreme events.

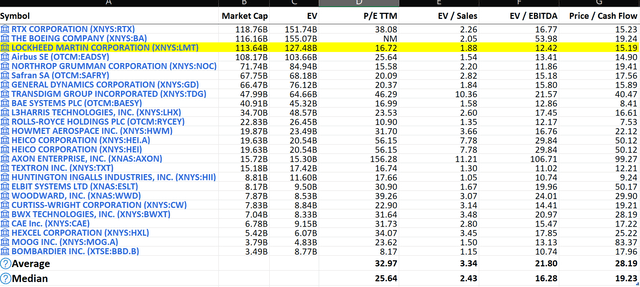

1. The list in the screenshot below has names only from the Defense and Aerospace industry extracted from SA.

2. I have eliminated names from this list that are below the $3B market cap. Most of these names were either unprofitable or did not have positive cash flows.

3. The verdict is clear across the board. In terms of sales, profitability or cash flows the company’s multiples are below the average, and the median.

Defense and Aerospace industry Comparables for valuation metrics (Seeking Alpha)

Part of my portfolio

This company is already part of my portfolio and has been for quite some time. In terms of the performance itself, this has not made any difference to my overall returns due to the price being mostly flat over the last few years. But I will continue to hold this as I believe over the long term this will serve its part in my portfolio in one of two ways –

- Low beta, steady overall returns and continue to benefit from U.S. military spending irrespective of the direction of the U.S. economy

- Hedge in an extreme geo-political scenario that would reduce the drawdown on my portfolio

The actual amount of drawdown protection itself is heavily dependent on sizing and positioning and sophisticated investors could even get positioned with call options at an opportune time. This could act as an even better hedge in an extreme situation. Still, it has to be mentioned that option plays are significantly difficult to get right in terms of pricing and timing should be tread with caution.

Read the full article here