Intro

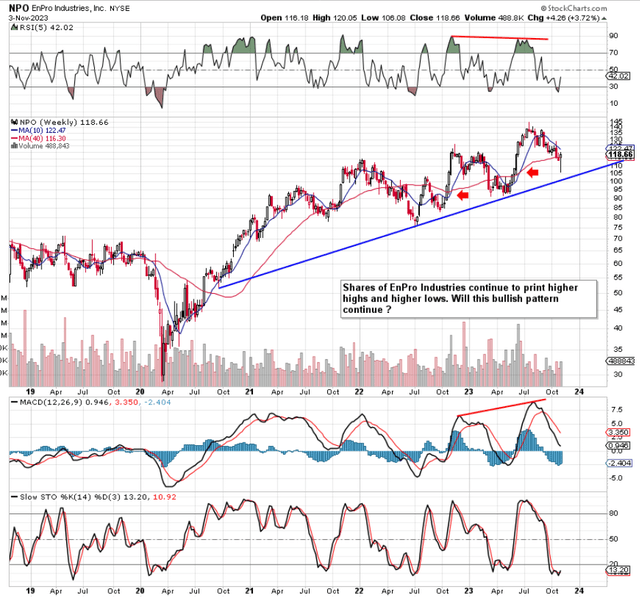

If we pull up an intermediate chart of EnPro Industries, Inc. (NYSE:NPO), (Specialty Industrial Machinery Player) we see that shares have consistently printed higher lows and higher highs since bottoming out in March 2020. Furthermore, given that no clear bearish intermediate divergences have presented themselves in EnPro’s technicals (as we see through both the RSI & MACD indicators), the ‘probable’ course of action here (in terms of forward-looking share-price trajectory) is that shares will bottom (at the below-depicted trend-line) if indeed shares manage to continue falling in this latest down move.

We state this because the depicted trendline is well over three years old and has been successfully tested on multiple occasions. This informs us that investor psychology has not changed in EnPro in that whenever shares have been trading below their main moving averages, buyers begin to step in. In saying this, given how EnPro is at the behest of external markets (particularly Advanced Surface Technologies) due to sustained weakness in the semiconductor industry, NPO only becomes a buy once more when the stock’s 10-week moving averages trades above its 40-week counterpart. This should happen in the aftermath of a successful trend-line test, but this is an unknown at this stage. Waiting for a golden cross (intermediate bullish moving average crossover) may have its disadvantages (meaningful upside must be given up while waiting for the confirmed swing) but we believe it is warranted at present due to the following reasons.

EnPro Technical Chart (StockCharts.com)

Q3 Numbers Highlighted Continued Near-Term Growth Worries

EnPro’s sustained demand in its ‘Sealing Technologies’ segment was not enough to compensate for the ‘Advanced Surface Technologies’ segment as AST sales of $89.4 million saw a year-over-year 27% decline for the quarter. This trend led to total Q3 sales decreasing by over 10% as lower volumes and an unfavorable mix took their toll on AST. The CFO did state that a sequential improvement is expected in AST in Q4, but sluggishness concerning semiconductor spending is expected to continue into fiscal 2024.

Even though trends in the semiconductor market over the near term may look bleak, EnPro continues to double down on its investments in this space due to how the likes of IoT (Internet of Things) and AI should continue to see strong investment. Through the CHIPS act in the US for example, EnPro aims to quickly transform an Arizona facility into a modern semiconductor operation. Time will tell if this will happen, but the act demonstrates the need for sustained semiconductor manufacturing in the US. The CEO’s comments below on the recent Q3 earnings call reflects how EnPro can take advantage of the long-term bullish trend in the semiconductor space.

The semiconductor market is widely expected to double in the upcoming decade, driven by macro forces, including AI and the Internet of Things. As chip architectures evolve, complexity is increasing. More processing steps are needed to manufacture each new generation of chips, and increasingly sophisticated tools are required to complete these steps. With enhanced complexity, process yield efficiencies, contamination control, and life cycle management of critical in-chamber tools become even more critical.

Our semiconductor business sits squarely in the middle of these trends, and we are well-positioned to participate in the industry’s growth. To meet this opportunity, we are investing to maintain and expand our technological differentiation and to position our businesses in regions where the above growth is expected.

Shares Look Above Fair Value

Valuing a stock can be tricky as investors can bring their own beliefs and experiences to the table. For example, if indeed shares drop to the depicted intermediate trend line above, we do expect some level of buyers to step in, although it remains to be seen if buyers will outnumber sellers at that potential juncture. This is why it is good practice to take a holistic approach to valuation by going through various metrics and comparing them with both the sector and EnPro’s historic averages.

| Multiple | Trailing | Sector | 5-Year Average |

| Price To Earnings (Non-GAAP) | 17.37 | 16.35 | 17.97 |

| Price To Sales | 2.29 | 1.30 | 1.50 |

| Price To Book | 1.76 | 2.37 | 1.55 |

| Price To Cash-Flow | 16.62 | 11.75 | 14.92 |

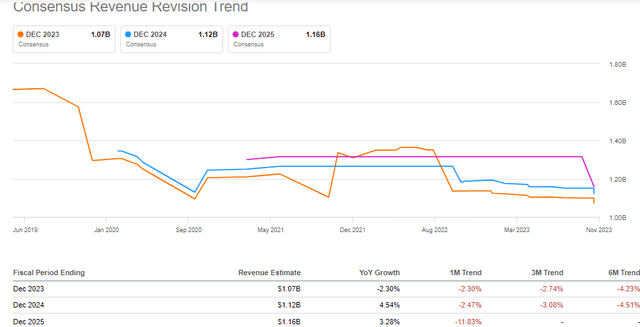

As we see above, EnPro’s sales (P/S of 2.29 trailing) by far are the most expensive when compared to both the sector and the company’s historic averages. Although management has been doing an excellent job regarding controlling costs, the company’s expensive sales and sluggish growth eventually will take their toll on margins if these trends persist. As we see below, for example, forward-looking sales numbers continue to be revised down which will make the company’s forward sales multiple even more expensive over time.

Suffice it to say, that sluggish projected forward-looking top-line growth rates are not a favorable trend considering the amount of goodwill & intangibles EnPro currently reports on its balance sheet. Goodwill & intangibles make up well over $1.5 billion or 62% of the company’s asset-base which highlights impairment risk going forward. Therefore, EnPro’s reported trailing book multiple of 1.76 in real terms is most likely substantially higher.

NPO Consensus Revenue Revision Trend (Seeking Alpha)

Conclusion

To sum up, although shares of EnPro have been making higher lows & higher highs for well over three years now, shares could easily fall to the $100-$105 level to test underside long-term support. Nuclear among others continues to drive Sealing Technologies forward, but sluggish growth in the semiconductor space continues to take its toll on the AST segment. NPO remains a Hold for us at present until we see further developments. We look forward to continued coverage.

Read the full article here