The iShares Expanded Tech-Software Sector ETF (BATS:IGV) has rebounded strongly from the 2022 tech sector bear market and has ridden the AI wave to a 35% gain YTD. The ETF has been led by #1 holding Microsoft (MSFT), which makes up 9.7% of the fund and is up 47% YTD. Microsoft is a beneficiary of two primary themes that are driving the entire software sector: digitization and migration to the cloud and AI. While much of investor focus with respect to the AI theme has been on companies like Nvidia (NVDA) that design high-performance compute engines (i.e. hardware), over the long-haul it is my opinion it is the software companies that will be the biggest winners in AI. That’s because it is the software companies what will be implementing the AI tools and productivity enhancements that their customers are demanding and which will bring the full potential of AI to fruition. That being the case, all investors need long-term exposure to the very profitable SaaS-based software companies that will be leading the way. And the IGV ETF owns the best-of-the-best. IGV is a BUY and should be considered as a long-term core technology holding for investors interested in building and holding a well-diversified portfolio through the market’s up-n-down cycles.

Investment Thesis

At the end of the 2022 bear-market, I cautioned investors not to give up on the software sector (see IGV: Software Is Dead, Long Live Software – a Seeking Alpha Editor’s Pick). Since that article was published, IGV has outperformed the S&P500 by 25%. Today, I continue my coverage of the IGV ETF on Seeking Alpha during a time when Nvidia and Microsoft seem to suck all the oxygen out of the room every time the topic of Generative AI pops up.

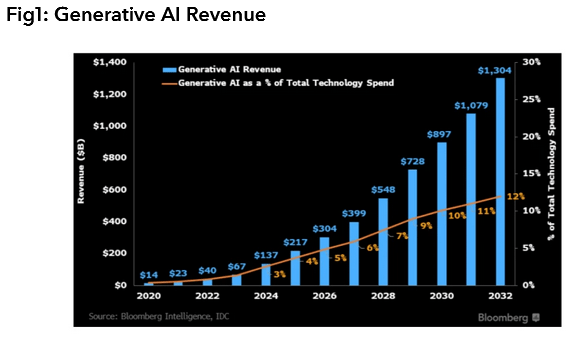

I’ll begin by pointing out a recent Bloomberg report that Generative AI is expected to become a $1.3 trillion market by 2032:

Bloomberg

That equates to a CAGR of a whopping 42% over the next 10-years. The study estimates that generative AI products could add as much as $280 billion of new software revenue. As you can see, even if these estimates are off by 10-20%, AI is still going to be a very positive catalyst for the software sector. And remember, most all of the leading software companies have built SaaS-based platforms that are easily scaled-up as the customer base broadens. That means revenue growth will also drive margin growth.

Bloomberg Intelligence’s Senior Technology Analyst Mandeep Singh – the lead author of the report – had this to say:

The world is poised to see an explosion of growth in the generative AI sector over the next ten years that promises to fundamentally change the way the technology sector operates. The technology is set to become an increasingly essential part of IT spending, ad spending, and cybersecurity as it develops.

That being the case, let’s take a look at the IGV ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

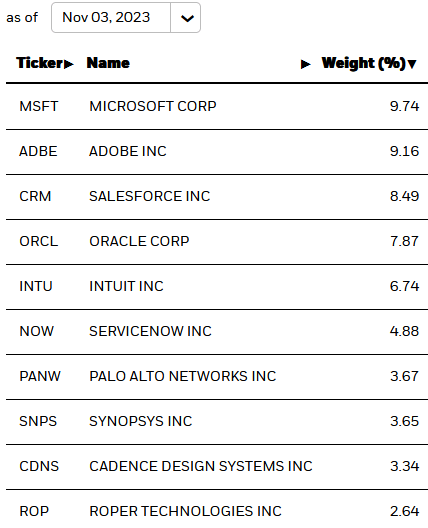

The top-10 holdings in the IGV ETF are shown below and were taken directly from the iShares IGV ETF homepage, where investors can find more detailed information on the fund:

iShares

As you can see, the IGV ETF is a concentrated fund with 60% of the fund allocated to its top-10 holdings. However, in a market in which size-n-scale are typically advantageous, I’m comfortable with this portfolio – and especially the dominant holdings.

