Dear readers/followers,

Investing in Loews (NYSE:L) is a play that includes investing in a business that doesn’t really have a significant yield. In this case, we’re talking about a yield of 0.38% which is more than 4% below the current risk-free rate. The company also doesn’t have the greatest history of outsized capital appreciation over time. Investors into Loews have seen decent outperformance, but at below 8% per year since early 2003, there are better companies out there – and many of them. It’s a good example of how a lack of dividends can really impact your personal rates of return, and why higher-yielding companies can actually make a lot of sense to invest in.

In fact, if you waited until 2006 to invest in Loews, your RoR would have been below 4%, significantly underperforming the market – and this is far from the only time when a Loews investment would have resulted in underperformance.

Let’s see what we have at the current results and forecasts, and we’ll see how we can forecast the company from here on out.

This is an update article on Loews – my last piece can be found here, and that piece already had a “HOLD” rating for the company.

Loews – Not all that great with all things considered

When I say “not all that great”, I am not talking about the business.

Anyone who looks even slightly closely at Loews can understand that the company is a great business. We’re talking about an FCF margin that’s actually among the 80th percentile, meaning it’s among the better ones in the entire industry. But again, having a good business model and being an investable company is not always the same thing. It seems like it should be, but it’s not.

As an example, if we project the company’s FCF on a normalized basis, the company is actually currently undervalued. We apply this valuation model of price/projected FCF range based on historicals because Loews doesn’t have a consistent story of earnings or revenues. Looking at Loews, these bounce all over the place. Over the past 20 years, more than 8 years, the company has seen drops in EPS over double digits, and 2 times even in triple digits, the worst at negative 340%. (Source: Loews Results)

I show you such numbers because it’s important to qualify this company in the context of other businesses.

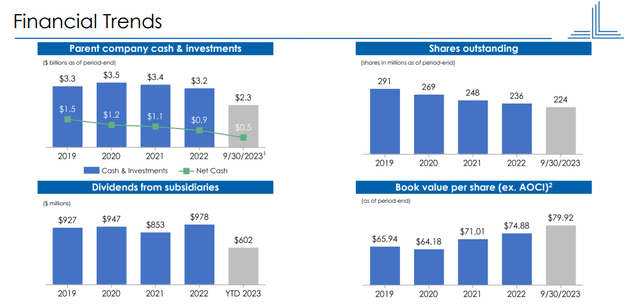

We have 3Q23 results. Those are the results we’ll be digesting here. Overall, 3Q23 was a good quarter. The company recorded over $250M of net income, versus negative results on a YoY period, including a one-off tax charge. As I’ve said before, Loews is primarily a share buybacker rather than a dividend payer, and the company made the same strategy in 3Q, repurchasing 1.9M shares at $118M, and purchasing CNA (CNA) shares, its main company, at $175M.

This had the result of increasing the company’s book value exclusive of AOCI (we use insurance-similar valuation techniques here) to almost $80/share, which at the current share price and valuation would of course imply a discount. However, as we know from looking at insurance companies, even good ex-AOCI book values don’t necessarily mean that this is a good investment – the same is true here.

The company recorded impressive 3Q23 dividends from its subsidiaries, over $100M, and $2.3B in cash and investments at the parent-company level, which is of course very impressive given the state of their current market. Revenues for the past 9M period were significantly better than in 2022, so was net income, and EPS was more than double.

Dividends stayed exactly the same.

Loews IR (Loews IR)

This sort of company is a very tricky one. The reason I say this is because I believe it should be a better investment. It should have a better track record than it does in terms of appreciation based on what it does. There’s something to be said for the notion that this company isn’t being valued “correctly” for its performance.

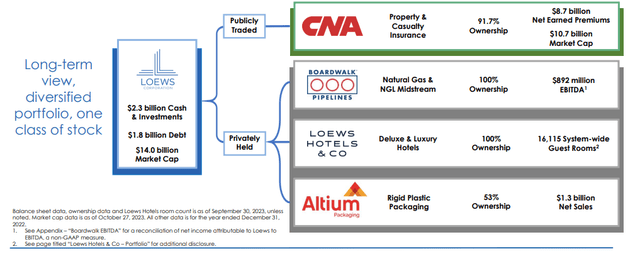

At the same time, you can clearly see that the company is a mix of some of the most volatile businesses you can imagine. We’re talking P/C insurance, we’re talking natgas/midstream, we’re talking resort/hotels of all things, and we’re talking cyclical packaging and basic materials.

The company’s various subsidiaries did very well. CNA, the largest segment, obviously saw positives from the rising interest rate environment, and underwriting results, but also from a significantly lower unfavorable impact from LTC annual reserve reviews.

Boardwalk, meanwhile, saw increased revenues which were on the earnings side not able to completely weigh up the increased costs of pipeline safety and employee expenses.

