Ford Motor Company (NYSE:F) emerges as a beacon of strategic innovation in Q3 2023, capitalizing on its Ford+ strategy. This innovative strategy has broadened the company’s vehicle portfolio under the leadership of President and CEO Jim Farley while also sharpening its focus on improving operational effectiveness and tackling the enduring challenges related to cost and quality. Such strategic recalibrations have been fruitful, allowing Ford to bask in increased revenue. Q3 2023 earnings release has propelled the stock value upward, culminating in a weekly close at elevated levels. This piece examines Ford’s financial health and market technicals to find potential investment prospects. There’s a noticeable recovery in the stock price from a significant support threshold, suggesting a persistent uptrend fueled by robust buying interest.

Ford+ Strategy and Financial Growth

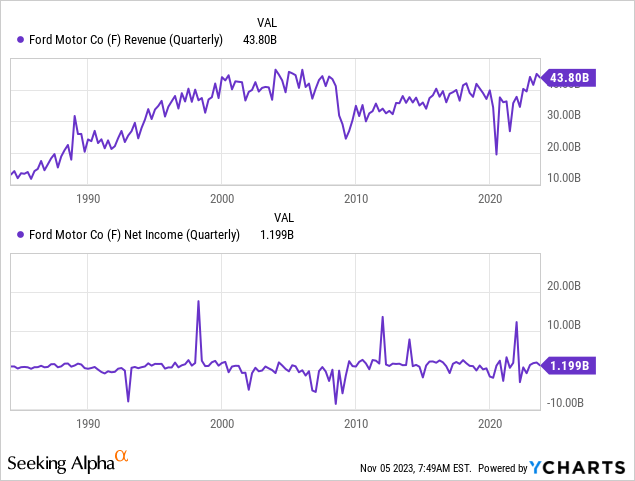

Ford’s financial performance in Q3 2023 marks a significant turnaround from the previous year, showcasing the initial fruits of the Ford+ strategy. This strategy, as detailed by President and CEO Jim Farley, is not only about delivering an impressive range of vehicles but also about improving the company’s operational efficiency, notably by tackling quality and cost issues. The company saw its revenue increase by 11% to $43.80 billion compared to Q3 2022, despite the number of vehicles sold remaining relatively flat.

This revenue boost indicates Ford’s ability to command higher prices or improve the mix of vehicles sold toward higher-margin models. The net income figure is particularly noteworthy, as it stands at $1.199 billion, a stark contrast to the net loss of $827 million in Q3 2022, as shown in the chart below. This improvement in profitability can be partly attributed to the absence of a hefty non-cash, pretax impairment that had affected last year’s figures.

Ford’s financial health is further underscored by its strong cash flow from operations, which totaled $4.6 billion in Q3 2023, contributing to a robust $12.4 billion over the first nine months of the year. The adjusted free cash flow paints a similarly positive picture, evidencing the company’s ability to generate cash after covering its capital expenditures. Moreover, the balance sheet remains a strength for Ford, with a significant cash reserve of over $29 billion and a liquidity pool of $51 billion. This substantial financial cushion, bolstered by a $4 billion contingent liquidity facility, provides Ford with considerable flexibility to navigate potential business uncertainties.

On the other hand, the segment-specific performances further highlight the effectiveness of Ford’s strategy. Ford Pro, focused on commercial vehicles and services, generated an impressive $1.7 billion in EBIT, demonstrating strong margins and revenue growth. Ford Blue, representing the traditional gas and hybrid vehicle lineup, also performed robustly with a 17% increase in EBIT, signaling that conventional segments continue to be profitable despite the growing focus on electric vehicles. Moreover, Ford Model e, responsible for electric vehicles, had increased sales and revenue but reported an EBIT loss due to ongoing investments and challenging market conditions. Ford’s approach to balancing the production of gas, hybrid, and electric vehicles seems pragmatic and financially sound, as per CFO John Lawler’s commentary, ensuring that the company is not overinvesting in electric vehicles to the detriment of profitability.

Furthermore, the company is tapping into the software services market with a significant year-over-year increase in paid subscriptions, now nearing 600,000. The recruitment of industry veteran Peter Stern to lead Ford Integrated Services suggests a strategic push to grow in this high-margin area, leveraging Ford’s advanced driver-assistance systems and other technology offerings.

However, Ford Credit, the company’s financing arm, experienced a downturn, with earnings before taxes decreasing due to lower lease residuals and financing margins. This downturn, though expected, indicates that not all segments within Ford are experiencing growth, and some headwinds remain.

In summary, Ford’s Q3 2023 financial performance presents a company amid a successful turnaround, capitalizing on strategic initiatives to bolster profitability, manage costs effectively, and innovate within its product offerings. While challenges remain, particularly in the electric vehicle market and financing segment, the overall health of the company appears robust, positioning it well for the future.

