A friend of mine has a very attractive theory about stockbroking, which is that the interaction between the investor and the salesperson is like the World Wrestling Federation (WWF), where like the professional wrestling matches everything is done for entertainment.

In stockbroking, fantastic stories are woven to investors in order to get investors to part with their capital, and impressive as the marketing performances are – it is generally understood by both sides that tales of ‘blue sky’ profits or impending doom are a fiction. It is of course easier to go along with this fiction when the (institutional) investor is investing other people’s money and not his/her own.

The WWF analogy, where colourful characters appear to do each other great harm is a generally very useful one, and specifically apt in the light of the debt ceiling debate that is warming up in the USA.

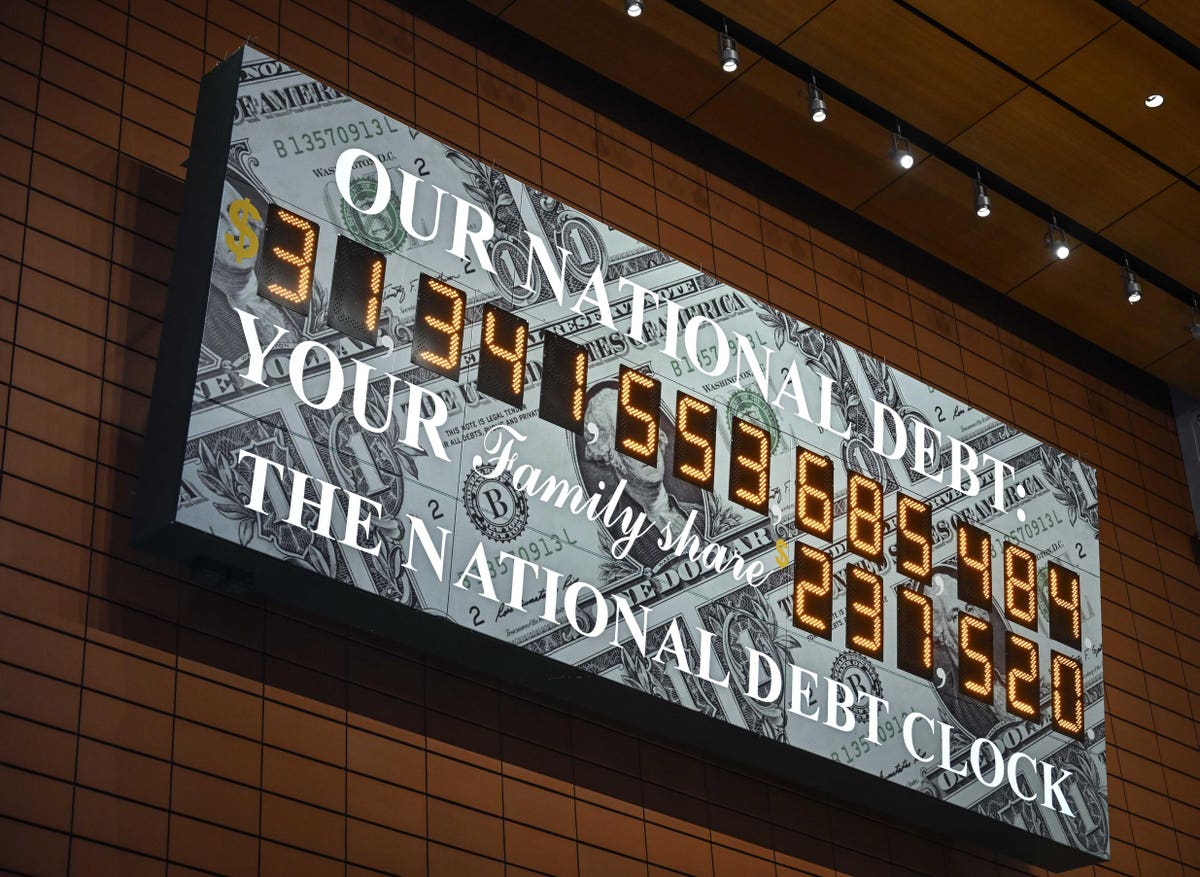

The debt ceiling stems from a provision in the constitution that states that only Congress can authorize borrowing on behalf of the US, and a 1917 act stipulates a limit on this debt (today’s limit is USD 31.4 trillion), that can be adjusted by consent of Congress. Today, higher rates complicate matters – the US spends more on interest payments than defence.

