Block (NYSE:SQ) submitted a strong earnings sheet for the third quarter that showed continual gross profit momentum, especially in the Cash App business. The Cash App is Block’s most promising and fastest-growing segment which generated more than 27% gross profit growth in Q3’23. As FinTech scales its product offerings, signs on new customers to its Cash App, and grows outside of the U.S., Block could soon achieve sustainable operating income profitability. Shares are not cheap, based off of revenues, but also not outrageously expensive considering at what rates Block is expected to grow its earnings per share going forward. With an improved earnings outlook, I believe shares of Block could see a further upside revaluation.

Previous rating

My prior rating on Block, following Q2’23 results, was strong buy — Buy The Drop — due to Block’s success in growing Cash App users. Additionally, the company is strengthening its position in international markets as Square now generates 17% of its gross profits in markets outside of the U.S. The FinTech is rapidly nearing operating income profitability and the company is set for strong earnings growth as a result.

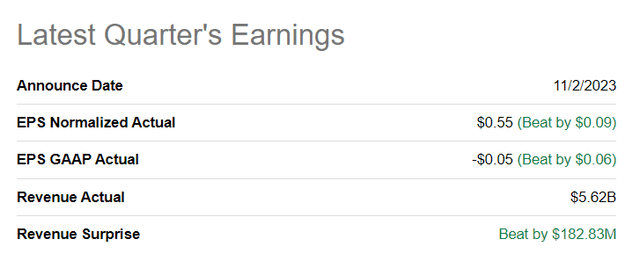

Block beat top and bottom line estimates

Block managed to present a much better-than-expected earnings card for the third quarter: Block generated $0.55 per share in adjusted earnings on total revenues of $5.62B. Adjusted EPS beat expectations by a good $0.09 per share margin and shares soared 16% after the close of the markets on Thursday.

Source: Seeking Alpha

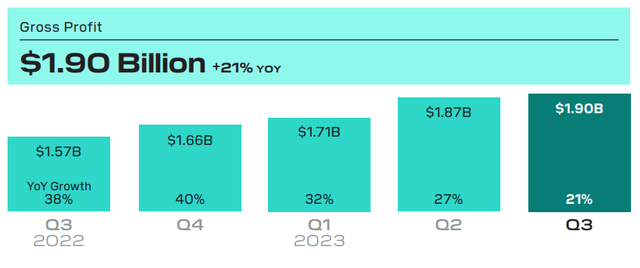

Gross profit momentum continued in Q3’23

Block’s gross profit continued to soar in the third-quarter, driven by strong product adoption of the company’s main product, the Cash App. The Cash App allows users to send money easily to friends and family and has been a major growth driver for the FinTech for years.

Block generated total gross profits in the amount of $1.90B, showing 21% year-over-year growth. About 52% of Block’s total gross profits came from the Cash App segment which generated $984M in gross profits and 27% year-over-year growth. The other $899M in gross profits came from the Square segment which offers, as an example, POS (point-of-sale) systems for merchants to take credit card payments. The Square segment grew its gross profits 15% year-over-year, so is growing at about half the pace as the Cash App business.

Source: Square

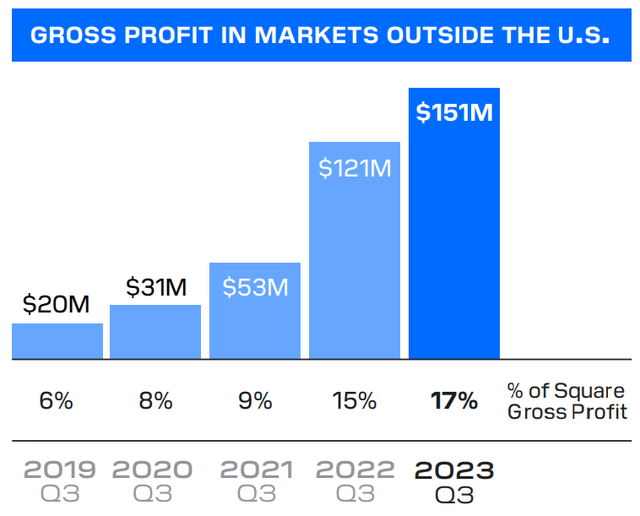

International growth opportunity

Square is gaining in popularity abroad which I like from a diversification point of view. Too often U.S.-based FinTechs are entirely focused on servicing the U.S. market which makes them miss out on opportunities abroad. Square, which offers a number of products including POS systems, business financing and inventory management, achieved 17% of its gross profits outside of the core U.S. market in the third-quarter… which is up 2PP quarter over quarter. Square product adoption in the small business segment is therefore a powerful growth driver going forward. In the longer term, I believe Square could generate 25% of its gross profit in markets outside of the U.S.