As mentioned previously, Microsoft is the #1 holding with a 9.7% weight. MSFT announced a strong FY24 Q1 report on October 24th. First quarter highlights included:

- Revenue of $56.5 billion: +13% yoy.

- Operating income of $26.9 billion: +25% yoy

- Net income was $22.3 billion: +27% yoy

- Diluted EPS was $2.99: +27% yoy

These are exactly the kind of revenue and earnings growth numbers one should expect from the #1 holding in a software ETF. Meantime, MSFT management is guiding for its cloud business (Azure) to grow 25%+ throughout FY24. While the Activision acquisition is likely to pressure margins in the short-term, it will add more than $6 billion to annual revenue and will be a bump-in-the-road relatively to MSFT’s cloud and commercial Office businesses. Going forward, MSFT will continue to benefit from its investments in OpenAI as it embeds AI across all its platforms – Office productivity tool CoPilot being the first big roll-out and is exhibit #1.

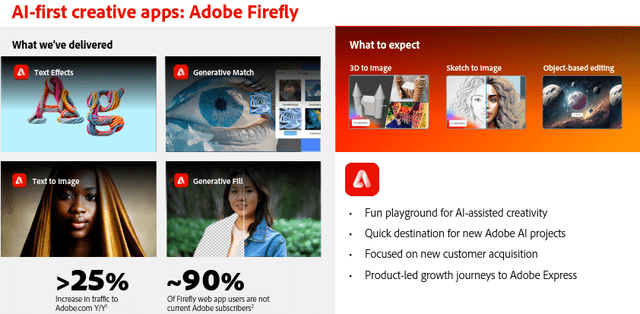

Adobe (ADBE) is the #2 holding in the IGV ETF with a 9.2% allocation. Adobe continues to set the standard in content creation software and dominates the category. This year, in a strong addition to its SaaS-based Creative Cloud platform, Adobe announced new generative AI models under its “Firefly” umbrella. For example, Firefly Vector will add strong new graphics capabilities to Adobe Illustrator. Meantime, a slide taken from Adobe’s October Investor Presentation showed the upside potential in AI when it revealed that ~90% of Firefly web-app users were not yet current Adobe subscribers:

Adobe

Adobe announced strong Q3 earnings in September, with EPS growth of 20%+.

Salesforce.com (CRM) is the #3 holding with a 8.5% weight. “CRM” stands for “Customer Relationship Management” and AI is the perfect technology for Salesforce to monitor its customers’ data in order gain insights into attractive business opportunities. That is, AI will boost CRM’s data analytics capability and, as a result, should increase its customers’ business outcomes and therefore their margin. CRM stock is +54% YTD.

The IGV ETF top-10 holdings has exposure to cybersecurity through its 3.7% allocation in #7 holding Palo Alto Networks (PANW).

In EDA (engineering design automation), IGV holds an aggregate 7% allocation in what is a duopoly of the two leading EDA providers: Synopsys (SNPS) and Cadence (CDNS). These two companies will continue to benefit from semiconductor companies like Nvidia, AMD (AMD), and Intel (INTC) as they continue their quest for ever more-powerful and complex high-speed high-performance compute engines to run AI and ML algorithms on mega-data sets.

Risks

The software sector is generally a high-growth and therefore highly valued group of companies. Indeed, the current P/E ratio of the IGV portfolio is 57x – which is more than double the S&P500’s current P/E of 24x.

However, in comparison investors should consider that Nvidia’s current P/E = 108x and its forward P/E = 41x; AMD’s current P/E = 1,000x+ and its forward P/E = 42x. In addition, I’d argue that the software sector as a whole actually exhibits significantly less cyclicality as compared to the hardware sector.

In a relatively volatile market, the IGV ETF can fluctuate rather wildly on a short-term basis. That is why I advise investors who want to establish a position be patient and scale-into the fund over time (i.e. dollar-cost-average).

Higher oil prices would lead to higher inflation and the potential for more interest rate increases by the Federal Reserve. In that scenario, the U.S. dollar would likely strengthen, creating a foreign exchange headwind (ala 2022) for software companies that generate much of their revenue overseas.

