By Suvi Platerink Kosonen, Senior Sector Strategist, Financials

The US’s bank troubles have been concentrated among smaller-sized banks, while the larger institutions have weathered the storm relatively well so far. The impact on banks in the European Union has remained moderate. European banks carry substantial liquidity buffers that they can tap into in times of stress.

US bank troubles remain limited to smaller banks so far

US bank worries have somewhat eased after the substantial deposit instability in the regional banks in March and April resulted in four mid-sized banks collapsing.

The combination of a high perceived impact from higher interest rates on these banks’ balance sheets and their relatively large uninsured deposit bases made them vulnerable to fast and extensive deposit outflows, potentially exaggerated by social media and the ease of mobile banking.

The problems have been concentrated among smaller lenders. Larger US banks have remained more stable throughout the crisis and have, to an extent, been part of the solution.

Finding a large and strong enough acquirer for a failing bank may get more difficult if there are more resolution cases. Lack of transparency on the potential treatment of uninsured depositors is a factor keeping financial markets (and depositors) on their toes regarding US bank risks.

Currently, depositors may count on deposit insurance of up to US$250k. In a report detailing three alternative ways to change the deposit guarantee system, the Federal Deposit Insurance Corporation (FDIC) suggests that a targeted significant increase in deposit insurance coverage for business payment accounts could best meet the objective of financial stability and depositor protection relative to its costs.

Targeted changes to the current framework could provide stability to the whole system but would come with a cost for the industry as a whole. As also pointed out by the FDIC, however, unlimited coverage would risk eliminating depositor discipline and result in the market discipline being driven by debtholders and stockholders.

In our view, stabilisation of deposit swings remains key for the sector worries to subside. The JPMorgan (JPM)-First Republic (OTCPK:FRCB) transaction removed one risk factor providing uncertainty to financial markets.

A targeted change to the deposit guarantee scheme could become part of a wider solution in the longer term but is unlikely to be a quick remedy as it requires Congressional action for some parts.

Higher coverage would also result in higher deposit insurance costs for the industry. In our opinion, increasing coverage could benefit smaller and riskier banks over stronger ones, as the latter already have better access to funding markets at more attractive levels. An unlimited deposit guarantee would pose a risk of a moral hazard.

The problems have been concentrated among smaller regional US banks, and we would not rule out further problems arising in the sector due to the tricky combination of relatively large unrealised losses and uninsured deposits.

Our base case is that larger banks remain better positioned, with their systemic importance and stronger buffers supporting market confidence. In a more negative scenario, smaller names could need a wider solution than handling issues on the go as they surface.

In Europe, banks weathered US bank stresses well

US bank troubles have had limited repercussions on the European banking sector. Large European banks have strong capital and liquidity buffers, which allow them to weather a substantial amount of uncertainty in times of stress.

Despite some pressure on deposit balances, we have not seen major liquidity events in European banks outside of Credit Suisse (CS). In fact, European bank earnings in the first quarter have been relatively strong.

European banks have to meet a Liquidity Coverage Ratio (LCR) of 100% to prepare for liquidity outflows. The main idea of the LCR is to force banks to hold sufficient liquid assets to meet potential net liquidity outflows over a 30-day stress period. European banking sectors exceed the requirement with large margins.

We have seen bank deposit bases contract in the first quarter this year. In an environment of higher interest rates, clients may start to look for better-yielding alternatives to bank deposits, which may reflect as deposit outflows and result in upside pressures on deposit pricing.

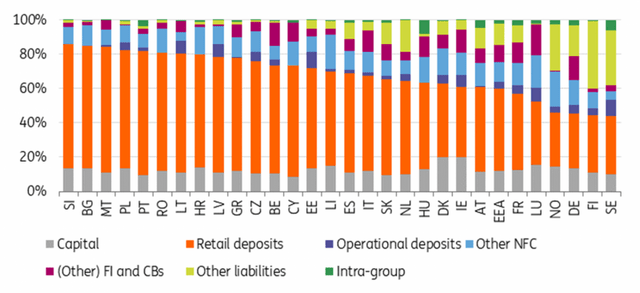

When assessing banks’ liquidity risks, retail deposits are generally seen as stickier and less prone to quick outflows. The bulk is supported by deposit guarantee schemes protecting deposit balances of up to €100k.

