Introduction

iShares Core MSCI EAFE ETF (BATS:IEFA) is an exchange-traded fund that provides investors with exposure to companies in developed markets across Europe, Australia, Asia, and the Far East (which explains the “EAFE” acronym). The fund is essentially a global developed-equity fund, but without U.S. and Canadian exposures; a way to specifically capture exposure to non-North American stocks in a developed-equity portfolio.

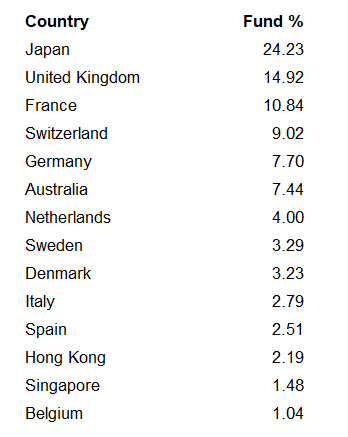

Any fund can provide alpha if it offers a sufficiently niche opportunity, too, and since international markets are generally much less “deep” (in terms of breadth of selection across different sectors and companies, and the size of capital markets), IEFA is not incredibly concentrated in any one geography. The largest is Japan (24.23%), followed by the United Kingdom (14.92%), and France (10.84%). These three companies are all part of the G7 club of developed economies. For reference, IEFA’s country-by-country exposures are presented as a list in full, below.

IEFA Country Exposures (iShares.com)

There is a broad level of diversification here, and in fact one of the more important drivers of value is the weighted risk-free rate, which I will calculate as part of this article. Developed markets have seen far higher rates in recent times than as pre-2022, during which inflation rates became high and persistent enough to warrant serious attention. Europe has moved from negative rates to firmly positive rates, and Japan is even appearing to depart from Yield Curve Control. While inflationary pressures may not persist for as long as markets think, in any event the “risk-free rate” component of valuation has become more critical to determining fair values.

I previously covered IEFA in October 2021, some time ago, believing the fund was more or less priced for 8% returns (which at the time would have made the fund, on a risk-adjusted basis, quite “average” in its apparent prospects). Since then, IEFA has fallen, while the S&P 500 U.S. equity index has roughly remained flat. It makes sense to revisit at this new juncture.

Cyclical Positioning

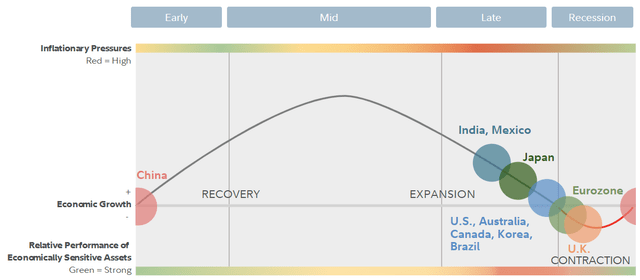

It makes sense to firstly consider the point in the business cycle. Fidelity offers regular business cycle updates, with the latest being as of Q4 2023. Factors considered include economic growth rates, credit creation (or contraction), earnings growth, fiscal and monetary policy, and sales and inventories. This holistic mix appears to suggest that countries such as Japan and Australia are in the later stages of their business cycle, while countries such as the United Kingdom, Italy, and France are in a recessionary period.

Global Business Cycle Positioning (Fidelity.com)

Markets tend to be leading versus the real world. Of course, markets may sometimes get things wrong. On the other hand, markets can sometimes drive outcomes themselves in a reflexive manner. In any event, in IEFA we are looking at a “late stage” portfolio on a country- and fund-weighted basis. This means that there is a possibility of weaker immediate performance, but the 9- to 12-month (and beyond) bias would be more positive (assuming markets lead by anywhere from 9 to 18 months at most).

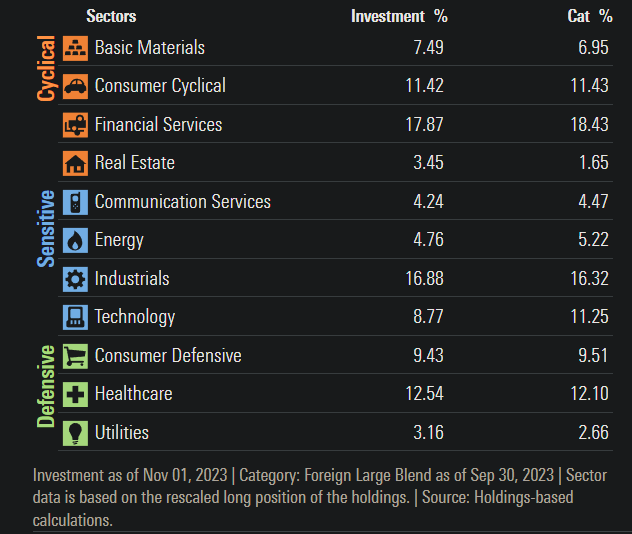

In terms of sector exposures on average, IEFA is fairly balanced; unsurprising, given its wide mandate, which covers small-, mid- and large-cap stocks across various developed markets. The portfolio itself is also very disparate with even the largest holdings being each less than 2% of the fund, overall. In total, there were 2,915 holdings in IEFA’s portfolio as of November 2, 2023.

