Alibaba Group Holding Limited (NYSE:BABA) stock’s upward momentum has stalled since my previous update in August 2023. Investors were struck with negative headwinds from China’s property market malaise, which saw BABA top out in early August. BABA then went on a massive selling spree that saw it collapse nearly 25% through its late October lows before consolidating. Given the significant market developments since then, I believe it’s opportune for me to update BABA holders on whether the recent bottoming process justifies another buying opportunity.

Alibaba is slated to report its fiscal second-quarter or FQ2 earnings release on November 16. It will be the company’s first earnings scorecard without its long-serving former Group Chairman and CEO, Daniel Zhang. Keen investors should recall that Zhang has also left Alibaba Cloud Intelligence Group, handing over the reins to Alibaba Group CEO Eddie Wu. Joe Tsai has assumed the Alibaba Group Chairmanship, as China’s leading e-commerce company continues its journey without Zhang. There were concerns about a possible disagreement over Zhang’s role in Alibaba Cloud, which led to his abrupt departure. With Alibaba Cloud earmarked for a future spinoff, I believe analysts on Alibaba’s upcoming call would be keen to assess Wu’s strategic direction, given the changes.

Smaller cloud rival Baidu (BIDU) has also been making significant progress in the generative AI space. China’s AI leader launched its Ernie 4.0 LLM in October, solidifying its credentials as China’s closest challenger to OpenAI (MSFT). Coupled with the launch of its paid chatbot recently, Baidu is well-primed to gain market share in China’s highly competitive cloud computing space. Investors will likely want to hear more from Alibaba’s new top leadership team on their progress in the generative AI space. Investors should also assess management’s commentary on crucial initiatives, helping Alibaba Cloud fend off Baidu’s possible encroachment.

Alibaba’s earnings release will arrive soon after the conclusion of China’s Singles’ Day shopping festival (from October 24 to November 11). It’s expected to be Alibaba’s most important sales festival of the year, which could provide crucial insights into the health of the Chinese consumer. There are concerns that this year’s focus is on the “value-conscious” consumer, as China’s consumer spending remains tepid. As such, I believe Alibaba’s focus will likely remain on cost optimization, as topline growth could disappoint.

Accordingly, analysts’ estimates suggest a revenue growth of 8.8% for FQ2, down from last quarter’s 13.9% uptick. Despite that, we have likely moved on from last year’s low-single-digit revenue growth cadence, notwithstanding the prevailing macroeconomic uncertainties in China. Notably, Alibaba’s efficiency drive should continue to help drive operating leverage, with adjusted EBITDA growth expected to reach 12.8% for FQ2.

Investors thinking the market has moved away from China’s e-commerce leader should think again. Accordingly, BABA notched a total return of more than 30% over the past year, suggesting the worst is likely over. With Alibaba’s best-in-class “A+” profitability grade and solid execution (“B+” earnings revision grade), I believe the company is well-positioned to ride the recovery in China’s economy. Patience is critical for investors looking to partake in BABA’s thesis, as geopolitical headwinds and fears over Chinese President Xi Jinping’s regulatory construct could discourage foreign investors from returning aggressively. Despite that, I believe BABA’s constructive bottoming process over the past year underpins my confidence that BABA’s dip-buyers are willing to support its pivotal $78 support zone.

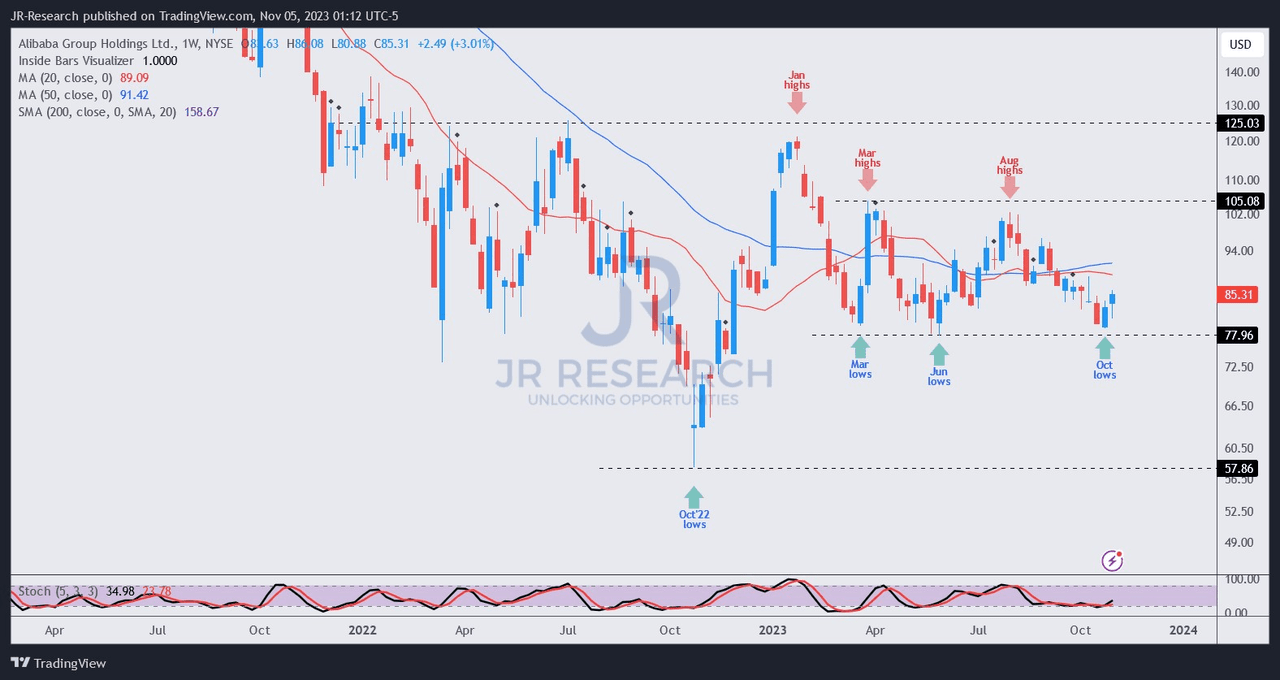

BABA price chart (weekly) (TradingView)

BABA has remained supported above its $78 level since March 2023. The recent plunge from its August highs didn’t breach that level decisively before buyers returned over the past two weeks.

Given more constructive expectations over Alibaba’s operating performance, I assessed that investors aren’t likely to de-rate it further, bolstered by its relatively attractive valuation (assigned a “B-” valuation grade by Seeking Alpha Quant).

As such, investors looking to join the recent dip-buyers to add exposure before its upcoming earnings release should capitalize on the recent pullback to buy more shares.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here