Southern European banks rely more on retail deposits in their funding mix, while Nordic, German and French banks have a smaller share of retail deposits in their funding palette.

German and French banks have attracted a larger share of operational and other non-financial customer deposits than their Belgian or Dutch peers. These deposits may be more price sensitive and more volatile in times of stress.

Available stable funding split by country (after weighting) as of end-2022

ING, EBA

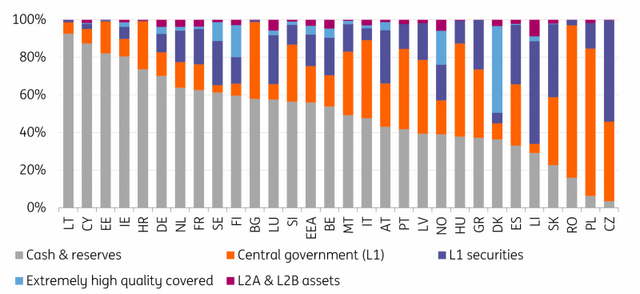

In case of liquidity outflows, banks rely on their liquidity buffers. Cash can be easily deployed. Debt securities may be used as collateral for central bank funding or in repo markets. Selling down securities portfolios may instead have an impact on earnings and capital metrics if the bonds were not being marked to market.

The bulk of liquidity buffers in countries such as Germany, the Netherlands and France rely on cash and reserves. In Southern European countries including Portugal, Italy, Greece and Spain, the share of central government exposures of liquidity buffers is instead higher.

Banking sector liquid assets by country (after weighting)

ING, EBA

In our recent publication, Scrutiny of Liquidity Metrics has Increased, we calculated that most European banks could absorb substantial outflows in their less stable deposit bases (including deposits outside deposit guarantee schemes) with their existing liquidity buffers.

Large banks with the least room for stressed deposit outflows included names less geared towards stable (retail) deposit funding, including selected Swiss, UK and Spanish banks. Banks with the strongest headroom for these types of liquidity shocks included mainly selected Benelux and Nordic names in our selection of banks.

Depositor protection is also on the radar in Europe, as it is in the US. One factor that could potentially support deposit stability in European banks is the Crisis Management and Deposit Insurance (CMDI) framework that is currently being assessed for changes.

The European Commission proposals provide for a general depositor preference with a single-tiered ranking. This means that all deposits, including uncovered corporate deposits, will rank above ordinary unsecured claims in insolvency.

Moreover, the relative ranking between the different categories of deposits would be replaced by a single-tier depositor preference, where all deposits rank pari-passu without a super preference for covered deposits.

These proposals suggest better protection for depositors, which could make deposits stickier and less prone to deposit runs. A general depositor preference would make the layer including preferred senior unsecured debt thinner in most EU countries.

This would likely push up the costs of issuing preferred senior unsecured debt and result in a tightening of the spread of non-preferred senior over preferred senior debt. Part of the impact could be mitigated by growing loss-absorption buffers, pushing up bank wholesale funding costs.

Conclusion

The US’s bank troubles have been concentrated among smaller-sized banks, while the larger institutions have weathered the storm relatively well so far. The impacts on banks in the European Union have remained moderate.

European banks carry substantial liquidity buffers that they can tap into in times of stress. On both sides of the pond, authorities are looking into potential changes that could result in better protection for depositors and as such perhaps more stability for the development of deposits in times of stress.

An increase in depositor protection will push up costs from the guarantee schemes that will eventually be borne by the banking system. Better protection for depositors may increase the costs of issuing preferred senior unsecured debt in selected EU countries due to a higher potential burden sharing in times of stress.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here