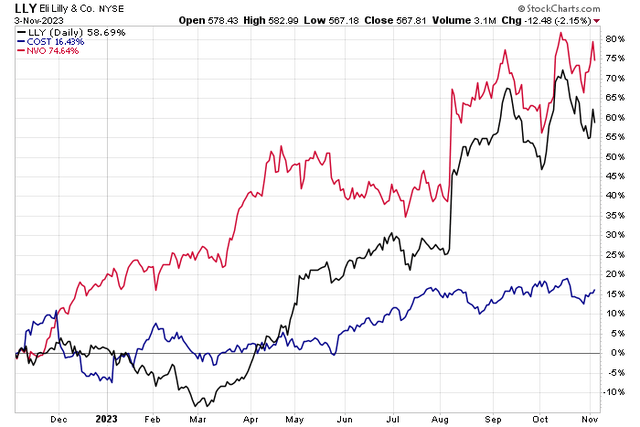

A handful of major food companies have hinted that the new GLP-1 weight loss drugs could have a negative impact on sales in the years ahead. There are a lot of unknowns, though, and while shares of Eli Lilly (LLY) and Novo Nordisk (NVO) have been strong in 2023, we have not seen broad selling pressure among grocers that would suggest the new drugs are a true disrupter to how Americans shop.

I have a hold rating on Costco Wholesale Corporation (NASDAQ:COST). I like the business fundamentals, reliable earnings, and its industry position, but the stock is about fully valued in my view, though the technicals suggest more upside ahead.

LLY, NVO Up Big YoY, But COST Shares Quietly Outperforming the SPX in 2023

StockCharts.com

According to Bank of America Global Research, Costco Wholesale Corporation operates membership-based warehouse clubs that offer a limited selection of branded and private-label products in a variety of merchandise categories. Costco operates 780+ warehouses globally.

The Washington-based $248 billion market Consumer Staples Merchandise Retail industry company within the Consumer Staples sector trades at a high 39.6 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.7% forward dividend yield. Ahead of earnings next month, shares trade with a low implied volatility percentage of 15.7% with an expected stock price swing around earnings of just 3.0%. Short interest on the stock is muted at only 1.06% as of November 3, 2023.

Back in September, COST reported strong EPS results of $4.86 on a GAAP basis, topping analysts’ estimates by $0.09. Quarterly revenue summed to $78.9 billion, a 9.5% year-on-year increase, also beating the Wall Street consensus. With comp-store sales of 3.1% domestically, and stronger abroad, most indicators suggested operations were on track.

Costco continues to see strong membership trends helping to drive impressive annual recurring revenue and increased customer foot traffic worldwide, though average transaction amounts may dip in the coming quarters – that’s what was seen in the previous quarter while its US gross margin ticked up 16 basis points. Be on the lookout for news of an increase in Costco’s membership fee, which would be a bump to the top and bottom lines. Moreover, a strong private label is seen as helping overall sales as consumers continue to shift toward cheaper product brands.

Key business risks include any unforeseen negative macro turns in the global economy as well as weakness in its California market. Food deflation could hurt the top line while FX changes could negatively impact translating foreign sales to dollars. Wage pressures and heightened competition are always challenges as well.

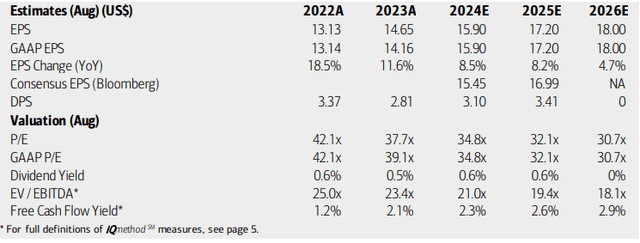

On valuation, analysts at BofA see earnings continuing to climb at a steady pace in 2024 and through 2025. While early, the 2026 look shows a deceleration in EPS growth, however. Seeking Alpha notes that the current consensus per-share profit estimate for the out year is near $16 with sales growth in the mid-single digits.

Dividends, meanwhile, are expected to rise at a steady clip. With trailing and forward earnings multiples in the 30s, there is quite the premium to pay to own this Consumer Staples stalwart. Its EV/EBITDA ratio is also significantly above the average of the broader market while the free cash flow yield is low.

Costco: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

Given the steep premium to both the S&P 500 and the Staples sector’s forward operating P/E, there is not much of a value case here. The growth and stability stories are on solid footing, however. If we assume $16 of forward EPS and apply COST’s 5-year average non-GAAP forward P/E, then shares are right near fair value today ($570). Shares trade at a slight premium to the typical price-to-sales ratio, too. Given resilient foot traffic numbers, and its reliable membership recurring revenue stream (with healthy renewal rates), I expect COST to continue to be a leader in the industry and trade at a premium valuation.

