Pre-Earnings Analysis

Bilibili (NASDAQ:BILI) is to report its third-quarter earnings at the end of November. Heading into its upcoming quarterly earnings report, there are several recent developments and factors to consider when analyzing Bilibili’s potential performance.

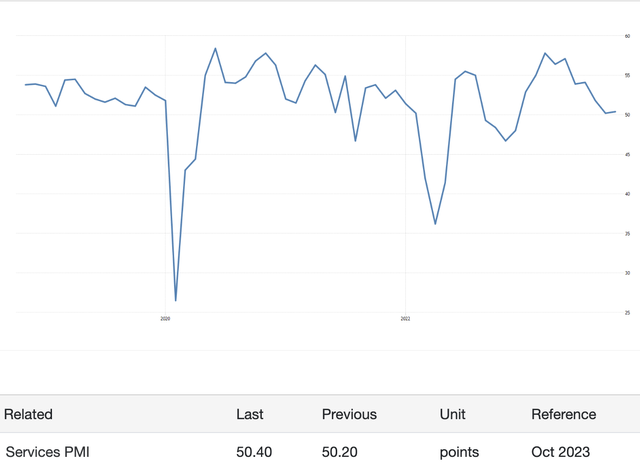

According to the most recent China Caixin Service PMI, which saw a declining trend in the second quarter after reaching a high in the first, and a minor rebound to 50.4 in October. This suggested that Q3 economic performance in China’s service sector is probably going to be worse than Q2’s.

Trading Economics

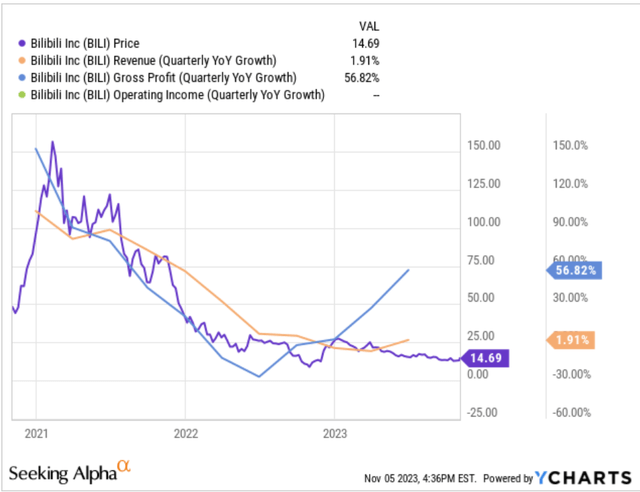

Despite the tough economic climate and rising youth unemployment in China in 2023, Bilibili has surpassed expectations. The company’s operating metrics have improved, bucking negative economic trends, and it has shown accelerated growth in revenue and profits. I believe this indicates that Bilibili’s monetization efforts are effective, and it has not hit a growth ceiling.

YCharts

Monetization Efforts

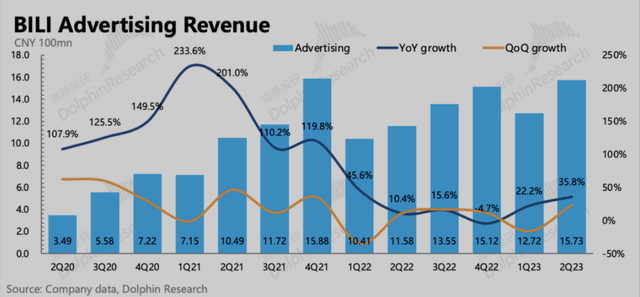

As the management started to focus on monetization, its advertising revenues were growing rapidly. Advertising revenues have now become one of the main drivers to accelerate revenue growth.

Dolphin research

In fact, the management was concerned that the rising revenue from advertising would negatively affect the user experience and, in turn, the long-term growth of the community. But first, we noticed that its value-added service revenues increased by 9%, quickening from Q2 and that its average daily time spent metric was 94 minutes in Q2, a 22% increase from the previous year and the same cadence as Q2. This implied that the introduction of advertising revenue had not resulted in any negative behavior from users. Therefore, if this pattern persists, we would like to see advertising revenues grow to be a significant source of income so that the business can keep raising its profile.

