Consumer Staples (XLP) stocks have suffered one of their worst hammering in recent times. Notably, XLP declined more than 16% from its mid-2023 highs through its lows in October 2023. For defensive sectors like XLP, the last time such a steep decline occurred was in mid-2022. As such, even The Hershey Company (NYSE:HSY) investors weren’t spared, as HSY fell nearly 35% over the same period, underperforming its sector peers significantly.

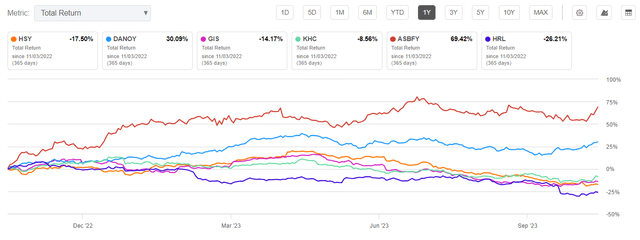

HSY Vs. peers (1Y total return %) (Seeking Alpha)

And not just that, HSY also underperformed most of its peers listed above in the packaged foods and meats industry. With a valuation grade of “D” assigned by Seeking Alpha Quant, I believe the battering is justified. In other words, HSY is still valued at a premium despite the hammering. Therefore, it was significantly overvalued before the recent decline.

Notwithstanding its wide-moat business model, the market seemingly turned cold over confectionary-exposed stocks like HSY. Bears could point to the increasing prominence of GLP-1 drugs by Novo Nordisk (NVO) and Eli Lilly (LLY), affecting buying sentiments in HSY. The argument is that consumers could be turning more health-conscious and thus could affect the structural growth drivers of Hershey.

That argument has some basis, as Wall Street also turned cautious on Hershey and its peers. To compound matters, retail and grocery giant Walmart (WMT) cautioned that these drugs “are starting to have an impact on shopper behavior.” As such, management indicated it gleaned a “slight pullback in the overall basket in terms of items purchased and calories in them.”

Moreover, Hershey highlighted in its recent third-quarter or FQ3 earnings call that a “key retailer reduced merchandising in various categories.” As a result, it impacted Hershey, “including confectionery, where Hershey had a significant share of merchandising.” TD Cowen attributed the “key retailer” to Walmart, although the research firm believes that “many of the challenges it faces will be temporary.”

Hershey’s management also indicated that it anticipates the “de-load” headwinds to affect its operating performance in early 2024, given more challenging comps. As such, I believe the market has likely attempted to price in these challenges on Hershey, given its confectionary-heavy business, where its wide moat is mainly predicated.

Notwithstanding the near-term caution, I believe it’s still too early to ascertain whether Hershey could suffer a structural decline in its volume. While there were some concerns in Q3, robust pricing action helped mitigate the weakness in volume. As such, while Hershey demonstrated its market leadership through its pricing prowess, it remains to be seen whether a “healthier consumer” could erode that pricing lever over time.

I urge investors not to be unduly worried, as Hershey is a highly profitable and innovative packaged food company. With a robust “A-” profitability grade, the company is well-primed to defend its market share leadership. Furthermore, the recent hype over the GLP-1 drugs could have been overstated. As such, the normalization of these fears could help improve confidence in HSY’s performance moving ahead.

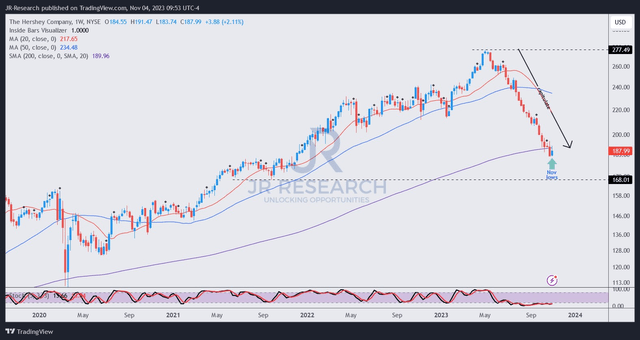

HSY price chart (weekly) (TradingView)

HSY fell to lows last seen in December 2021, as investors capitulated, as seen above. As a result, I assessed that much of the pessimism in HSY has likely been priced in. Also, dip- and momentum-buyers probably took the opportunity to rotate out, as investors sold out of XLP over the past five to six months.

However, I also gleaned that HSY could be bottoming out, although I still need a validated signal over the next few weeks. If the current levels don’t hold, a further drop toward the $168 support level is plausible, although the risk/reward is likely skewed toward buyers at the current levels.

As such, while I noted the near-term headwinds and possible structural challenges on Hershey, I believe they have been reflected.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here