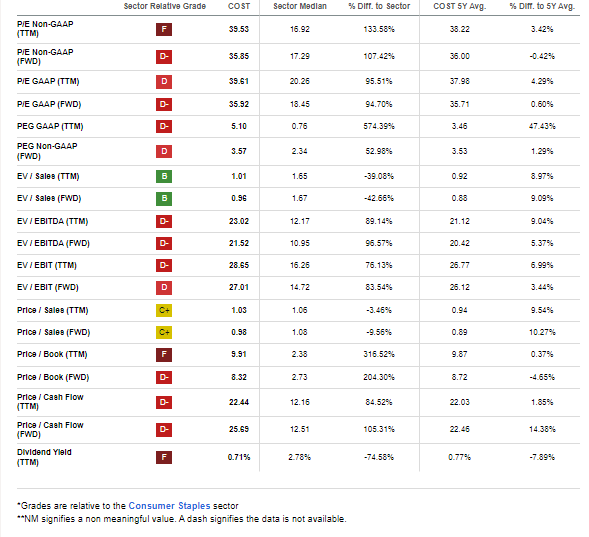

COST: Shares Not in the Bargain Bin

Seeking Alpha

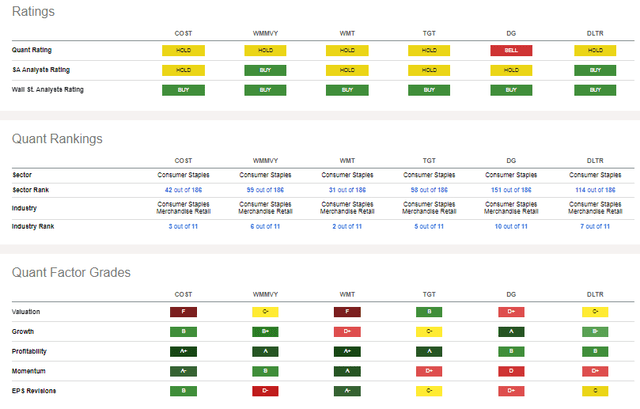

Compared to its peers, COST features a high valuation, but EPS growth is very strong and resilient. It is among the most consistently profitable companies in the S&P 500 with high share-price momentum to boot. Finally, EPS revisions since the previous earnings release have been solid, which cannot be said of its grocery store and broadline retail peers.

Competitor Analysis

Seeking Alpha

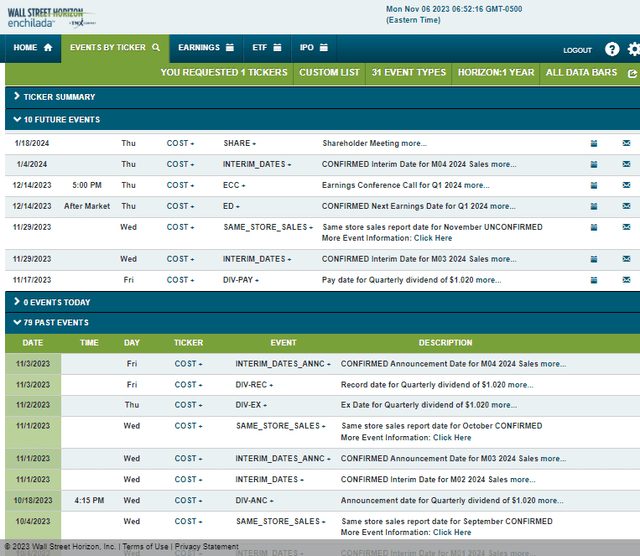

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2024 earnings date of Thursday, December 14 with a conference call immediately after the numbers cross the wires. You can listen live here. COST is also perhaps the most famous firm still reporting monthly same store sales numbers, and those are expected to be released on Wednesday, November 29 after a quarterly dividend pay date on Friday, November 17. Finally, Costco’s annual shareholders meeting takes place early in the new year.

Corporate Event Risk Calendar

Wall Street Horizon

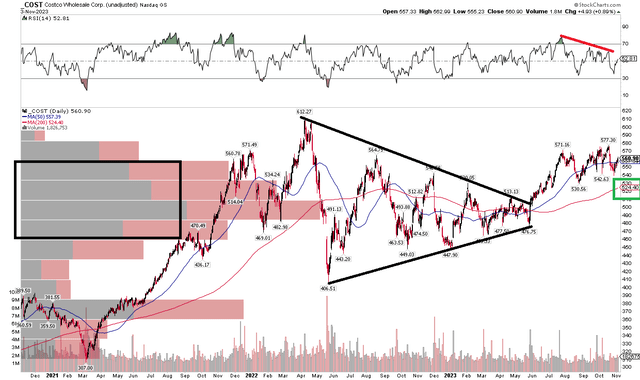

The Technical Take

With shares near fair value on this high-quality growth company, the chart is generally bullish. Notice in the chart below that COST broke out from a symmetrical triangle this past June. The price target based on the height of that pattern, added on top of the breakout point, comes to the low $700s, suggesting significant upside from current levels.

Also take a look at the long-term 200-day moving average – it is positively sloped after going through a sideways trend from mid-2022 through the first half of this year. What I also like from a technical perspective is that the stock has been steadily working its way through a high amount of volume by price over the last handful of months. A bearish sign, however, is seen at the top of the graph – the RSI indicator shows a bearish negative divergence, so that bears watching. With support near $500 and the all-time high of $612 being possible resistance, we have a few price levels to monitor on this large cap.

Overall, the trend is positive.

COST: Bullish Uptrend, Bearish Near-Term RSI Divergence

StockCharts.com

The Bottom Line

I have a hold rating on Costco. I like the technical setup and the fundamental business model, but the stock is merely near fair value in my view.

Read the full article here