Investment Thesis

I am convinced that the composition of your investment portfolio is the key factor for long-term investment success. Therefore, I believe that portfolio allocation is a highly important topic for investors. This is the reason why I continuously write articles about portfolio allocation here on Seeking Alpha, such as the one here.

The Importance of a well-balanced Portfolio

I strongly believe that an investment portfolio, which provides the most benefits for investors, has a balanced mix of high dividend yield and dividend growth companies.

Moreover, I am convinced that a well-balanced investment portfolio should include companies with a reduced risk level, helping you to protect your portfolio.

Those companies with a low risk level are like the defense players of your favorite sports team. But instead of preventing the rivals from scoring, these companies help you to protect your wealth in difficult economic times. They are important key players for the construction of an all-weather portfolio which is suitable for different market environments.

The importance of High Dividend Yield Companies

Today’s article focuses on high dividend yield companies. They play a key role within your portfolio, given their enormous ability to help you generate extra income.

You can then use this extra income to reinvest while benefiting from the compound interest effect, or, alternatively, you can use the dividend payments from the companies you have invested in to meet your financial obligations. Both are excellent ways to benefit from dividend paying companies that are part of your portfolio.

The Selected Companies

For today’s article, I have filtered out three companies for you. These companies not only provide you with an attractive Dividend Yield, but they currently also have an attractive Valuation.

In a first step, the companies needed to meet the following criteria to be part of a pre-selection:

- Market Capitalization > $5B

- EBIT Margin [TTM] > 5%

- 24M Beta Factor < 1

- Dividend Yield [FWD] > 4%

- P/E Non-GAAP [FWD] Ratio < 30

From this pre-selection, I selected the companies below:

- VICI Properties (VICI)

- Pfizer (PFE)

- AT&T (T)

VICI Properties

VICI Properties is a real estate investment trust that currently has a Market Capitalization of $28.97B. In 2023, the company has shown a negative stock performance of -12.82%, as illustrated in the graphic below.

Source: Seeking Alpha

VICI Properties currently pays shareholders a Dividend Yield [FWD] of 6.11%. I consider this dividend to be highly attractive for investors. This is even more the case when considering the company’s relatively low Payout Ratio of 65.55% and the dividend growth it has shown in recent years.

VICI Properties’ Dividend Growth Rate [CAGR] over the past 3 Years stands at 9.04% and at 17.42% over the past 5 years. It is further worth mentioning that VICI Properties has shown an EPS Diluted Growth Rate [FWD] of 15.04%, which is significantly above the Sector Median of -0.79%, again underlying the company’s strength in terms of dividend growth.

Different metrics further underline the company’s attractive growth perspective. Its AFFO Growth Rate [FWD] of 7.16% stands significantly above the Sector Median of 4.09%, and its FFO Growth Rate [FWD] is at 14.10%, also significantly above the Sector Median of 4.76%.

In terms of Valuation, I am convinced that the company is currently at least fairly valued, which is underlined by its P/AFFO [FWD] Ratio of 12.66, which is only slightly above the Sector Median of 12.39.

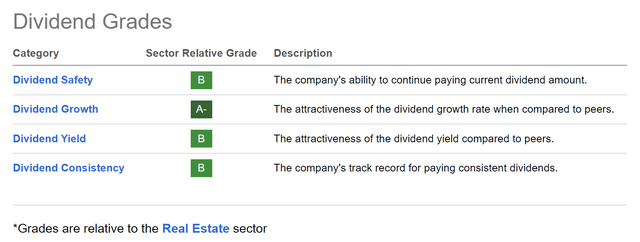

Below you can find the results of the Seeking Alpha Dividend Grades, which underline VICI Properties’ solid dividend. The company receives an A- rating in terms of Dividend Growth, and a B rating for Dividend Safety, Dividend Yield, and Dividend Consistency.

Source: Seeking Alpha

Pfizer

The share price of Pfizer has declined by 41.17% since the beginning of 2023. The graphic below illustrates the company’s performance within this time frame.

Source: Seeking Alpha

I believe that Pfizer is an excellent pick for dividend income investors aiming to blend dividend income with dividend growth. Pfizer pays shareholders a Dividend Yield [FWD] of 5.37%. In addition to that, the company’s Payout Ratio stands at 56.79%, which clearly indicates that its dividend is relatively safe.

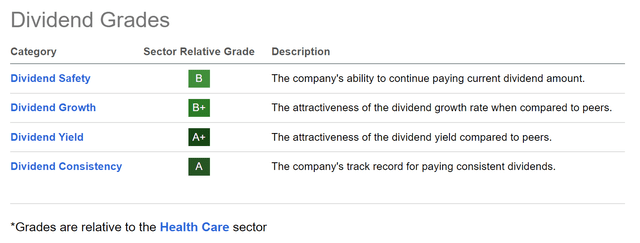

The safety of Pfizer’s Dividend is further confirmed by taking a closer look at the Seeking Alpha Dividend Grades: the company receives an A+ rating for Dividend Yield, an A rating for Dividend Consistency, a B+ for Dividend Growth, and a B for Dividend Safety.