Source: Block

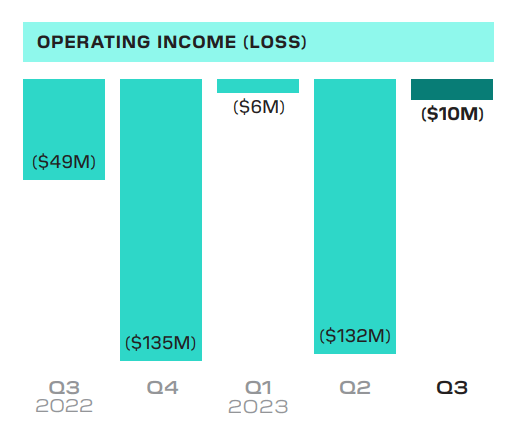

Nearing an inflection point

The reason why Block’s Q3’23 earnings report was received so well by investors was that the company is nearing an important inflection point: it could soon post positive operating income which I believe could be a catalyst for Block’s shares as well. Block’s operating loss in Q3’23 was $10M, but losses have drastically narrowed and adjusted operating income was $90M, showing a 3.6X factor increase over the previous quarter. In my opinion, Block could generate positive operating income as early as next year.

Source: Block

Block has an attractive valuation

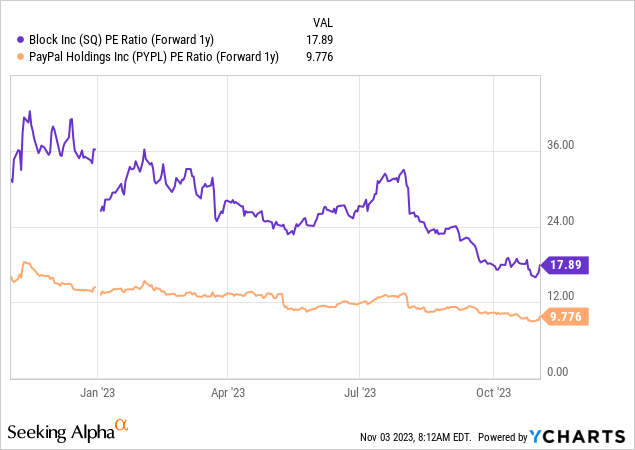

In a direct P/E comparison between PayPal (PYPL) and Block, PayPal comes out on the top, largely because the FinTech suffered a decline in its user base which has resulted in a depressed earnings multiplier. But Block has considerable potential to grow, so I believe the risk profile is still very favorable.

Block is expected to generate $1.95 per share in earnings in FY 2023 and $2.60 per share in FY 2024. This year, Block is projected to see 95% EPS growth and for next year the expectation is for 33% growth. For context, PayPal’s EPS growth rates for this year and next year are 20% and 13%. In other words, Block is expected to have 20 PP higher EPS growth in FY 2024 than PayPal.

Due to momentum in the Cash App business as well as Square’s success in the U.S. and abroad, the valuation multiplier is not outrageous: Block trades at 17.9X FY 2024 earnings compared to a P/E ratio of 9.8X for PayPal. Given that Block is growing so rapidly, relative to PayPal, I believe the FinTech could be valued at ~$65 per share, based off of a consensus EPS of $2.60, implying a 25X P/E ratio.

Risks with Block

Investors are losing their patience with start-ups, in the FinTech space or elsewhere, that are consistently generating losses and companies sooner or later have to show that they are capable of transitioning their loss-making start-ups to more mature and reliably growing enterprises that actually generate profits. Block is just at the brink of achieving positive operating income and GAAP profits, but if the timeline gets pushed out, investors may be disappointed… which may hurt the valuation factor. What I also see as a commercial risk for Block is that the FinTech is overly dependent for its gross profit growth on the Cash App business.

Final thoughts

Block continued to execute well in the third-quarter: Cash App’s gross profits grew 27% year over and reached a new record at $1.9B. Ever since the second-quarter earnings report, Block has steadily revalued down-wards which I believe was not really warranted given the FinTech’s strong growth momentum. Shares are not exactly a bargain, relative to other FinTechs like PayPal, but they are modestly valued given the potential for above-average EPS growth. Since the third-quarter earnings report confirmed that Block continues to grow rapidly and is moving towards operating income profitability, I believe the risk profile remains heavily skewed to the upside!

Read the full article here