In my prior coverage of mountain state multifamily operator, Centerspace (NYSE:CSR), I concluded that shares were fairly valued and maintained a neutral view on the stock due to a less favorable environment for rental rate growth.

Shares in the stock have since declined over 20%. At less than 11x forward funds from operations (“FFO”), CSR trades at a discount to several other multifamily peers. Elme Communities (ELME), for example, trades at 13.8x, while Independence Realty Trust (IRT) commands 11.8x.

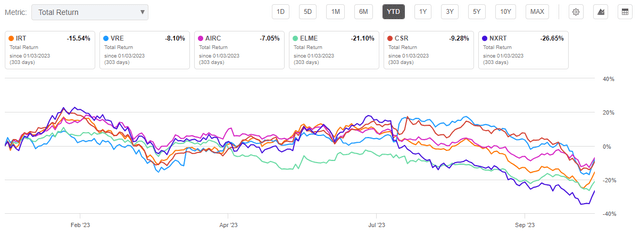

While the stock hasn’t suffered as steep of losses as its competitors, shares are still down nearly double-digits on a YTD basis.

Seeking Alpha – YTD Performance Of CSR Compared To Peers

In Q3, CSR announced an entry into a new operating region in their Colorado market, and they also increased the midpoint of their full-year core FFO guidance. While I believe CSR warrants a second look from investors seeking new or further positioning in the multifamily REIT sector, I continue to have a neutral view on the stock’s future prospects.

CSR Key Portfolio Metrics

CSR’s primary footprint is in the midwestern and mountain regions of Minneapolis, Denver, and North Dakota. The three regions combined represent about 70% of their total net operating income (“NOI”).

At the end of Q3, same-store average occupancy stood at 94.7%, down sequentially by 50 basis points (“bps”) but in-line with average occupancy in the same period last year.

Average monthly rental rates in the same-store population were approximately $1,500/month in Q3, 3% higher from Q2 and up 7% from Q3 fiscal 2022. From an affordability standpoint, tenants are significantly better off renting than opting for home ownership in the region.

The average value of a home in Minneapolis, for example, is currently $320K, according to Zillow’s Home Value Index. Assuming an 8% mortgage rate, it would be nearly $400/month more expensive to buy rather than rent one of CSR’s apartments, figuring a total mortgage of 80% of the home value.

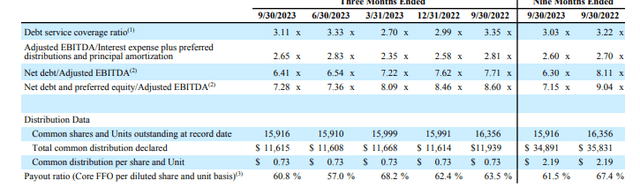

Within the balance sheet, CSR does operate on a higher debt load. I have noted this as one concern in prior coverage in the stock. In recent periods, however, CSR has made significant progress in reducing total leverage. In Q2, CSR reduced their total net debt multiple to 6.5x from 7.2x previously. In addition, they also reduced their floating rate exposure to less than 2% of their total debt stack.

CSR Q3FY23 Investor Supplement – Quarterly Debt Metrics

CSR Q3 Results

In the same-store pool, total revenues grew 5.7%, led higher by strong growth in their St. Cloud, MN and Omaha, NE markets, each of which grew a respective 11.4% and 9.7%. Though overall same-store expense growth outpaced revenues, total same-store NOI still grew 5.4%.

CSR also reported blended rent spreads of 3.9%, comprised of a 2.3% increase on new signings and a 4.9% increase in renewals.

There was less to cheer about on a sequential basis. Here, CSR reported negative NOI due to a 7.4% increase in total same-store expenses against flat growth in total revenues.

The two largest factors driving expenses were real estate taxes and insurance. Insurance, in particular, was up 21.4% during the quarter. Commentary from CSR CEO Anne Olson also suggested that insurance costs are likely to remain high for the remainder of the year and into 2024.

The higher non-controllable expense environment would also be paired with slowing rental rate growth. In the month of October, for example, CSR was still reporting positive rental spreads; but barely, at just 0.8%, with positive renewal rates of 5.3% largely offset by a 2.4% decrease in new signings.

Despite the weaker sequential performance, the management team still had enough confidence to increase the midpoint of their full-year core FFO guidance by $0.02/share to $4.67/share.

Investment activity during the quarter could have contributed to this. First, CSR announced the sale of four communities in their North Dakota market for an aggregate total of +$82.5M. CSR also closed on the acquisition of a community in Fort Collins, Colorado, for a total purchase price of +$94.5M. As part of the purchase, CSR took on a +$52.7M mortgage with an interest rate of 3.4%, a relative discount compared to current market rates.

CSR Dividend Payout

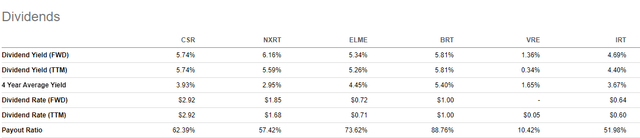

Centerspace currently provides a quarterly dividend of $0.73/share. Annualized, this represents a yield of about 5.75% at current trading levels. This is in the middle-of-the-pack with their peers, who offer yields ranging from 4.7% in the case of IRT to 6.2% for NexPoint Residential (NXRT)

Seeking Alpha – Dividend Yield Of CSR Compared To Peers

At the forecasted midpoint of FFO, the payout ratio stands at approximately 62%, in-line with sector averages. Coverage could be considered more strained, however, when factoring in their value-add capital expenditures, which is a significant aspect of their business.

The higher debt servicing costs also may impede payout growth in future periods. This, though, is also the case with peers, NXRT and IRT.

Is CSR Stock A Buy, Sell, Or Hold?

CSR increased the midpoint of their full-year guidance following decent quarterly results that included continued YOY same-store growth. It also followed the announcement of their entry into the Fort Collins MSA, which should provide a tailwind to the performance of their overall Colorado market.

According to management commentary, the median home value in Fort Collins was approximately $560K. At current mortgage rates with a 20% down payment, a buyer would be spending about $3,300/month to own a home in the market.

Alternatively, the average rent in the market is $2,000/month. The rent at one of CSR’s properties could be even less, as the company’s portfolio average stands at about $1,500/month. The relative discount to ownership should attract tenants into CSR’s properties.

While the entry into the Fort Collins MSA was one positive development, the sequential weakness in the overall portfolio doesn’t inspire confidence into future operating performance. CSR noted declining spreads to start Q4 with slowing leasing volume. Additionally, rising insurance costs appear to be taking a bite out of same-store NOI.

While the stock does appear to trade at discount of less than 11x forward FFO, I view the increase in guidance with skepticism, especially in the face of a rental market that appears to be slowing. While the stock appears more attractive at current trading levels, I remain neutral on its future prospects and continue to view shares as best left on hold.

Read the full article here