Source: Seeking Alpha

In addition to the above, it can be highlighted that different metrics underline Pfizer’s currently attractive Valuation: the company currently has a P/E GAAP [TTM] Ratio of 8.12, which is 47.29% below its Average from the past 5 years.

In addition to that, it can be noted that Pfizer’s current Dividend Yield [TTM] of 5.34% stands 43.65% above its average from the past 5 years, once again underlying my investment thesis that Pfizer is currently undervalued.

It is also worth highlighting that Pfizer is on my watchlist for potential inclusion into The Dividend Income Accelerator Portfolio, which I started to build two months ago.

AT&T

Since the beginning of the year, AT&T has shown a negative performance of -17.69%. At the company’s current stock price of $15.42, it is available for a P/E GAAP [FWD] Ratio of 6.82.

AT&T’s current P/E [FWD] Ratio stands 38.58% below its average from the past 5 years. This clearly underscores my investment thesis that the company is currently undervalued.

The same is shown when having a look at AT&T’s Dividend Yield [TTM] of 7.27%, which is 78.93% above the Sector Median, and 5.42% above its Average Dividend Yield [TTM] over the past 5 years.

When compared to its competitor Verizon (VZ), it is worth mentioning that AT&T currently has a lower Valuation (P/E [FWD] Ratio of 6.82 compared to 7.85), and is slightly more attractive in terms of Profitability (EBIT Margin [TTM] of 25.47% compared to 22.87%). Furthermore, AT&T has the lower Total Debt to Equity Ratio (129.96% compared to 179.71%), which indicates that an investment in the company comes attached to a slightly lower risk level when compared to Verizon.

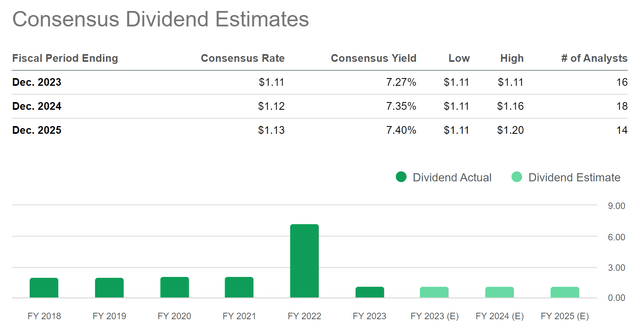

Below you can find Consensus Dividend Estimates for AT&T. The company’s Consensus Yield for 2023 stands at 7.27%, while it’s at 7.35% for 2024, and 7.40% for 2025. These numbers reflect my opinion that AT&T is attractive for dividend income investors at its current price levels.

Source: Seeking Alpha

The company’s relatively low Payout Ratio of 44.76% further shows that AT&T’s dividend should be relatively safe within the near future.

I have recently incorporated AT&T into The Dividend Income Accelerator Portfolio.

Conclusion

The Importance of High Dividend Yield Companies in your Investment Portfolio

High dividend yield companies that have a relatively low Valuation, can be excellent additions to your investment portfolio. They can bring you several benefits: they serve as a source of extra income besides your job salary and you can use this extra money to pay your bills (or alternatively you can use it to reinvest).

Imagine using the dividends you receive from McDonald’s (MCD) to buy the next burgers you enjoy with your friends. Or to use the dividends you receive from Procter & Gamble (PG) or Unilever (UL) to cover your grocery expenses.

The Importance of Risk Mitigation

High dividend yield companies can further help you protect your investment portfolio for the next stock market crash. The companies I have presented today have a 24M Beta Factor of 0.53 (AT&T), 0.56 (Pfizer), and 0.77 (VICI Properties), indicating that they help to safeguard your portfolio.

If their Valuation is attractive, the inclusion of high dividend yield companies comes along with even more benefits. This helps you to further limit the downside risk of your investment portfolio.

The Characteristics of the Selected Companies

Each of the selected picks that I have presented in this article pays shareholders an attractive Dividend Yield, has a relatively low Payout Ratio, and I expect each of them to raise their dividend in the coming years.

The Benefits of Investing in Companies That Pay Sustainable Dividends

Investing in companies with sustainable dividends helps you to steadily increase your wealth while generating extra income that is raised annually. It further helps you to invest with a reduced risk level. From such companies, investors have a lower probability of experiencing a dividend cut.

Investing with a reduced risk level implies an increase in the likelihood of achieving attractive investment results. While investing, we aim to avoid speculating at all costs, ensuring that we achieve attractive investment outcomes with a high probability. This is the investment approach I am following with the construction of The Dividend Income Accelerator Portfolio.

Author’s Note: I greatly appreciate your feedback on my selection of high dividend yield companies. Feel free to share your favorite high dividend yield companies!

Read the full article here