Congress on side

Presidents with a friendly Congress (for instance George W Bush received eight debt ceiling increases) do not need to worry much about this fiscal hurdle, however it becomes weaponized in the face of a ‘cohabitation’.

A good deal of the weaponization follows the WWF script, both sides huff and puff and take each other to the limit of pain, whence a deal is arrived at. Donald Trump, as an impresario (he was close friends with boxing promotor Don King, and at times part of the WWF theatre) understands this, recently telling CNN ‘the US should default….the Dems will probably cave’.

The debt ceiling debate has gotten a little out of control before. Memorably for investors in 2011 as the deadline approached, the US debt was downgraded by S&P from AAA to AA+, provoking a slide in markets. In 2013, the debt ceiling debate ran right to the limit, the personal highlight of which was when the late Senator John McCain tweeted a piece of research I had authored about wealth inequality (in Russia – he was spot on then).

There is no reason for the debt ceiling to be a market issue, except for perhaps four questions – the willingness of markets to participate in the WWF like theatre, the historic levels of bitterness across the American political spectrum, an amalgam of economic faultlines the most pressing of which is weakness in the US regional banking sector, and the venality of US Congressmen and women.

What can go wrong?

In short, we have the tinder and the sparks for this to go horribly wrong over the summer. The timing of any debt ceiling imbroglio will depend on the exact moment that the treasury runs out of money. Janet Yellen has stated that this could happen in early June but interest rate and money market pricing suggests close to July for a default event.

First, let me sketch three broad scenarios

Bi-partisanship (15%) – President Joe Biden, when he was a senator, was renowned for his bi-partisanship and the friendships he cultivated on both sides of the House. That era is gone now, and American politics is radicalized. Under current party structures, there is no incentive – absent an external threat – for politicians to come together and pragmatically pass a ceiling increase. That is why I grant this ‘grown-up’ scenario a low probability. Indeed, the only thing that might send the Democrats and Republicans rushing into each other’s arms is a banking crisis.

Chicken (70%) – in this scenario the Democrats and Republicans bicker till the last minute, with the Republicans trying to curb the spending power of the administration as a quid pro quo for voting the debt ceiling increase. The important element here is how complicit markets are – if we see a spike in equity volatility, a deepening of the credit crunch and loud warnings of the ‘end of the dollar’ and American financial hegemony, then a ceiling rise will be passed.

Having spoken to many people in Washington, I find them overly focused on the debt ceiling and not some of the underlying stresses in the US financial system – namely a credit crunch and a periphery crisis in banking. The risks could very easily become the real problem and dwarf the ceiling debate. Two other factors to note here are that a drawn out ceiling debate will result in less market liquidity in Q3 and an eventual deal might produce a minor, negative fiscal shock.

Cliffhanger (15%) – the risk here is that enough Republicans (i.e. McCarthy) are in thrall to Donald Trump that they are willing to do to America’s financial reputation what he has done to American democracy, and that a historic default becomes likely. Such a scenario is not as wild as we might have thought six years ago, but it would likely be preceded by the enacting of Treasury emergency financing plans and stern words from the Chair of the Federal Reserve. A formal default may not just happen, but it could come close.

In the context of the WWF thesis, the middle scenario is the best one – we all have a fright, are fantastically entertained and enjoy a happy ending. As it stands, few have an incentive for the debt ceiling to pass quietly, and many want and need a spectacle. Prepare to be entertained.

Read the full article here