However, the company revised its revenue guidance downward to reflect the delay of game launches and lower revenues from IP derivatives. It now expects the company to grow 5.5% revenue in 2023, which implies 5.7% revenue growth for the second half of 2023. This result is still impressive as it is an acceleration from 4.2% in the first half of 2023 and again demonstrated an opposite trend as suggested by the recent China Caixin Service PMI. It showed that Bilibili is likely to outperform compared to the total service sector in China, which strengthens investor confidence in management and the platform.

Our original analysis was bullish on the name not because it was the Chinese YouTube but further, we see the potential of AI to empower small creators specifically, in our article, “Will Netflix Be Disrupted By Artificial Intelligence Generated Content?”, we discussed our rationale of a bullish view toward the UGC platform compared to PUGC such as Netflix in that we see the AI tool is narrowing the gap of quality between professional studios and individual creators. More significantly, users place greater value on personalization and relevance in the entertainment sector than they do on video quality. Hence, we are bullish on the future of OGC platforms such as Google (GOOG) (GOOGL) and Bilibili. The company in Q2 continued to grow its creators at an astonishing rate of 40%.

Over 1.58 million creators earned money through various Bilibili channels, showing a 40% increase year-over-year. In addition to our cash incentive program, more creators are earning income through advertising and live broadcasting channels.

This suggested that despite recent weak young generation employment in China, Bilibili is the one who is recruiting due to its capability to best utilize the skills of the young generation and is also likely to benefit from relatively stronger bargaining power currently amid the weak employment environment.

Competition and Market Dynamics

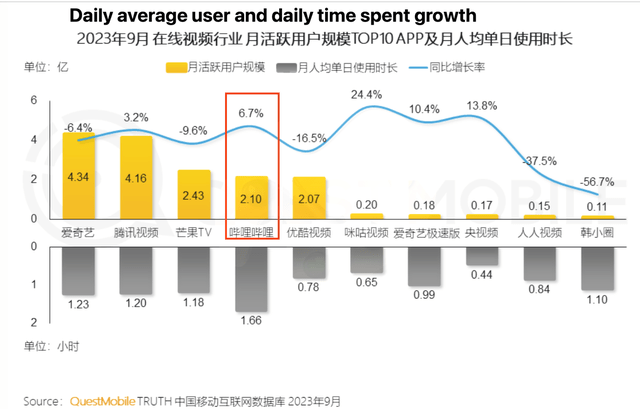

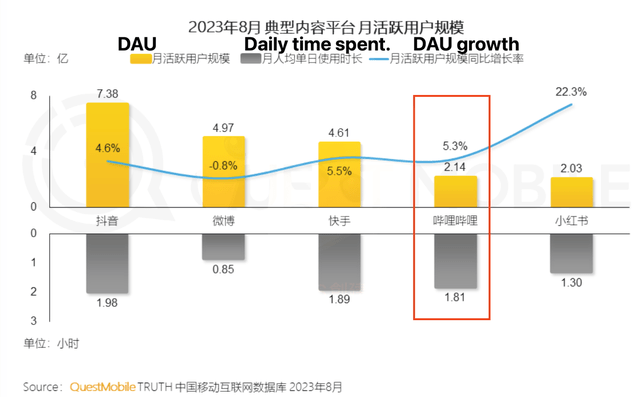

Based on QuestMobile’s data, among its competitors such as iQIYI (IQ) and Tencent Video, Bilibili was ranked top among the competitors with similar or large user bases in terms of daily average users, daily time spent, and daily time spent growth in September 2023. This suggested that Bilibili leads in user engagement and is likely to sustain its growth momentum to take more market share.