Lastly, the IGV’s expense ratio of 0.41% is not typical of the low-cost ETFs I generally favor. That said, one cannot argue with the returns – and that is a segue into the next segment.

Performance

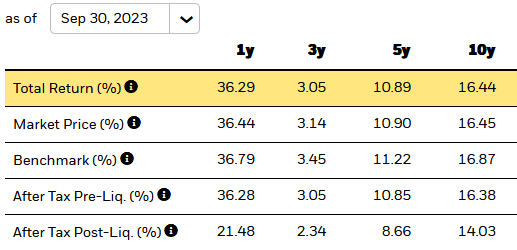

The long-term returns of the IGV ETF – as of the end of Q3 – are shown below:

iShares

As can be seen, despite the excellent returns over the past year, the 3-year returns of the IGV ETF – which includes the 2022 bear-market, are less than impressive. However, the 10-year average annual returns of 16.4% are.

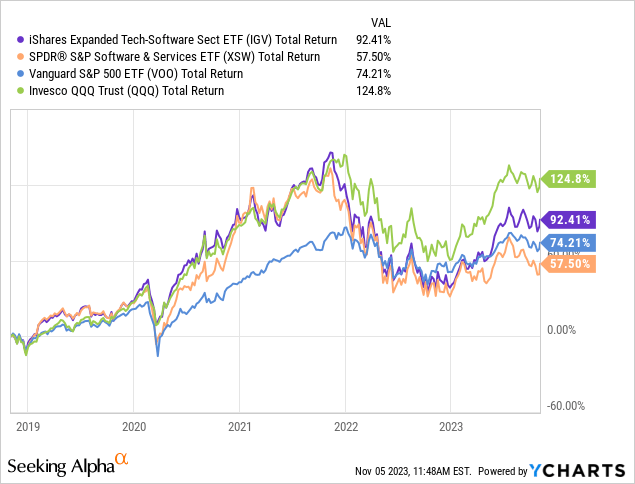

The graphic below shows a 5-year total returns comparison of the IGV ETF against the SPDR S&P Software & Services ETF (XSW), the S&P 500 ETF (VOO), and the Invesco Nasdaq-100 Trust (QQQ):

As can be seen in the graphic, the IGV ETF has handily outperformed the S&P500 over the past 5-years, but has trailed the triple-Q’s by some 32%.

Summary & Conclusion

Despite its relatively high expense ratio and high valuation level, I hold the IGV ETF in my own personal portfolio and advise investors consider it as a core long-term holding for theirs. That’s because I consider software – just as I do semiconductors – to be a key technology for the 21st Century. These leading software companies have already established SaaS-based platforms that easily scale-up as they add customers. That means higher (AI related …) revenue will lead to higher-margins and more free-cash-flow.

That said, some investors may prefer simply what is arguably a (the?) leading stock in the sector: Microsoft. And I can understand that view. Me, I want a more diversified ETF because I already have substantial exposure to Microsoft via my holdings in VOO, QQQ, (FTEC), and a number of other technology funds.

IGV is a BUY and – just like QQQ and FTEC – should be considered as long-term tech sector holdings.

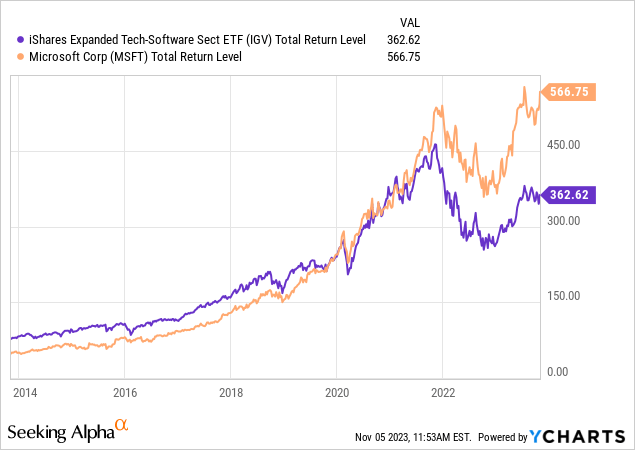

I’ll end with a 10-year total returns comparison and note that those that simply held Microsoft over that time frame have been very well rewarded:

Read the full article here