Technical Pivots Underpinning Ford’s Strategy

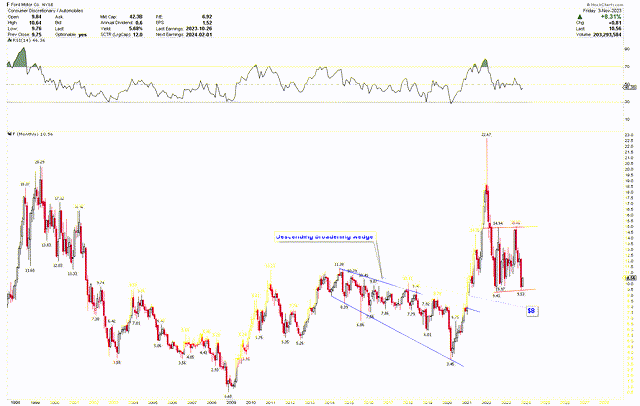

The monthly chart below illustrates that Ford’s stock price has experienced significant fluctuations over the past few years, indicating high volatility. The overall trajectory of the stock has been upward after 2009, propelling prices to elevated levels. The stock exhibited a descending broadening wedge pattern from 2014 to 2020, ultimately breaking out and initiating an uptrend that saw the stock soar to elevated levels.

This rally was the strongest in Ford’s history due to the company’s aggressive pivot towards electrification and an industry-wide recovery from the COVID-19 pandemic-induced slowdown. Ford announced substantial investments in electric vehicle production, including the Mustang Mach-E and the electric version of its best-selling F-150 pickup truck, signaling a significant shift in its product line to align with the global push towards sustainability. This commitment to electric vehicles was complemented by launching its commercial business unit, Ford Pro, and strategic partnerships to expand its battery production and technology capabilities. These moves reassured investors about Ford’s ability to adapt to the rapidly changing automotive landscape and to tap into new revenue streams, buoying the stock price as market confidence in the company’s prospects grew.

Ford Monthly Chart (stockcharts.com)

Moreover, Ford’s performance was buoyed by broader economic trends. As economies rebounded from the pandemic, consumer demand for automobiles surged, driving up sales across the sector. The global semiconductor shortage, while initially a challenge, eventually led to a decrease in dealer inventories, contributing to higher transaction prices and margins for available vehicles. Ford managed supply chain issues adeptly, further reinforcing investor confidence. Additionally, Ford Credit remained robust, contributing positively to its earnings. These favorable conditions, combined with Ford’s cost-cutting measures and operational restructuring initiated before the pandemic, played a critical role in the company’s financial turnaround and the ascent of its stock to higher points after 2020.

This substantial price surge peaked at an all-time high of $22.67 and produced a bearish hammer on the monthly chart and declined due to a confluence of factors. A critical driver behind this descent was the global supply chain disruption, particularly the semiconductor chip shortage that heavily impacted automotive manufacturers, constraining Ford’s production capacity and ability to meet the burgeoning demand for its new vehicles, including its electric vehicle lineup. Additionally, investor sentiment cooled due to rising inflation and fears of an economic slowdown, which led to a broad sell-off in the equity markets, disproportionately affecting Ford stocks. Moreover, there was increased competition in the electric vehicle space, with traditional and new manufacturers accelerating electric vehicle rollouts. This may have diluted Ford’s market position and its potential for growth in this crucial segment. These elements combined to undermine Ford’s stock performance despite the company’s strategic moves and its initially strong sales figures in 2022.

The price decrease has brought it down to $9.41, which has begun to oscillate between the broad spectrum of $9 to $15. Currently, the price is recovering from the bottom of this support bracket, close to $9, and it is anticipated to surge sharply back up to $15. Nonetheless, should the price continue to fall, robust support is found at the $8 level, corresponding to the support line of the descending broadening wedge pattern.

Key Action for Investors

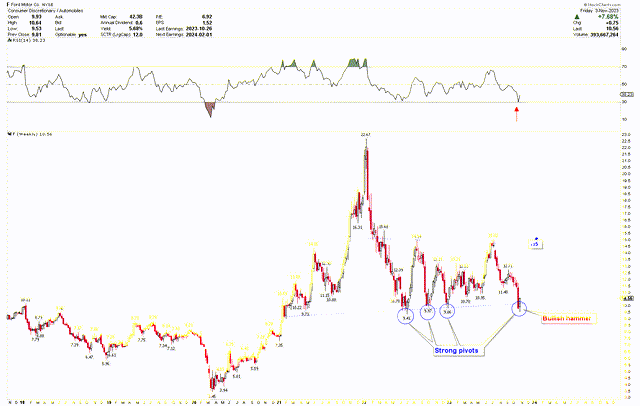

To gain a deeper insight into the aforementioned optimistic scenario, the weekly chart below illustrates the critical price corridor between $9 and $15 that was also highlighted in the above discussion. Notably, there’s evidence of a bullish hammer pattern forming on the weekly chart, suggesting robust support at these price points. Historical data shows a trend reversal at these levels in 2022 and 2023, underscoring the significance of this level. Additionally, RSI appears to be pivoting away from the oversold territory, which may indicate that prices have reached a potential low.