QuestMobile

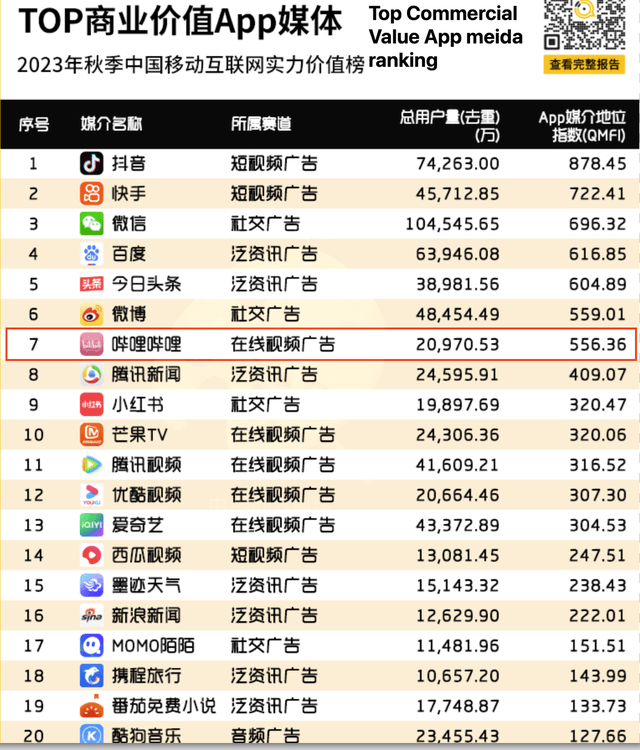

Based on QuestMobile’s commercial value media ranking, Bilibili was ranked at number 7 in China, which is ahead of its peers Tencent and iQIYI despite Bilibili having a smaller user base.

QuestMobile

Furthermore, there is a lot of competition in the Chinese entertainment market. In addition to Tencent Video and iQIYI, other formidable rivals that compete with Bilibili for users’ attention include Douyin (short form), Xiaohongshu (content), and Kuaishou (short form). As QuestMobile data suggests, Douyin, Kuaishou and Xiaohongshu are growing their DAU at a similar or higher rate than Bilibili.

QuestMobile

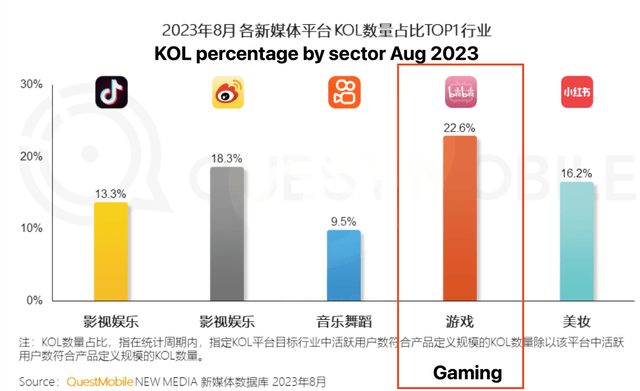

One of Bilibili’s strategies to compete in the market is to set itself apart from other platforms with its service offering by concentrating on gaming and building the largest KOL base in the industry.

QuestMobile

Gaming is one of the largest industries in China, as reported by Statista, there are 666 million players and the total size of gaming revenue can be as large as $44 billion. Hence, we view Bilibili’s niche in gaming as providing more upside and less competition risk than other strong peers.

However, China’s gaming risk is not low compared to other sectors. There is more regulation in the space from the China government, for example, video gaming was criticized as a “cause of myopia” among students by the government. There are regulations to restrict children younger than 18 from playing video games during the school week and a 1-hour daily limit. The regulation is likely to pose uncertainty on Bilibili’s potential long-term growth as there are always new regulations coming unexpectedly from the China government in this space. This is one area that we will closely monitor and investors should pay attention to going forward. However, Bilibili’s strong position and focus on user-generated video content creation is likely to be less affected by gaming regulations and may continue to grow even if restrictions on gaming persist. This is because Bilibili can continue to attract users to watch archival and user-created gaming content, even if new game launches are restricted.

