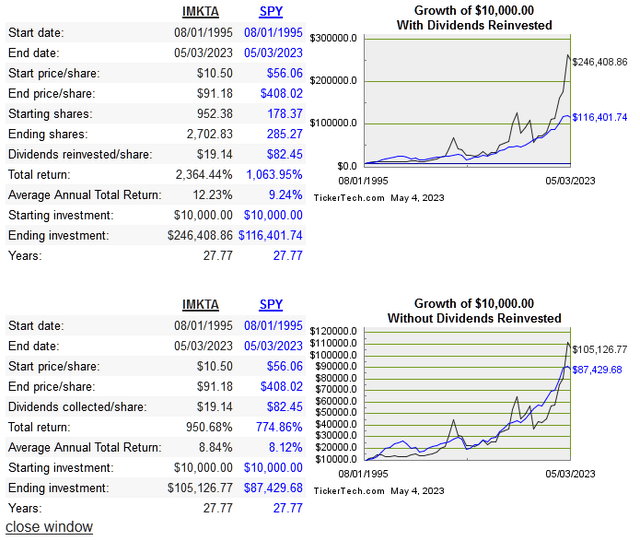

Ingles Markets (NASDAQ:IMKTA) is a regional grocer that operates 198 stores in six southern states. Founded in 1963, the company became publicly traded in 1987. Below the long-term share price performance:

dividend channel

Next is the return on capital metrics:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-year CAGR |

|

IMKTA |

4.3% |

13.5% |

5% |

23.1% |

15.2% |

|

WMK |

5.7% |

9.1% |

8.5% |

4.2% |

21.4% |

|

GO |

11.8%* |

5.9%* |

4%* |

29.8%* |

31.5%* |

|

VLGEA |

3.8% |

8.2% |

7.1% |

-2.1% |

3.4% |

*6-year

Source: quickfs

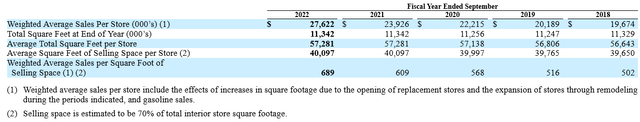

Growth hasn’t been part of the story of this company in a very long time. They ran 175 stores in 1994 versus 198 today. There are no plans for expansion, but the sales per sq. ft. are growing:

2023 annual report

The biggest change since COVID has been Improved operating and FCF margins. If these are the new normal, its good news for this company. Operating profit has jumped from around 3% pre-pandemic to now closer to 6%.

Capital Allocation

The next tables shows of where capital was allocated:

|

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

EBIT |

126 |

123 |

139 |

129 |

128 |

125 |

152 |

281 |

350 |

377 |

|

FCF |

44 |

46 |

49 |

21 |

29 |

11 |

50 |

227 |

166 |

220 |

|

Dividends |

30 |

14 |

13 |

13 |

13 |

13 |

13 |

13 |

13 |

12 |

|

Repurchases |

37 |

65 |

80 |

|||||||

|

Debt repayment |

1,252 |

405 |

735 |

740 |

453 |

529 |

318 |

522 |

1,020 |

19 |

Ingles has never made an acquisition and they have been paying a dividend continuously for decades. They do own many of the properties where the stores are located, and are likely holding those assets for the long run.

The TTM share count has dropped 25%, after essentially staying flat for the past seven years. This is a great sign, and there is no reason to think that EPS and FCF/share won’t be boosted if this continues. The dividends are paltry at this point, in terms of percentage of operating profits and the yield at current share price. It won’t add much to your returns compared to the reduction in share count.

Risk

There is relatively little risk from an operational standpoint, the business has proven itself recession resistant and is in good financial shape. There won’t really be expansion of stores, but if the current FCF yield can remain at or close to this level, shareholders should be rewarded. The behavior of the company is predictable, and as mentioned I like the use of now higher FCF levels.