IEFA Sector Exposures (Morningstar.com)

The balance here reduces one’s risk but also the potential for alpha, as the balance acts as a kind of “automatic stabilizer” across the market cycle (i.e., lower beta). Yahoo! Finance calculate the fund’s beta at 1.08x on a five-year, monthly basis. iShares themselves calculate beta at 0.93x on a three-year basis.

Additionally, with $97 billion in assets as of November 3, 2023, we can see that IEFA’s ability to generate large alpha is likely to be limited due to diversification and size, but that does not rule out out-performance versus, say, North American stocks. The non-U.S. holdings also enables U.S. investors to view IEFA as a lower-risk FX hedge, implicitly, as the stocks held within the portfolio are denominated locally in foreign currencies, which IEFA does not hedge against.

Valuation

Regardless of business cycle positioning or portfolio composition, we can take a snapshot in time, today, to estimate the forward return profile of IEFA. In absolute terms, does IEFA appear undervalued? I would say that it does appear inexpensive at this juncture, and materially more so than when I last reviewed IEFA.

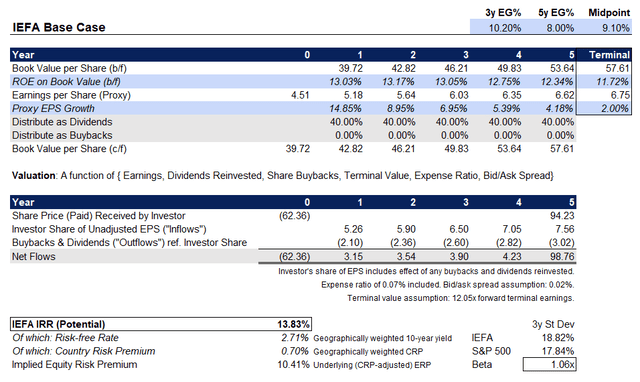

IEFA’s benchmark index, which it seeks to track, is the MSCI EAFE IMI index. The most recent factsheet for the benchmark is as of October 31, 2023, in which it reports trailing and forward price/earnings ratios of 13.84x and 12.05x, with a price/book ratio of 1.57x, and an indicative dividend yield of 3.30%. Using these numbers and backing them into market prices for IEFA, and using a reference three- to five-year consensus analyst estimate for average earnings growth for IEFA’s portfolio of 10.24% from Morningstar, we can build a basic discounted cash-flow valuation method for IEFA.

IEFA Base Case Model (Author’s Calculations)

The implied IRR is 13.83%, with a country-weighted risk-free rate component of 2.71% using 10-year bond yields, plus a weighted country risk premium of 0.70% based on Professor Damodaran’s running calculations. With developed markets usually not offering equity risk premiums above 5.5% over the long run (this figure is actually much lower for markets such as the U.S. given survivorship bias, and out-sized long-term returns), this would suggest that IEFA is priced at a discount.

If we were to say that the ERP should be no more than 6.5% (as a ceiling), and add in the current weighted risk-free rate as an implicit assumption that eventually inflationary pressures will fall from today’s levels (i.e., that long-term yields/risk-free rates will ease at least a little), then the implied discount rate should be no more than about 9.2%. This suggests IEFA is under-valued by investors and “not in demand”. While I do not necessarily believe IEFA will lift 50% from current values all else equal, on valuation alone, I do think that this corresponds nicely with business cycle positioning from an investor sentiment perspective. A diversified, international and relatively low-beta fund (I calculate beta vs. the S&P 500 directly on a three-year, monthly basis of 1.06x), IEFA is basically a good hold over the long run at current levels.

My calculations assume a three- to five-year average growth rate of 8.00-10.20%, implicitly, with a return to modest 2% earnings growth in year six (my terminal year). These are fairly safe assumptions, and I also have taken into account the fund’s albeit low expense ratio of 0.07% and the 30-day median bid/ask spread of 0.02% (low, due to the high popularity of IEFA by fund assets; an added benefit of transacting in these higher-AUM funds). Should rates be lower in 10 years’ time than today, IEFA should prove to be even cheaper, all else equal.

In conclusion, I would take an optimistic view. Over the long run, I feel that IEFA will remain a safe, long-term hold, and a useful implicit FX hedge for U.S. investors looking to remove U.S.-centric bias in their equity portfolios.

Read the full article here