Valuation

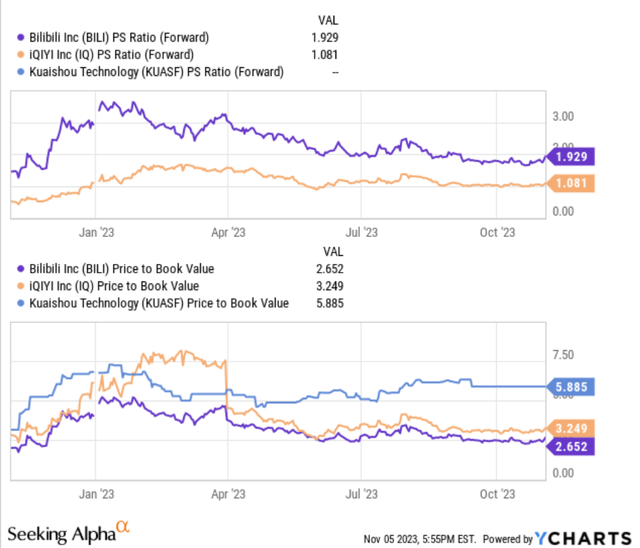

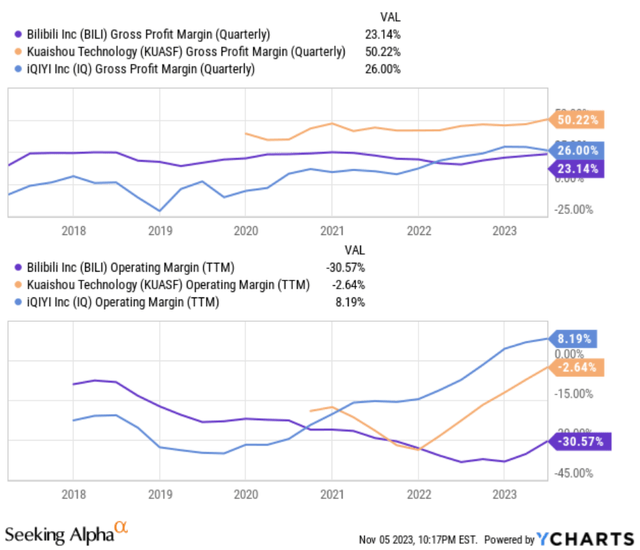

Bilibili operates in a niche market in long-form video and although Kuaishou and iQIYI are not the best comparables to Bilibili, we think the relative valuation still provides insight for investors.

Kuaishou’s stock P/S ratio is 2.2x, according to Webull. Hence, Bilibili is currently trading at a P/S ratio of 1.9x, which is higher than iQIYI but lower than Kuaishou.

YCharts

The valuation multiple is better aligned with its profitability profile. Bilibili has a lower gross margin and operating margin than its peers due to its low monetization rate. This is also attributed to 2 reasons. One is that Bilibili has a younger customer base and this group has lower purchasing power and another is that Bilibili has a more complex business model as it generates revenues from 4 segments: (1) gaming, (2) value-added, (3) advertising and (4) e-commerce. Its e-commerce business, which includes IP derivatives sales, is currently losing money and thus significantly drags its profitability.

Management mentioned that non-core businesses including the IP business are currently undergoing restructuring and repositioning. As the low-margin e-commerce business currently comprises a lower percentage of sales and high-margin business such as advertising is growing, the profitability is improving slowly. Hence, despite the company’s improving profitability in the past couple of quarters, the relative valuation is about reflecting its current weak profitability compared to peers.

YCharts

Conclusion

Video entertainment is a highly competitive environment. The company is currently losing money and experiencing weak profitability compared to peers. Nonetheless, given its positioning in long-form video and emphasis on user-generated content, we believe Bilibili has long-term potential as well as a niche in gaming video. Bilibili has its own legacy issues such as a complicated business model and a young consumer base that drags down its profitability. However, if the company can continue growing in this niche market around gaming and user-generated video content, the long-term potential is still bright in our view.

In the short term, despite Bilibili continuing to show improvement in its operating metrics and continuing to expand its user base against a downtrend in China’s service sector, the current sentiment around China is still weak. Hence, for investors interested in investing in Chinese companies like Bilibili, we recommend starting with a small position.

Read the full article here