Long term debt is at $598 million, and with cash and equivalents at $250 million, I see little concern here.

The largest shareholder is 23% owner Robert B Ingle II, but he holds a second class of shares that give him majority voting power. I mention this not as a risk, but just as something to keep in mind as an explanation for the long term behavior of the company.

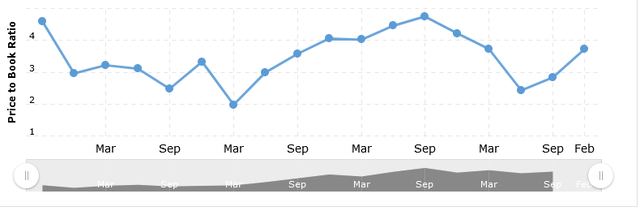

Valuation

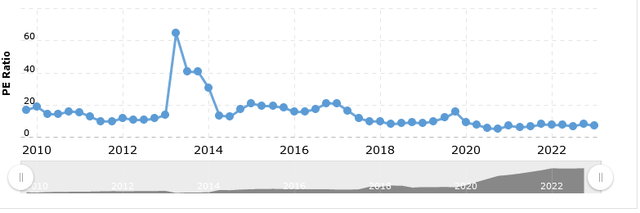

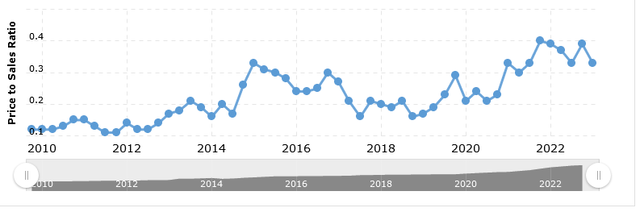

Just like other grocers, IMKTA benefited from the pandemic, and the shares didn’t get caught up in the mania conditions of 2021 and thus avoided a huge drawdown in 2022. First let’s look at the multiples versus peers, followed by historical multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

IMKTA |

0.3 |

4 |

17.5 |

1.1 |

0.8% |

|

WMK |

0.3 |

6.3 |

16 |

1.5 |

1.8% |

|

GO |

0.9 |

19.4 |

60.9 |

2.8 |

n/a |

|

VLGEA |

0.1 |

3.2 |

5.6 |

0.8 |

4.7% |

macrotrends macrotrends macrotrends

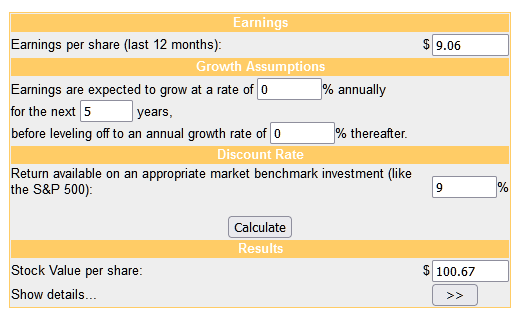

There isn’t any discount apparent when looking at multiples against peers, nor historically. Next is the DCF model:

money chimp

I chose 2020 EPS and assumed no growth, yet the price is still undervalued today assuming EPS can stay near this level.

There could be a rerating of this stock in the shorter term, but a much better scenario would be multiples stay flat while management continues to buy back shares. I like the potential for this to be a cannibal stock, which drastically shrinks its share count. At this price I consider it a buy.

Conclusion

At first glance this seems like just another grocer, but there’s more to the story. This company happens to be in an industry that got a boost from the pandemic rather than a setback. It has already proven itself recession resistant, and is in good financial shape.

The price doesn’t reflect the quality right now so I consider it a buy. If you’re waiting for a short term pop so you can make your exit, you may be waiting a while. Since I’m hoping for a serious share cannibal strategy, I want to see these low multiples last for a while.

You don’t need store growth to make money with this stock, but the key will be to keep an eye on capital allocation.

Read the full article here