The hotels actually went down in 3Q23 – lower income from JV’s, translating into lower traffic and interest in part. The company’s high-level financial trends are excellent, and in part, the company’s valuation reflects this over the past few years.

Loews IR (Loews IR)

The company spent cash on repurchasing shares, increasing its CNA stake, retiring half a billion of debt at the corporate level, and paying debt, leaving the company with almost a billion less in net cash/investments YoY – but given the uses of cash here, and that repurchasing is part of the core of Loew’s strategy, I don’t have a problem with this.

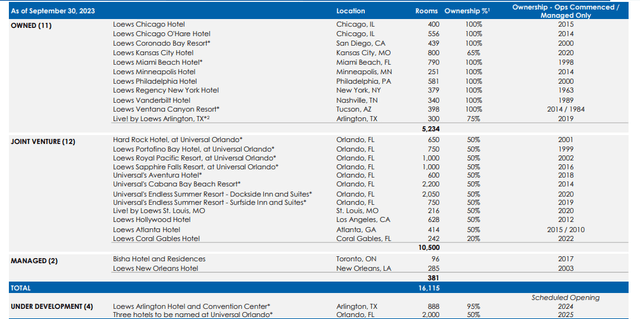

You may ask which hotels, to focus on hotels for once, the company actually owns. And it’s not at all a bad portfolio – in fact, both ownership and JV are pretty diverse and qualitative locations. The company is also adding new ones.

Loews IR (Loews IR)

However, in the end, my stance on Loews has not changed for a very long time, and it’s not changing as of this article either. While the company has delivered this at times, and there are implications for a better earnings trend on a forward basis, there’s just too much uncertainty baked into the investment at this time.

Why is that?

Because Loews needs to be viewed as a superior alternative to other investments. At least if I am to invest in it with hard-earned money. The dividend, or lack of a good dividend is part of the problem we’re seeing here, but it’s not the entirety of the problem. There simply are so many great investments available on the market today, even after the last two days of recovery.

Many of my investments have only begun to really recover, and they’re still more than solid picks to put money into.

If you have company A and company B, and A has better yield, fundamentals, upside, safety, and history, you shouldn’t even consider company B. And there are many companies with exactly these fundamentals out there.

Let’s see what Loews can offer us at a price of over $69/share, which is where the company is currently trading.

Loews – Not favorable in terms of valuation

Now, in my last article, I gave the company a stance of overvaluation. The reason is not because the company is overvalued to its AOCI book value – which it isn’t. It’s because I discount the company, given the yield and its specifics and also its exposures, at least 30% to that BV.

Even with the recent boost in BV that comes to a price target of around $55/share. I could perhaps be convinced at this time to increase my PT from $50/share to $55/share, but the fact is we’ve also seen material increases in risk-free rates and upsides since I set that target – so I’d say it evens out. Instead of increasing PT, I would increase my discount to 35% of BV to reach my $50/share. As I’ve said before, the higher the risk-free rate and WACC go, the higher interest rates go, and the higher discounts I’m going to apply to this company. In order for Loews to become anything like “Interesting” as an investment, it needs to see drop in valuation – but while the company applies quarterly buybacks regardless of valuation, this is going to have a headwind given how this props the price up.

Most analysts and techniques evaluating Loews consider the company within the realm of fairly valued at around $70/share. A tangible BV points to somewhere at $63/share (Source: Gurufocus), looking at sales points to around $71/share, and with a PB ratio that’s close to its 10-year high, a price that’s close to a 10-year high, and an ROIC that’s lower than WACC…this is tricky. The dividend yield is at the 10-year low, and the company is trading in a market that throws around 4-6% yields like Skittles in A-rated businesses.

Why go for Loews?

The arguments the company has going for it are high insider buying, high safety scores, and extreme unlikelihood of financial troubles, despite the cyclicality and risk profiles of its subsidiaries.

However, when we look at what the company “wants” for its business, that simply isn’t interesting enough for me in terms of pricing.

So while I can only tip my hat to a good 3Q23, I cannot in good conscience change my rating. Loews is a “HOLD” here with the following thesis.

Thesis

- Loews is still a quality business with expertly managed subsidiaries with through-cyclic earnings stability. The fundamentals here are excellent, and therefore, at the right price, it’s a “BUY” even without a potential solid yield – it just needs to be cheap enough.

- This company is still overvalued. At any time, when you bought the company at 17-19X P/E, the company has delivered substandard, or below-market returns. The same goes true in some cases for the 15x+ P/E.

- 3Q23 has not made this stance or thesis any easier, given that the company is now more expensive, but the market has better opportunities than even when I wrote on the company last time around.

- Therefore, my stance is “HOLD” – I’ll wait until we’re back below $50/share, based on today’s book value, and I would want a 30% discount to BV to go in here. This price target was updated as of November of 2023.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

Most of the boxes are checked here, but there are still some issues with the valuation and what I expect from the company – so I say “HOLD”.

Read the full article here