Ford Weekly Chart (stockcharts.com)

However, it should be noted that for a decisive bullish momentum to take hold in Ford’s market, a breakthrough above the significant threshold of $15 is needed. Should the monthly closing price surpass this mark, it would signal an impending upward movement in the market. In the meantime, if the price hovers below $15, a neutral market trend will likely persist in the short term.

Nonetheless, considering the importance of this support level and the emergence of the bullish hammer, investors may want to seize the opportunity to purchase Ford shares at the current levels, with the prospect of an uptrend and a breakthrough above $15 in mind. Should prices dip to $8, this would allow investors to increase their positions further.

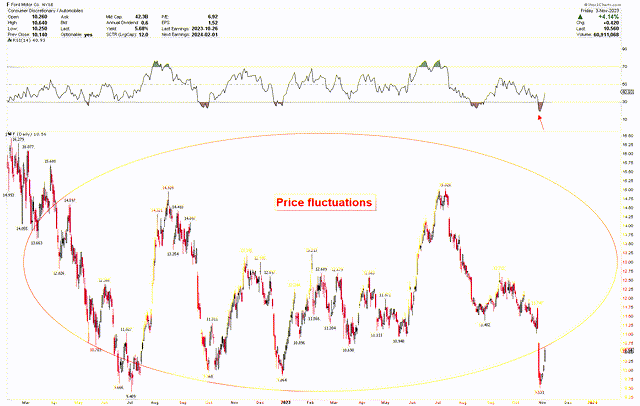

The daily chart below illustrates the intense price consolidation, highlighting significant volatility and a recent bounce back from lower levels. This activity is particularly noticeable during the market’s oversold periods, as depicted by the RSI on the daily chart.

Ford Daily Chart (stockcharts.com )

Market Risks

The company faces market risks tied to the cyclical nature of the auto industry, which is susceptible to economic downturns that can adversely affect consumer spending and vehicle sales. Supply chain issues, particularly the semiconductor chip shortage, threaten production and demand fulfillment, potentially leading to lost sales and a weakened market position. Additionally, rising material costs amidst inflationary pressures could compress margins if these costs cannot be transferred to consumers. The intense competition in the burgeoning electric vehicle market also represents a strategic challenge, with established and new players vying for market share, potentially diluting Ford’s growth in this sector.

Financially, Ford exhibits strength with a robust balance sheet and strong cash reserves. Still, market risks remain in the form of potential interest rate hikes affecting vehicle financing and the operational performance of Ford Credit. The company’s ability to manage debt and liquidity in a volatile market is crucial, particularly as Ford Credit experiences a downturn with decreased earnings before taxes due to lower lease residuals and financing margins. The execution of the Ford+ strategy remains paramount, with risks centering on Ford’s ability to continuously innovate and efficiently operationalize new initiatives, especially in the high-margin software services market.

Moreover, the volatility of Ford’s stock price, influenced by broader economic trends and investor sentiment, poses investment risks. While the company’s pivot towards electrification and strategic partnerships have historically boosted investor confidence, the current stock trajectory indicates a fluctuation pattern until the $15 is broken. Furthermore, should Ford shares persist in downward momentum, falling below the $7 mark, it could undermine the long-term optimistic forecast.

Bottom Line

In conclusion, Q3 2023 marks a pivotal point for Ford, showcasing a company on the cusp of a favorable turnaround. Through the strategic implementation of its Ford+ plan, the company has skillfully navigated the complexities of a rapidly evolving automotive industry. Guided by the shrewd direction of President and CEO Jim Farley, the company has strengthened its financial health and showcased savvy fiscal management through the enhancement of its income, the sustenance of a solid operational cash flow, and the establishment of a sizeable monetary reserve, ensuring a foundation for upcoming projects and a safeguard against economic variances.

From the technical perspective, the stock’s volatility reflects the broader industry’s susceptibility to macroeconomic shifts, supply chain disruptions, and evolving consumer preferences, particularly in the electric vehicle market. While the stock has shown resilience at crucial support levels of $9, the path forward suggests careful navigation through the potential market risks associated with economic cycles, competitive dynamics, and production capabilities. The appearance of a bullish hammer at a significant support level suggests a possible turnaround in price. If prices rise above $15, it could trigger a robust surge in the Ford market. Presently, Ford’s stock is attractively priced for buy. Investors have the opportunity to capitalize on this lower price point, investing in Ford stocks with the expectation of an upward trend.

Read the full article here